courtneyk

Hub Group, Inc. (NASDAQ:HUBG) is launching many initiatives to become more efficient and more innovative. I also noted profit improvement initiatives, which will likely lead to revenue generation. With all that being said, I believe that the upside potential in the stock price is not sufficient to justify a position in the stock. There are many risks, which may push the stock price down. I may try to grab shares, but not at the current stock price. Keep in mind that I do like Hub Group, but I dislike its stock price.

The Hub Group Mission

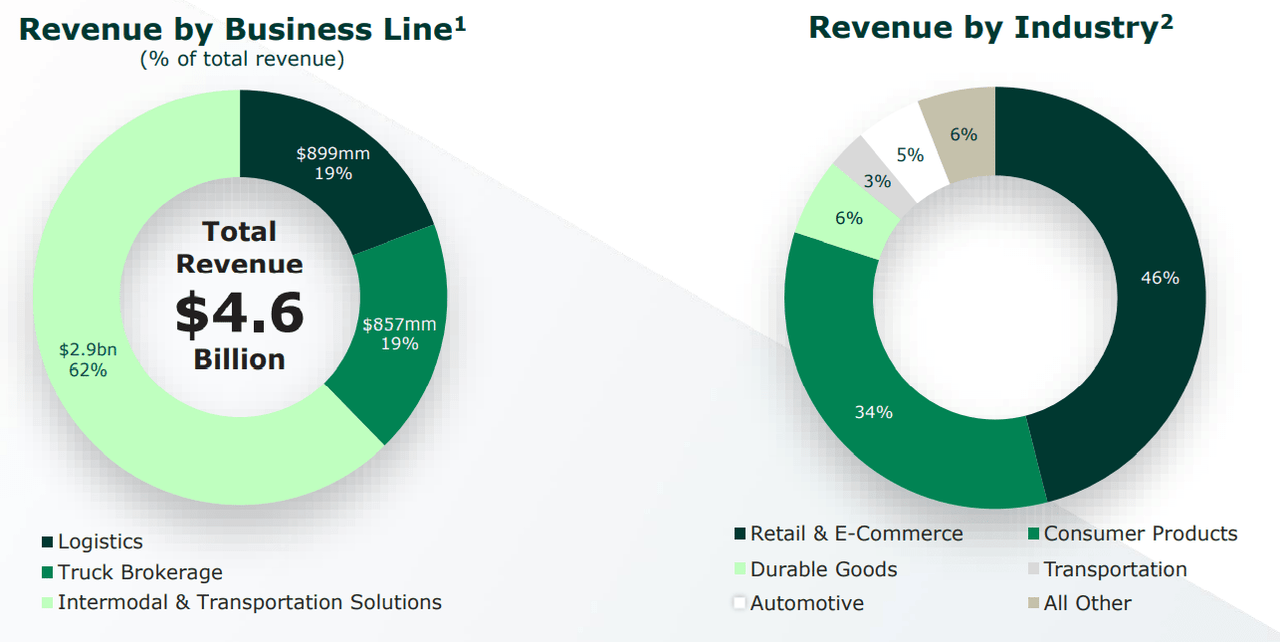

Hub Group, Inc is a supply chain solutions provider offering transportation and logistics management services. The company provides services such as truckload, temperature-controlled, dedicated and regional trucking.

Most clients come from the consumer products industry as well as the retail and ecommerce sector. Hence, a decline in any of these activities may lead to a decline in the company’s revenue.

Investor Presentation

I decided to research Hub Group once I noticed several profit improvement initiatives announced in a recent quarterly report. In my view, the most relevant are the efficiencies coming from sharing of equipment and drivers as well as the delivery of revenue under a new business line called Intermodal and Transportation Solutions:

As part of our profit improvement initiatives we have focused on realizing efficiencies between our dedicated and drayage trucking operations, including through the sharing of equipment and drivers, and by leveraging a combined driver support services function.

Our dedicated and drayage teams now operate as one combined organization. As a result, beginning in first quarter 2022 we now report revenue for these operations under the “Intermodal and Transportation Solutions” line of business. Source: Hub Group, Inc. Reports First Quarter 2022 Results

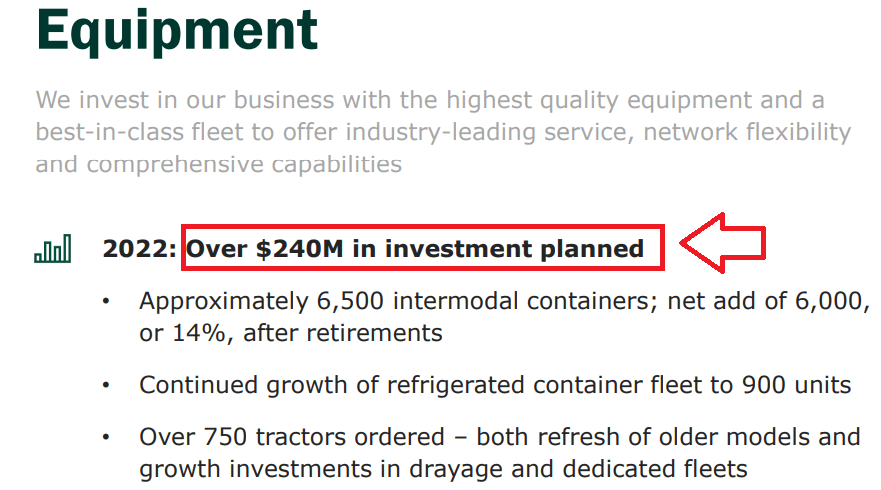

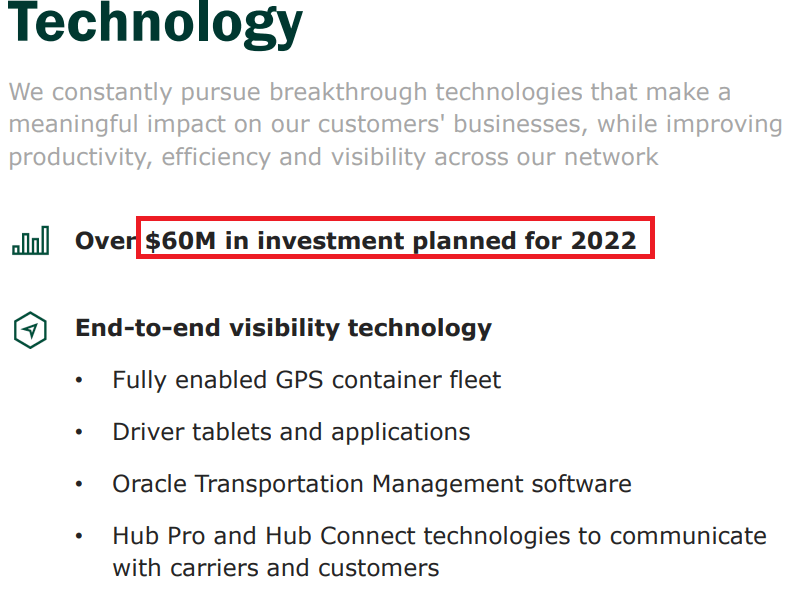

Besides, management announced new investments in equipment and technology, which will likely enhance revenue generation from 2022. Among the new equipment, management expects to add more intermodal containers, GPS, driver tablets, and new software applications.

Investor Presentation

Investor Presentation

Analysts Are Expecting Sales Growth, Positive Net Income, And Growing Free Cash Flow

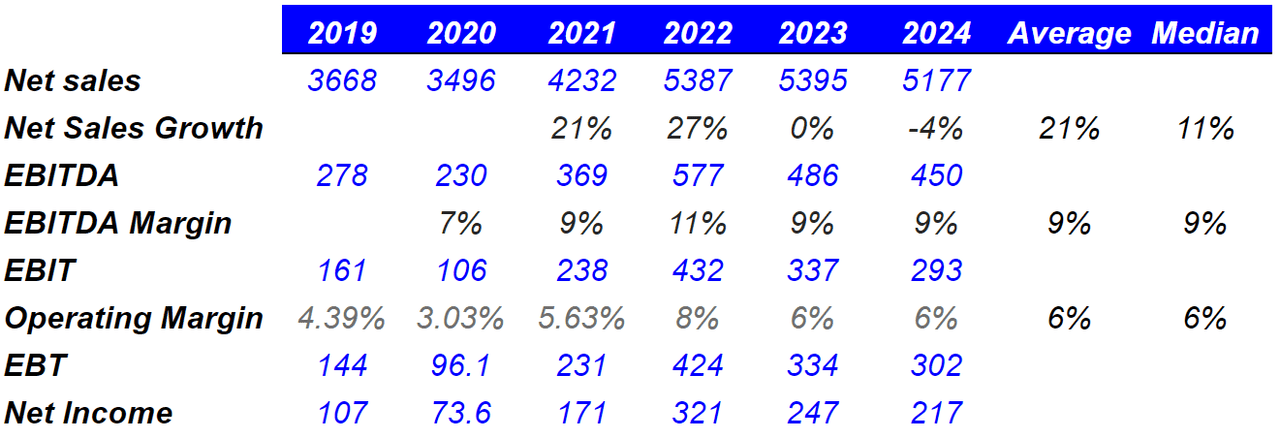

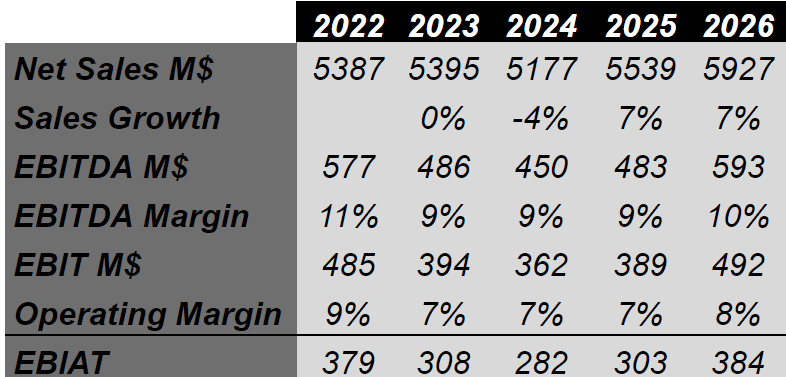

In my view, investment analysts are relatively optimistic about HUBG. They expect a decline in sales growth in 2023, but sales growth in 2022 is expected to be close to 27%. The EBITDA margin may be close to double digit, and operating margin may reach 8% to 6% from 2022 to 2024.

Marketscreener.com

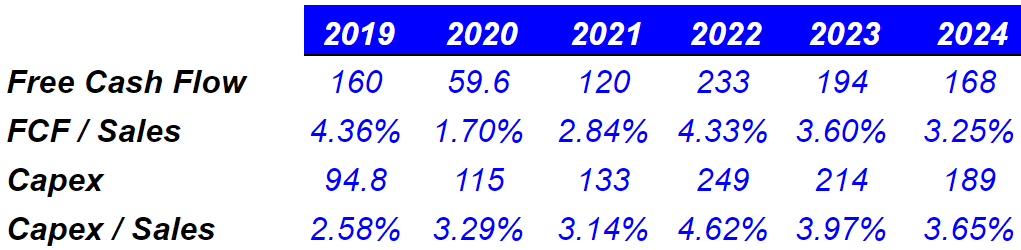

With that about the income statement, the cash flow statement gets even more interesting. Estimates about HUBG include FCF/Sales between 4.3% and 3.25%. The capex/sales ratio is also expected to stand at around 3.6%. Have a look at the figures of analysts because I based some of my models on the estimates given by other financial analysts.

marketscreener.com

Management is also optimistic about the year 2022. In a recent presentation, HUBG delivered 2022 sales guidance of $5.3-$5.5 billion and capital expenditures close to $240-$265 million. I used some of these figures in my base case scenario:

We expect that our 2022 diluted earnings per share will range from $9.00 to $10.00. We estimate revenue will range from $5.3 to $5.5 billion, and that gross margin as a percentage of revenue will range from 15.6% to 16.0%. We estimate our costs and expenses will range from $420 to $440 million for the year. We project our effective tax rate for the year will be 24-25%. We expect capital expenditures for 2022 to range from $240 to $265 million. Source: Hub Group, Inc. Reports First Quarter 2022 Results

Base Case Scenario: Investments In Technology Could Lead To A Share Price Of $94

Under my base case scenario, I assumed that investments in technology will successfully enhance the company’s relationships with clients, drivers, and vendors. Among the recent innovations, in my view, new robotic process automation and artificial intelligence will likely improve efficiency and free cash flow generation:

In 2021, we also delivered solutions using computer visioning, robotic process automation and artificial intelligence to create increased efficiency in our operations and back office functions. This included the automation of manual processes, using human augmentation solutions to allow our experienced supply chain professionals to make critical decisions while allowing a robot to complete the repeatable tasks, and developing learning-based robots to drive better decision support to the hands of operating teams. Source: 10-k

Besides, I think that a lot of technological innovation will come from acquisitions of innovative competitors. Management has already reported meaningful acquisition of Choptank Transport, LLC and NonstopDelivery, LLC:

On October 19, 2021, we acquired 100% of the equity interests of Choptank Transport, LLC. The acquisition added scale to our truck brokerage operation, enhanced our refrigerated trucking transportation services offering and complemented our growing fleet of refrigerated intermodal containers.

On December 9, 2020, we acquired NonstopDelivery, LLC. NSD provides residential final mile delivery services throughout the United States. The financial results of NSD, since the date of acquisition, are included in our logistics line of business. Source: 10-k

Finally, under this case, I expect that HUBG will likely increase its energy-efficient transportation solutions as promised by management. As a result, the company may receive more attention from investors, which could lead to a decrease in the cost of capital. HUBG discussed these initiatives in the last annual report.

Our service offering facilitates our customers’ desires for energy-efficient transportation solutions and assists in meeting their objectives to reduce their environmental footprint. Our intermodal service is significantly more fuel efficient as compared to trucking transportation, and we continually seek opportunities to convert our customers’ transportation needs from trucking to intermodal. In addition, our logistics offering includes shipment consolidation and network optimization services that seek to maximize the amount of freight carried per mile which reduces fuel consumption. Source: 10-k

Considering conservative assumptions, I used sales growth around -4% and 7% as well as an EBITDA Margin of 9%-11%. The results include 2026 EBIAT of $384 million.

Hohaf

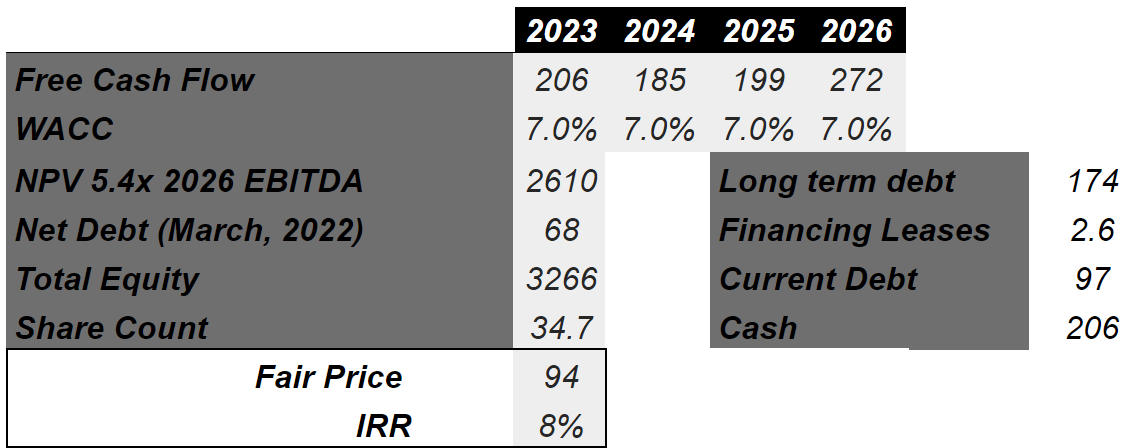

My model also included free cash flow close to $206 million in 2023 and $272 million in 2026. If I use a discount of 7% like other analysts, the implied equity is $3.26 billion, and the fair price would be $94 per share. The internal rate of return would reach even 8%.

Hohaf

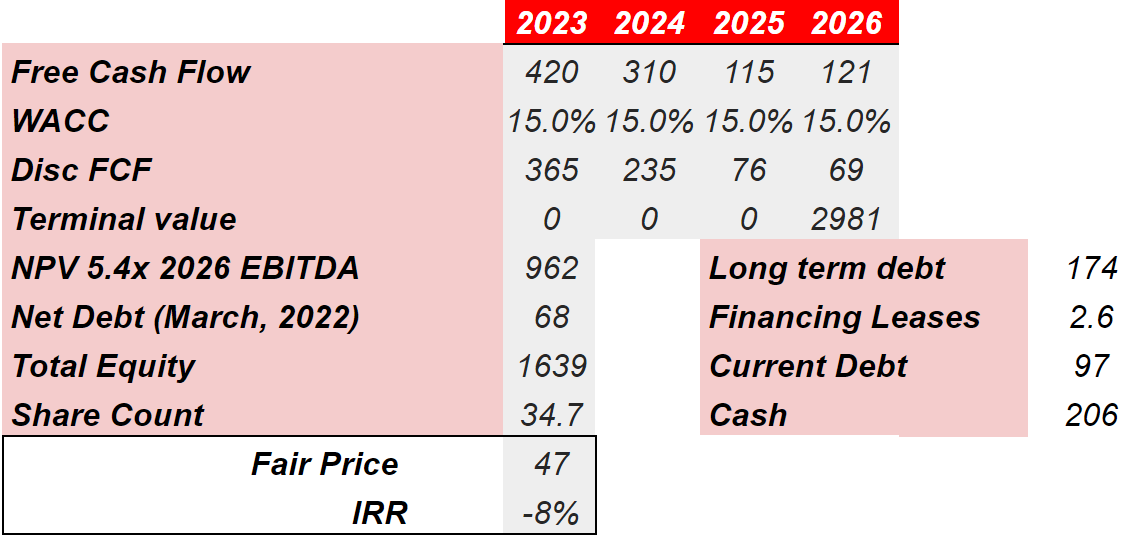

Worst Case Scenario: The Stock Price Could Decline To $47 Per Share

HUBG depends on rail services to operate, and many times there are not many options. It means that management does not have a lot of bargaining power while negotiating agreements. As a result, the company may suffer an increase in transportation costs, which may affect HUBG’s EBITDA margin:

We depend on the major railroads in North America for virtually all of the intermodal services we provide. In many regions, rail service is limited to one or a few railroads. We primarily rely on contractual relationships with two railroads to support our intermodal business.

Rate increases result in higher intermodal transportation costs, reducing the attractiveness of intermodal transportation compared to truck or other transportation modes, which could cause a decrease in demand for our services. Source: 10-k

Under my worst case scenario, I think that labor shortages, slowdowns, or stoppages may be likely. The results would include decreases in sales growth and free cash flow declines, which may lead to a decrease in HUBG’s stock valuation:

Our business has, at times, been adversely affected by situations impacting one or more railroads, including labor shortages, slowdowns or stoppages, adverse weather conditions, changes to rail operations, or other factors that hinder the railroads’ ability to provide reliable transportation services and these situations may occur again in the future. Source: 10-k

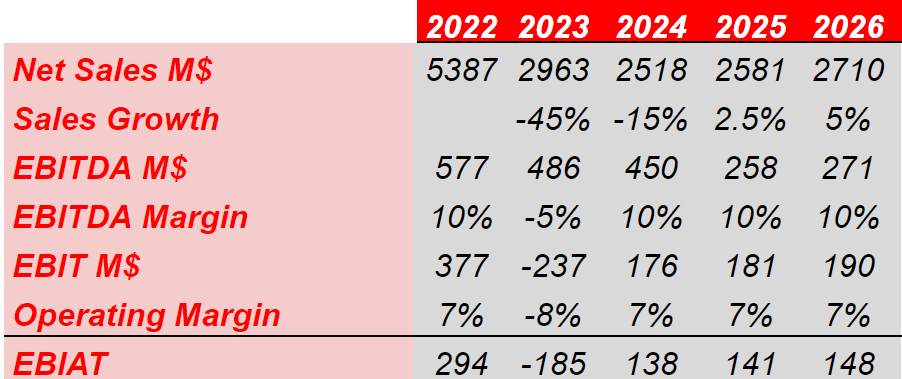

Under very traumatic circumstances, I used sales growth of -458% in 2023 and -15% in 2024. I also included an EBITDA margin of 10%, which implied 2026 EBIAT of almost $150 million.

Hohaf

Now, with a discount of 15%, an exit multiple of 5x, and almost 35 million shares outstanding, the fair price would be around $50 per share. The resulting internal rate of return would be -8%.

Hohaf

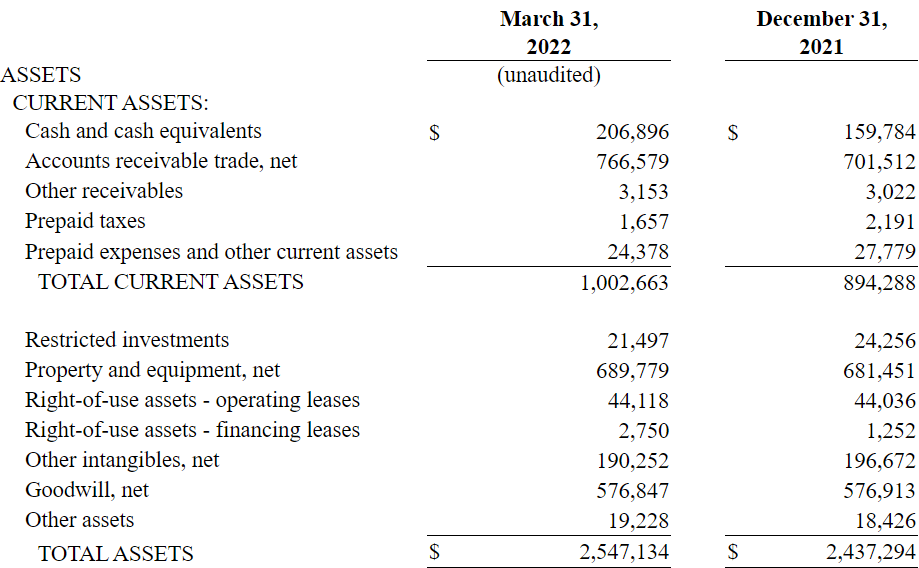

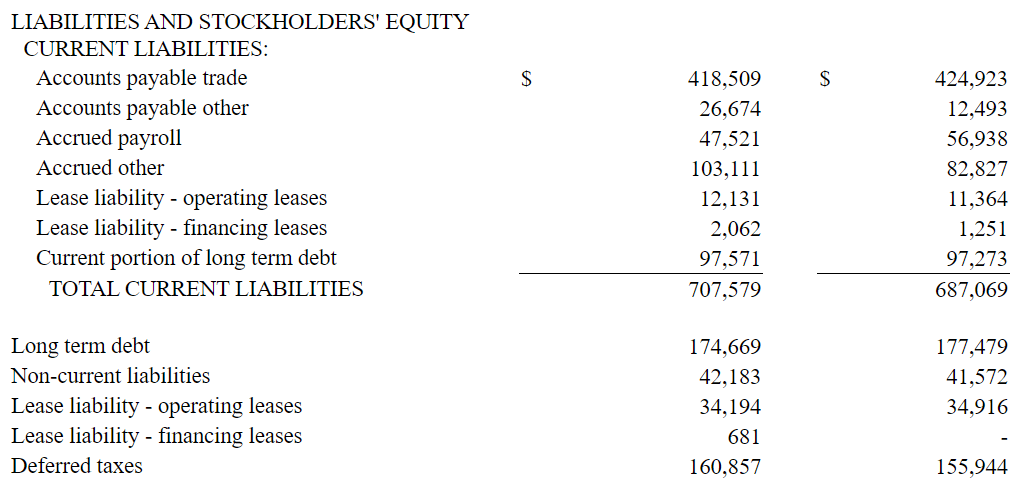

Balance Sheet

As of March 31, 2022, cash and cash equivalents were equal to $206 million, and the asset/liability ratio is larger than 1x. I believe that HUBG’s balance sheet would allow a number of new acquisitions.

10-Q

With long-term debt worth $174 million and current portion of long term debt of $97 million, the total amount of debt is not worrying.

10-Q

My Takeaway: The Fair Price Is Not Far From The Current Stock Price

Management is undertaking a lot of initiatives to improve efficiency and technological innovation. I believe that the company is well-managed. With that, the current valuation is not that far from what, I believe, is the fair price. Besides, there are some risks that could justify a decline in the stock price. In sum, I believe that the upside potential and the downside risk are somewhat symmetrical. I will be waiting to see if I can grab some shares at a bit lower price, not at the current price mark. Keep in mind that this is a company that I will follow carefully.

Be the first to comment