Darren415

“When will the Fed stop raising rates?” The most pressing question in investors’ minds these days is putting a lot of pressure on markets.

With the S&P 500 down ~-22%, we went looking for potential alternative income vehicles to add to the mix.

The DoubleLine Income Solutions Fund (NYSE:DSL) is a closed-end fund whose “objective is to provide a high level of current income and its secondary objective is to seek capital appreciation. The Fund will seek to achieve its investment objectives by investing in a portfolio of investments selected for their potential to provide high current income, growth of capital, or both. The Fund may invest in debt securities and other income-producing investments anywhere in the world, including emerging markets.

The Fund’s investment advisor, DoubleLine Capital LP (“DoubleLine” or the “Advisor”), allocates the Fund’s assets among debt security market sectors. DSL is a fund designed primarily as a long-term investment and not as a trading tool. ” (DSL site)

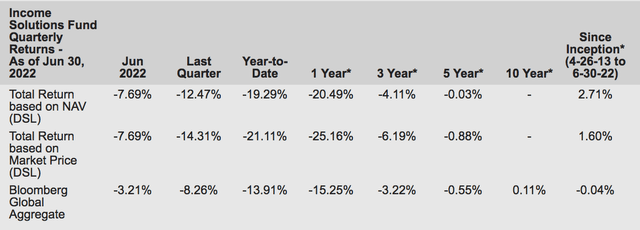

That comment about DSL being a long-term investment is borne out by DSL’s return since inception, where it has outperformed the Bloomberg Global Aggregate index’s -0.04% return, but DSL’s annualized quarterly return was only 2.71%, as of 6/30/22.

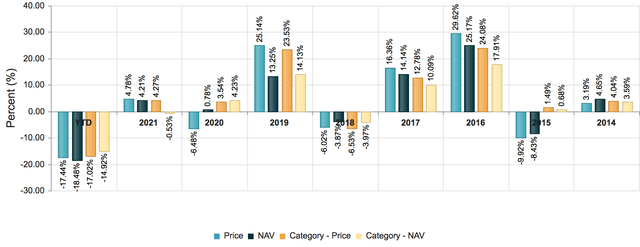

Breaking it down into yearly returns shows DSL outperforming the Morningstar US CEF Global Income category in 2014, and 2016-2019.

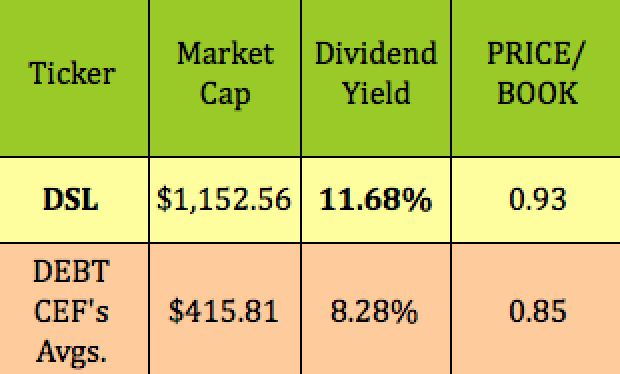

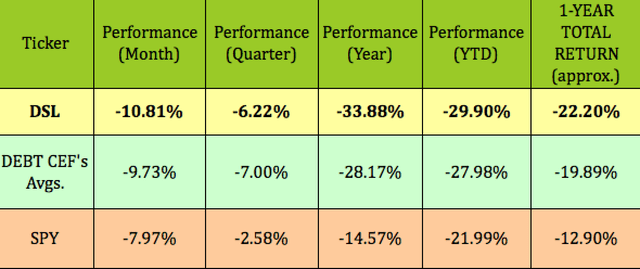

More recently, DSL has lagged the broad debt CEF averages and those of the S&P 500 over the past month, year, and so far in 2022, in addition to its one-year total return lagging:

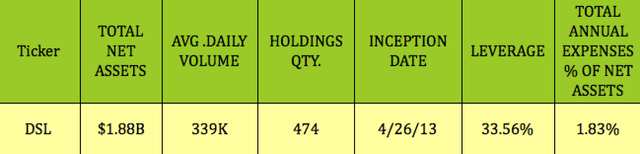

DSL’s inception date was 4/26/13. It has 474 holdings, with net assets of $1.88B, and daily average volume of 339K. Management uses leverage to increase the fund’s returns – leverage is at 33.56%, as of 9/28/22.

Pricing:

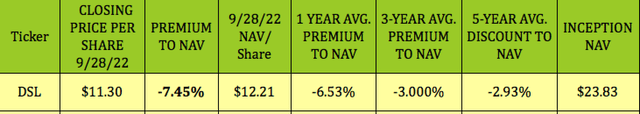

Since NAV/Share is calculated at the end of each trading day, you have to look at the most recent closing values to determine the current NAV discount or premium. Buying CEFs like DSL at a deeper discount than their historical average discounts/premiums can be a useful strategy due to mean reversion. DSL was selling at a -7.45% discount to NAV, as of the 9/28/22 close. That compares favorably to its 1- and 3-year discounts of -6.53% and -3%, and its 5-year average NAV discount of -2.93%:

DSL is one of the largest debt CEFs, with a $1.15B market cap. It’s trading at a higher .93X P/Book than the industry’s .85X broad average, and the market is demanding a much higher dividend yield.

Hidden Dividend Stocks Plus

Dividends:

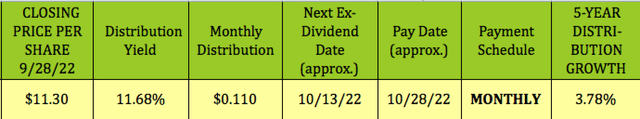

DSL pays monthly distributions, and generally goes ex-dividend near the middle of each month, with a pay date near the end of the month. At its 9/28/22 closing price of $11.30, it yielded 11.68%.

It has a five-year distribution growth of 3.78%. However, management lowered the monthly distribution from $.15 to $.11 in December 2020, where it has remained.

DSL’s fiscal year ends on Sept. 30, with semi-annual fiscal reports also issued for the six months ending on March 30.

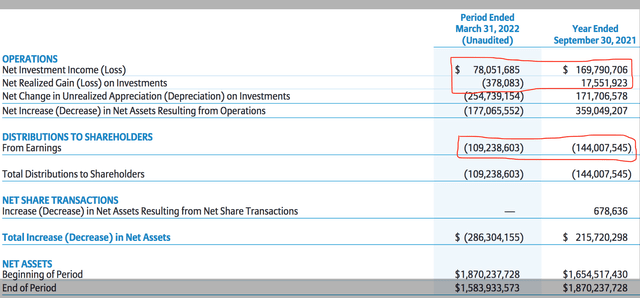

For the year ending 9/30/21, DSL had a Distribution Coverage ratio of 1.30X, based upon NII and Net Realized Gains. The current fiscal year has been a much different story though, with the six months ending 3/31/22 showing a sub-par Distribution Coverage ratio of .71X:

Holdings:

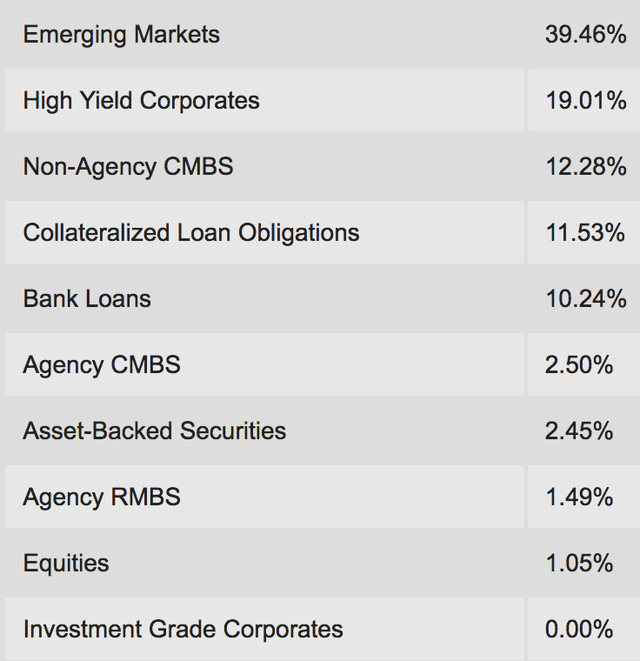

DSL has a great deal of international exposure, at nearly 40%. Its five biggest sectors comprise ~82% of its portfolio.

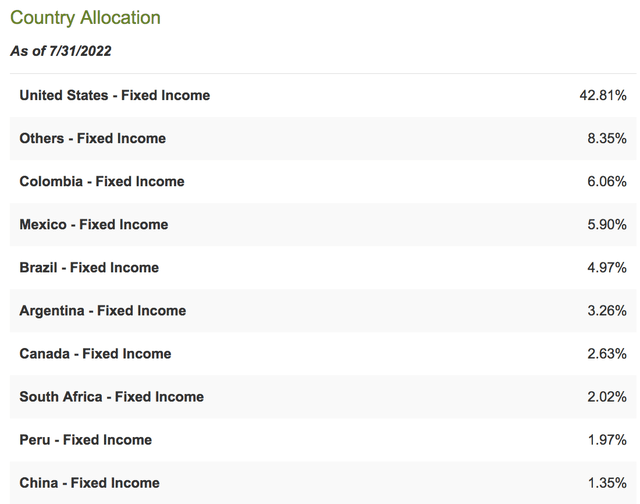

The US is by far its biggest regional exposure, at ~43%. It has ~22% exposure in Mexico and South America, with only ~1% exposure to China.

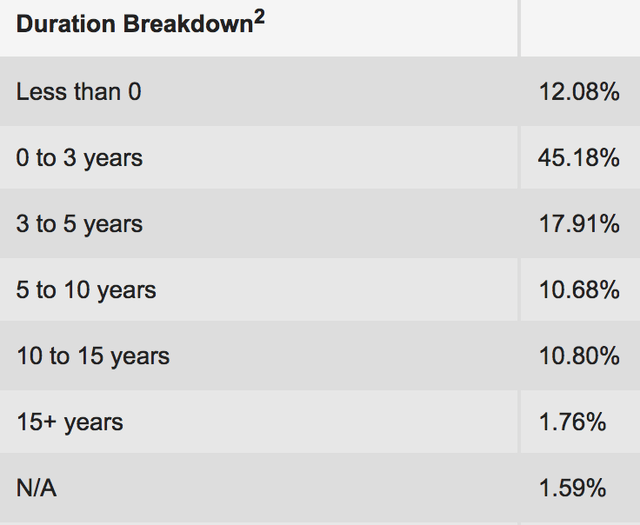

Portfolio duration is skewed to shorter-term holdings, with ~45% invested in zero to three years duration.

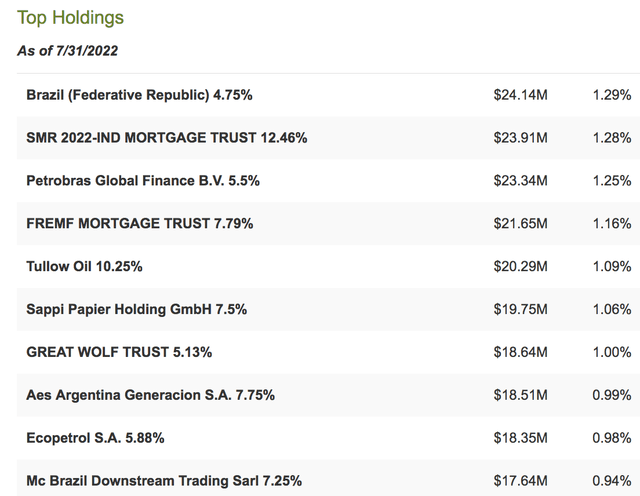

DSL’s top 10 holdings included three Brazilian positions, a government issue, one from Energy major Petrobras, and one from Brazil Downstream Trading. It also has two Colombian holdings. Although these are its top holdings, the highest exposure is only 1.29%:

Parting Thoughts:

One of DSL’s best years was in 2019, when the Fed lowered rates three times. DSL’s price rallied ~25%, and its NAV rose ~13%. That sort of brings us back to our initial question – when will the Fed stop raising rates.

In fact, maybe the more pertinent question when considering an investment in DSL is when will the Fed reverse direction and start cutting rates again?

In light of that uncertainty, as it relates to DSL, we don’t advise buying DSL at this point in time.

All tables by Hidden Dividend Stocks Plus, except where noted.

Be the first to comment