Alistair Berg/DigitalVision via Getty Images

One of the biggest challenges facing all Americans today is the pervasive inflation that has been driving up prices of everything all across our nation. This has forced many people to take on second jobs or find other means to generate extra income in order to pay their bills. Fortunately, as investors, we do not need to work so hard to get extra money as we have other methods available to us. One of these methods is to purchase a closed-end fund that focuses specifically on the generation of income. This is because these funds provide easy access to a diversified professionally-managed portfolio that can in most cases deliver a higher yield than just about anything else in the market. In this article, we will discuss one of these funds, the John Hancock Tax-Advantaged Global Shareholder Yield Fund (NYSE:HTY). As of the time of writing, this fund boasts a 13.01% yield, which is certainly enough to make anyone craving income take notice. I have discussed this fund before, but that was a year ago so obviously, a great many things have changed. This article will therefore focus specifically on those changes and provide an updated analysis of the fund’s finances. Therefore, let us investigate and see if this fund could be a reasonable addition to your portfolio today.

About The Fund

According to the fund’s webpage, the John Hancock Tax-Advantaged Global Shareholder Yield Fund has the stated objective of providing investors with a high level of total return. This is not exactly unusual for an equity fund as equities are a total return instrument by their very nature. After all, we invest in equities to both get a capital gain and a dividend. The fund specifically states that it is after those two things as it wants to provide investors with a total return in the form of both current income and capital gains. As is often the case with closed-end funds, it ultimately pays both out in the form of distributions regardless of the actual source of the money. The name of the fund gives a pretty good idea of its strategy as it buys dividend-paying equities from around the world. Interestingly, the fund does not specify if it will only invest in common equities or if preferred equities can also be included in the fund. If preferred equities can be included, it may be to the shareholders’ benefit. This is because preferred securities tend to be somewhat less volatile than common equities and possess higher dividend yields, which will boost the fund’s income. However, they do not have the same potential for capital gains. A good mix of the two security types would thus reduce the fund’s volatility somewhat and still provide a healthy mix of both income and capital gains.

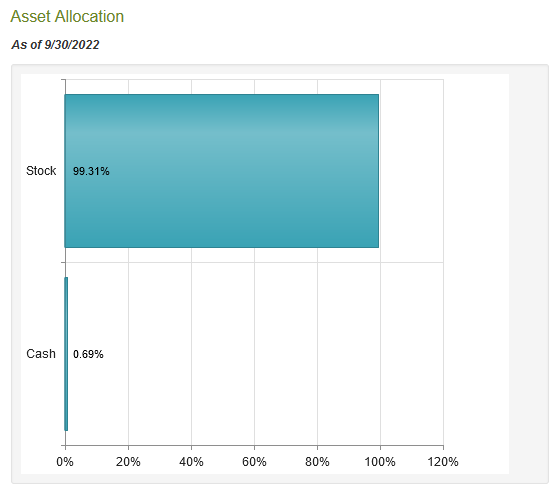

With that said, the John Hancock Tax-Advantaged Global Shareholder Yield Fund is currently invested fully in common equity:

CEF Connect

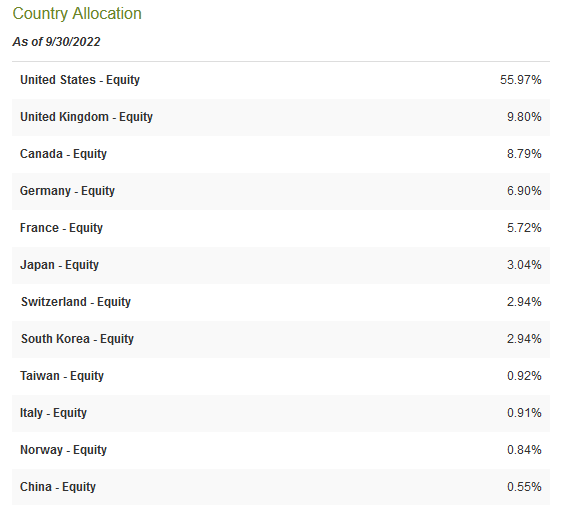

As already mentioned, the fund’s description does not specifically exclude including preferred stock in the portfolio. However, management either does not think that including such assets currently makes sense or it has some provision forbidding the inclusion of things other than common stock. Unfortunately, as we all know, global markets have not exactly given a good performance this year. As of the time of writing, the Vanguard Total World Stock ETF is down 18.59% year-to-date, which is still a better performance than the John Hancock fund has delivered:

With that said, when we consider the distribution yield on the John Hancock fund, it somewhat outperforms the index. The fund’s net asset value is only down 18.15% year-to-date despite the market punishing the shares much more than that. This is likely the quality of the fund’s portfolio. As already mentioned, the fund invests in dividend-paying securities. One often underappreciated characteristic of dividend-paying equities is that they tend to be much more stable than non-dividend-paying ones. This is because those companies that commit to a regular dividend generally are indicating that they are stable financially even through challenging economic conditions and that they do not desperately need the money. The market appreciates this sort of statement and as a result, these companies are rewarded by investors.

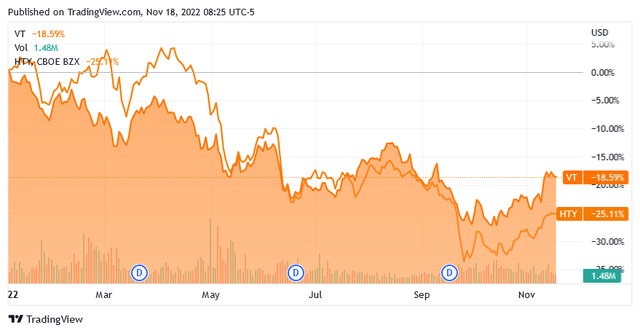

A look at the largest positions in the fund reveals that this fund is indeed committed to investing in dividend-paying equities:

This is a very different portfolio than that possessed by many of the other income-focused closed-end funds that we have looked at recently. In particular, we do not see any of the high-flying technology or cult stocks that dominated the “easy money” era, except for Microsoft (MSFT). With that said, there have been a number of changes to the portfolio since the last time that we looked at the company. Here are the changes to the top ten holdings list:

|

Removed |

Added |

|

Nutrien (NTR) |

Texas Instruments (TXN) |

|

British American Tobacco (BTI) |

Royal Bank of Canada (RY) |

|

Samsung Electronics (OTCPK:SSNLF) |

Philip Morris International (PM) |

|

Analog Devices, Inc. (ADI) |

TotalEnergies (TTE) |

|

BAE Systems (OTCPK:BAESF) |

Deutsche Telekom (OTCQX:DTEGY) |

In addition to this, the weights of several of the remaining positions changed significantly over the past year but this could easily be caused by one stock outperforming another in the market. However, the simple fact that so many positions changed compared to the prior year could make us believe that the fund has a fairly high turnover. This could be a problem because trading stocks or other assets costs money that is billed to the investors. This creates a drag on performance that forces management to earn enough of a return to both cover the expenses and then earn a return that is acceptable to the investors. This is the reason why index funds are so popular as they do relatively minimal trading and have very low expenses. This is certainly relevant here as the John Hancock Tax-Advantaged Global Shareholder Yield Fund has a 302.00% annual turnover. As we have already seen though, the current market environment is one in which we really want to have a good management team. This fund has outperformed the index despite the added costs from all the trading. Thus, it is quite hard to hold this high turnover against the fund right now.

As my long-time readers on the topic of closed-end funds are likely well aware, I do not generally like to see any position in a fund account for more than 5% of the portfolio. That is because this is approximately the point at which the position begins to expose the fund to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification but if the asset accounts for too much of the portfolio then this risk will not be completely diversified away. Thus, the concern is that some event may occur that causes the price of a given asset to decline when the market does not and if that asset accounts for too much of the portfolio then it could end up dragging the entire fund down with it. We have actually seen that this year with those funds that are heavily invested in the mega-cap technology stocks, which have substantially underperformed so far this year. As we can clearly see above though, this is not something that we really need to worry about here as there is no asset that accounts for a significant portion of the portfolio.

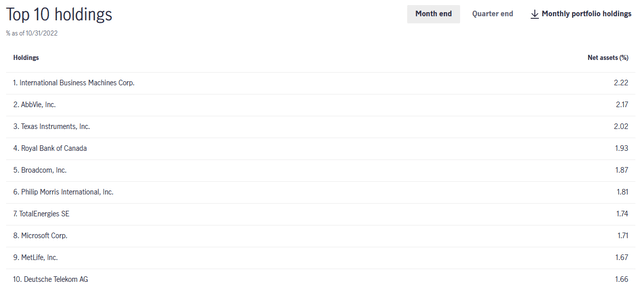

As we can see above, there are a number of foreign companies in the fund’s largest positions list. However, it still has more than half of its assets invested in the United States:

CEF Connect

The 55.97% weighting to the United States that we see here is somewhat higher than the fund had last year. It is also substantially higher than this country’s actual representation in the global economy. The United States only accounts for a little under 25% of the global gross domestic product. However, most global funds have a 60% to 70% allocation to the United States so the fund is still more diversified than that. I would still prefer to see more countries on this list and a lower weighting to America though. It is important to have an international (ex-US) fund to complement this one in your portfolio in order to achieve appropriate international diversification.

Distribution Analysis

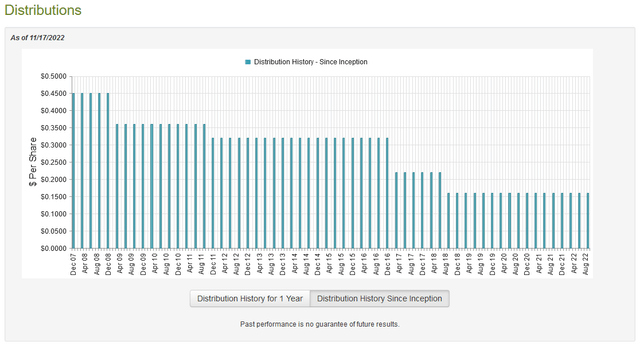

As mentioned earlier in this article, one of the objectives of the John Hancock Tax-Advantaged Global Shareholder Yield Fund is to provide its investors with a high level of total consisting of current income. As such, we might expect that the fund boasts a very high distribution yield. This is indeed the case as the fund currently pays out a quarterly distribution of $0.16 per share ($0.64 per share annually), which gives the fund a 13.01% yield at the current price. Unfortunately, the fund’s track record regarding this distribution is not particularly good as it has steadily reduced the payout over time:

This track record is likely to be a turn-off to anyone looking for a safe and secure source of income to use to support their incomes and pay their bills. This is especially true in today’s inflationary environment that has forced us to increase our incomes simply to maintain the same standard of living. However, it is also important to keep in mind that anyone buying the fund today will receive the current distribution at the current yield. The current distribution has been steady since 2018, which is a reasonably long track record. As is always the case though, it is important that we ensure that the fund can actually afford the distribution that it pays out. After all, we do want it to be forced to cut again since that would not only reduce our incomes but the share price would also most likely collapse.

Unfortunately, we do not have an especially current report to consult for that purpose. The fund’s most recent financial report corresponds to the six-month period ending April 30, 2022. This report will therefore give us no particular insight into the fund’s performance during the volatile market that we have seen over the past several months. However, this year’s market weakness started well before April so we can still glean some insights from this documentation. During that six-month period, the John Hancock Tax-Advantaged Global Shareholder Yield Fund received a total of $2,059,682 in dividends and another $265 in interest from the assets in its portfolio. After we net out foreign withholding taxes, the fund had a total income of $1,957,855 during the period. It covered its expenses out of this amount, leaving it with $1,510,801 available for investors. This was insufficient to cover the $3,493,759 that the fund actually paid out in distributions. At first glance, this likely looks rather concerning.

The fund does, however, have other methods through which it can obtain the money that it needs to cover its distribution. As mentioned earlier in the article, the fund seeks capital gains in addition to income. It was unfortunately rather unsuccessful at this during the quarter. The fund did manage to obtain net $188,468 realized gains but this was more than offset by the $2,352,003 net unrealized losses that it covered. Overall, the fund’s assets decreased by $4,122,313 during the period. This is a bad sign as it makes it much harder for the fund to sustain its current distribution. This is because the smaller its portfolio, the more difficult it is to generate the capital gains needed to maintain the payout. Investors may want to be cautious here, particularly since the very high yield indicates the market’s concern that the distribution will be cut.

Valuation

It is always critical that we do not overpay for any asset in our portfolio. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the John Hancock Tax-Advantaged Global Shareholder Yield Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can obtain it at a price that is less than the net asset value. This is because such a scenario implies that we are acquiring the fund’s assets for less than they are actually worth. This is fortunately the case right now. As of November 17, 2022 (the most recent date for which data is currently available), the fund has a net asset value of $5.57 per share but trades for $4.92 per share. This gives the shares an 11.67% discount to net asset value at the current price. This is relatively in line with the 11.30% discount that the shares have had on average over the past year. Overall, this is quite a large discount and is a very reasonable price.

Conclusion

Overall, the John Hancock Tax-Advantaged Global Shareholder Yield Fund has a lot going for it. The fund boasts a very high distribution yield that is backed by a reasonably well-diversified portfolio. The fact that the fund has been outperforming its benchmark index is also reasonably nice to see. The only real concern here is that the current distribution may not be sustainable and it might have to cut in the near future if it cannot start achieving higher gains. As this is probably a tall order, it would be a good idea to be cautious. The large discount helps to offset the risk though and it might be worth considering, particularly if that discount gets larger.

Be the first to comment