fazon1

HSBC logo (HSBC website)

Investment thesis

HSBC Holdings plc (NYSE:HSBC), the seventh largest bank in the world measured by assets held, reported their 2022 interim report with some good progress taking place.

It has been the largest financial holding in my portfolio since 2015.

In my last article, I shared my observations and thoughts surrounding the status after Q1 was reported. Here is my stance over the last five years.

Tudor Invest stance over the last 5 years (Seeking Alpha)

Now that HSBC has published its Q2 and FH 2022 results, it is again a good time to look under the hood, to see how they are doing.

First Half 2022 Financial results

As a result of a USD $1.8 billion gain on the recognition of a deferred tax asset, HSBC reported a net profit to shareholders after taxes in FH of 2022 of USD 8.29 billion. This was up from the USD 7.28 billion in 2021.

In the past, it has always been Asia that has been the shining star, with profits from Europe being more muted. It was therefore good to see that their second-largest market, namely the UK, was able to contribute with USD $2.5 billion of adjusted profits, which was up 15% from FH 2021.

As a group, HSBC delivered an annualized return on tangible equity of 9.9% in the FH of 2022. If we look at this compared to the 9.4% ROTE in FH of 2021, it does seem rather ambitious that they now have a target of achieving at least 12% from 2023 onwards. Perhaps holding less capital and an improved return on this capital will get them there.

HSBC continued to raise its spending on technology.

However, their ambition is to keep cost growth to around 2% in 2023, despite strong inflation headwinds.

They claim that they do have good cost discipline across the whole group. All the investments in technology start to deliver improved efficiencies. They will also continue to reduce the global real estate footprint and reduce their operations headcount. They have not yet completed all of these actions, and as such, we should see further savings at least offset some of the pressure from inflation.

What matter most is a positive jaw, which is described as a widening gap between revenue and costs. In the FH this year, their cost control led to a positive adjusted jaw that was up 12%.

Tangible net asset value per share was USD $7.48, which was down 32 cents from Q1, mainly due to foreign exchange impacts and from making the Q4 2021 dividend payment.

We keep reminding readers of how important the interest rate margins and the net interest income are for all banks.

Whenever you look at a bank’s profit and loss you will see that for most banks, this is the largest contributor to their income.

Net interest income came in at USD $14.5 billion in FH of 2022, which was 10.3% higher than the corresponding period last year.

The NIM was up 9% from Q1 to Q2 and came in at 135 bps.

HSBC – forward-looking NII (HSBC 2022 Interim Report)

Net fee and other income were 9% lower than last year’s FH and came in at USD 6.06 billion for FH of 2022

The reduction in fee income was mainly from their Wealth division, particularly in broking and unit trusts in Hong Kong. It reflected the weaker equity markets. Covid-19-related restrictions also had an impact as they resulted in some temporary branch closures. These reductions were partially offset by higher credit card income.

I have earlier been very positive about HSBC’s foray into insurance where they are increasing their investments.

This is starting to bear fruit already, with the value of the new business in their Asia insurance franchise growing by 41% in FH 2022 despite adverse market conditions.

I believe more growth will come from here.

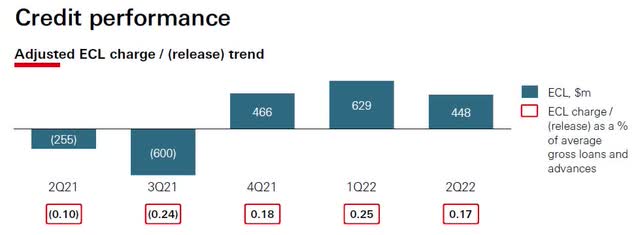

HSBC took a net charge of USD $448 million of ECLs in Q2. This included a further $140 million relating to their mainland China commercial real estate portfolio.

Outside of this one specific portfolio, the overall quality of their loan book remains good. Loans that fall into the category of stage 3 loans, as a percentage of total loans, remained stable at approximately 1.8%

HSBC – adjusted ECL (HSBC 2022 Interim Report)

Their CET-1 capital ratio is now 13.6%

- Returning capital to shareholders

The bank declared an interim dividend for 2022 of US cents 9 per share. That is up from the 7 cents they paid last year.

As one ADR is equal to 5 common shares, it means that the dividend is 45 US cents per ADR

I was pleased to learn that as shareholders spoke to the company about improving the dividend payout ratio and returning to paying dividends quarterly, they took notice and will now take action.

For 2023 and 2024, they will return to paying a quarterly dividend and they aim to pay out roughly 50% of their earnings. What will happen thereafter is not known.

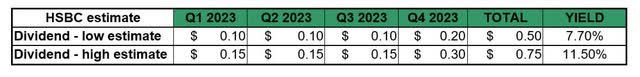

Let us look at what next year should bring, in terms of dividends.

HSBC estimates for dividend 2023 (Author)

If HSBC returns to paying dividends at the same level as prior to the pandemic, we should see dividends at my low estimate. So far this year, they have delivered EPS of USD 0.62

We are only halfway through the year, so a 50% payout ratio is well covered by the present EPS.

With higher interest income as a result of the higher level of interest rates shown earlier, we can potentially see a 50% increase in the dividend, although it is unlikely. My own estimate is that it will end close to the low range stated.

The yield is based on the current share price.

HSBC has now stopped the share buyback for the time being.

Business development

As I have pointed out in earlier articles, their 157 years of history in China and the fact that HSBC is now the largest “non-Chinese controlled” bank should offer HSBC many new business opportunities.

If you have followed the news about the run on some smaller banks in China lately, you might get worried. In the provinces of Henan and Anhui, a banking crisis began to unfold when savers were denied access to their accounts at a number of rural banks. This resulted in protests from disgruntled customers. The value of frozen funds was estimated at 40 billion RMB, which equals USD $6 billion.

There was also a mortgage payment revolt that spread to over 90 Chinese cities, as banks demanded payments while real estate companies had stopped completing projects. Customers refused to pay.

The end result will, in my opinion, be that more people will eventually check more carefully when they decide to trust someone else with their hard-earned money. They will hopefully ask themselves if there is a high degree of probability that the lender will return the money to them. After all, the return of money is far more important than the return on money. Hopefully, this will dawn on those that used these shadow banks and small rural banks.

This should, in my opinion, in the long run, open up more opportunities for the largest banks in China and also for large foreign banks.

Even though HSBC is the largest foreign bank in China, they still only command a market share of less than 0.2%.

Where many people see risks, I see opportunities. This is one of them.

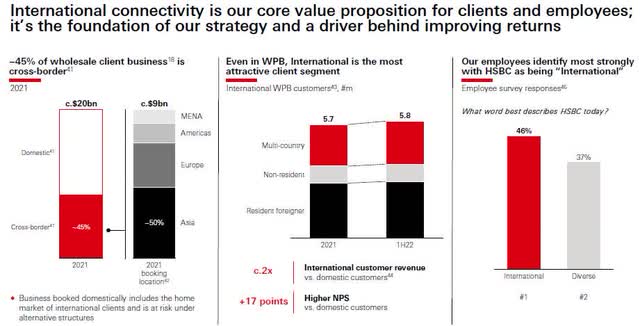

One of their largest shareholders, Ping An Insurance Group of China (OTCPK:PNGAY), had approached HSBC asking them to consider splitting the bank up, with one part being the most lucrative Asian part and another bank for the rest.

Bear in mind that in FH 2022, Asia contributed 68.7% of the profit before taxes. Europe contributed 9.5% and North America with 9.4%.

I do not think this is in the bank’s interest, and neither do the management and the board of the bank. The synergies and the important factor of servicing large multinational organizations globally have always been one of HSBC’s key competitive strengths.

Why is it so important for HSBC to be the world’s leading global bank?

HSBC as a global bank (HSBC 2022 Interim Report)

- Journey to net zero carbon emission

Last, but not least, I want to comment on the issue of climate change.

Whenever this topic comes up here on SA, I have noticed that there are many commentators that think it is all a hoax. Everything will be just fine.

I prefer to listen to scientists that study this topic for a living. They all agree that global warming is caused mainly by human activities, and most importantly, unless we do something to try to stop the trend, this planet we call home will not be a good place to live on.

That is why there is a very urgent need for the world’s transition to lower emissions.

So does HSBC think, and this can also be an opportunity for financial firms, as the demand to finance this shift is going to be huge.

The overall amount of sustainable finance and investment provided by HSBC and facilitated since the start of 2020 now stands at more than USD $170 billion, well on its way towards its target of up to USD $1 trillion by 2030.

Conclusion

Is HSBC a stronger, leaner, and better bank now than what it was 5 years ago?

As with so many things in life, it is not an easy question to answer.

On one hand, the share price has gone nowhere for many years. I paid roughly the same for my position in HSBC as what it is worth today. But we know that the price is what you pay and the value is what you get. The problem is always that we do not know how long time it takes for the price to reflect fair value.

The good news about a more generous dividend starting next year did help the share price the following day, as it increased by 5%.

On the other hand, I still think that HSBC is offering good value at the present share price, especially when we take into account the tailwind from higher NII and a more focused business than we saw in the past

From this, I conclude that HSBC Holdings is still a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment