Dan Kitwood

HSBC Holdings plc (NYSE:HSBC) is expected to achieve most of its financial target in the next few months, allowing it to prioritize dividend payments thereafter and, potentially, become a high-dividend yield play over the next twelve months.

Company Overview

HSBC is one of the few global banks, considering that it is currently present in more than 60 countries across the world, and one of the largest banks in the world. It currently has a market value of about $100 billion, and trades on the London and New York Stock Exchanges.

The bank has some $3 trillion in assets and about 40 million customers. Despite still having a global scale, HSBC’s strategy has been to downsize its operations and has exited several markets over the past decade, to focus on markets where it has higher profitability.

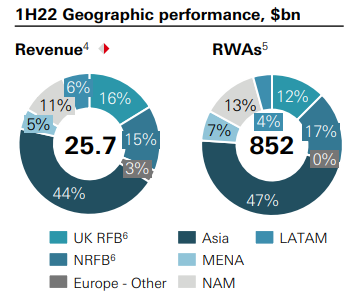

The bank is based in the U.K., but its roots come from Asia and still has a significant presence in that region. Indeed, during the first semester of 2022, Asia accounted for close to half of the bank’s risk-weighted assets and some 44% of its total revenue, being the largest region by far within the group.

Geographic performance (HSBC)

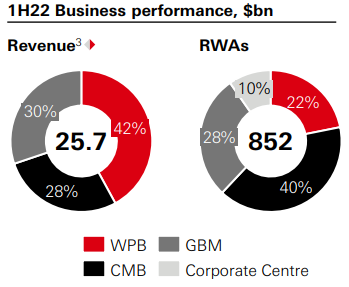

Its business is spread across several financial activities, namely retail and commercial banking, investment banking, asset management, beyond others. HSBC reports its operating lines under three main global businesses, namely Wealth and Personal Banking (WPB), Commercial Banking (CMB), and Global Banking and Markets (GBM), plus Corporate Centre that includes treasury activities, legacy businesses and some other assets. As shown in the next graph, its business is well diversified across its three core segments in terms of revenue, even though WPB is the largest one representing more than 40% of revenue generated during the first half of this year.

Business Overview (HSBC)

Business Strategy

HSBC’s global reach is one of its main distinguishing factors compared to other European banks, even though this business profile has been questioned in recent years. Over the past few years, the bank has downsized its size, though the exit from several markets where it had sub-scale and low profitability, such as France in 2021.

Despite that, its business profile has not changed considerably, with the bank being highly exposed to Asia, and then having several smaller markets that don’t share much synergies between each other.

Nevertheless, this global presence and long history of being a major banking supplier for global commerce, is a key competitive advantage that is not easily to replicate. This is a positive competitive position compared to its peers mainly on commercial banking, where it has a leading position on global trade finance.

Geographically, a very important region is Asia, which the bank targets as a major growth engine over the coming years. While there has been some pressure from a major shareholder, the Chinese insurance company Ping An Insurance Group, for the bank to separate this unit, HSBC’s management believes there is more value to keep the bank’s current business profile.

While due to geopolitical tensions between the U.S. and China, a more streamlined profile could be an advantage for the Asian unit, it could also lose direct access to U.S. dollars over the long term, which are key for global trade finance. In my opinion, this is the main reason why HSBC should keep its current business mix, even if a spin-off of Asian operations would probably lead to lower capital requirements, boosting somewhat the unit’s profitability, and potentially, lead to a higher market value for the stand-alone unit than the market values today as part of the whole group.

However, if this unit would lose direct access to U.S. dollars due to political tensions, this could mean that its competitive advantage in commercial banking would be lost, which would clearly destroy value for shareholders in the long haul.

Beyond that, I think a major reason why Ping An wants the bank to separate its business is so the Asian unit isn’t subject to the U.K.’s banking regulations, which would likely be softer regarding dividend distributions. The insurance company was quite upset from the Bank of England’s request for banks to suspend dividend distributions during the pandemic, as the insurance business model relies heavily on dividend income, beyond other sources of income, to meet its liabilities. Therefore, this means that to some extent, Ping An may be pushing the bank to separate its business due to its particular interests, rather than considering all shareholders interests over the long term.

As the bank is not likely to spin-off its Asian operations, its strategy is no expected to change much on the short term, as the bank continues to be focused on organic growth in its current regions and business segments. Its main financial targets are to achieve a return on tangible equity (RoTE) above 12% from 2023, and aim to revert to quarterly dividend payments next year with a dividend payout ratio of about 50%.

Financial Overview

Regarding its financial performance, HSBC has delivered a relatively mixed performance in the past few years, as its business was naturally affected by the pandemic, which led to lower profitability in the last two years. Indeed, its net income plunged by 50% in 2020 to some $6.9 billion, but has recovered rapidly last year to close at $14 billion.

During the first six months of 2022, the bank’s operating performance was mixed, considering that revenue increased by 12% YoY to $13.1 billion due to higher net interest income, but profit before tax dropped by 1% YoY to $5 billion. On the other hand, as the bank starts to benefit from higher interest rates, it has revised upwards its guidance for the full year, expecting to generate at least $31 billion in revenue in 2022 (representing annual growth of 17%), and at least $37 billion in 2023 (+19% YoY).

This means that revenue growth is expected to maintain a growing trend in the coming quarters, which together with good cost control and sound asset quality, should have a positive impact on profitability. This explains why HSBC is expected to report a RoTE higher than 12% next year, while in 2021 its reported RoTE was only 8.3%.

As the banking industry is mature and growth is rather low, a higher profitability level (that is sustainable over the long term) is a key factor for a higher valuation of its shares, thus RoTE is a key measure, beyond others, within the banking industry to distinguish the bank’s quality profile.

Going forward, the bank’s topline should continue to perform well given that HSBC is somewhat sensitive to higher U.S. dollar rates, thus its revenue is expected to improve if the Fed maintains its hiking cycle at least until the middle of 2023, while further gains from there may be more difficult to achieve. Beyond a higher top-line, its investments in digitalization and cost cutting should be another positive factor for earnings growth in the next few quarters, even though its impacts are more limited in the short term.

Regarding its capitalization, HSBC has a sound position given that its fully loaded core equity tier 1 ratio (CET1) was 13.6% and its leverage ratio was 5.4%, at the end of June 2022. This is a comfortable capital position, but slightly below the bank’s medium-term target of having a CET1 ratio between 14-14.5%, thus HSBC needs to generate capital in the coming quarters to improve capitalization and distribute dividends to shareholders in the next six to twelve months.

According to the bank, it should achieve its target during the first half of next year, and has already accrued dividends in its last quarterly figures, thus restarting quarterly dividend distributions during 2023 seems to be a reasonable expectation.

Investors should note that, during 2022, HSBC has distributed two dividends, amounting to $0.27 per share in total, but before the pandemic its regular distribution was quarterly. According to analysts’ estimates, its total dividend related to 2023 earnings could go up to about $0.435 per share, an increase of more than 60% from the current year.

This means that, if HSBC does deliver a big dividend increase next year, at its current share price, HSBC offers a forward dividend yield of close to 9%, which means that HSBC may become a high-dividend yielder in the near future.

Conclusion

HSBC is one of the largest global banks and its business profile is not expected to change meaningfully in the coming years. This means that potential excess capital will, most likely, be returned to shareholders in the next couple of years. As profitability is expected to improve markedly in the coming quarters, supported by higher revenue, a growing dividend is likely and the bank has the potential to become a high-dividend yielder.

Be the first to comment