Tsuji

HSBC logo (NYSE:HSBC)

Investment thesis

In our last article on HSBC Holdings plc (HSBC) dated the 2nd of August, we concluded that it still offered investors good value, especially in view of the tailwind it had from higher net interest income and a more focused business.

Now that the bank has published the financial results for the 3rd quarter of 2022, it is a good time to assess how the bank is doing.

Third Quarter 2022 Financial Results

The HSBC Holdings numbers improved both on the top line and the bottom line.

Adjusted revenue improved by 28% from Q3 of 2021, to USD $14.3 billion in Q3. Profit before taxes came in at USD $6.5 billion which was an improvement of 18% from the same quarter last year.

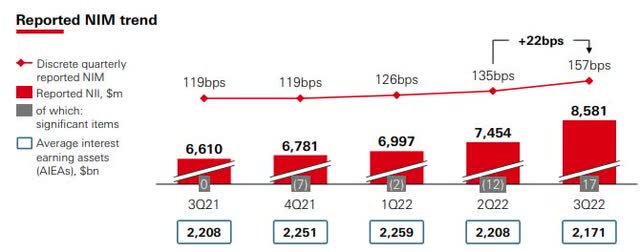

As expected, it was especially their net interest income that saw the biggest improvement. It was up USD $2.5 billion to USD $8.56 billion for the quarter. That was a whopping 40% increase.

HSBC – NIM and NII trend (HSBC 3rd Quarter 2022 Presentation)

It is reasonable to believe that this trend will continue, as there is always a time lag between an uptick in the interest rate and before it trickles down into profits after the repricing of loans.

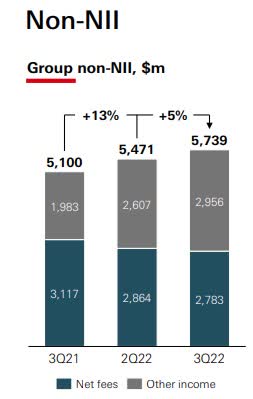

Fees and other non-interest income are also growing nicely.

HSBC – Fees and non NII grew in Q3 (HSBV 3rd Q 2022 Presentation)

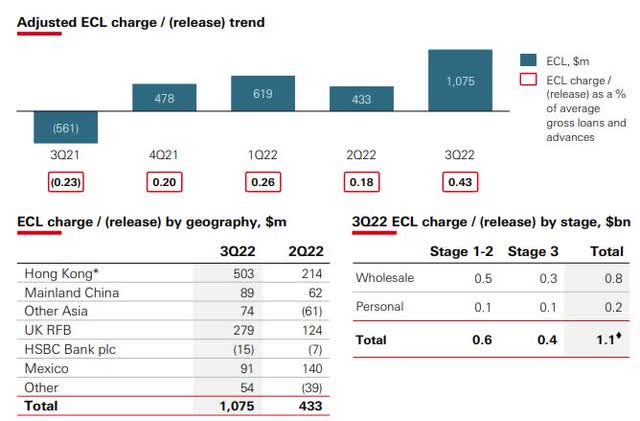

With higher interest rates, we need to monitor closely the credit performance.

HSBC – ECL up in Q3 of 2022 (HSBC Q3 2022 Presentation)

Their Estimated Credit Losses of USD $1.08 billion more than doubled in Q3 from the USD $433 million in Q2.

The two main reasons for this were a charge of USD $300 million taken on exposure to commercial real estate exposure in China and USD $200 million tied to uncertainties around the UK economy.

It should also be pointed out that even though the mortgage market in Hong Kong is performing well at this moment, we would argue that a potential fallout from higher interest rates has not yet hit the bank. Bear in mind that 96% of new mortgages in Hong Kong are done with floating rates tied to Hibor.

With the Hong Kong Dollar being pegged to the USD, the Hong Kong Monetary Authority has little room to maneuver outside of what the Federal Reserve does.

Now well into the last quarter of the year, we noticed that HSBC and its subsidiary Hang Seng Bank (OTCPK:HSNGY) on 3rd of November lifted their prime rates by 25 basis points to a 14-year high at 5.375%.

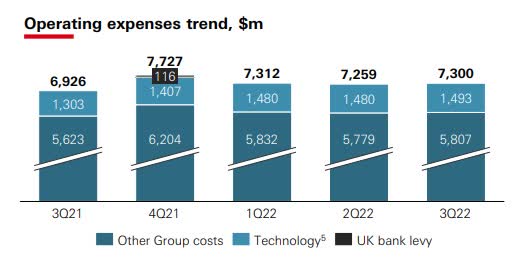

Let us look at HSBC’s operating expenses.

HSBC operating expenses 9 months 2022 (HSBC Q3 2022 Presentation)

We have been quite vocal over the years in stating that HSBC should do more to try to improve its cost control.

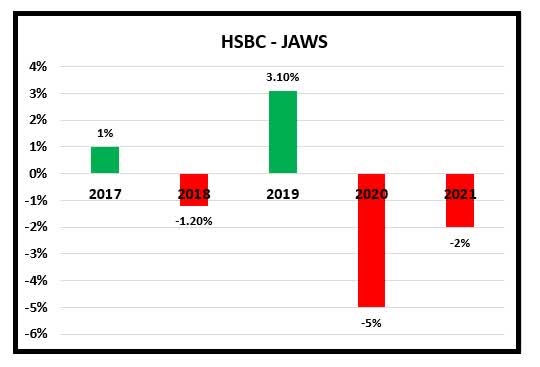

This used to be reported yearly by HSBC as “jaws,” which is defined as the difference between revenue and cost growth rate. They used adjusted numbers excluding currency translations and significant items.

In HSBC’s 2015 annual result, the jaws were -3.7%. Their goal is to produce positive jaws that ideally should grow. This has been very difficult to do.

HSBC jaws (Data from HSBC. Graph by author)

For the first 9 months of this year, HSBC’s adjusted revenue has increased by 11% to USD $40 billion. Their adjusted operating expenses in the same period have been broadly stable as it is up just USD $200 million, or 1%.

From this information, we can assume that they should get a positive jaw of around 10% for 2022.

We understand that big investments are made in IT and the whole process of digitization. But the goal of doing so should be to improve customer experiences, cut time in handling, and reduce overall costs. Therefore, these investment costs should tapper off. Reduction in physical real estate footprint, number of employees, traveling, and other expenses should come down.

This concern of not keeping good cost control has also been an area of concern for their large shareholder Ping An Insurance (OTCPK: PNGAY). They recently pointed out that HSBC’s cost-income ratio, at 64.2%, is 13% higher than an equivalent peer group.

However, judging from the improvements we should see in jaws this year, it is perhaps unfair of Ping An to make the claim that HSBC is not doing enough on controlling its costs.

Business development

Despite the cutback in headcounts that HSBC communicated last year, they are also increasing headcounts where they see new business opportunities. The bank has expanded its wealth management business in China by hiring 1,300 wealth managers with a target to hire up to about 3,000 there over the medium term.

As we have pointed out in earlier articles, HSBC’s foray into insurance businesses, especially those targeted towards their wealth customers should continue to see solid growth going forward.

One interesting development which will benefit HSBC is some news that was reported by SCMP on the 7th of November that Hong Kong’s government is exploring ways to expand and deepen its financial links with mainland China by adding insurance products to an array of cross-border investment platforms for stocks, bonds and wealth management instruments.

Mainland Chinese people bought insurance products in Hong Kong with policies worth HKD 72.68 billion at the peak in 2016. At that time, it represented 39% of the premiums in the city. With the border effectively being closed during the pandemic, this slumped to just HKD 688 million last year.

We expect the volume of this business to pick up once the movement of people across the border resumes.

If they can get sales of such products added to the cross-border trade, it obviously makes it easier for their customers as it should enable them to do the transactions without physically going to Hong Kong.

Conclusion

Hong Kong’s stock market is dependent upon investors’ perception of the fortunes, or lack of fortunes, from investing in China.

As long as there is widespread concern about investing there, the share price of HSBC will continue to trade between HKD 40 and HKD 50 per share.

HSBC – trading in the range of HKD 40 to 50 (Yahoo Finance)

Once, there is more clarity around China’s two biggest problems, namely the covid-19 pandemic and the real estate market, we should see more money flowing back in. The two counters on the Hong Kong stock exchange with the highest weighting in the index are Alibaba (BABA, BABAF) and HSBC.

Another potential catalyst for a higher share price will be a more shareholder-friendly dividend policy. Next year they will resume with quarterly dividend payments and have already communicated that they plan to pay out 50% of earnings as dividends in 2023 and 2024.

Based on the present share price of HKD 40.10 and if we assume EPS matches this year, shareholders could be looking at a dividend of HKD 2.34 in 2023

That would provide shareholders with a slightly better yield up from 4.4% to 5.3%

In our view, HSBC is still a good value here, and we maintain our buy stance.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment