Editor’s note: Seeking Alpha is proud to welcome Mitchell Martin as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Marina_Skoropadskaya

Investment Thesis

HP Inc. (NYSE:HPQ) has dropped in price due to concerns about their ability to increase printing revenue and adapt to a hybrid remote workplace setting. Combine this with a dying paper industry, and you have a perfect formula striking fear of a potential value trap. Perhaps I’m falling for the bait, but I believe HPQ is good for a low-risk investment with the potential of a high reward. Strong fundamentals, a fair price, growth in key areas, a strong dividend, consistently repurchasing shares, breakthrough technology in 3D printing, gaming and peripherals all play a role to potentially back HPQ in the upcoming years. The HPQ stock is now sitting close to the price Warren Buffett bought it in April 2022.

HP Inc. Overview

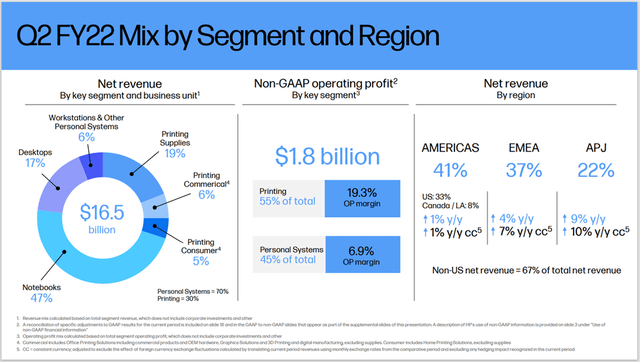

HPQ is a key player in the personal systems and printing industry. A breakdown of their products sold is shown in their Q2 FY22 presentation.

HPQ Q2 FY22 Earnings Announcement

HPQ faced negative revenue growth with their printing products in Q2. The company attributed this to a lack of demand for commercial printing when employees worked from home. Conversely, Personal Systems saw impressive performance. Workers were printing less in the office but they took their HP laptops home. HPQ’s product line diversity buffers against pandemic disasters and should prove to be beneficial as the hybrid remote setting evolves.

HPQ Q2 FY22 Earnings Announcement

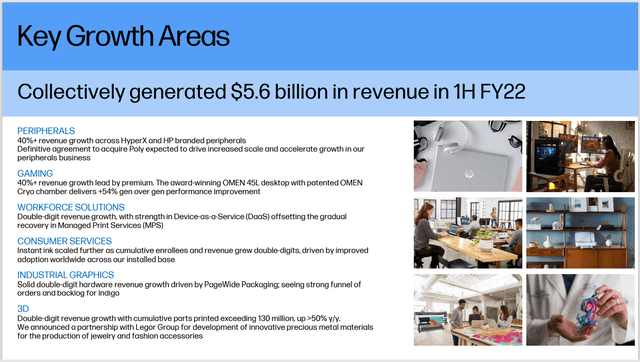

In fact, the evolution of this product line will most likely be the key difference between a grandpa dividend stock and an exciting growth opportunity. As HPQ sees less of a demand for paper printing services, they have done an excellent job adapting by developing new product lines, including a personal favorite, the MultiJet fusion 3D printer.

HPQ Q2 FY22 Earnings Announcement

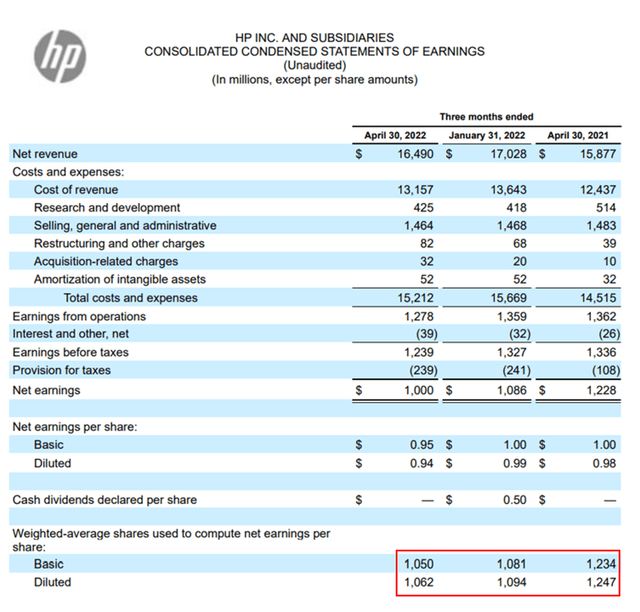

HP Q2 FY22 Earnings

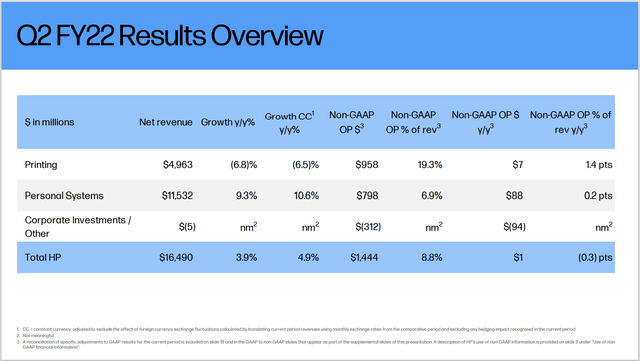

HPQ’s last quarterly earnings in May indicated an increase in Net Revenue of $16.5 billion which is up 3.9%. They missed slightly on EPS which was at $0.94 compared to a predicted $0.95. They also generated $0.4 billion of cash flow even with half of their product line, printing systems, declining in revenue by 7%. Although the declined printing revenue and the cash flow results were lackluster, HPQ’s CEO, Enrique Lores felt they performed well despite the commodity and overall supply chain constraints.

HP Inc. (NYSE:HPQ) Q2 2022 Earnings Conference Call May 31, 2022 5:00 PM ET (Seeking Alpha)

HPQ Stock Valuation

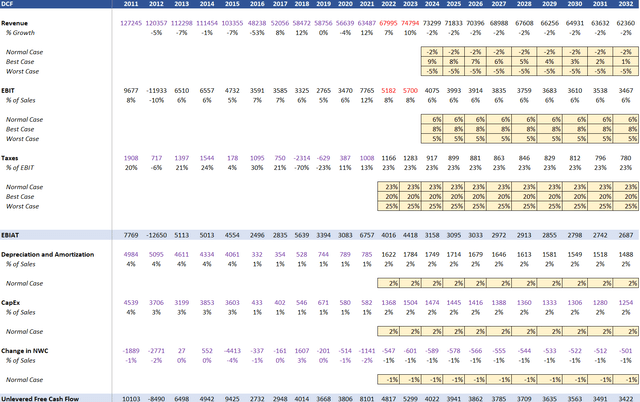

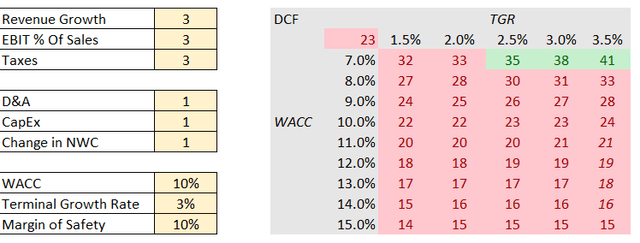

A fair value of $38 per share was calculated by an unlevered DCF analysis using a CAPM discount and averaging worst case, best case, and normal case scenarios.

Cases use an average of (13) Analysts’ projections in 2022 and 2023 from Financial Modeling Prep, which are in red text, and financials coming from their API.

Personal inputs in the remaining projections over the next ten years can be seen in the tan boxes. Three cases (Normal, Best, Worst) were assigned to Revenue Growth, EBIT (% of Sales), Taxes (% of EBIT) and a flat rate was assigned to Depreciation and Amortization (% of Sales).

Figure 1: Discounted Cash Flow Assumptions (Author)

Assumptions

Revenue Growth

- Normal Case: (-2%) from 2024 to 2032. (-2%) is an average of the last 10 years, including the analysts’ projections.

- Best Case: Starting with 9% growth in 2024 and linearly reduced to 1% in 2032.

- Worst Case: (-5%) from 2024 to 2032. This represents a worse environment over 2020 when HPQ had a (-4%) growth during the pandemic.

EBIT % of Sales

- Normal Case: 6% from 2024 to 2032. This represents an average performance similar from 2015 to 2020 after the HPQ/HPE split.

- Best Case: 8% from 2024 to 2032. This just mirrors analysts’ projections.

- Worst Case: 5% from 2024 to 2032. This represents their worst years of EBIT margin in 2015 and 2020.

Taxes % of EBIT

- Normal Case: 23% from 2022 to 2032. Though the average tax rate for HPQ over the last 10 years was around 4%, this value seemed unreasonable for a company this size. Fairly conservative values were used based on the highest taxed years.

- Best Case: 20% from 2022 to 2032.

- Worst Case: 25% from 2022 to 2032. This represents a higher taxed rate potentially due to something like an administration change.

Depreciation and Amortization (% of Sales): 2% YOY. This is just a 10-year average

Capex (% of Sales): 2% YOY. This is just a 10-year average

Change in NWC (% of Sales): (-1%) YOY. This is just a 10-year average

WACC/Return: 10%

Terminal Growth Rate: 2.5%

Factor of safety: 10%

Fair Value

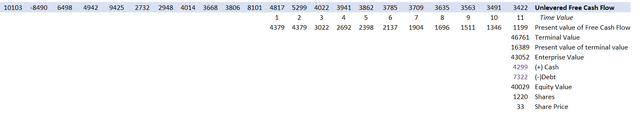

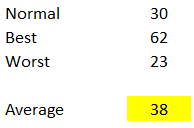

After the assumptions were made, Unlevered Free Cash Flow was calculated and discounted to find a fair value.

Figure 2: Fair Value Calculation (Author)

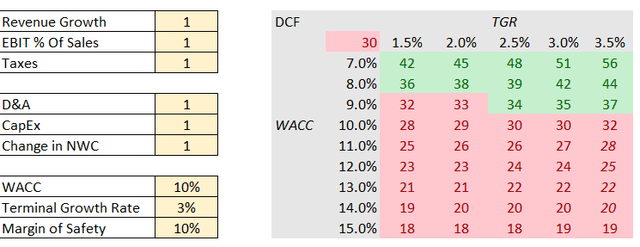

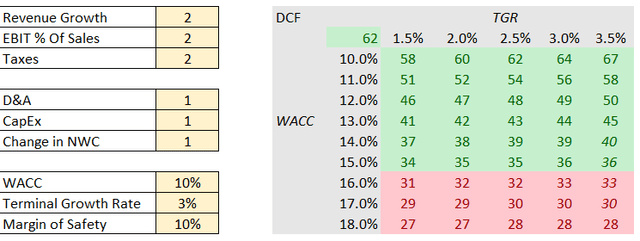

This process was repeated for the three different cases and shown in each sensitivity table.

Figure 3: Sensitivity table 1 – Normal Case Scenario (Author) Figure 4: Sensitivity table 2 – Best Case Scenario (Author) Figure 5: Sensitivity table 3 – Worst Case Scenario (Author)

An average of the three cases was taken to arrive at a fair value of $38.

Figure 6: Average of three scenarios (Author)

Valuation Ratios

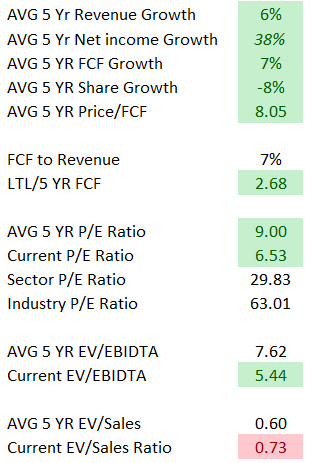

You will notice by the sensitivity analysis that buying around $35 puts us in the return range of 7%-15% YOY, depending on the scenario. A DCF is fine for a 1000-foot view of a fair value, but further investigation should be done on some key ratios.

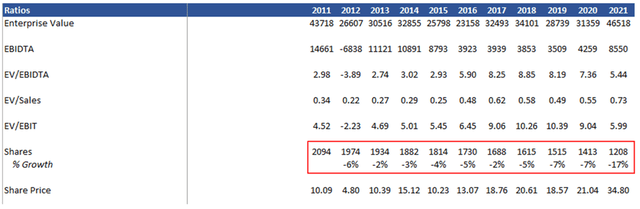

Figure 7: Valuation Ratios (Author)

Valuation ratios look fantastic with growth in revenue, net income, and free cash flow. You will notice a value indicating a (-8%) in share growth over the last 5 years. This means HPQ has bought back an average of 8% of their shares each year, which could increase the share value so long as HPQ continues this trend.

We have excellent values in long-term liabilities as a ratio of cash flow and average price to free cash flow. HPQ has a low P/E ratio compared to their average over the last five years, and is extremely low compared to the sector and the industry they compete in. EV/EBIDTA is low compared to their average and EV/Sales is not backbreaking as it sits.

Overall, the valuation of HPQ looks fantastic.

Share Buybacks

HPQ has spent the last 10 years repurchasing shares. In their 10-k, they commented on how they plan to continue this, and they have. In Q2, they returned $1.3 billion to shareholders through share repurchases and dividends. As HPQ continues to buyback shares, this becomes an opportunity for an investor to hold a larger percentage of the company.

HPQ Q2 Earnings Statement (HP Inc. Reports Fiscal 2022 Second Quarter Results) Share Repurchases Since 2011 (Author)

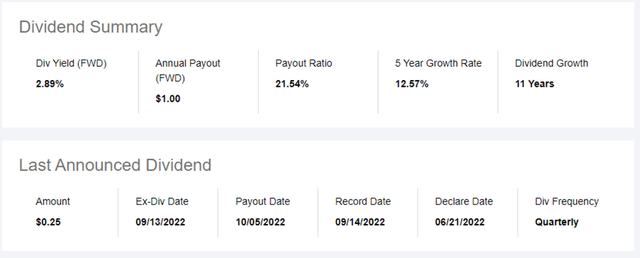

HPQ Dividend Yield

HPQ has grown its dividend over the last 11 years and is sitting at a pretty 2.89% right now. This combined with share repurchases rewards long-term shareholders.

HPQ Dividend Summary (Seeking Alpha)

Risks and Mitigants

As mentioned above, HPQ needs to continue to revolutionize their product line to stay competitive but there are some other risks summarized from their 10-k that may impact the bullish thesis if not taken care of.

Supplier Dependent

HPQ is heavily dependent on single sourced suppliers such as AMD (AMD) , Intel (INTC), and Canon (CAJ) due to HPQ’s Make-to-order operations strategy and lack of advanced processor suppliers available. With the recent passage of the CHIPS Act, some of these companies received funds to help them manufacture their products and deliver to customers like HPQ.

Competitive Industry

HPQ is in a competitive industry with giants like Dell (DELL), Apple (AAPL), and Microsoft (MSFT). Although HPQ will have to continue to innovate and grow to stay competitive, they do have product lines separating them from these giants.

Failure to Produce Printing Revenue

This is the biggest risk of them all. If HPQ cannot grow their printing revenue, they will be cutting into half of their profits. Although I am a believer that you will always need that one piece of paper, they understand this risk and are continuing to develop product lines. Hopefully by the time paper is banned from existence, their 3D printing services have exploded. Non-believers may want to wait for the price to dip to the mid-20s before buying to cover this risk, if it ever gets that low.

Conclusion

HPQ has strong valuations even with very conservative assumptions. A (-2%) revenue growth for the next 10 years, high tax rates, and a 10% margin of safety still indicate a buy. This does not take into account the almost 3% dividend yield and consistent share buybacks. They do have risks involved in their printing line, but there is evidence showing they have done an excellent job to combat this through product line innovation. HPQ is a heads or tails stock – heads, they execute on printing and key growth areas, leading to a 15% return with a 3% dividend yield, while still buying back shares; or tails, the printing industry is tossed into the oblivion, they fail to capitalize on other product lines and are beaten out of competition. I guess this would result in about a 6% return before selling. So, it seems more like heads you win big, or tails you don’t lose.

Be the first to comment