wellesenterprises

Thesis

Warren Buffett bought $4.2 billion worth of HP (NYSE:HPQ) equity in April 2022, when the stock was trading at about $40/share. Since then, the stock has derated by about -20% and investors who follow Warren Buffett’s lead with a lag could enjoy a very favorable deal. Trading at a one year forward GAAP P/E of less than x8 and a greater than 3% dividend yield, HPQ stock is dirt cheap, in my opinion.

Personally, I believe that HP should be valued at about $47.51/share, indicating 50% upside. I base my argument on a residual earnings model anchored on analyst consensus EPS.

For reference, HPQ stock is down about 17.5% YTD, versus a loss of about 15.5% for the S&P 500 (SPY).

About HP

HP Inc. is a multinational information technology company headquartered in Palo Alto. The company has taken a leading competitive positioning in design, manufacturing and distribution of personal computers and related hardware such as PC periphery devices, printers and data centers. HP operates three key segments: personal systems (1), printing (2), and corporate investments (3).

The personal systems segment accounts for about 70% of total sales and offers a variety of IT/PC hardware such as computers, notebooks, workstations, displays and other computer peripherals. The segment also sells software and PC related services. The printing segment is responsible for about 30% of the company’s total revenues and offers printer hardware as well as related supplies and services. The corporate investments segment is negligible in terms of revenues. The segment is focused on HP Labs (new business opportunities), business incubation, and investment projects.

HP Inc. was founded in 1939 and defines its mission as follows:

HP Inc. is a technology company that believes one thoughtful idea has the power to change the world. Its product and service portfolio of personal systems, printers, and 3D printing solutions helps bring these ideas to life.

Strong Fundamentals

Buying HP stock offers investors exposure to steady revenue growth and value accumulation. From 2018 to 2021, HP increased revenues from $58.5 billion to $63.5 billion, representing a CAGR of almost 3%–in line with nominal GDP growth. However, on the backdrop of a material gross margin expansion, the company managed to increase operating income at a much higher CAGR of 10%: increasing from $4.32 to $5.81. The higher profitability was not achieved at the expense of high-quality investments. In fact, over the same period, R&D expenses increased from $1.4 billion to $1.9 billion.

HP’s balance sheet is strong. As of June 30, the company had $4.5 billion of cash and short term investments against $10.2 billion of total debt. In my opinion, HP’s net debt position is easily manageable in relation to the company’s strong annual cash from operations of $6.1 billion (TTM reference).

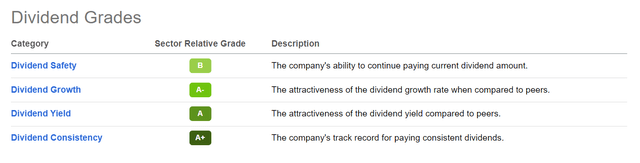

Consequently, I argue that HPQ’s attractive >3% dividend yield is sustainable.

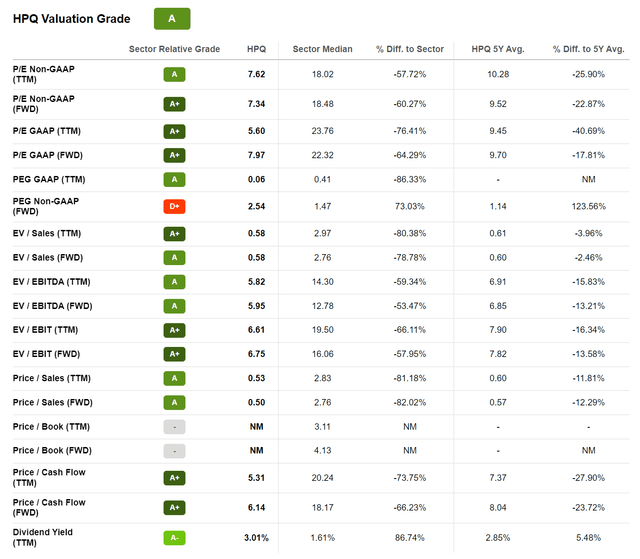

Attractive Multiples

In relation to the company’s solid fundamentals, HP stock is arguably undervalued. Trading at a one-year forward P/E of about 8x, a P/S of 0.5x and a EV/EBIT of 6.7x, investors enjoy a significant discount to the sector median. Notably, according to data compiled Seeking Alpha, HP stock trades 50% – 80% cheaper than peers.

Residual Earnings Valuation

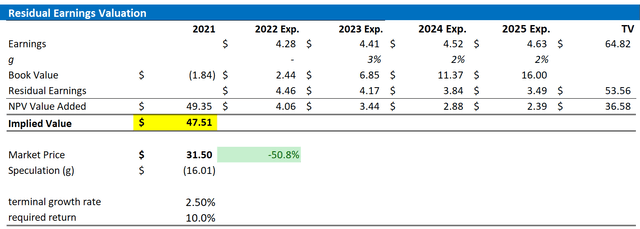

Let us now look at the valuation. What could be a fair per-share value for HP’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on HP’s cost of equity at 10%.

- To derive HP’s tax rate, I extrapolate the 3-year average effective tax rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply 2.5%. This is more/less in line with HP’s cyclical adjusted performance for the past 3 years.

Based on the above assumptions, my calculation returns a base-case target price for HP of $47.51/share, implying material upside of about 50%.

Bloomberg Terminal data; Author’s calculation

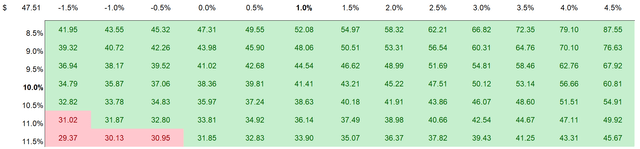

I understand that investors might have different assumptions with regards to HP’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Bloomberg Terminal data; Author’s calculation

Risks To My Thesis

HP generates a significant portion of revenues from the PC and computer hardware segment. Accordingly, a major global slowdown of PC purchases could result in a significant downward correction of HP’s EPS estimates–although likely temporary. Moreover, investors should consider that much of HP’s current share price volatility is driven by investor sentiment towards the stock market. Thus, investors should be prepared to stomach price volatility even though HP’s business outlook remains unchanged.

Conclusion

Buffett has an amazing track-record of buying businesses for less than what they are worth. And Buffett’s HP pick should arguably support the investor’s highly respectable long-term performance: trading at a one year forward P/E of less than 8x, despite little financial leverage, HP stock is clearly undervalued.

Personally, I use a residual earnings model to value HP and calculate about 50% upside. Investors can also enjoy an attractive dividend yield of greater than 3%. This should provide downside support to the stock’s valuation and delight shareholders while they wait for the stock’s valuation to catch up with fundamentals. Accordingly, I am confident to initiate coverage with a ‘Buy’ recommendation.

Be the first to comment