jimfeng/iStock Unreleased via Getty Images

Introduction

Howard Hughes Corporation (NYSE:HHC), a unique master-planned community (MPC) developer, is once again trading at a steep discount to intrinsic value as well as its pre-COVID highs. The company owns a valuable mix of Class A multi-family, office, hospitality, and retail real estate assets within their well-located MPCs. They also own large amounts of valuable land that they routinely sell to home-builders.

HHC owns and controls 5 high-quality master-planned communities including The Woodlands in Texas, The Woodlands Hills Summerlin in Las Vegas, Ward Village in Honolulu, Columbia in Maryland, and Bridgeland in Texas.

Currently trading at $53.55 per share, HHC is down 59.6% from its February 2019 high of $129.35 and down 49.3% from its 52-week high of $105.51 in April 2022.

While the pandemic briefly negatively affected HHC’s NOI (net operating income), NOI has now fully recovered and shares are now priced at a significant discount to the net value of its underlying land and real estate.

Bill Ackman’s Pershing Square Owns 27.3% of Shares Outstanding

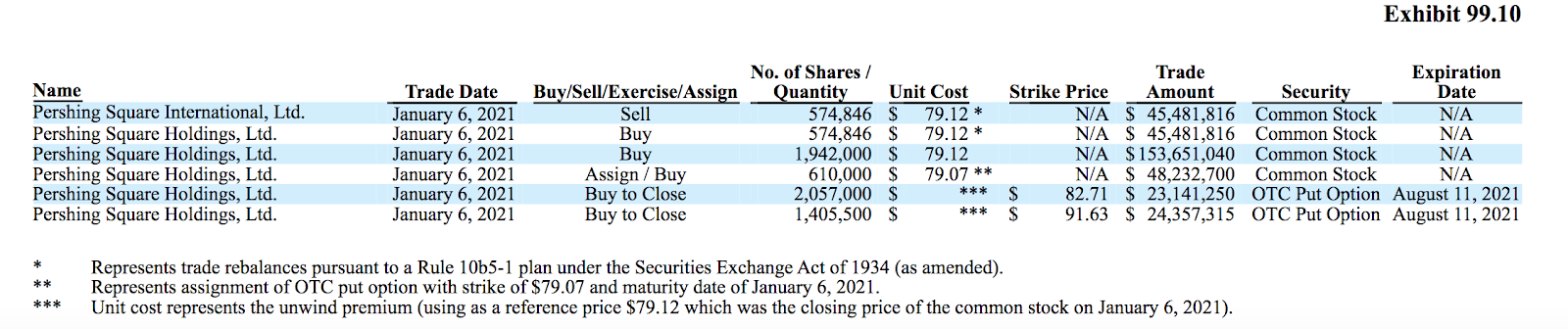

Bill Ackman’s Pershing Square initiated a position in HHC as a result of the GGP spin-off in 2009, and increased the Fund’s position in HHC in January 2021 at prices of above $79 a share.

13F

Pershing Square maintains the position in its portfolio and remains bullish as per its most recent shareholder letter.

Investors now have the opportunity to buy HHC shares at just 37.8% of the company’s NAV (net asset value), and below Bill Ackman’s January 2021 acquisition price.

Net Operating Income Now at All-Time High, with Strong NOI Growth over Past Decade

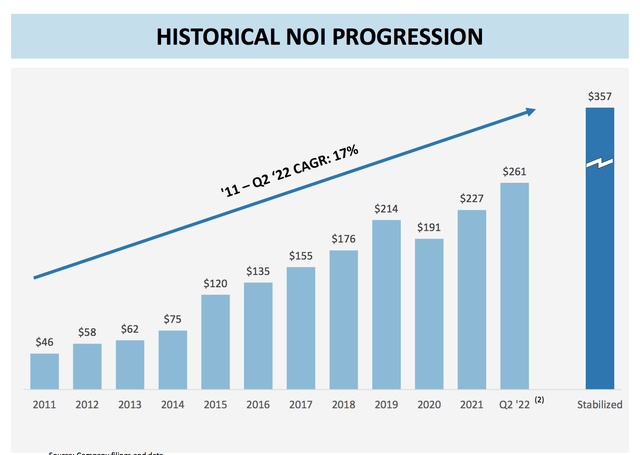

When HHC was last trading at below $60 a share, there was serious concern in the market regarding how quickly HHC could return to its pre-pandemic NOI, particularly given HHC’s exposure to office and retail real estate. HHC had an NOI of $214M in 2019, which then dipped to $191M in 2020, with concern that NOI could further decrease. 2021 proved to be the best year on record for HHC, with NOI of $227M, 6.1% higher than 2019 and 18.8% higher than 2020.

With NOI from operating assets now at an all-time high, it’s clear that the underlying business is performing well despite the turmoil in the stock market.

HHC is a Skillful Developer with Strong Track Record of Growing NAV

Management also has a strong track record in creating value within their real estate portfolio, with NOI rapidly growing at a management-provided CAGR of 17% since 2011. With HHC being a real estate developer, NOI increases every year with the completion and stabilization of their real estate developments. This 17% NOI growth is uniquely impressive given that 3-5% NOI growth is typical in office, multi-family, and retail commercial real estate.

Management expects that when their existing operating assets are fully stabilized, those assets will produce a stabilized NOI of $357M. As NOI grows, so does the value of the underlying real estate.

Since inception, HHC has averaged 9.8% yield on cost and 24.5% return on equity, allowing the company to construct assets at far below replacement cost and market value.

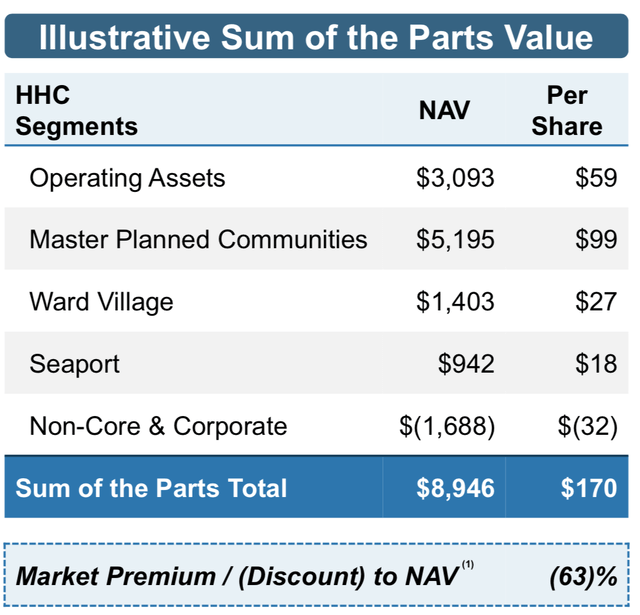

Management Estimates $170 NAV per share

In my previous article on HHC, written in January 2021, I estimated $170 per share in NAV based on a sum of the parts valuation of their different MPCs. Management have since confirmed that they agree with my previous NAV estimate, coming out with their own sum of the parts valuation with an NAV estimate of $170.

Their sum of the parts valuation is below. While they took a slightly different approach, we arrived at the same value.

Note that they don’t break down debt allocation for each category. My assumption is that property-level mortgage debt is factored into NAV for its respective category, while corporate level debt is in the non-core and corporate bucket (hence the negative NAV in that segment).

Operating Asset Valuation

Since cap rates in the real estate market and HHC’s portfolio NOI have moved since my previous article, it is worth revisiting my NAV valuation and comparing it to management’s estimation. HHC has the following breakdown of NOI from operating assets. Cap rates listed below are used to calculated the asset value and are taken from CBRE’s H1 2022 Cap Rate Survey.

| H1 2022 NOI | H1 2022 Annualized NOI | NOI % | Market Cap Rate | Asset Value | |

| Office | $54.8M | $109.6M | 48.1% | 6.73% | $1.63B |

|

Retail |

$28M | $56M | 24.6% | 6.74% | $830.9M |

| Multi-family | $23M | $46M | 20.2% | 4.75% | $968.4M |

| Other | $8.1M | $16.2M | 7.1% | 7.5% | $108M |

| Total Operating Asset Value | $113.9M | $227.8M | 100% | $3.537B |

Based on the NOI produced from each segment of the stabilized operating portfolio and their corresponding cap rates, this segment has an asset value of ~$3.5B.

Seaport in NYC is not yet stabilized and currently has slightly negative NOI of ~negative $700,000. Management is expecting ~$50M in stabilized NOI, representing about close to 38.6% of the gap between current NOI of $227.5M and $357M pro-forma stabilized NOI. Market cap rates in Manhattan are around 3.5-4%, so a more elevated 5% cap rate on pro-forma NOI would yield an asset value of $1B for Seaport. This is in line with management’s valuation, which valued Seaport at cost ($1.03B).

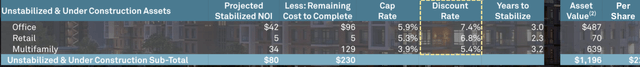

Excluding Seaport, there is an additional $79.5M in pro-forma stabilized NOI coming from the stabilization of existing assets as well as ongoing developments projects. Management is estimating a value of $1.2B on these assets after factoring in remaining construction costs.

HHC 2021 Investor Presentation

Note their last estimate on this subset of assets is from 2021 and has not been updated in their 2022 presentation. Given the expected cap rate expansion in the real estate market, I would use a 6.5% average cap rate rather than their 3.9-5.9% range, giving a $1B valuation on the unstabilized assets after construction costs. Including Seaport and other unstabilized assets, we are now at $5.5B in asset value from the operating portfolio.

In addition to the operating portfolio, HHC is also developing and selling residential condos in Ward Village. They estimate asset value to be $1.6B based on condo sale prices in their existing developments. I applied a $200M haircut to due to a potential ongoing slowdown in the residential market, although HHC condo sales have been robust and seemingly unaffected as of Q2 2022.

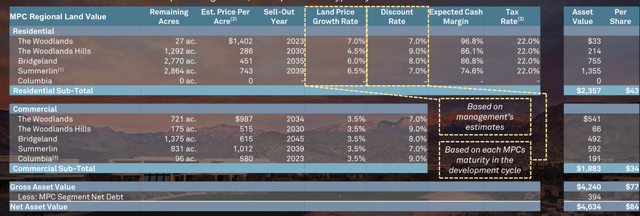

MPC Land Valuation

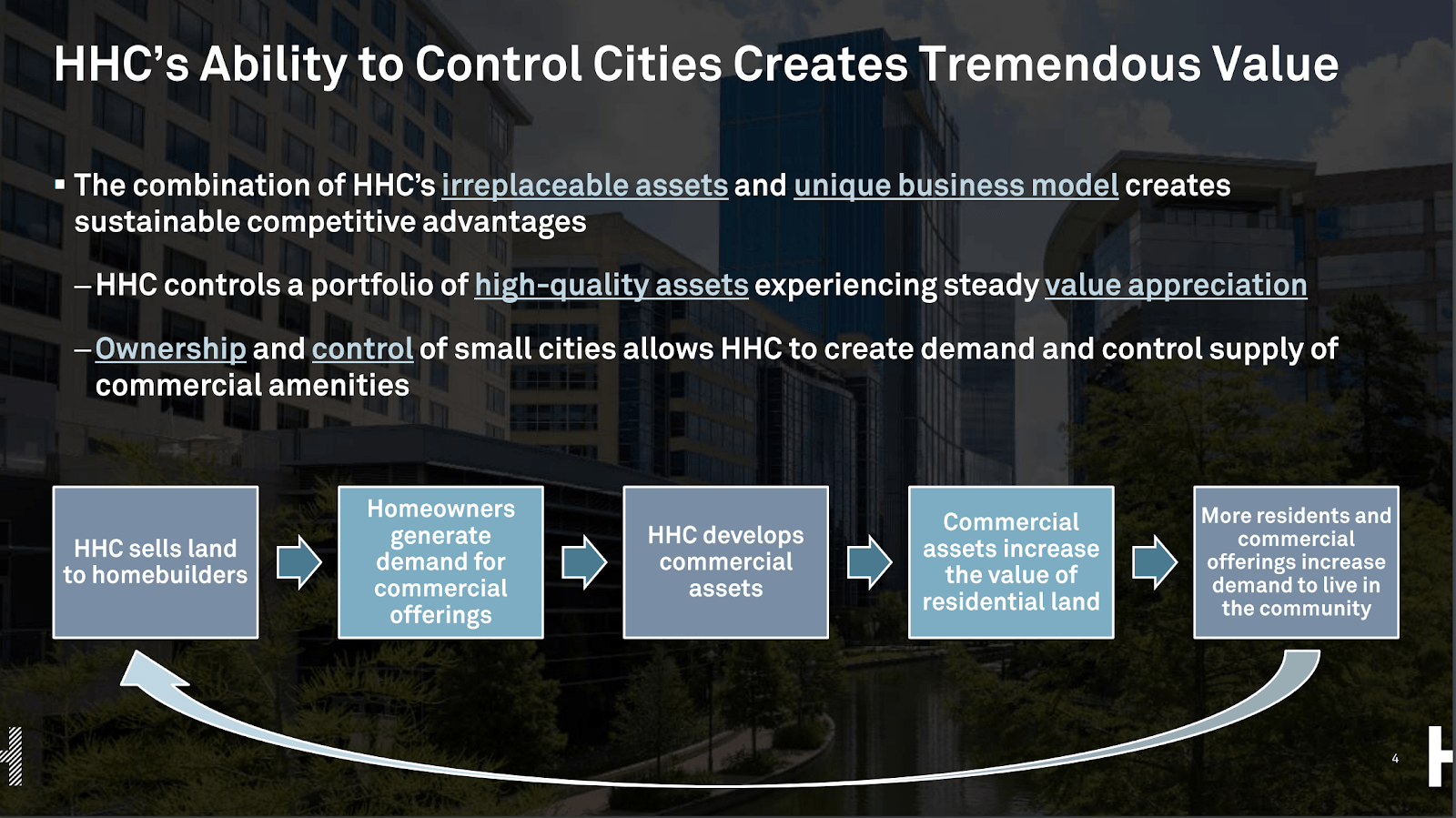

HHC is unique in that it owns almost all of the land for all of its communities. As it develops its properties, the surrounding land becomes more valuable, and it then sells acres of this land to homebuilders. This virtuous cycle is described below.

Investor Presentation

The precise number of acres remaining in HHC’s land bank is not mentioned in the most recent 2022 filings; the most recent figures available are from the 2021 Investor Presentation.

The company is estimating $4.24B in land value, derived from $2.36B in residential land and $1.88B in commercial land. Estimated price per acre is based on the average price over the past 4 quarters, so the price per acre is likely 3-5% higher now in 2022.

NAV Executive Summary

| Stabilized Assets | $3.54B |

| Seaport | $1B |

| Other Unstabilized Assets | $1B |

| Ward Village Residential and Retail Development | $1.4B |

| MPC Land Value | $4.2B |

| Cash and Restricted Cash | $922M |

| Douglas Ranch Completed Acquisition (Q2 2022) | $541.3M |

| Receivables and Prepaid Expenses | $818M |

| Total Asset Value | $13.2B |

| Total Liabilities | $6B |

| NAV | $7.2B |

| NAV per share | $141.77 |

| Upside to NAV | 165% |

Subtracting liabilities from the market value of assets, we get a $7.2B NAV, or NAV per share of $141.77. This is the theoretical liquidation value of the company.

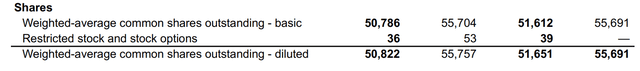

Stock Buybacks below NAV

HHC has recently been buying back shares, with a clear message from management that share buybacks are a strong method of delivering shareholder value. Over the past 12 months, share count decreased by ~5M (9% of shares outstanding) from 55.7M to 50.8M.

This is a strong signal. There are many REITs who speak about their discount to NAV but do not aggressively buyback shares when the stock is at a wide discount. With $922M in cash and restricted cash, I would be surprised to not see more stock buybacks from HHC soon with the current wide discount to NAV.

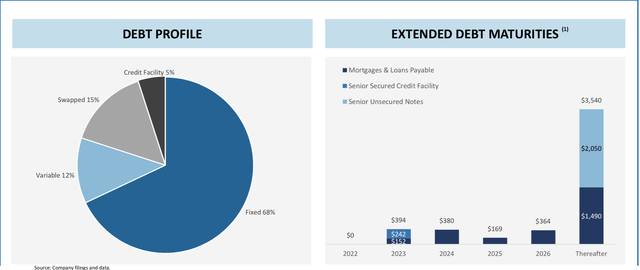

Risks to Consider: Rising Interest Rates & Cap Rate Expansion

The stock market has been troubled recently by rising interest rates and the following increased cost of borrowing. HHC’s debt is largely fixed or swapped, with just 17% being variable. That fixed debt mostly matures after 2026, so rising rates should not materially affect HHC for the next few years.

However, if rates are elevated for an extended period of time, then HHC will have to refinance their mortgages at substantially higher rates, decreasing their cash flow. This may also reduce their IRRs on new development projects, as they would need to take out new, higher-interest rate construction loans to begin new projects.

Additionally, with a higher risk-free rate on the 10Y Treasury and increased mortgage rates, real estate investors are now expecting cap rates to increase, which would bring down property values.

Conclusion

HHC represents an opportunity for 165% upside to NAV. In order to be bullish, you need to assume that the stock will partially recover to intrinsic value. With Bill Ackman’s long-standing relationship and 27.3% ownership stake in HHC, HHC’s recent stock buybacks, and all-time high net operating income, HHC is a strong buy at current price levels of $53.55 per share.

Be the first to comment