AdShooter

Suncor (NYSE:SU) is an end-to-end oil company which performs exploration, extraction, refining and also distribution through its network. Based out of the Canadian oil sands it was the first company to commercially produce crude oil from these oil sands. As one of the top players in the industry its market share is defendable and well entrenched in North America. However, investing in the Oil and Gas Industry is fraught with challenges and an ill-timed investment in the wrong company is more than likely to fail. In this write-up I will try to cover how an investment in Suncor would work while:

- Diversifying your returns

- Adding new dimensions to your portfolio

- Avoiding a blow-up of your investment in the Oil & Gas Industry, all things considered.

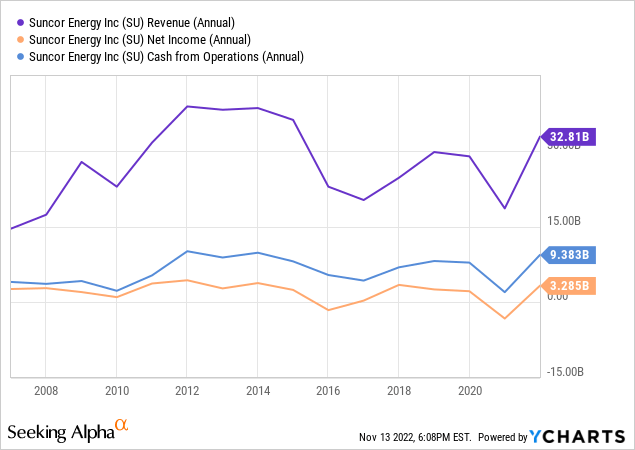

Financials that whipsaw

It is no secret that oil companies have been raking in record profits this year. But all of them suffered during the oil crash of 2020. This phenomenon was not just an exception restricted to the pandemic year. Commodity businesses are cyclical, driven by supply and demand. During times of excess supply and/or low demand, commodity prices take a hit which affects the top line. In the last 20 years alone, we have seen this pattern repeat for the oil bust of 2015-2016 and also the great recession of 2008. So it’s good to see their performance in good years and more crucial to see how they are compensating for the bad years.

1) As expected, top line dips during the bust years and trends up the following years. This trend is also reflected in Net Income and operating cash flow.

2) Reported revenues from Q2 came in at the highest in the company’s history, followed by revenues from the latest quarter which underscores that we are in yet another cyclical uptrend for oil.

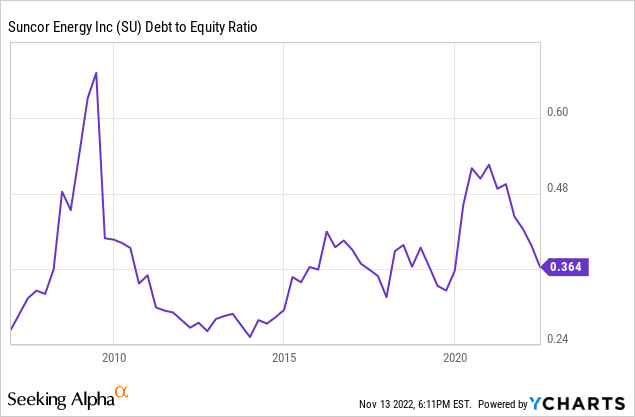

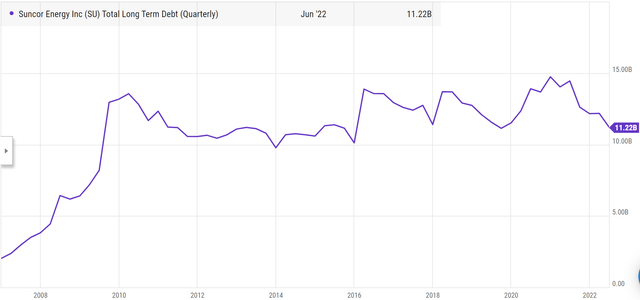

3) As expected debt rises significantly around bad years but it is managed well during the good years. As a latest example of this, in its most recent quarter, they completed a debt tender of $3.6B which helped in structural reduction of long-term debt and reduced net debt by $1.8B subject to certain exclusions

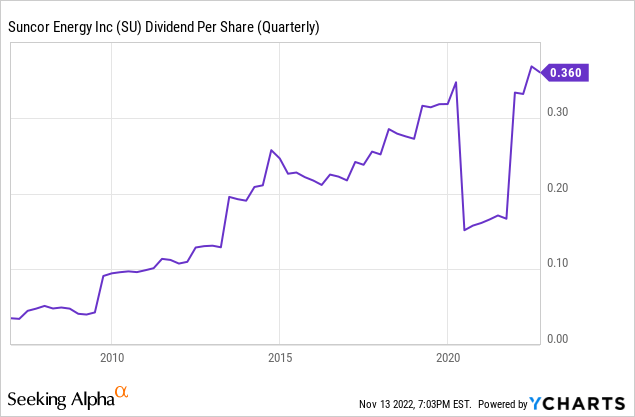

YCharts

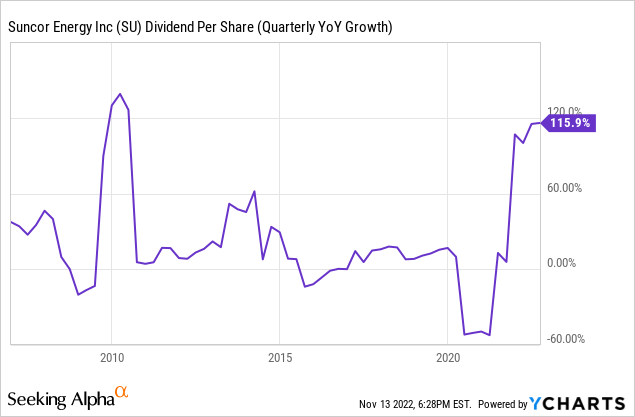

4) The company actively rewards shareholders through stock buybacks (10% targeted for 2022 alone) and dividends. While its dividend payments dipped during the bust years, it is up over the entire time frame. Most importantly, with a low payout ratio the payments are well covered by earnings and cashflows

Path to sustainability

As fossil fuel companies are held more and more accountable for climate change with every passing year, you cannot have a conversation about any business in this industry without their path to sustainability. Although there is probably no realistic future without hydrocarbons in my view, it is important to see if a business in this industry can keep itself relevant for the future.

- Suncor is making carbon capture use and storage (CCUS) as a big part of their net zero efforts by 2050 and collaborating across the industry and with governments to implement it at scale

- Investor in Svante which is developing a post combustion CO2 capture technology for industrial emissions

-

Aiming to reduce emissions by 10 megatons by 2030 by investing in cogeneration – A form of low carbon power

-

Operates the largest ethanol plant in Canada, a cleaner burning renewable liquid fuel blended into Petro-Canada gasoline and actively investing in other initiatives to produce more advanced biofuels

-

Pioneered Canada’s Electric Highway, a coast-to-coast network of fast-charging electric vehicle stations across Canada

-

Currently involved in generating more than 100MW of wind power with an additional 400MW planned for the near future

-

Planning a 220MW solar project expected to be fully operational by late 2024

Acceptable valuation compared to its peers

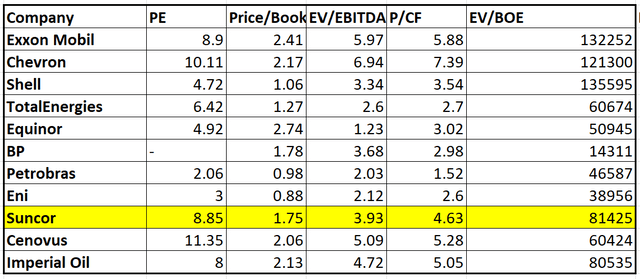

While valuing this company within its sector, Suncor scores a good valuation score of (B+) as sourced from Seeking Alpha. However, this would not be a fair comparison as within the energy sector, challenges faced by each industry is unique. When it comes to oil and gas, some industries are extremely sensitive to oil prices (Ex: upstream) and other industries less so (Ex: midstream). So let us pick companies more suitable for comparison with Suncor.

Valuation Metrics (Seeking Alpha)

- I have taken the top companies by market cap for comparison with Suncor in the Integrated Oil and Gas Industry

- Suncor is the ninth biggest company in the industry in terms of market cap

- Ranks 6th in terms of Price to Earnings multiple, 5th in terms of Price to Book multiple, 7th in terms of EV/EBITDA multiple and 7th in terms of Price to Cash flow and 8th on EV by Barrels of Oil equivalent per day

- Not the absolute best in terms of present valuation but this may change in the future

Dangers of the Oil & Gas Industry and risks to expect

Holding a commodity company is certainly not for the faint of heart and the facts below post a grim picture –

- More than 100 oil and gas companies declared bankruptcy in 2020

- Almost 150 bankruptcies during the oil bust of 2015-2016

- The great recession had rolling effects on the industry much after 2010

From my own personal experience of exposure to mid-cap oil companies, I had completely lost my investment during the oil bust of 2015-2016. I tried to apply the main lessons I learnt during that time to this investment –

- Look at its financial positioning, its long-term positioning and its valuation to rule out the worst for Suncor.

- Check the company’s performance for the past cycles to see if it has the tools to survive during down years

- The nature of the industry (Integrated) it operates in which makes it less susceptible to swings in oil prices as opposed to a pure play upstream company

But still the cyclical nature of the industry can wipe out your gains if you are positioned only for the short term –

- Recessions have historically been bad for the oil industry as they kill the necessary demand which affects the oil prices. This time will probably be no different.

- OPEC controls oil prices by throttling/flooding supply at will. There are theories about the 2015-2016 oil bust that it was actively caused by OPEC, flooding the market with supply with an intent to kill the shale oil industry in US. No reason to believe that OPEC would not do this again.

How to Invest

If an investor sees the same advantages in buying Suncor as I mentioned above, they should probably enter the investment over a period of time. For example, if the idea is to have 5% of your portfolio in this investment, start with a portion of that and over a period of 3 – 5 years, gradually increase your position to that level. Doing so would allow for two main advantages –

- If the cycle turns you can decrease the average price of your investment and eventually when the cycle flips again you will be in a profitable position much earlier.

- Enter the company at better valuations

The plan for myself is to enter a small position with Suncor now and keep a close eye on this for the next several years to enter at better price points.

Be the first to comment