Galeanu Mihai/iStock via Getty Images

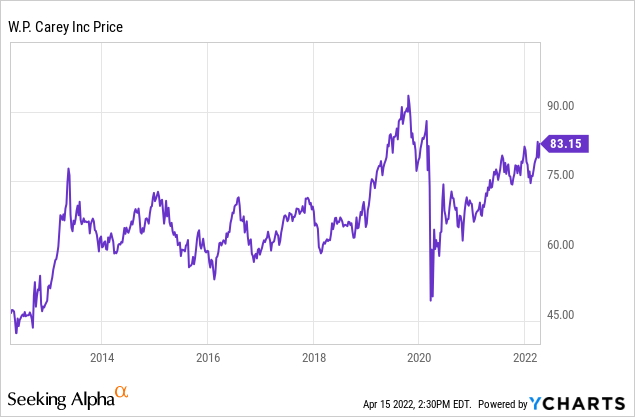

Ever since the pandemic broke out and started to rattle stock markets 2 years ago, I have become an ardent supporter of W. P. Carey (NYSE:WPC). Back then, REITs across the board had seen massive selling and W. P. Carey dropped as low as $38.62. That was the time when I started doing my due diligence on the company and subsequently started to invest into the stock with the goal to make this one of my core holdings.

More than 2 years later, the company is at its strongest ever, boasting a superior dividend and guiding for much better than expected adjusted funds from operations for 2022. Dividend growth has been anemic over the past couple of years, but with 2022 poised to be very strong, W. P. Carey’s payout ratio will finally come down meaningfully and should provide the company with ample opportunity for faster dividend growth going forward.

What is going on at W. P. Carey?

W. P. Carey capped of a strong fiscal 2021 with a stellar earnings report featuring a double beat and record Q4 AFFO of $1.30, up a whopping $0.10 above estimates with revenues soaring 22% Y/Y. On top of that, full-year AFFO came in at $5.03, beating its prior guidance of $4.87 to $4.97 provided two quarters earlier.

What’s more, W. P. Carey surprised analysts with rather bullish 2022 AFFO guidance setting a range between $5.18 to $5.30 representing between 3% to 5.4% growth.

W. P. Carey is generally not a very exciting stock from a price perspective. Most of the time it is trading in a rather narrow range and after the sharp COVID-19 driven selloff and quick recovery, the stock has been consistently above $65 most of the time and is currently trading at the top end of that range.

However, in the last couple of weeks the stock has steadily appreciated as inflation intensified and the yield curve started to invert. Investors apparently appreciate a company which is well-positioned against inflation and whose dividend is not too far away from the current inflation rates. Hence, entry opportunities in the $70s or even $60s are long gone for the time being and the $80-$90 corridor seems to be the normal although I do expect the stock to reach its previous pre-COVID highs in excess of $90.

Over the past couple of years W. P. Carey has been a great stock to invest in equipped with a high starting yield, very moderate price appreciation and tremendous compounding power. I have started to invest in Spring 2020 and will subsequently share and analyze that journey while also point out that even at its higher prices today it does not change my autopilot strategy.

The market is finally appreciating the company’s strong performance and resilient operations by awarding it a higher multiple. W. P. Carey is a boring stock but one with a high and secure dividend and a company that has definitely come out stronger from the pandemic than what it has been before.

How I am investing into WPC Stock?

Personally, I very much prefer to buy quality stocks which have been beaten down and W. P. Carey perfectly fit that condition between 2020 all the way to the best part of 2021. As mentioned above, in light of W. P. Carey’s formerly narrow trading range in the mid $70s the stock appreciated rather sharply over the last couple of weeks and thus that condition is no longer satisfied. That said however, the stock is still a good deal at its current price with a yield slightly above 5% and regular monthly purchases over time can still generate a healthy amount of added dividend income.

To me personally quality real-estate is a buy-and-hold forever asset class and W. P. Carey’s wide and high-quality diversification both geographically and in terms of property type gives an investor exposure to an excellent real estate portfolio buy just buying some shares. Especially in times of high inflation a real estate portfolio of which is overwhelming majority has built-in rent escalators linked to CPI is one of the most secure ways to invest hard-earned cash.

As a result, I have rather aggressively set up bi-monthly savings plans starting in March 2020 and have recently increased monthly contributions with further increases planned for the future.

Now more than two years later I have taken the time to analyze all these monthly investments in order to assess how I have been doing.

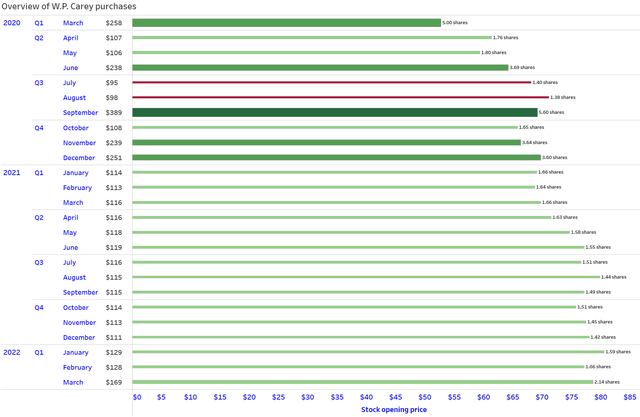

Overview of W. P. Carey Purchases (Designed by author)

This chart depicts all my individual purchases in W. P. Carey. In total I purchased 53.45 shares for an aggregate cost of $3,695 and a cost basis of $69.13.

The horizontal axis shows the stock opening price on the day of purchase which is generally when the automatic savings plan purchase is triggered and the vertical axis depicts the time line as well as the total amount invested per month. The bars are sized based on the amount of transacted shares and colored in green and red with a color switch at $100 which is my minimum target for monthly purchases.

For this to work as it does, it is important that the broker allows to buy fractional shares. For me as a German investor, the only broker with this feature and automated savings plans is consorsbank.de but for U.S. investors there are numerous ones. The chart is no rocket science and you can easily see that the higher the stock price the less shares were purchased.

In 2020, I often made additional purchases outside of the monthly savings plans as the stock was too cheap to ignore and tried to funnel additional cash into the stock whenever possible. For the whole of 2021 monthly contributions have been constant on a Euro basis and only slightly fluctuate on a US Dollar basis. As the stock steadily appreciated I bought less and less shares. In January, 2021 I was able snatch 1.66 shares for $114 but by December 2021 I could only purchase 1.42 shares for the same investment.

To counter this I have decided to increase my monthly contributions in 2022 with the ultimate goal of being able to buy at least 2 additional shares per month and that goal was reached for the first time in March.

Certainly, the invested amounts are small but contributing at least $100 every month for years (and for even more years in the future) will ultimately also accumulate a lot of capital and is thus a perfect way to build wealth with relatively small regular investments.

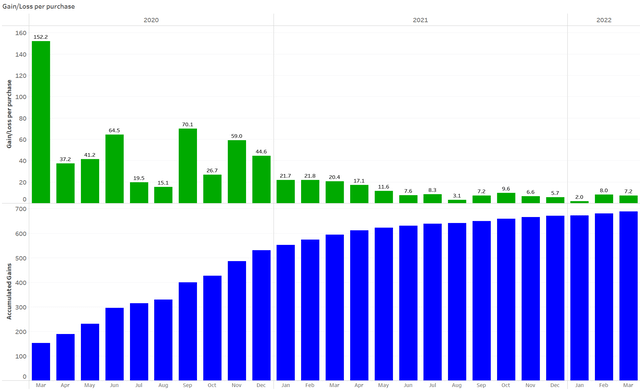

Over a long time, multiple single purchases of $100 every month can also generate significant returns. Here is a chart showing how each single purchase has performed so far as well as the accumulated gains over time.

W. P. Carey Gain/Loss per Transaction (Designed by author)

Admittedly, a two-year investment journey is still a pretty short time frame but it still allows for some analysis and insights. First of all, it is noticeable that every single purchase so far has generated a gain thanks to the stock’s steady appreciation. In fact, I would have preferred the stock price to stay in the $60s or at least $70s for years but waiting for such a correction is not a strategy I want to pursue.

In hindsight, I should have also invested more money into the stock in 2020 and thereby reduced investments into other stocks but that sort of conclusion is not helpful. Instead I have now set a goal of acquiring at least 2 shares per month which will add at least $6 to each subsequent quarterly dividend payment and thereby moderately but steadily increase my dividend income which is the ultimate goal.

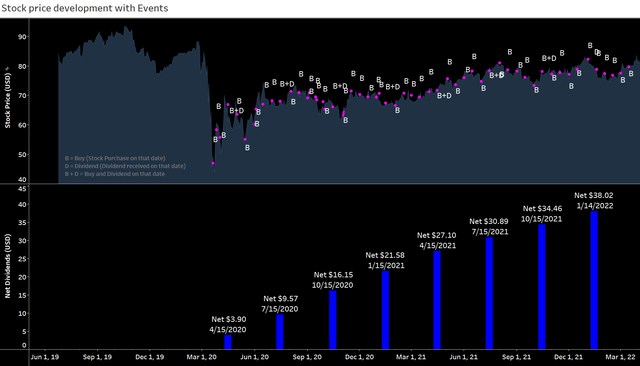

Finally, here we can see how these purchases (shown in pink) are plotted on W. P. Carey’s stock price chart.

Stock price development with events (Designed by author)

On the bottom of this chart I have shown how dividend payments have developed over time. The growth is virtually entirely fueled by consistent and ongoing monthly purchases as W. P. Carey’s organic dividend growth of 0.2% per quarter is anemic and at best has contributed less than $5 so far.

Within just 2 years I was able to build up a fast rising income stream with a current run-rate of almost $160 annually. By the end of the year the annual run-rate will already have jumped to around $220 with an intermediate goal of $400 I want to reach by the end of 2024 but possibly sooner. That would equate to $100 in net quarterly dividends which would be a very solid amount.

Investor Takeaway

W. P. Carey is a great all-around REIT with a solid and proven business model that pays reliable and safe dividends. W. P. is uniquely positioned as we are apparently entering or have already entered a period of sustained inflation.

W. P. Carey is uniquely diversified and is focusing on the right properties for the post-pandemic era.

W. P. Carey has been delivering best-in-class rent collections throughout the pandemic with rent coverage never dropping below the 90s and having been consistently in the high 90s ever since.

Unfortunately, the stock has rallied in 2022 driven by strong fundamentals and a general flight into solid value stocks. I personally love buying great stocks at a discount and in ideal scenario would love to see such a stock just stay where it is for years in order to accumulate more. However, that shouldn’t prevent investors from investing into such a solid stock on a regular basis. If the price continues going up you will be able to afford fewer shares for the same amount but at the same time see your unrealized gains rise. If the stock will finally correct you will be able to cost average down and with an almost 5% dividend yield right now this is the safe way to generate strong dividend income over time.

I have been doing that for only 2 years but I plan to do that for at least the next 20 years and I am 100% confident that it will pay off.

Be the first to comment