imaginima

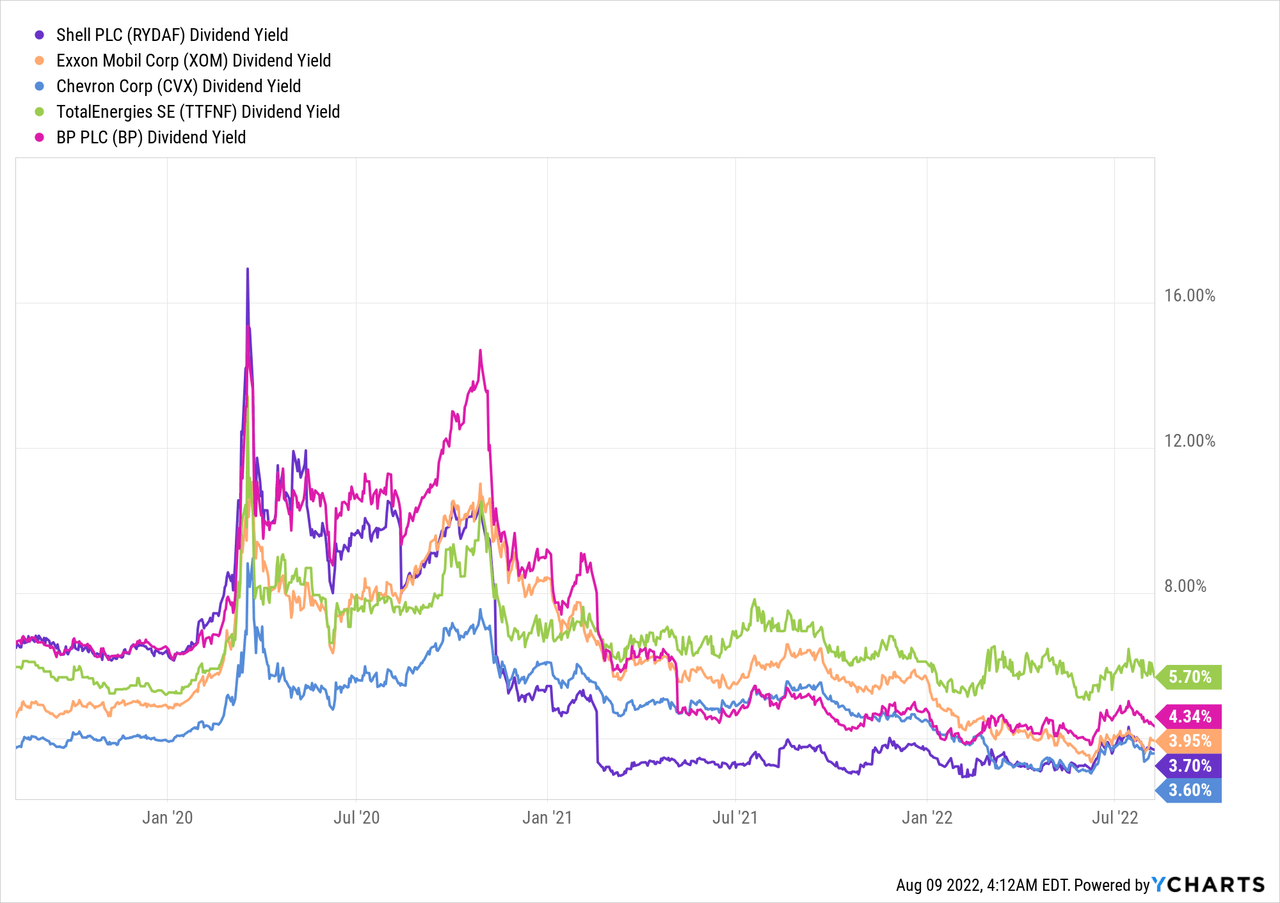

Many dividend investors are attracted by the high dividends that can be found among companies in the energy sector. Periods are quite common where you can buy traditional energy companies with 5-8% dividend yield. The share price performance and dividend safety is however strongly correlated with the overall energy prices, for example oil (CL1:COM) and gas (NG1:COM) spot prices. These can however be very volatile and rather driven by geopolitical than fundamental factors. Especially during the last few years we have seen wild swings up and down. Shell (SHEL) for example also cut its dividend in 2020.

This means that investments in this sector have attractive dividend yields, but can potentially add a lot of volatility to your portfolio and dividends are not always safe. This is not helping when you invest to build a Sleep Well At Night dividend (retirement) portfolio. There are however ways to still benefit from the energy sector, but with substantially reduced risks.

In this article, I share with you how I build and manage my investments in the energy sector, with also the aim of reduced volatility and dividend safety.

Recap: My investment strategy and goal

Let me first recap my personal investment strategy and goals, to help you better understand my approach and perspective. My goal is to reach financial independence many years before my official retirement age of 67 (or perhaps even 70 or later by then). This independence is achieved when my annual dividend income equals or exceeds my annual cost of living. At that moment I become completely independent from the income from my full-time job. Maybe I am still happily working in a full-time job and continue working, but maybe I decide to quit and find a different meaning for the remainder of my life. Achieving this goal of financial independence seems very realistic and my calculations show I can achieve it within the next 10-15 years.

All my investment decisions are made with this ultimate goal in mind. This means that whenever I have money to invest (my monthly addition to my investment account or re-investing dividend), I assess how it brings me closer to reaching this goal. This means that I look at the dividend that I expect the investment to generate immediately, but also 10 – 15 years into the future. This means that I always try to balance between a reasonable entry yield and expected dividend growth. I also only invest in undervalued or fairly valued high-quality companies and intend to hold them for decades. Safety of principal and foremost reliability of the dividend is extremely important to me.

Please also check out this article on a model portfolio to get more insights into my investment style and portfolio, including the update I wrote when the Ukraine crisis unfolded and the portfolio was seriously stress-tested.

Investing in traditional energy companies

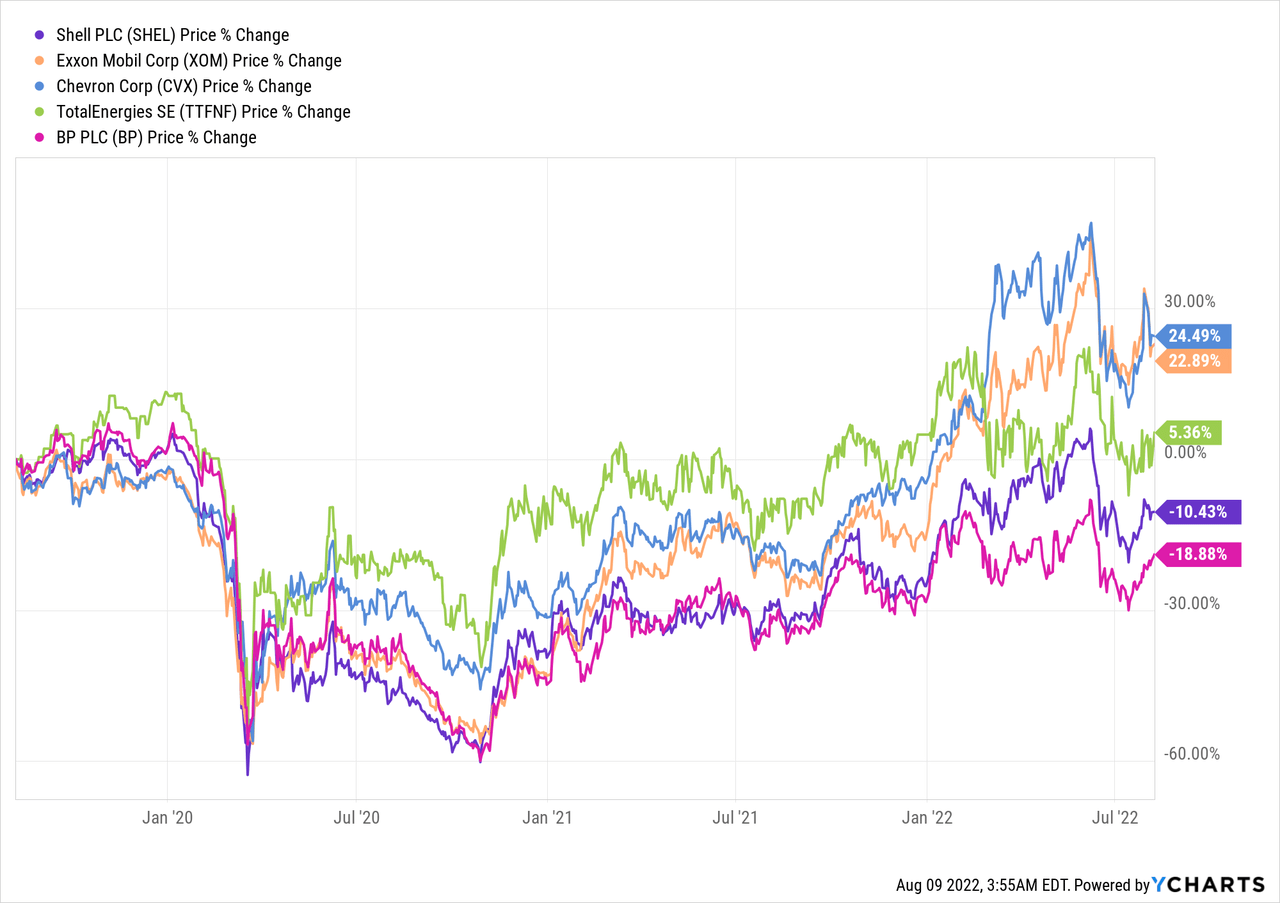

Many investors know and have invested in traditional energy companies like Shell PLC, Exxon Mobil (XOM), Chevron (CVX), Total (OTCPK:TTFNF) (TTE) and British Petroleum (BP). As you can see in the chart below, the share price of these companies has been quite a roller-coaster over the last three years.

Let’s assume you would have had them in your portfolio prior to COVID-19. At the bottom you would have been sitting on losses up to -60% and at the top wins up to 30+%. These movements directly correlate with the price movements of generic oil and gas prices. This also makes a lot of sense, because the revenue they can make from their oil and gas production is directly linked to that. Besides the generic volatility with this kind of investments/companies, you also see individual difference. After these three years the share price performance ranges from +24% for Chevron to -19% for British Petroleum. Please note that dividends are excluded in this comparison.

Some investors might feel comfortable with such volatility and in that case: good for you and continue doing what you do. I can however imagine there are many dividend investors that don’t feel comfortable with it.

Being concerned with the volatility in the sector, it would be a pity to avoid it and deny yourself the juicy dividends that can be earned. Consider this:

| Company | Dividend yield |

| Shell | 3.7% |

| Exxon | 4% |

| Chevron | 3.6% |

| Total | 5.7% |

| BP | 4.3% |

Not bad right, especially considering these companies are currently relatively expensive (share price-wise) due to very high energy prices, which pushes down the dividend yield. Over the past three years, investors would have had many opportunities to buy shares against even more attractive starting dividend yields.

How to reduce volatility with energy sector investments

There are several ways to reduce your investment risk, which is defined by share price volatility and dividend income (and safety of that).

- Diversify your investments across multiple companies

- Only buy companies that are fairly valued or undervalued

- Expand to energy companies with business models less exposed to the direct price (movements) of energy prices

- Hedge your investments with companies that actually benefit from low energy prices.

- Globally diversify to reduce geopolitical and FX risks

- Maximize your sector exposure within your portfolio

In my investment portfolio, I use all of them and this has helped to systematically reduce the investment risks.

Let me elaborate briefly on each point and provide you with examples of how I apply them.

1. Diversify your investments across multiple companies

This is for most readers quite obvious and not only applicable to the energy sector but still very true. By investing in multiple companies in the energy sector instead of just one or two, you reduce your so-called company risk. Individual companies have their unique risk profiles and can sometimes have very negative surprises. Think about lawsuits, accounting scandals, etc. Such events can have a strong impact on the share price of individual companies and if it is the only one (or one of the few) in your portfolio, you can get burned. In addition, by limiting yourself to few companies, you might also miss out on the winners of the future, which is often very hard to predict.

If you however invest in multiple companies, even in the same sector, you reduce the investment risks individual companies bring. By doing so you expose yourself much more to the risk profile (and potential rewards) of the overall sector.

I always want to have multiple companies within the same sector in my portfolio. I for example really like to have exposure to the defensive sector of consumer goods. I don’t try to pick only one potential winner, but spread across high quality companies in the sector. In this sector I have Procter & Gamble (PG), Unilever (UL) (OTCPK:UNLVF)(OTCPK:UNLYF) and Nestle (OTCPK:NSRGY)(OTCPK:NSRGF). In a broader sense I also have shares in Ahold Delhaize (OTCQX:ADRNY)(OTCQX:AHODF), which is also operating linked to the sector.

For the more traditional energy sector (oil and gas) exposure I have only invested in Shell, but have diversified and hedged it with other multiple investments that I will explain later on.

2. Only buy companies that are fairly valued or undervalued

Being a value investor I always check how a company is valued before making any investment decisions. For me, it is crucial that a company is at least fairly valued, but ideally showing some nice undervaluation. Doing so provides you with a comfortable Margin of Safety, which gives you an extra buffer against potential (paper) losses. You are also paving the way for future profits, once the valuation of the company normalizes again.

I for example always check the following metrics before investing:

- Is the company structurally profitable and able to grow top-line and bottom-line in previous years, but also in the years ahead?

- What is the PE ratio and how is that relating to the growth prospects of the company?

- What is the current dividend yield versus the (average) historical dividend yield?

- If the share price is depressed, is there a company-specific reason (red flags?) or is the sector the company operates in simply not popular right now (less of an issue)?

This approach has helped me to only invest in companies when they are relatively cheap and build up a low cost base. I have bought shares of Shell in several batches during the last decade and currently have a cost base of EUR 21.50 versus a current share price of EUR 26. When the share prices gets really depressed I buy more and average down my cost base. For example, when COVID-19 hit the world and energy prices (including traditional energy companies) collapsed, I for example happily added another batch to my Shell position at a share price of only EUR 17.

3. Expand to energy companies with business models less exposed directly to (movements of) energy prices

The revenue and profitability of traditional energy companies like Shell, BP, Exxon, etc. are strongly correlated to the broader global energy prices. Simply put, if oil and/or gas is very expensive, BP gets much more for the oil it produces. This also works the other way around. This explains the wild swings in financial performance and share prices of these companies, strongly linked to the broader global energy prices. There are however also companies operating in the energy sector that are much less directly exposed to the broader energy prices.

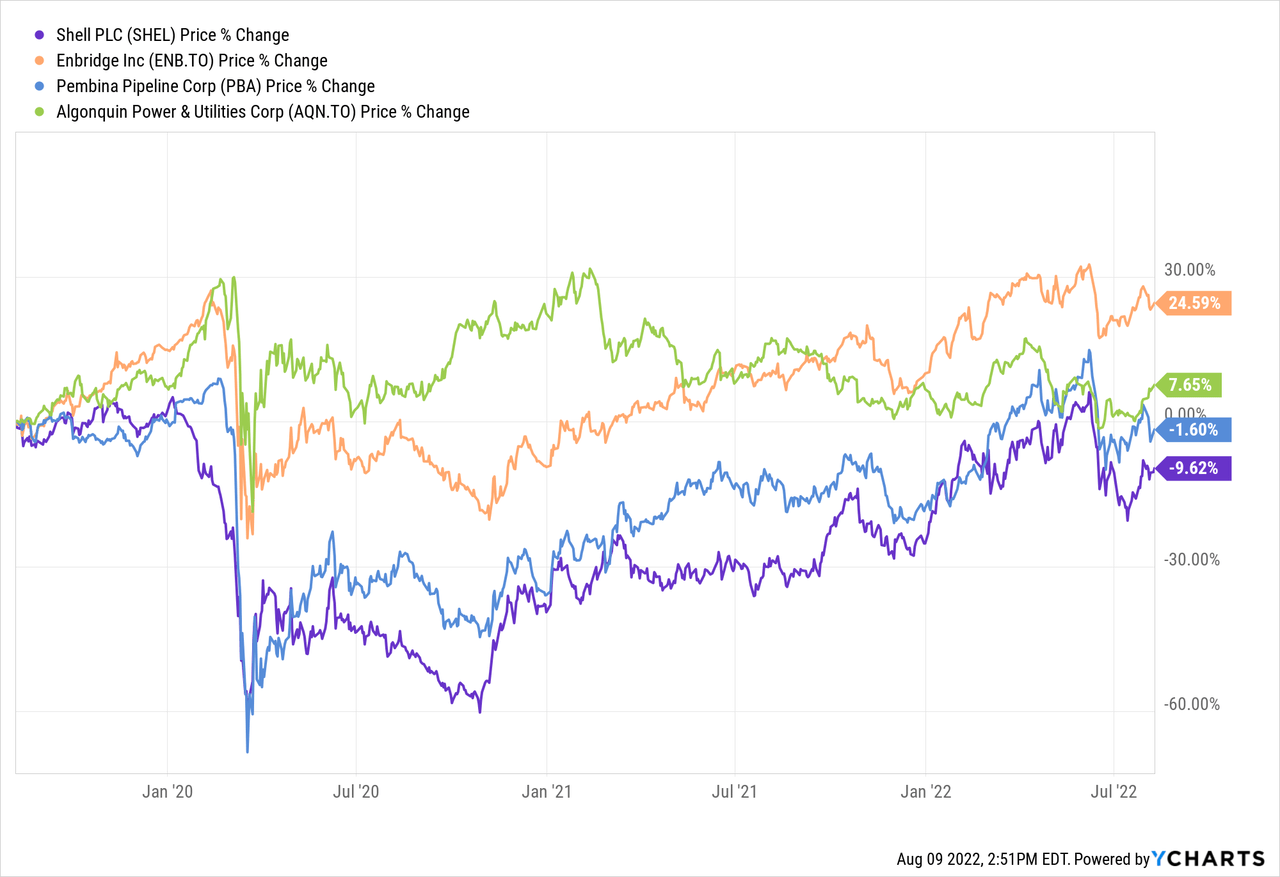

These are for example companies developing and operating the infrastructure (e.g. pipelines) for oil and gas transportation. This infrastructure transports the raw commodities to facilities where they are further processed/refined towards end-user products. I for example own shares of Enbridge (ENB) and Pembina (PBA), two Canadian companies active in this space. They have long-term contracts to distribute oil and gas for large traditional energy companies via their infrastructure.

The prices for this transportation are mostly fixed and locked-in in long-term contracts. They also require the companies to pay for the transportation capacity regardless of whether they use it or not. This means that the revenue and earnings of Enbridge and Pembina are hardly affected by wild swings in the global oil and gas markets, at least in the short and medium term. It is always interesting to see that their share prices still move (albeit less extreme) with global energy prices, but I always see that as creating potential opportunities to buy additional shares.

Another example is Algonquin (AQN), a Canadian utility company managing and also building energy production facilities, usually with pre-determined long-term energy production contracts in place. The company is also heavily investing in renewable energy production facilities, which also provides even more diversification within the energy sector. Completed facilities are often ‘dropped’ into Atlantica Sustainable Infrastructure plc (AY), a Yieldco company that focuses on managing such companies over their lifetime. Algonquin has a 44% stake in Atlantica Yield, which also provides a steady income to the company.

Let me show how the share price of these companies moved compared to for example Shell.

As you can see, these companies have performed better than Shell over the last three years and were less volatile.

4. Hedge your investments with companies that actually benefit from low energy prices

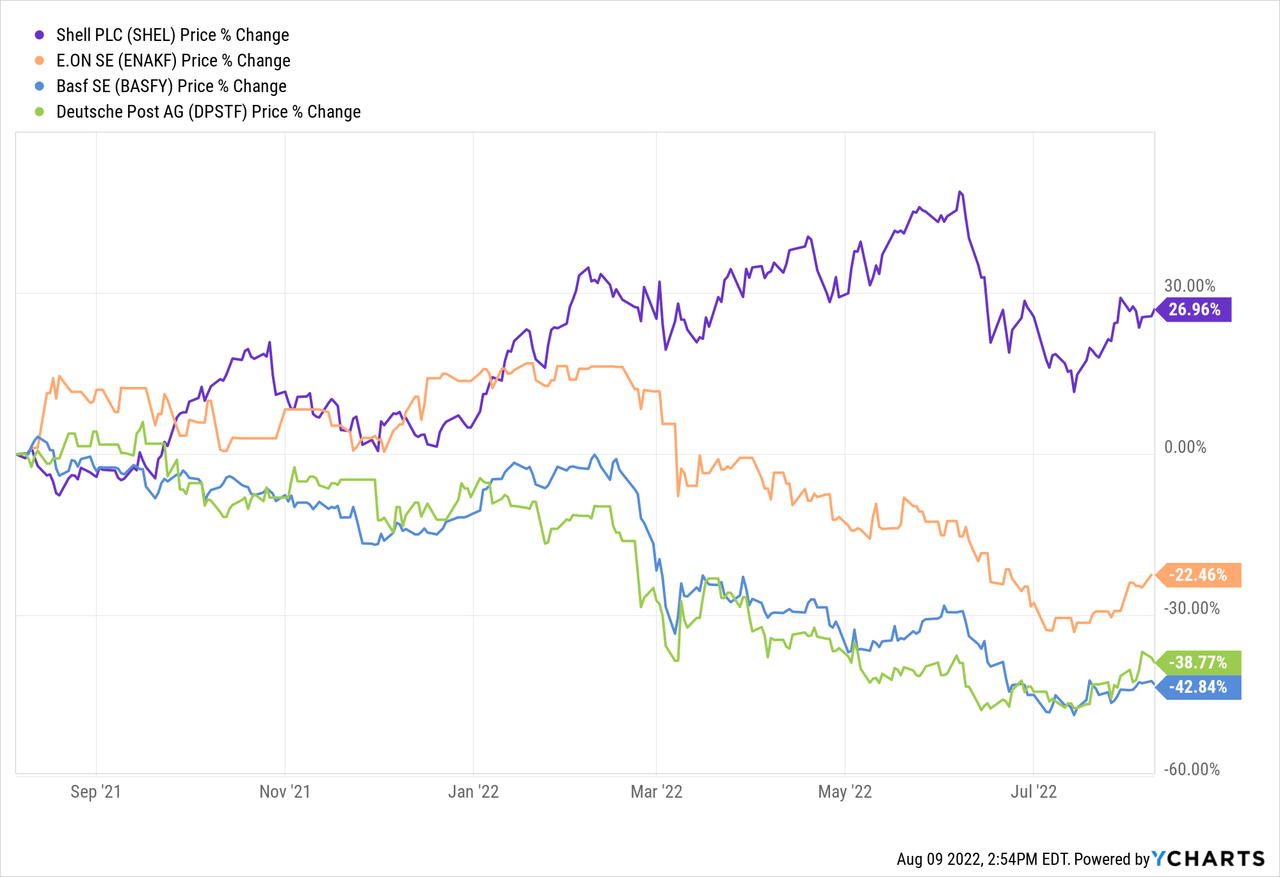

It is also helpful to invest in high-quality companies that actually benefit from low energy prices and vice versa. This means that usually the share prices move inverse to traditional energy companies and this reduces your portfolio volatility.

In my portfolio, I also have investments in EON (OTCPK:EONGY), BASF (OTCQX:BASFY) (OTCQX:BFFAF) and Deutsche Post (OTCPK:DPSTF) (OTCPK:DPSGY).

EON is a utility from Germany and active across Europe. It provides energy to customers and the rates are often fixed for the duration of these contracts. When energy prices are high, this means that EON is facing higher costs and is limited (in the short term) in charging these additional costs to its customers. That is a key driver for the downward pressure on the share price over the last months.

BASF is a chemical company, also from Germany but operating globally. The company needs vast amounts of gas to operate its chemical plants. This means that when energy markets get nervous and energy prices spike, the company is facing higher input costs. They also have contracts with customers and cannot easily charge them higher input costs in the short term. There are even concerns that they might be forced by the government to (temporarily) shut down some plants due to the energy crisis in Europe.

Deutsche Post is a global logistical company. It is not difficult to imagine that when you operate many vans, scooters and freight planes to deliver all post and packages to your customers globally, energy prices are a major cost component. This also means that Deutsche Post is actually benefiting when energy prices are low and vice versa.

As you can see below, the share prices of these three companies moved opposite to that of Shell over the last year. A major driver for this is the spike in global energy prices. If these however would drop again, I expect the share price reaction to be also opposite again.

Let me be clear about one thing: their inverse sensitivity for global energy prices is not the primary reason that I have invested in them. These are all individually great companies with a long track record that have met my quality and valuation criteria. I however also consider how they fit into my overall portfolio and this inverse global energy price sensitivity is also an argument for me to hold them.

5. Globally diversify to reduce geopolitical and FX risks

To reduce the potential impact of geopolitical and FX (foreign exchange rates) risks, it is also wise to diversify globally. When something major happens to a certain country or region, you are less affected.

Last year, who would have expected the Ukraine situation to happen? Who would have foreseen the spike in energy prices this has caused? If you had only invested in European energy companies, your investments would not have performed well. Imagine you had investments in Russian energy companies as a foreign investor and all uncertainties and complexities you would have faced. What if the situation with China and Taiwan would further escalate, what will happen and how will that affect the financial and energy markets?

We also have seen significant FX movements this year, which can also affect you as an investor. The dollar has significantly strengthened against the euro and they are almost on par. If you would have been a US-based investor with primarily European investments, your investment results would have suffered because of that. The other way around you would have had strong tailwinds.

I don’t assume I know exactly what will happen in the world and how this will impact the financial markets. I however know that unexpected major things will continue to happen every now and then. My main focus is to ensure that if something bad happens, the exposure of my portfolio is limited. I do this by investing in different countries, sectors and currencies.

For the energy sector, as you have read in this article, I do this as well. I have investments in energy companies from Europe (Shell, Eon), but also North America (Enbridge, Pembina, Algonquin). These investments and their underlying earnings are also in different currencies (Euro, USD and CAD), which limits my exposure to one single currency.

6. Maximize your sector exposure within your portfolio

Last but not least (and also obvious but still true), it helps reduce portfolio volatility if you consciously manage your sector exposure within your portfolio. You can do this by spreading across multiple sectors and maximizing your exposure to specific sectors.

Personally, I have a maximum of 20-25% of exposure to one sector that I feel comfortable with. In most sectors I however have 10-15% of exposure and this is what I feel most comfortable with. When looking at the energy sector, all my investments in Shell, Enbridge, Pembina, Algonquin and E.ON add up to 12% of my investment portfolio.

Investment Thesis

In this article, I have shown you how dividend investors can effectively manage the risks of investments in the energy sector. I have shown how I personally do that and with what companies.

To recap:

- Diversify your investments across multiple companies

- Only buy companies that are fairly valued or undervalued

- Expand to energy companies with business models less exposed to the direct price (movements) of energy prices

- Hedge your investments with companies that actually benefit from low energy prices.

- Globally diversify to reduce geopolitical and FX risks

- Maximize your sector exposure within your portfolio

When applied correctly, dividend investors can get access to the often high dividend yields that can be found in the energy sector, without adding a lot of volatility to your investment portfolio.

In case you are interested to further expand your energy sector exposure, let me share a few energy sector companies that I view as attractive investments right now.

Enbridge: the company is not expensive with a P/E ratio of 20 and offers a 6% dividend yield. To diversify (unless you are from Canada) I would recommend investors to check out the Canadian ticker.

EON: the company is very cheap with a trailing P/E ratio of 5 and forward P/E ratio of 10 and the company also offers 5.7% dividend yield. To diversify (unless you are from Europe) I would recommend investors to check out the European ticker.

Conclusion

As mentioned at the start, it is a pity dividend investors either avoid or have been burned by energy sector investments. In my perspective and as I have explained this is not necessary and you can still invest in companies in the sector and enjoy the high dividend. I at least do already for many years and will keep the energy sector as one of the pillars of my investment portfolio.

Hopefully you enjoyed the article. Happy to hear if you (dis)agree and what other suggestions you have to manage your risk in this sector.

Be the first to comment