Imgorthand

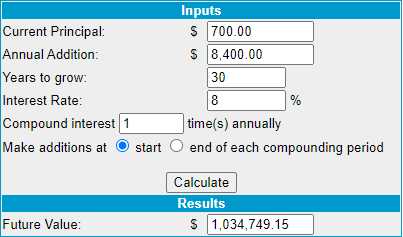

$700 monthly at 8% over 30 years (MoneyChimp.com )

Retirement

It’s something we all have to prepare for. At some point, there will come a day when you don’t want to work anymore or simply can’t work anymore. A lot of people put off saving for retirement because they don’t think they have enough to make a difference so I’m going to show you how wrong that thinking is.

We have a Compound Interest Calculator, which you can play with here, and I have it set for 30 years. Even if you are 60 – you will probably appreciate an extra $1M when you are 90, right?

For the average person making the average $70,000 per household, we’re targeting 8% annual returns on $700 per month invested – about 10% of your income. Although it will take 30 years to show you – I am going to set up a $700 to $1M Portfolio we can follow and each month we will deploy another $700 and make adjustments and we’ll see if we can improve upon an 8% annual gain, which is about the average for the market over the long haul.

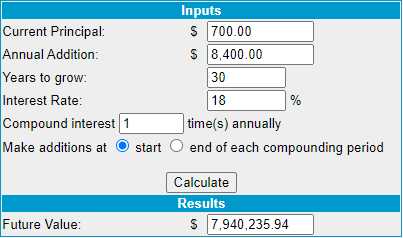

$700 Compounded over 30 years at 18% (MoneyChimp.com)

If we can boost our returns to 12%, we’ll have $2.29M in 30 years but 18%, which is what I’m shooting for, will give us an inflation-fighting $7.9M in 2053 – by just saving $700 a month for 360 months!

But where will you get $700 per month? There are easy ways to do it like driving a sensible car that saves you $100/month in payments and $50/month in insurance, you can get a house that’s a bit smaller and save $300/month and instead of a hobby, you can get another job (there’s plenty of them) that pays you $150 on the weekends, etc.

It’s not about the $15/hour you get for working 10 hours on the weekend (or nights during the week) – it’s about the $8M that turns into 30 years from now. Think about that when you are dropping someone off at the airport for a $5 tip!

If $700 per month turns into $8M at 18%, consider that every monthly dollar you save now in your budget is $11,500 you are giving yourself in 30 years!

Let’s look at how this works by first skipping ahead to the end of year 1, when we’ve put $8,400 to work, and let’s say we made $1,600 along the way, and we have $10,000 in our portfolio.

- We can buy 100 shares of AT&T (T) for $18 ($1,800) and T pays a $1.11 dividend annually.

- We can sell 1 T 2024 $17 put for $1.85, promising to buy 100 more shares at $17 for which we will be paid $185 now.

- We can sell 1 T 2024 $17 call for $2.45 ($245), promising to sell our shares for $17.

The net of that spread is $1,370 and, over the next 17 months, we will collect $166 in dividends and either we will get paid $17,000 if T is over $17 (we can roll the options when the time comes to avoid that) or we will be assigned another set of T shares at $1,700.

T Weekly Chart (Finviz.com)

If we are called away at $1,700, we make $330 on the spread and $166 in dividends is $496, which is 36% from our $1,370 outlay but let’s call it a $3,070 use of cash assuming this is an IRA with no margin ability. Even so, $496 is 16% over 17 months – so we’re on track with that for a 10% average gain.

If we are assigned another 100 shares, then we are truly using our $3,070 for 200 shares, but then we’d sell 2026 calls for $490(ish) and that would drop our basis back to $2,580 on 200 shares ($12.90) and the $1.11 dividend alone would be 8.6% annually. Two years later, we sell more calls, and we’re down to $8 and then 2 years later (2028) we are down to $3.10 and by 2030, our T shares are free, and we’re still getting paid $222 in dividends annually.

And, of course, the $3,050 we get back between now and 2030 would go into starting a new cycle and, after a while, we will have dozens of overlapping cycles like that on various stocks. It’s boring, but it works like a charm!

We don’t really care if T goes up or down – as long as they stay in business we will end up owning them for free and that’s where our returns start compounding because, while we were recouping our money, we are buying another stock that will also be net free in 10 years or less, and then, we would have our $6,140 back in cash and $6,140 worth or stocks (the two “free” sets) and we’ll be collecting $222 in dividends. That is how compounding works in our favor.

10 years later (conservatively), it’s $24,280 and $444 in dividends and, by year 30, it’s $48,560 and $888 in dividends. And how do we get to $6,140 worth of stock, $3,070 in cash and $222 in annual dividends? Well, we just need to have $3,070 by the end of this year and that’s $250/month (we’ll get some dividends along the way as well) deployed over 12 months – imagine what happens when you put in $700/month and repeat this process 30 times!

We can’t sell options until we have 100 shares, so for $700, this month, we can afford 38 shares of T. But let’s not put all our eggs in one basket and buy just 20 shares of T for $360 to start.

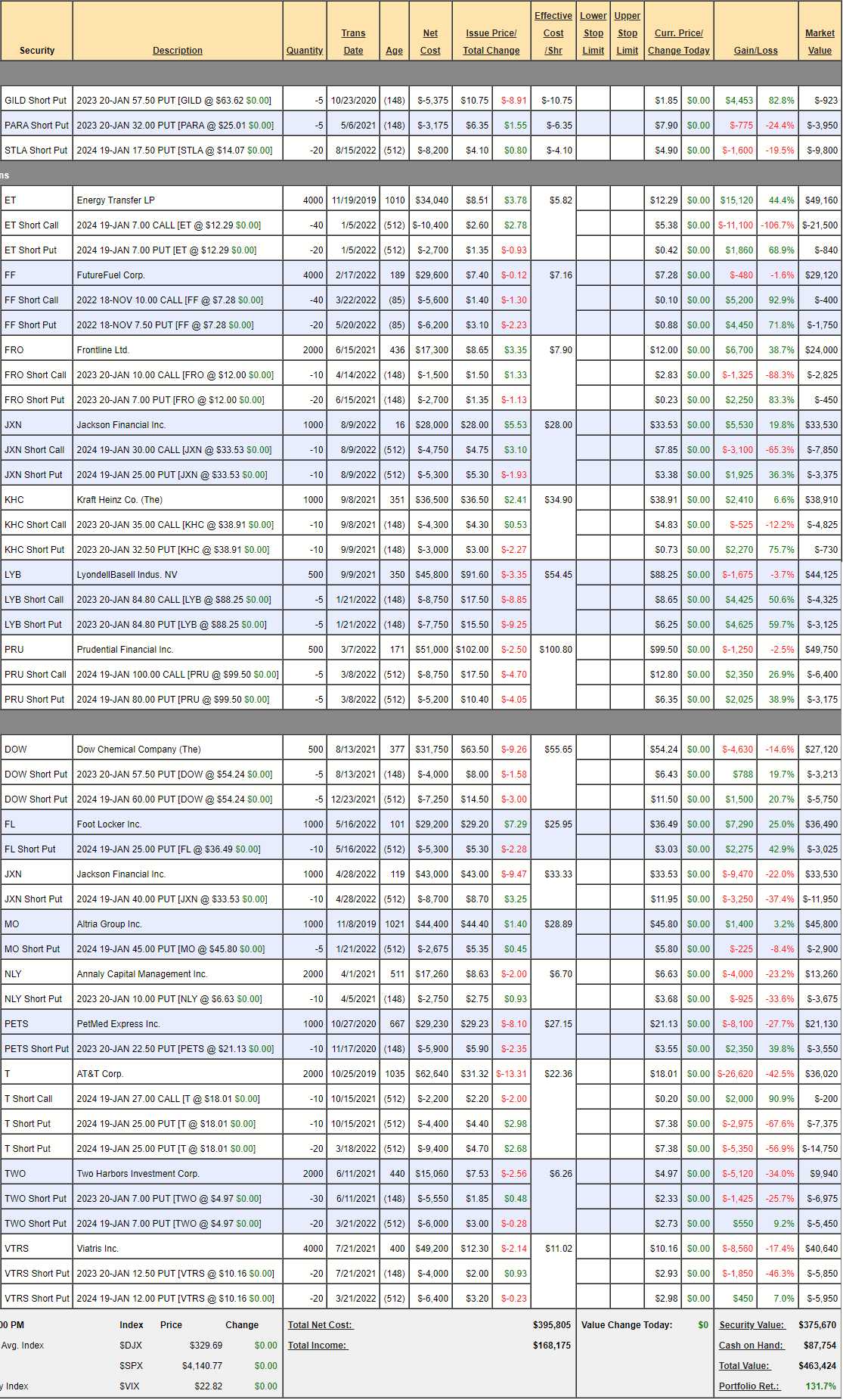

Again, this is dead boring for a LONG time. We started our current Dividend Portfolio back on 10/25/19 with $200,000 and, almost 3 years later, we’re at $463,424. That’s up 131.7%, so we’re averaging over 40% annually, which is great but, at the start, it’s like torture – even when you begin with a lot more cash.

PhilStockWorld Dividend Portfolio (Philstockworld.com)

Pulling from the above set, Annaly (NLY) at $6.65 will be my next pick as they pay an 0.88 annual dividend, which is 13% right off the bat. We spent $360, so we have $340 left, so we’ll add 50 shares of NLY for $332.50 and next month we’ll be able to sell our first option!

NLY Weekly Chart (Finviz.com)

What’s our plan with NLY?

- Accumulate 500 shares for $3,325

- Sell 5 Jan $6 calls for 0.75 ($375)

- Sell 5 2024 $7 puts for $1.60 ($800)

That drops our net on 500 shares to $2,150 or $4.30 per share so, if we are called away at $6, we are thrilled to have an $850 (39.5%) profit. If we are assigned 500 more at $7 ($3,500) then we’ll have 1,000 shares at $5,650 ($5.65 – 15% below the current price) and, as above, we wash, rinse and repeat until we have free stock.

Be the first to comment