hallojulie/iStock via Getty Images

BlackRock said buy (sell), I said the opposite

I form my outlook on S&P 500 (SP500) (SPX) (SPY) using a global macro approach, and I follow the newsletters of established financial institutions to compare the relative recommendations. Obviously, most of the time, everybody is on the same page, bullish on stocks. However, the value of analysis depends on picking the tops and bottoms – this is where you find the disagreement.

One of the key commentaries I follow is by BlackRock, which is also based on a global macro approach. We both entered the year bullish in stocks and remained bullish after the first 10% drop early in 2022. However, at that point our outlooks diverged.

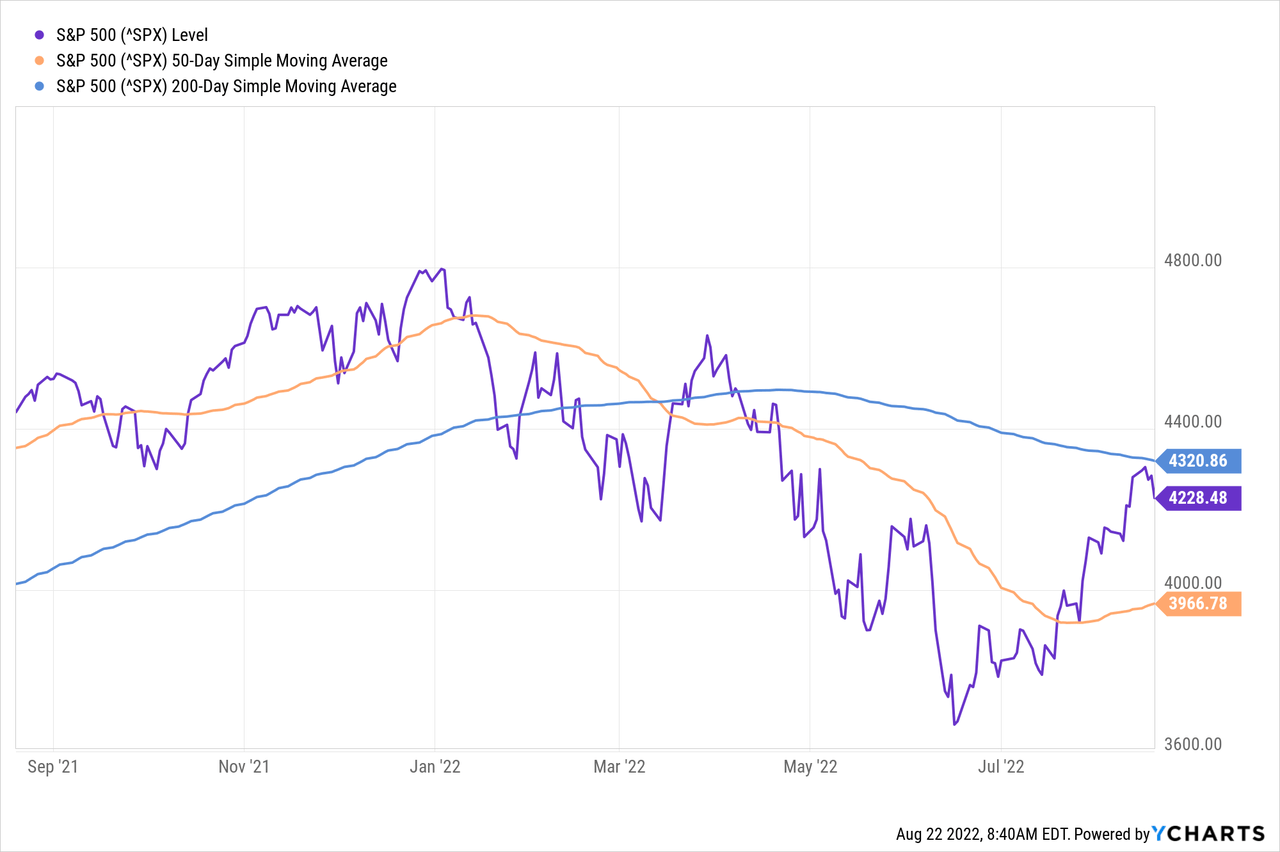

- In late April with S&P 500 at around 4500, just below the high of 4800, it was obvious to me that we are in early stages of the bear market – I recommended the sell. BlackRock continued to recommend overweight (buy).

- In late May with S&P 500 at around 3900, BlackRock downgrades stocks to neutral, while I upgraded to buy – this was about 2 weeks before the bottom of June 16th. In fact, on June 13th, nearly at the bottom, BlackRock specifically advises against “buying the dip”.

- On June 27th, I continue to recommend to buy the dip, while BlackRock downgrades stocks to underweight (sell) on July 11th – all this happening at the 3800-3900 level, which is right at the -20% bear market threshold. In fact, I specifically recommended buying above the 3840 level. I reiterated to buy stocks on July 18th.

- On Aug 15, after a significant summer rally of over 17%, I downgraded to sell. BlackRock continues to recommend underweight. Now we are on the same page

Obviously, BlackRock missed calling the top, in-fact called the top near the bottom, and in that sense missed the bottom. The question is, if both analyses are based on global macro approach, what did BlackRock miss that I didn’t.

What was the difference?

In late April BlackRock continued to recommend overweight on S&P 500 believing that the Fed is not serious about increasing the interest rates as signaled, or that the Fed put was still in place. I believed the opposite – the Fed put was gone and the Fed would significantly increase the interest rates, which would cause the liquidity shock and the deep selloff in stocks. Here are the quotes:

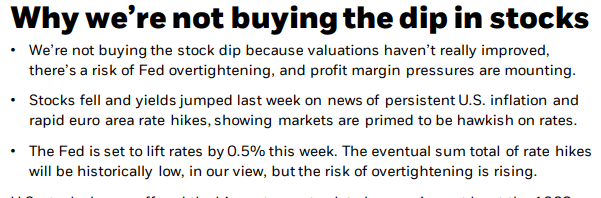

- BlackRock Weekly Market Commentary on April 18th, 2022 “Why we still like stocks as yields spike”

Tactical views on US equities (BlackRock)

We overweight U.S. equities due to still strong earnings momentum. We see the Fed not fully delivering on its hawkish rate projections. We like the market’s quality factor for its resiliency to a broad range of economic scenarios.

- Tokic on Seeking Alpha, April 22nd, 2022 “Sell Stocks: The Fed Will ‘Walk The Walk'”

S&P500 (SP500) is still overvalued at the ttm PE Ratio near 24 and the forward PE ratio near 19. Market analysts, such as BlackRock, still expect the Fed to primarily protect the stock market via the Fed put. They don’t realize that the game has changed. The Fed put is an effective tool in a deflationary environment when the Fed aims to boost demand via the wealth effect – a rising stock market boosts confidence and demand via increases in wealth. But we are not in a deflationary environment now – we are now facing de-anchoring long term inflationary expectations amid the 40-year high CPI inflation. Thus, the Fed now has no need for the wealth effect. In fact, the Fed has to curtail demand to fight inflation – and falling asset prices will actually help. Thus, S&P 500 is likely in an unfolding bear market since January 2022, with a long way to go – given only a modest current drawdown of 6-7%.

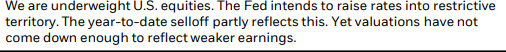

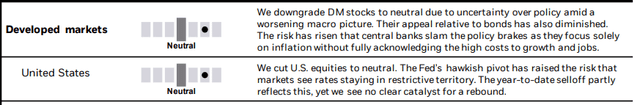

In late May, BlackRock admitted that the Fed was serious about inflation, and first downgraded US stocks to neutral and then right at the bottom in mid-June to underweight (sell). However, I argued that, after the significant drop in stock prices, the Fed actually made a mild dovish turn, and upgraded to buy. In fact, the peak Fed hawkishness happened on June 16th – right at the bottom. Here are the quotes.

- BlackRock Weekly Market Commentary on May 23rd, 2022, “Turning neutral on DM equities”

- Tokic on Seeking Alpha, May 30th, 2022 “The Fed Makes A ‘Mild Dovish Turn’ – Buy Stocks”

However, the bullish case is also very simple: given the mild dovish turn from the May FOMC meeting, the Fed is just hiking to the neutral level from the very low base – the near 0% level. Most importantly, the currently expected terminal rate of 2.95% is still historically extremely low, and thus, unlikely to cause a recession. S&P500 rose 6% last week in response to the mild dovish turn, and it’s likely the “bounce” will continue into the June FOMC meeting, and likely through the summer. Given the Fed’s mild dovish turn, and consequently a much lower recession probability, I am continuing to buy, and accordingly, I increase the rating from neutral to buy.

- BlackRock Weekly Market Commentary on June 13th, 2022 “Why we are not buying the dip in stocks”

BlackRock

- Tokic on Seeking Alpha, June 27, 2022: “The Summer Rally Has Begun (And It Has Legs)”

The last week’s SPY rally of over 6% is likely the beginning of the summer rally, which will be first tested at the 50 day moving average, and potentially reach the 200 day moving average at currently 439.

- BlackRock Weekly Market Commentary on July 11th, 2022 “Downgrading stocks, upgrading credit”

Tokic on Seeking Alpha on July 18th, 2022 “Face It – The Market Is Getting More Resilient And This Is Bullish”

The market bottomed on June 17th…The liquidity risk receded because we are past the peak Fed hawkishness – the monetary policy tightening worst-case scenario is behind us. In fact, the Federal Funds futures are starting to price the end of the Fed’s hiking cycle in Feb 2023 and the first cut in Aug 2023…Thus, I am in the bullish camp – and still recommend a tactical buy on SPY.

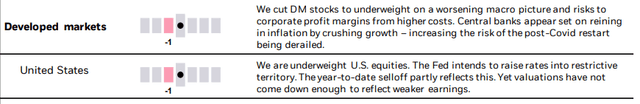

In my view, the summer rally was in-fact a relief rally after the Phase 1 liquidity shock selloff. In mid-August, I recommended to take profits and start thinking about the tactical short positions in SP500 – expecting the Phase 2 selloff or a recessionary selloff. BlackRock continues to recommend underweight. So, we are on the same page now.

- Tokic on Seeking Alpha on Aug 15th, 2022 “Expect A Rough September”

The S&P 500 had a large summer rally, which is hitting the key technical resistance. But more importantly, fundamentally, the recession probability will be much higher in September, as the 10y-3mo curve inverts, while the monetary policy tightening will increase, via QT and the interest rate hikes. Thus, the Phase 2 of the full bear market is approaching. Tactically, this means taking profits of speculative long position, and starting to establish the tactical short positions.

- BlackRock Weekly Market Commentary on Aug 15th, 2022 “Caution: earnings under pressure”

BlackRock

What are the implications?

I have to admit that it was difficult to remain confident in my own analysis, when it clashed with the BlackRock’s analysis. The key implication from this case-study is that, while it is important to understand the points made by the large financial institutions, ultimately, you have to trust your own analysis – supported with the prudent risk management.

Here is S&P 500 chart with the levels:

Be the first to comment