Michael M. Santiago

In January I realized my dream of starting an investment firm, Kingdom Capital Advisors. The firm is off to a great start, beating the S&P by over 35% through Q2-22, but most don’t know that without the 2020/2021 GameStop (NYSE:GME) saga the firm may have never begun. Today, I wanted to share more of the origin story, how it affected me as an investor and my current thoughts on GME as an investment.

Background

I followed GameStop before it was a household name. It was a popular stock at times due to the high dividend yield, but concerns swirled that the business model couldn’t last. There were bearish rumors that the company would shortly be insolvent, and bullish rumors that GME could earn half its market cap in 2020. Michael Burry even showed up in 2019 and demanded significant share repurchases.

My initial investment was a reminder that a “cheap” stock can always get cheaper, as I made initial purchases around a $10 share price before eventually watching the stock decline under $3 (both pre-split), and eventually added more after Ryan Cohen began his involvement. GME had a near brush with a technical default in 2020, despite their high cash balance, due to COVID and tripping covenants on their lending arrangements. This was an important lesson in risk management and position sizing as even successful trades can flirt with disaster.

I submitted two articles, arguing that GME was different than common comparisons Radio Shack and Blockbuster, and another article forecasting console cash flow in the back half of 2020 to possibly exceed GME’s entire market capitalization. I traded around the position with shares and options, including fall of 2020 when I held 300 $10 call contracts that paid off well, but nowhere near the ~$15m they would have been worth if held until late Jan-21. A poor holiday sales update showed me that the console refresh would not be the tailwind I expected, so I made the hard choice to move on from the story.

Exiting at $20 was consistent with my own valuation of the business (2-5x on my shares and ~20x on my calls), but the opportunity cost will always haunt me to some degree. Nevertheless, the financial freedom, connections, and following I gained from the GME saga provided the impetus to launch my own fund.

Expectations Vs Reality

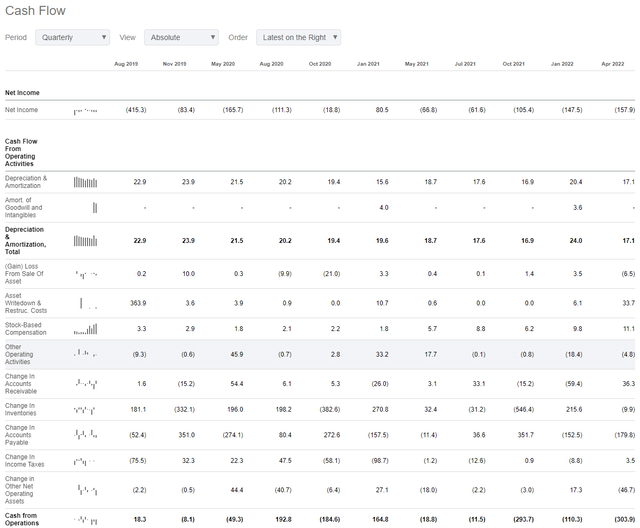

How did my expectations for cash flow age? Horribly:

GME failed to generate positive cash flow from operations in 2H-20 and has since incinerated nearly $1B more, even before factoring in the ~$100m of CapEx spent. The only cash flow generated at GME is ~$1.6B from the issuance of shares in 2021. Not a bad trade considering these same shares were bought back in 2019 at a fraction of the cost. However, my reason for buying GME was the cash flow, which remains nonexistent.

The story would have looked much different in 2020 without COVID, and without the supply chain issues that hampered sales during the initial console refresh. Sadly, that future never materialized, and we now face a GME that missed their opportunity.

Lessons Learned

-

Margin of Safety Matters. Buying a stock with cash exceeding the market cap, a buyback in place, and a decent possibility of near-term earnings made for a compelling margin of safety in 2019. COVID could have upended this thesis, but fortunately, there was enough support from the balance sheet to survive.

-

It Can Be Better to be Lucky than Good. Without Ryan Cohen engaging with GME, the business could very well be bankrupt today. As highlighted above, supply chain constraints killed FY20 cash flow and the business would likely be insolvent today without the money raised via share issuance in FY21 and made possible by the squeeze. Some might argue the “short squeeze” would have happened without Cohen, and maybe it would have, but I walked away from this investment feeling more lucky than smart.

-

Understand the Bear Case. There were many signs in 2019 and 2020 that the GME pre-owned segment was struggling, 4-wall EBITDA was a bad measure for store viability, and that GME was losing market share to peers. These common bear arguments nearly proved correct until they were run over by the squeeze, and I too quickly dismissed deterioration in GME’s core business which was exacerbated by COVID and supply chain pressure.

-

Turnarounds are Hard. Ryan Cohen outlined what was needed in his Nov-20 letter to the GME board, including “we urge you to quickly provide stockholders with a credible and publicly-available roadmap for cost containment, prioritizing profitable retail locations and geographic markets, and building the e-commerce ecosystem gamers deserve.” Despite over a year and a half at the reigns himself, such a public roadmap does not exist and there is minimal visibility into how this platform will suddenly become profitable as gaming sales trends reverse.

-

Sticking It to the Shorts is a Hollow Victory. While the high short interest was an interesting part of the GME thesis, I’ve found it disappointing to watch the culture war built around “sticking it to the shorts.” Melvin Capital is gone, but most short-sellers have managed their books just fine despite retail efforts to bankrupt them. There’s no harm in advocating for market change if you think it’s needed, but I would encourage readers not to ever buy or sell an investment with the goal of hurting a trader on the other side. Such bitterness will at best lead to a hollow victory, and at worst result in material losses after you blur investing with a personal crusade.

Looking Forward

“Ape” strongholds like GMEdd.com maintain a $1069 price target (pre-split), but as pandemic gaming sales are lapped, year-over-year comps are now down significantly across the gaming spectrum. The company has avoided investor questions on earnings calls, and Cohen has spent more time complaining about consultants and short sellers on Twitter than outlining a plan for the future of the GME platform. The recently launched NFT marketplace is GME’s cornerstone of innovation thus far, but it will not solve current cash burn challenges. I went to the GME homepage to see what they have cooking, and it’s almost indistinguishable from 2019:

I wish the story was more promising. I became rather attached to the business during 2019 and 2020, following the blow-by-blow attempts to save the company. I’m not sure if buying a business like Funko (FNKO) or Turtle Beach (HEAR) would solve the business issues, but both could have been had for minimal dilution over the past year to bring popular gamer brands in-house. Sadly, just as GME missed an opportunity to buy Twitch ($970m to Amazon (AMZN) in 2014) and instead invested in “diversification” via Spring Mobile, Cricket, and Simply Mac (later sold together for $700m), GME appears to have missed another window by entering NFTs a year after their surge in popularity, not using their stratospheric valuation to acquire any cash generating subsidiaries and failing to make meaningful forays into eSports. To this end, the banner on their eSports page is linking to an Overwatch tips article from…2020.

Game Informer Link From GME “Esports”

Recent comments by the company address removing corporate bloat that was just added last year, but say nothing about declining gross profit at the store level, which should be a leading concern for most investors. Cutting SG&A back to FY20 levels still wouldn’t make the trailing 12 months profitable, and firing the CFO does not inspire confidence that an internal plan is well underway to attain profitability.

Given business trends, I expect GME will soon need to sell more shares to fund their widening losses. Since the book value of the company is only 10% of the current market cap, this would be a logical step to increase shareholder value.

Conclusion

GME taught me many valuable lessons as an investor and helped me realize my dream of launching a fund. I’m thankful for my time in the GME investor community prior to its surge in popularity and wish the best of luck to those that held for longer than I did. I don’t see a reason to own the stock today, but maybe Ryan Cohen has some tricks up his sleeve, beyond selling more shares, to stop the cash hemorrhaging. I’m not betting on it.

Be the first to comment