Andrii Yalanskyi

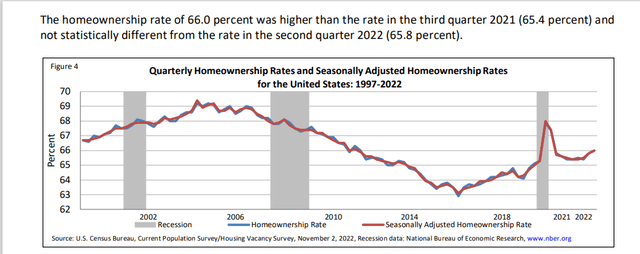

For many folks in the good old US of A, owning a home is the epitome of the American dream. Home ownership hovers around 66% now in 2022, which means that roughly 2 out of every 3 eligible homeowners own their home (or more likely, has a mortgage). That rate went up as high as 69% in 2005 and then dropped as low as 63% in 2016 before rising again until the 2020 pandemic. Home ownership rates shot up to nearly 68% in mid-2020 before dropping again rapidly until the third quarter of 2022 as the trend now begins to head back up to 66%.

Home Ownership rates (US Census Bureau)

Sone of the reasons for home ownership to rise from 2016 to 2020 included historically low interest rates, a constricted supply of new homes, favorable demographics, a growing economy with good stock market performance and a relatively wealthy population of prospective buyers that caused demand to surge. Then the pandemic came along in 2020, followed by the Russian invasion of Ukraine early this year causing everything to change. Interest rates started rising, inflation soared, and housing prices crashed from the bubbly highs they had reached after the surge in post-pandemic demand for housing that occurred in 2021.

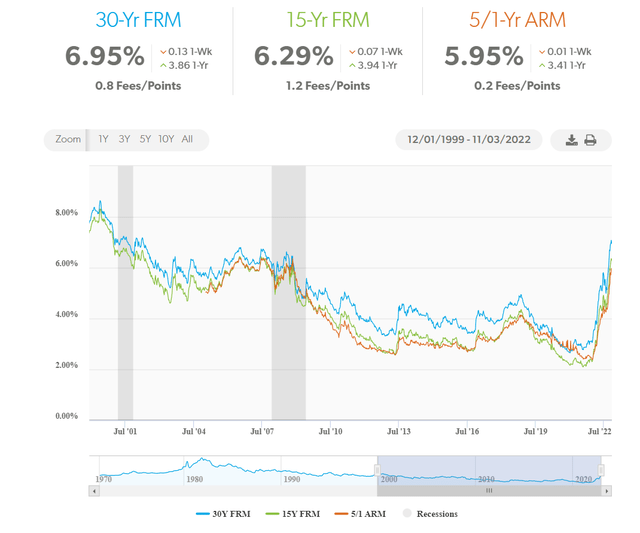

If you had been sleeping like Rip Van Winkle for the past 20 years, you might not have noticed that mortgage rates had been declining from a high above 8% in the year 2000 up until this year. The steady decline all the way down to below 3% through two different recessions might have lulled you into thinking that mortgage rates would never go up above 5% again. But lo and behold, in the past twelve months rates for a 30-year fixed rate mortgage shot up to just above 7% for the first time in ten years before pulling back slightly in early November. This statement from Freddie Mac on 11/3/22 sums it up.

Mortgage Rates Dip Under Seven Percent

Mortgage rates continue to hover around seven percent, as the dynamics of a once-hot housing market have faded considerably. Unsure buyers navigating an unpredictable landscape keeps demand declining while other potential buyers remain sidelined from an affordability standpoint. Yesterday’s interest rate hike by the Federal Reserve will certainly inject additional lead into the heels of the housing market.

mortgage rates (Freddie Mac)

Now, in November 2022 as the Federal Reserve keeps increasing the base lending rate (now targeting 3.75% to 4%) to fight inflation, there appears to be no end in sight for the rising mortgage rates that are preventing homebuyers from being able to afford a new home purchase. Furthermore, the planned reductions in Treasury holdings and MBS will likely further pressure mortgage rates and the housing market into 2023.

The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that were issued in May.

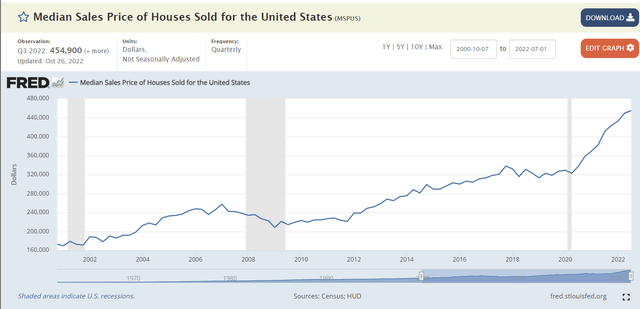

Housing prices shot up dramatically after the Covid pandemic with many working from home, or moving to a new home, as well as spending more time remodeling and making home improvements to existing homes with the intention to sell as the supply of available new homes continued to drop.

St Louis Fed

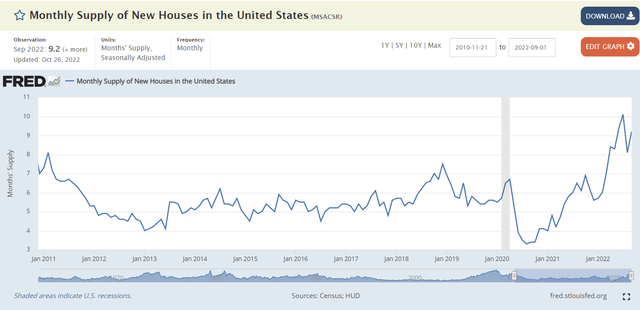

For the past ten years the monthly supply of new homes available for sale in the United States was staying fairly consistent at around 5 to 6 months, until the end of 2020 when that trend began to reverse. Suddenly, new homes available for sale are taking much longer to sell as demand dries up due to increasing mortgage rates and lower demand.

St Louis Fed

What Should Real Estate Investors Do?

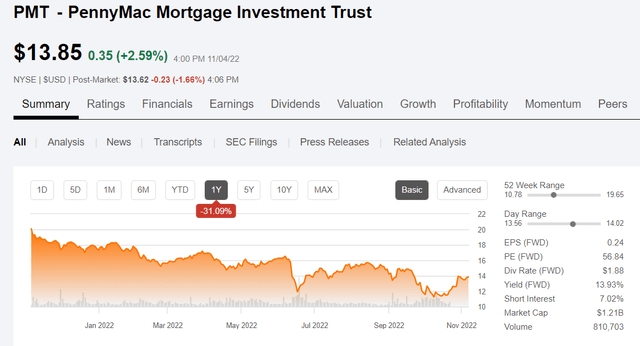

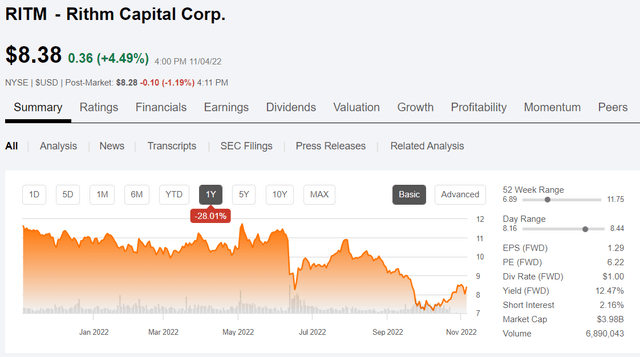

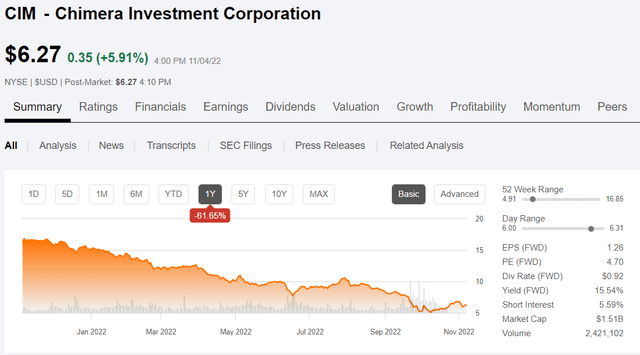

Some traditional investment opportunities available to retail investors in the mortgage industry include REITs such as PennyMac Mortgage Investment Trust (PMT), Rithm Capital (RITM), and Chimera Investment (CIM), which all offer a high current dividend yield in their common stock offerings.

Current distribution yields are high for these three mREITs due in large part to their share price suffering significant declines over the past one-year period. REITs are historically cheap, and mortgage REITs overall, have suffered the most in 2022 with an average YTD drop of -40% in the sector.

PMT common stock yields nearly 14% at the current closing price of $13.85 as of 11/4/22, while the share price is down more than 30% over the last year. The company reported Q3 earnings on Oct 27 and book value dropped slightly but may be stabilizing now in the fourth quarter as the overall market improves. Book value per common share decreased to $16.18 at September 30, 2022 from $16.59 as of June 30, 2022.

Seeking Alpha

RITM offers a 12.5% yield at the closing price of $8.38 with a -28% price decline. RITM reported a Q3 earnings beat although revenues declined -30% QOQ. Book value was estimated at $12.10 as of September 30. Earnings for distribution came in at $0.32 per diluted common share.

Seeking Alpha

CIM offers the highest current yield at 15.5% at today’s closing price of $6.27 with the largest percentage drop in share price of -61%. CIM reported an earnings miss in the Q3 report on November 3, but stated $0.27 in earnings per diluted common share available for distribution. GAAP book value reported was $7.44 per common share.

Seeking Alpha

In the Q3 earnings press release, the CIM CEO and Chief Investment Officer, Mohit Maria had this to say about the company’s future prospects.

“In the third quarter, elevated market volatility led to higher rates and wider spreads putting further pressure on our book value. However, these market conditions have brought new opportunities on both sides of the balance sheet. This quarter we committed to purchasing approximately $750 million mortgage loans, completed a $370 million securitization, and entered into $885 million of new interest rate swaps as a liability hedge against further increases in interest rates. Since quarter end, we have increased our cash position, entered into an additional $1.1 billion of hedges, closed a new non-mark-to-market financing facility, expect to close a purchase of jumbo prime loans into another long-term non-mark-to-market structure, and lastly, completed a $145 million securitization. We believe we are well positioned to take advantage of new market opportunities and that our patience and investment discipline will benefit our shareholders over the long-term.”

The market has reacted positively to each of the three earnings reports as evidenced by the recent upticks in each of the price charts shown above. It appears that the worst may be over for these mortgage REITs after suffering a brutal year so far in 2022.

However, the worst may not be behind them if the housing market crash continues into next year as some are predicting. In summarizing the housing market crash of 2022, a recent post in The Atlantic explains what happened.

This madness set the stage for an utterly bizarre 2022. As the rising cost of shelter helped push up core inflation, the Federal Reserve raised interest rates—again, and again, and again. It’s hard to appreciate just how dramatically mortgage rates have trampolined, but maybe this sentence does the trick: Just 20 months ago, the average fixed rate for a 30-year mortgage was lower than at any time on record; today, it’s higher than in any other month this century. “You’d be kind of crazy to sell your house right now unless you have to,” Weisenthal said. It’s not a great buyer’s market, because rates are spiking. And it’s not a great seller’s market, because owners don’t want to double their monthly payments by taking on a new mortgage at a higher rate. While the flash-freeze recession of 2020 brought the housing market to a boil, the simmering inflation of 2022 has somewhat frozen it.

Because of this uniquely historic situation with out-of-control inflation, additional rate increases likely, fewer home buyers on the near horizon, and other uncertainties surrounding the post-election geopolitical situation, I am not comfortable recommending investors purchase the common shares of these stocks. Instead, I would suggest that investors who are looking for a high yield income distribution with less risk in the capital structure, should consider the preferred stock in these companies.

Preferred Shares Offer Protection and Steady Income

Preferred stocks are like a blend between equity and fixed income, offering the high yield income that REIT common shares can deliver, but trading like a bond with a fixed distribution whose payment takes priority over common shareholders. Other authors are much more knowledgeable than I am when it comes to REIT preferred stock, and this article from Hoya Capital provides an excellent overview if you would like to learn more.

While the common shares of PMT, RITM, and CIM all appear to be well covered in the current quarter, the future reporting periods may not look as optimistic given all that is happening today. For that reason, I have chosen to invest in the preferred shares of each. In my case, I am looking for limited downside risk for an investment that will provide regular (quarterly in the case of most preferred stocks) distributions that will not change until the stock is called or redeemed.

My choices of preferred shares include the C shares of PMT (PMT.PC), the D shares of CIM (CIM.PD), and the D shares of RITM (RITM.PD). My objective is to create an income stream from these investments and not necessarily to capture capital gains, although that is also quite likely to occur if the bottom is indeed in for the mREIT sector.

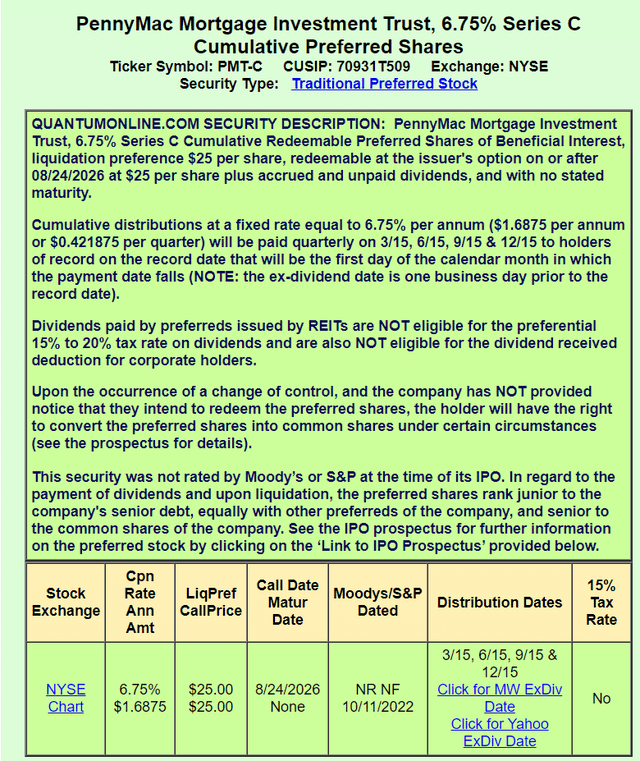

PMT C Preferred Shares

PMT.PC has a coupon rate of 6.75% which means it pays $1.687 per year or $0.421875 per quarter. The liquidation price is $25, and it is callable on 8/24/26. The current share price as of 11/4/22 market close is $17.00, which indicates a current yield of 9.9%. The yield to call can be easily calculated using this calculator and is 18.4% based on current parameters.

The Quantum Online website is very helpful in describing all the pertinent characteristics of preferred stock offerings.

Quantum Online

A recent article from Retired Investor does a deep dive into these preferred shares if you would like to read his analysis, which really helped convince me to purchase some for my retirement income portfolio.

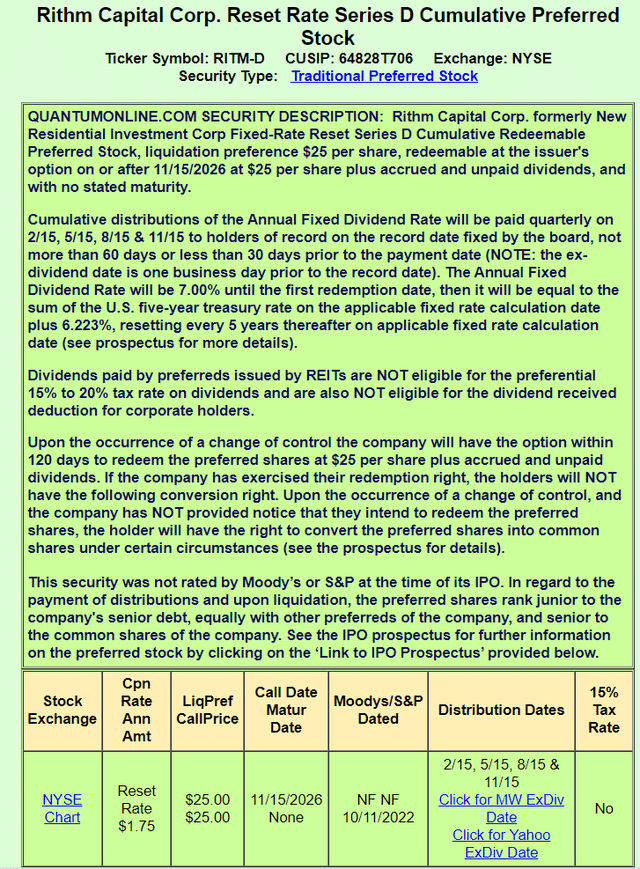

RITM D Preferred Shares

The D preferred shares from RITM (RITM.PD) pay a coupon rate of 7% which works out to $1.75 per year or $0.4375 per quarter and are callable 11/25/2026 for $25. At the 11/4/22 closing price of $17.79 that works out to a current annual yield of 9.8% and the yield to call is 16.6%.

A feature that is true of all four of the preferred shares offered by RITM (formerly NRZ) is their fixed to floating rate structure. In the case of the D shares, the fixed rate converts to a floating rate if not called in 2026 that features a coupon determined as the 5-year Treasury rate plus spread (6.223%) that gets reset every five years. This sounds somewhat complicated but is not an unusual arrangement for preferred shares to adjust the coupon rate based on current interest rates if they are not redeemed by the call date.

Quantum Online

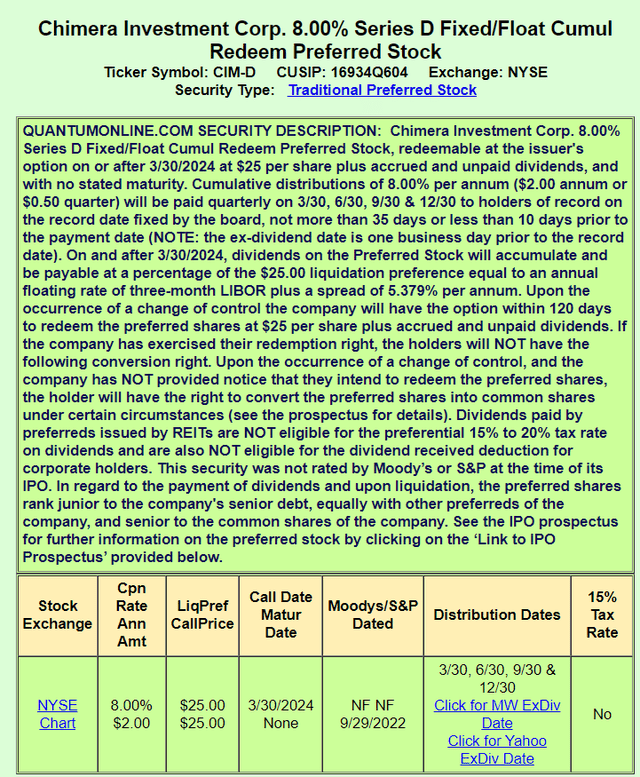

CIM D Preferred Shares

I prefer the D shares of CIM due to the fixed to floating nature of them along with a severely depressed share price. Author Dane Bowler wrote an in-depth article on all of the CIM preferred shares back in July where he explained the differences between the A,B,C, and D shares. They were wildly mispriced at that time, according to him, and they have become even more of a bargain now.

The CIM.PD shares trade at $17.76 as of the 11/4/22 market close and pay an 8% coupon which works out to $.50 per quarter. The call date is much earlier than the others in March 2024. The current yield works out to 11% and the yield to call is a whopping 34.75%, however, the shares are unlikely to be called and will instead convert to a floating rate. The floating rate will be calculated as the 3-month LIBOR plus spread of 5.379% per annum.

Quantum Online

The B shares also look attractive at current prices and I am not trying to suggest that the D shares are better for everyone but based on my own investment objectives and risk tolerance I decided to go with them.

Summary and Recommendations

The housing market has struggled mightily in 2022 to keep up with inflation, rising mortgage rates, a sudden drop in demand, and other external forces that have led to severely depressed prices for many REITs that specialize in residential mortgages. As investors look for opportunities in the ashes, preferred stocks in several REITs rise to the occasion.

There are probably more REIT preferred stocks in addition to the ones that I highlighted in this article that look attractive to income investors at current prices. I highlighted three that I feel are good opportunities right now and for the next 4 to 5 years to offer a steady income stream with minimal risk relative to the common shares of the REITs that I analyzed. Please do your own due diligence before taking my advice as your situation is likely to be different than mine, or you may identify additional risks that I have overlooked. If you would like to contribute to the discussion, please add your comments.

Be the first to comment