da-kuk

Dear co-investor,

During the second quarter of the year, the dynamics that we have been discussing in previous quarterly letters have not changed. The damaging effects of the energy transition (exacerbated by the Russian invasion of Ukraine), the Chinese economic crisis and high inflation (with its consequent tightening of monetary policies) have continued. This cocktail has led the world’s major stock markets, as well as fixed income assets, to record one of the worst first half-years in their history.

Despite this, our portfolios have continued to weather this difficult environment. Our Horos Value Internacional fund fell -2.0% over the quarter, compared to a -10.2% decline of its benchmark. Horos Value Iberia, on the other hand, was down by -1.0% over the period, compared to -1.1% in its benchmark index.

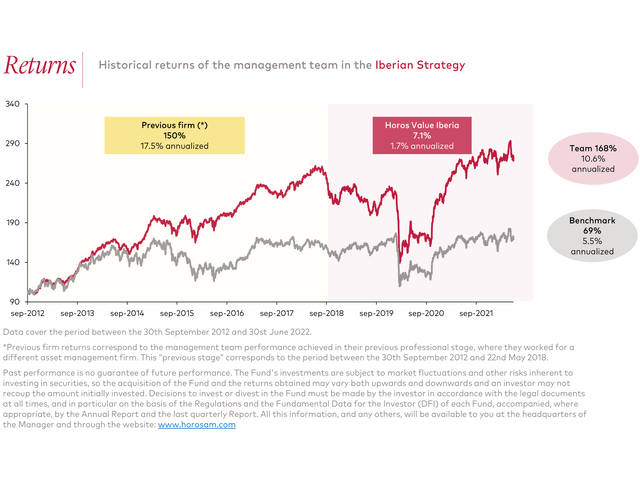

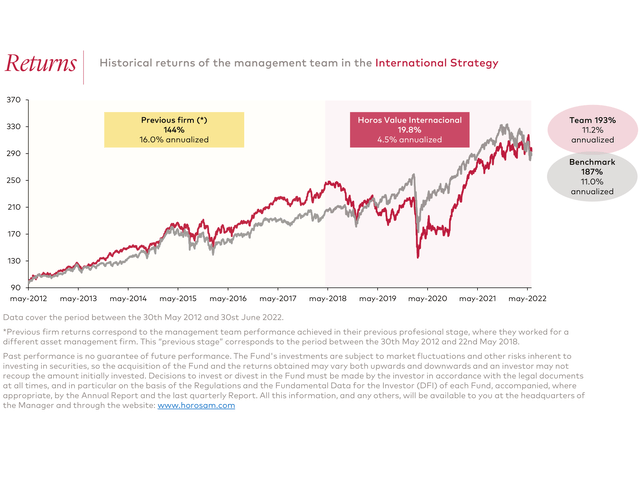

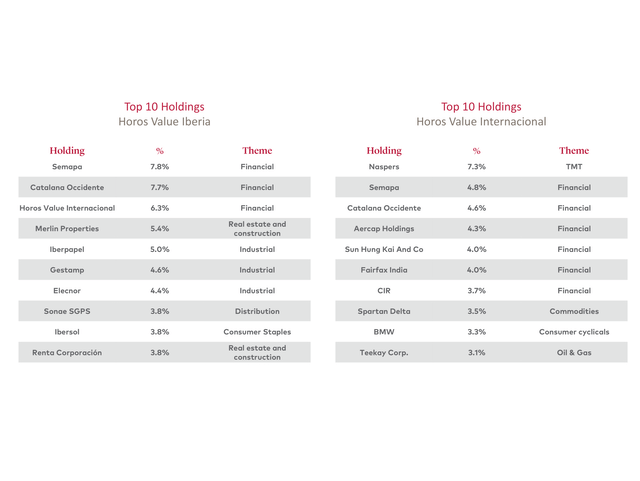

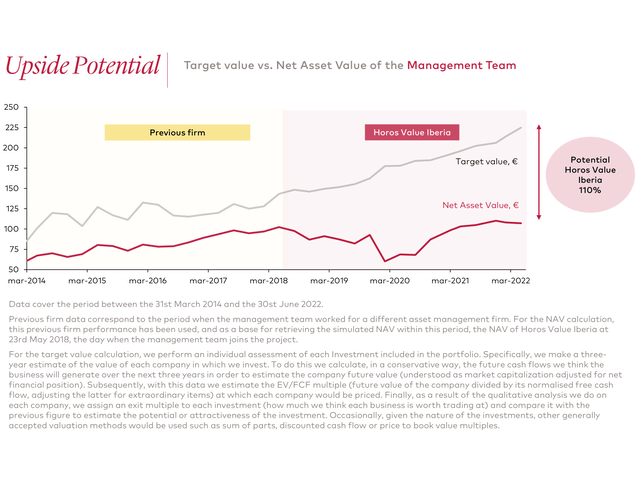

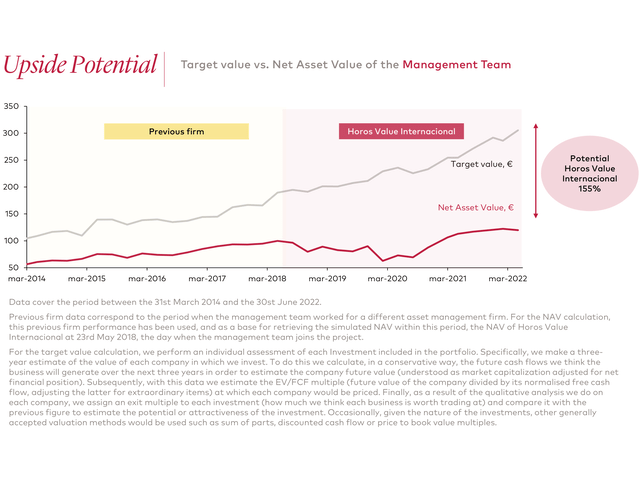

As usual, I would like to take this opportunity to update our longer-term performance. Since the inception of Horos (May 21, 2018), Horos Value Internacional has returned 19.8%, below the 39.3% gain of its benchmark, while Horos Value Iberia has returned 7.1%, outperforming the 0.6% return of its index. Moreover, since 2012, the returns of this management team stand at 193% for the international strategy and 168% for the Iberian strategy, compared to 187% and 69% of their benchmark indices, respectively.[1]

The sources of uncertainty are many and of significant magnitude. For this reason, it is vital to work with great management teams that can make the most appropriate decisions for their shareholders at all times. We will therefore devote this quarter’s letter to explaining the keys to good capital allocation.

Thank you for your confidence.

Yours sincerely,

Javier Ruiz, CFA | Chief Investment Officer | Horos Asset Management

Executive summary

The goal is not to have the longest train, but to arrive at the station first using the least fuel.

– Tom Murphy

The current sources of uncertainty, far from being contained, seem to be growing: How far will Russia’s invasion of Ukraine go? What about its impact on the energy and food markets? When will the current inflation levels roll over? How much will central banks hike interest rates? How badly is the Chinese economy affected? Many questions and, unfortunately, few accurate answers. We can do great research, but the reality is that the pendulum can swing the other way at any time.

For this reason, it is particularly critical that the companies in which we invest have management teams capable of making the most appropriate decisions for their shareholders, regardless of the economic or market context in which we find ourselves. However, neither the management teams, nor often the shareholders of the companies, fully understand what proper capital allocation consists of. We therefore wanted to dedicate this quarterly letter to explaining, in a simple way, our view on this subject.

In addition, we will discuss the most significant changes that we have made to our portfolios. Among others, we can highlight that at Horos Value Internacional we exited our position in the liquefied natural gas infrastructure company Golar LNG (GLNG) and invested in the technology platform company Alphabet (GOOG, GOOGL), in the non-destructive testing and other asset protection services provider Mistras Group (MG), in the LNG shipping player Cool Company, in the financial company MBIA Inc. (MBI) and, for the third time in the last year, in the metallurgical coal producer Ramaco Resources (METC).

At Horos Value Iberia, we sold our stake in the renewable energy company Greenalia, following the takeover bid launched by its main shareholders, and we initiated a new position in Vidrala (OTCPK:VDRFF), the glass producer.

The role of the short term in value investing

True long-term thinking is goal-less thinking. It’s not about any single accomplishment. It is about the cycle of endless refinement and continuous improvement.

– James Clear

As the reader of this letter is (I hope!) well aware, the cornerstone of our investment philosophy at Horos Asset Management is value investing. Essentially, this approach attempts to take advantage of the opportunities (inefficiencies) that the market offers in order to be able to acquire assets for a price below their underlying value. However, we would be wrong to think that the job of the value investor ends once he has invested in this advantageous situation. Markets are complex adaptive systems.

They are always changing, processing and reacting with different intensity and duration to new information.[2] It can be said that markets are permanently evolving, engaged in a persistent attempt to reach an efficiency that never seems to arrive.[3] This process has a double and opposite impact on the work of the value investor. On the one hand, it makes life easier for them by continually offering new investment opportunities.

On the other hand, it makes life more difficult, by forcing them to periodically reassess the merits of their portfolio and the opportunity cost of keeping it unchanged. This may come as a shock, initially, since it has always been said that value investing involves investing with a long-term view and patience (which is often associated with the well-known buy-and-hold strategy). This is true. However, this characteristic entails a persevering, short-term exercise of trying to improve the portfolio. Otherwise, that long-term view and patience may not deliver the expected returns.

Specifically, we have two ways of doing this. The first one is what we call the recycling of fund assets. Basically, Alejandro, Miguel and I sell the companies that have seen their upside potential significantly reduced (if all goes well because our investment thesis has been proven right) in order to invest in new ideas that improve the portfolio’s risk-return ratio. Sometimes, these investments go into companies already present in the fund, given their greater attractiveness at the time.

The latter overlaps with the second way of aiming to achieve satisfactory returns over the long term, namely portfolio rebalancing. Rebalancing is simply adjusting the weights of the companies in our funds according to their recent stock price and business performance and the consequent change in the upside potential that we expect for each of them. In this way, in a process that is much more art than science (we do not use strict formulas or rules to make these adjustments), we succeed in making our portfolios increase their estimated returns over time.[4]

However, as is to be expected, we investors are not the only ones who can influence the future performance of our funds with this asset recycling and weight rebalancing. The management teams of the companies in which we invest also play a role that can be critical to our goals. Even though we find new attractive investment ideas or concentrate the portfolio in those companies with the greatest theoretical upside, if the management team of these companies makes decisions that are detrimental to our interests, all that work will be in vain.

Hence the importance of understanding the role of the companies’ management teams and, more specifically, their capital allocation. This is the subject of this quarterly letter.

The big question

Entrepreneurship consists of the typically human capacity to recognize the opportunities for profit which exist in one’s environment.

– Jesús Huerta de Soto

One of the innate characteristics of human beings is, without a doubt, that continuous search to try to improve their future situation by means of changes that one introduces in their present situation or state. In other words, and in general terms, we all act and make decisions with the aim of improving, taking advantage of the opportunities presented to us. Obviously, the reality and the results achieved may be very different from what one was looking for with one’s actions, but that is another subject that is beyond the scope of this document.

Therefore, this entrepreneurial spirit, referred to by Austrian economists as “entrepreneurship,” is much more present in all of us than we might imagine.[5] However, if there is one person profile in which this entrepreneurial function is most evident, it would indeed be that of the CEO of a company. These managers (as well as the rest of their team) have to deal, in their decision making, with the continuous changes that occur in their business, in the industry in which they operate and in the economy as a whole, often at a global level.

Their decisions will certainly affect the future of the company and, consequently, the future of its shareholders, and are particularly relevant for publicly traded companies in what is known as capital allocation.

But what exactly is capital allocation? Michael Mauboussin is probably the analyst who has best defined the concept:

Capital allocation is the most fundamental responsibility of a senior management team of a public corporation. Successful capital allocation means converting inputs, including money, things, ideas, and people, into something more valuable than they would be otherwise.[6]

In other words, a company’s capital allocation deserves a good rating if it has created value for its shareholders. Conversely, managers who have destroyed value with their decisions deserve to repeat a course. And how do we know if a management team is doing the right thing? Of course, the history of the Washington Post can serve as an easy guide to understanding this. As William N. Thorndike details in his highly recommended book The Outsiders, in the more than two decades that Katherine Graham was the company’s CEO, the Washington Post easily outperformed its peers in terms of shareholder returns.7 How did she do it? First, she was able to surround herself with some of the best capital allocators of all time (Warren Buffett and Dan Burke were on the company’s board). Second, when allocating capital, the board was always trying to answer the question: what is the best use for the next dollar generated by the business?8

This question is the compass that should guide company management teams. However, beneath its apparent simplicity, it hides a myriad of possibilities that, fortunately, management teams (and, therefore, ourselves in our research) can reduce to four areas of action: reinvesting in the business (here we like to include any decision that has an operational impact on companies), acquisitions of other entities and assets (we should also look at the reverse side of this operation: divestment of divisions and asset sales), repayment of debt (or its issuance) and shareholder distribution (dividend and share buybacks, net of capital increases).

In order to understand these possibilities more clearly and, especially, their great impact on our potential returns as shareholders, we are going to look at different real examples of investments we have in our portfolio for each of them.

A world of possibilities

What we want is very large discounts to intrinsic value with great capital allocators.

– Monish Pabrai

OPERATIONAL DECISIONS

Although it may look less appealing from the outside, there is no doubt that the primary mission of a good capital allocator of a company is to protect or even improve the profitability and sustainability of the business he or she manages. In general, ignoring a company’s capital structure, any measure that contributes to increasing the operating cash flow generation of a business in a sustainable manner would serve to fulfill this mission. Once again, a vast world of possibilities opens up. On the one hand, these measures can be focused on increasing revenues.

To do so, the company may try to increase the volume of product sold, the price of the product, or a combination of both. Depending on the particular context or the nature of the business, it will make sense to opt for one or the other of these alternatives (for example, it is not easy to raise prices in a deflationary recession). On the other hand, and in addition to the above, the focus of the actions can be more on reducing the costs of operating the company. In the end, the aim is to increase the efficiency of production processes without affecting sales or the sustainability of the business.

In our current portfolio, we can find companies that have taken measures to increase the operating cash flow generation of their businesses with a long-term vision. For example, within the commodities sector, we are shareholders of two companies that are investing to substantially increase their revenues in the short and medium term.

I am referring to Ramaco Resources and Spartan Delta (OTCPK:DALXF). In the case of Ramaco Resources, the company is increasing its metallurgical coal production capacity by investing in its Elk Creek and Berwind assets, which makes it one of the producers that is best able to capitalize on the high prices of this mineral over the last year. Meanwhile, Spartan Delta acquired Canadian oil and gas assets in recent years at very attractive prices and is now making the investments to extract these fossil fuels, also benefiting from the current market environment.

On the cost-cutting side, a paradigmatic example of this can be found in the Portuguese holding company Sonae (OTC:SOSSF). The company, excellently led by Claudia Azevedo, has not refrained from taking measures that contribute to increasing the profitability of its business.

Clear examples of this would be the merger of the sporting goods retailer Sport Zone with some of its competitors in Iberia (JD Sports and Sprinter) or the restructuring of its technology products distribution business Worten, selling stores to its competitor Media Markt or, directly, closing the less profitable ones, which contributed to improving the margins of these businesses and, therefore, their cash generation capacity.

Although these are the most immediate ways of influencing companies’ revenues or costs, they can also opt, when the nature of the business allows it, for a longer-term route with a more difficult-to-quantify impact: the conscious increase of certain costs in an attempt to increase sales more than proportionally.

This would include, among others, spending on research and development (think of the development of BMW‘s range of electric vehicles or the development and application of artificial intelligence in the case of Alphabet) or advertising (in the insurance sector, for example, companies tend to spend large sums of money on advertising to maintain or increase their market share).

Finally, as a last example of the many and diverse ways in which a management team can seek to improve the company’s operating cash flow, would be the continuous improvement of working capital. Spanish companies such as Global Dominion (OTCPK:GBDMF), Gestamp (OTCPK:GMPUF) or Talgo (OTC:TLLGF) have demonstrated a strong historical commitment to improving or containing their working capital, accustoming their shareholders to continuous positive surprises in this respect.

INORGANIC DECISIONS

Once a company’s management team considers that the operational needs of the business are covered and that, at least at that moment, there are no attractive initiatives that contribute to improve its profitability, then it should consider what (better) use to make of the cash generated. Of course, one of the classic alternatives is to acquire other companies. In fact, there are studies that show this to be the historically favored alternative for company managers.[7]

The classic motive (the unspeakable word for many) that is often put forward to justify this type of move is that of synergies, that is, the economic improvements achieved by simply acquiring another entity, either by increasing sales over and above what both entities could achieve separately or by achieving a more than proportional cost savings. However, history has demonstrated three facts that call into question the merits of mergers and acquisitions. On the one hand, acquisitions usually generate value for the shareholders who sell their company, not for those who buy it.

On the other hand, the promised synergies are rarely realized. Finally, if any synergies are achieved, they are usually in cost savings, rarely in revenue growth.[8] For all these reasons, we should always be skeptical when one of our companies acquires another and promises massive value creation after the deal.

That said, there are management teams that are a clear exception to this rule and have made corporate transactions their hallmark, usually creating value for their shareholders. In our funds we have several companies that have more than fulfilled this task. However, not all have implemented this strategy in the same way, perhaps conditioned by the nature of their sector or the size of their company.

For instance, Spanish companies such as Applus (OTCPK:APLUF), Global Dominion or Prim have historically specialized in making many annual acquisitions of small size, taking advantage of the fragmentation of the sector in which they operate and paying attractive multiples for the companies acquired.

Other companies in which we are invested tend to focus on relatively medium-sized acquisitions. These are, therefore, less frequent than in the previous case, but with a certain recurrence. This would be the case with Catalana Occidente (OTC:GCNJF), Groupe Guillin and Vidrala. The Spanish insurer Catalana Occidente has always been characterized by retaining a significant percentage of its profits, with the intention of making acquisitions in its sector that bring it the benefits of greater scale and product diversification and where it can implement efficiency measures that improve the profitability of the acquired businesses.

Similarly, Groupe Guillin, a French food packaging manufacturer, has historically taken advantage of the predictability of its business to take on debt (in a sensible way) and make acquisitions in different European geographies with the same objective of achieving greater scale, product diversification and greater efficiency in the acquired plants. Exactly the same could be said in the case of the Spanish glass manufacturer, Vidrala, with its acquisitions of the Encirc group in the UK in 2015 or Santos Barosa in Portugal in 2017.

Finally, there are companies that make very relevant corporate transactions, even transformational ones, sporadically and taking advantage of their position of financial strength and operational capacity in times of stress for the sector or for the target company. Such is the case of AerCap (AER), the world leader in the aircraft leasing business.

As we have discussed in detail in previous letters, the team led by Aengus Kelly has never been shy about making large acquisitions, such as the purchase of International Lease Finance Corporation in 2013, taking advantage of the capital needs of its parent company AIG (AIG), or that of GECAS, the other major player in the sector and part of the General Electric (GE) group (also with certain financial stress), during the coronavirus pandemic. Both deals provided significant value for their shareholders, although perhaps, for the time being, less obvious and less substantial in the case of GECAS.

However, there are times when the best move is not to buy another entity, but rather for the company to divest itself of a division in order to unlock value and use the proceeds for uses that generate higher returns for shareholders or, directly, to restructure or sell those that are a burden to the company as a whole. We have recently seen the first possibility in Merlin Properties SOCIMI (OTCPK:MRPRF). The REIT, led by Ismael Clemente, sold last April its Tree office portfolio (precisely, those that were used to set up the entity in its IPO in 2014), for close to 2,000 million euros.

This sale price represents a valuation 12% higher than the book value at the end of 2021, which improves and gives greater certainty to the company’s NAV. With the cash generated from the sale of this portfolio, Merlin Properties announced that it would distribute an extraordinary dividend, perhaps buy back its own shares (taking advantage of the discount on its NAV) and reduce the company’s debt. Another recent case of this type of action can be found, once again, in the Sonae holding company.

The company sold c. 25% of its supermarket division (Sonae MC) to the private equity firm CVC in the third quarter of 2021, receiving around 530 million euros in the transaction and thus assigning a valuation to the only division of the company that lacked an “objective” market value.

As for the second reason for divesting a division, Vidrala also serves as an illustrative example. In 2019 the Spanish company decided to divest its glass container manufacturing activity in Ghlin (Belgium), with margins much lower than those of the company’s other plants, to focus its efforts on the group’s most competitive and strategic production centers.

CAPITAL RAISING DECISIONS

Predictably, management teams may encounter the problem of having identified an attractive opportunity to expand their business or make an acquisition, but not having the cash to do so. In these cases, the company may choose to borrow money from third parties, either by increasing debt or by raising capital. Once again, the recurrence and size of corporate transactions will determine the volume of financing required for each company.

Thus, in the example we have already mentioned of Applus, we see how the company maintains relatively high levels of debt, taking advantage of the stability of the bulk of its business to make constant acquisitions. On the other hand, companies with a very defensive profile, such as Vidrala or Groupe Guillin, increase their leverage when they are going to make a major acquisition, something that usually happens every two or three years.

In addition, although it rarely happens (at least in our portfolios), a company may decide to increase its debt to buy back its own shares if the managers believe that the intrinsic value of the company is greater than its market capitalization and if they are convinced that the balance sheet can support an increase in debt to carry out the buyback. If both conditions are not met, the outcome can end up being truly disastrous. Many technology platforms have in recent years opted to leverage themselves financially to increase their share buyback programs.

In most of these cases, the move was made at very high valuation multiples, which may have destroyed, as we will see in the next section, a lot of value for their shareholders. We believe that this is not the case with Alphabet, as its balance sheet continues to show a comfortable net cash position and as we are convinced (otherwise we would not have reinvested in the company) that its intrinsic value is much higher than what the market reflects today.

Although less common among our investments, we have had the occasional case of a company that has decided to raise capital to make a major acquisition, sometimes combined with an increase in debt. Such is the case of AerCap (whose purchase of GECAS we have highlighted above), the offshore drilling company Shelf Drilling (OTCPK:SHLLF, with its recent capital raise to acquire several jack-up rigs from Noble Corporation, NE), TGS (with its acquisition announced a few weeks ago of Magseis, OTCPK:MSEIF) or Spartan Delta (OTCPK:DALXF, also mentioned).

In all these deals, the value of the acquired assets outweighs the negative effect of the dilution caused by the capital raise, thus creating value for their shareholders.

SHAREHOLDER RETURN DECISIONS

We have one last investment option left to discuss in the arsenal of potential decisions of a management team: share buybacks. From the conversations we have with the companies in which we invest, and especially from the way they are often implemented, I am not afraid to say that share buybacks are the tool least understood by a company’s managers.

On the one hand, it is often seen only as a type of dividend equivalent payout and therefore should only be used when there is excess cash in the company. On the other hand, usually outside the United States, managers tend to use a wide variety of ill-founded arguments to avoid repurchasing their own shares.

In addition, partly because of the above, companies tend to follow a clearly procyclical pattern when it comes to share buybacks, being more aggressive in their implementation when shares are more overvalued and much more cautious, even avoiding their use, when share prices are at very depressed levels. This behavior, which is more or less widespread, has negative consequences for shareholders, since, depending on the valuation level of the companies, share buybacks will either generate value, be neutral (and therefore equivalent to a dividend) or destroy value.

To understand this, we will show a simple numerical exercise that the reader can skip if he or she does not need to check the mechanism by which buybacks create or destroy value.

Let us imagine a company with one million shares outstanding and a share price of €150. Therefore, its market capitalization will be €150M. In addition, let us assume that its intrinsic value per share (i.e., what the company should be worth on the stock market) is also €150. In this case (and only in this case), carrying out a share buyback will have neither a positive nor a negative impact on shareholders, ignoring the opportunity cost of other alternatives or the tax impact of the dividend.

If, for example, the company repurchases shares at €150 for an amount of €15M (10% of market capitalization), the number of shares outstanding will also have been cut by 10%, from 1,000,000 shares outstanding to 900,000. In the process, shareholders who have kept their shares will see that the value of those remaining outstanding is the same as before the buyback in unit terms, since the value of the company after the buyback (€150M – €15M = €135M) divided by the shares remaining outstanding (900,000 shares) is still €150 per share. So, is the share buyback a neutral tool like the payment of the dividend? Far from it.

Let us now consider a scenario of a market downturn, in which the intrinsic value of the company is still €150 per share, but its share price drops to €100. At that point, the management team sees a great opportunity to generate value for its shareholders and implements the same €15M share buyback program. In this case, since the price is lower, the number of shares repurchased increases from 100,000 to 150,000 shares. And what happens to shareholders who keep their shares?

Well, the purchase price is obviously favorable, since the value of the company after the buyback (€150M – €15M = €135M) divided by the shares remaining outstanding (850,000 shares) is €158.8 per share, higher than the €150 intrinsic value of the company before the buyback.

Lastly, let us look now at the opposite case. Imagine a booming stock market, in which the company’s share price rises from €150 to €200 (i.e., €50 above its intrinsic value). The managers decide to implement a buyback program of €15M, which reduces the outstanding shares to 925,000 (they can only buy back 75,000 of their own shares). In this case, the shareholders who remain without selling their shares pay the consequences of this repurchase at overvalued prices. Why?

Because the value of the company after the buyback (€150M – €15M = €135M) divided by the new number of shares (925,000 shares) gives an intrinsic value per share of €145.95. Shareholders have therefore seen €4.05 of value per share destroyed following the buybacks.

Once we have clarified how share buybacks work, we can draw two conclusions. On the one hand, share buybacks have very different impacts to those of dividends. On the other hand, if they are carried out at prices at which the company is clearly undervalued, they are an excellent way of creating value for its long-term shareholders. Since we are convinced that our investments are trading well below their intrinsic value, it is now not difficult to understand why we are so supportive of our companies implementing share buyback programs.

In fact, we are delighted to see that many of them are taking advantage of current valuations to do so. Naspers (OTCPK:NPSNY), Fairfax India (OTCPK:FFXDF) or CIR, for example, are very clear examples of companies where buybacks are creating a lot of value for their shareholders.

Likewise, although we are not going to go into this in depth, managers may find it even more attractive to buy back their debt if it is trading at a significant discount in the market, thus reducing their leverage and their financial cost more quickly than if they had to wait for the maturity of their issues. These moves are more likely to occur in sectors under severe financial stress, either because they are in a deep crisis (e.g., the Chinese real estate sector) or because the capital market has closed for that industry.

The latter is precisely what happened to the fossil fuel sector and, in particular, to coal producers due to the consequences of the energy transition planning that we have already highlighted in our previous two quarterly letters (see hereand here). Our thermal coal producer, Geo Energy Resources (OTCPK:GRYRF), has taken advantage of this inefficiency to actively buy back its bonds at a steep discount.

Finally, there is the possibility that the management team may not find any attractive investment alternatives for its cash. In this case, two things can happen. Either the company accumulates the excess cash generated by the business, awaiting an investment opportunity, or it distributes the cash as a dividend to its shareholders. Within our investments, Catalana Occidente is probably the clearest example of the former. As noted above, the Spanish insurer usually makes medium sized acquisitions every two or three years, which it finances with the retained earnings of the business (earnings not distributed as dividends).

Consequently, when it does not make acquisitions, this retained earnings accumulate on the company’s balance sheet, increasing the company’s excess capital reserves each year. The current excess reserves are probably around 900 million euros, i.e., 25% of its market cap, which demonstrates the extent to which the company is convinced of its acquisition strategy. The problem with this strategy lies in the opportunity cost of waiting for the next opportunity to come along, so there may come a point at which it makes sense to put the cash accumulated by the company to other uses.

Given the attractiveness of Catalana Occidente‘s current valuation, a share buyback program would be a great value driver for its current shareholders.

As for the other possibility, we think that the dividend should be the last option for the management team. Only when the company has its operating needs covered and no measures can be taken to sustainably improve its cash generation, when the balance sheet is strong and there are no attractive investment alternatives (including share or debt repurchases), only then should companies distribute dividends. We are sick and tired of seeing companies that force themselves to pay a dividend every year, justifying it on the grounds that their shareholders demand it.

And, sadly, it is very likely that this is partly true. I think we all know people who buy shares in the Spanish companies we all have in mind because they pay a good dividend (ignoring the fact that the share price is a much more important variable in the performance of their investment). However, despite this criticism, there is one particular stock market in which we are much more favorable to dividend payments today: Hong Kong. I will devote the last section of the first part of this letter to explaining why.

A universe at a permanent discount

Show me the money!

– Jerry Maguire

If there is one thing that has always characterized our investment style, it is that we will seek to invest in those situations where inefficiencies are most evident. Generally, these types of opportunities arise in markets or industries that are ignored by the investment community. For this reason, we had a strong exposure to Japan in 2013, to European small and mid-caps subsequently or to commodities the last few years, to name three clear cases. Certainly, another stock market where we are seeing a similar situation is Hong Kong.

Hence, we have been holding a significant exposure to some of its listed companies for some time now. However, it is not my goal to explain the specific reasons why this opportunity arose, but rather to highlight our change of approach to these investments.

Five or six years ago, when we started investing in this market, we did so by looking for companies that met, as always, our investment principles. Namely: easy to understand businesses (otherwise we will not “travel” that far to invest), with competitive advantages or barriers to entry (such as irreplicable assets, scale or reputation), strong financial position (all our Hong Kong investments have always had a net cash position), good capital allocation (well-managed business and capital allocation that, at the very least, does not destroy shareholder value) and, lastly, a high margin of safety (we have probably never invested in such undervalued companies).

However, although all our investments have (a priori) met these criteria, over the years we have come across two dynamics, or rather two different profiles of capital allocators in these companies, specifically with regard to shareholder returns.

Generally, as noted above, we think that dividends should only be paid when the management team does not know what to do with the excess cash in the business. As a result, we are not overly concerned about the percentage of earnings a company distributes to its shareholders or its dividend yield. However, in the case of Hong Kong, we have become more supportive of an active dividend distribution policy. The reason is quite simple.

The Hong Kong market is so inefficient that many of our investments, far from seeing their large and unjustified discount to intrinsic value decline over the years, have seen their discount increase. Although we would prefer the management team to act more decisively to close these discounts (e.g., by buying back shares either with excess cash or after selling assets), the reality is that, in general, the management teams of Hong Kong companies tend to focus too much on managing their business and ignore the performance of their market value.

This, together with other factors, means that large discounts persist for a long time. Although we are very patient and willing to wait years for investments to pay off, the opportunity cost grows over time. This is something we have experienced, apart from other fundamental reasons, in our investments in the real estate companies Keck Seng Investments (OTCPK:KCKSF) and Asia Standard International (OTCPK:ASASF).

For this reason, in recent years we have favored companies that are more generous with dividends to their shareholders. In this way, our returns will be more protected from this temporary risk. Companies such as the luxury residential developer Tai Cheung Holdings (OTC:TAICF), the restaurant companies Tang Palace or Ajisen China Holdings (OTCPK:AJSCY) and the financial holding company Sun Hung Kai & Co (OTCPK:SUHJY), are clear examples of companies that have historically paid out large dividends to their shareholders, contributing to their large discount being partly offset by this distribution.

Main changes to our portfolios

You find bargains among the unpopular things, the things that everybody hates. The key is that you must have patience.

– Peter Cundill

The following is a summary of the most significant changes to our funds’ portfolios:

HOROS VALUE INTERNACIONAL

Stake decreases & exits:

COMMODITIES (20.8%)

Holdings discussed: TGS (1.9%), Sprott Physical Uranium Trust (1.6%) and Golar LNG (exited)

This quarter we sold our entire stake in Golar LNG. As we highlighted in our previous letter, the company engaged in the conversion of natural gas into liquefied natural gas (FLNG infrastructures), the storage of LNG and regasification through FSRU and the transportation of LNG (with its stake in Cool Company), has benefited greatly from the current tightness in the natural gas market, derived from the energy transition and, indeed, aggravated by the Russian invasion of Ukraine and the various sanctions and measures taken by the Western nations against the country led by Vladimir Putin.

On the one hand, its market value relative to our intrinsic value estimate has considerably narrowed following its outstanding performance. On the other hand, our search for a more favorable riskreturn setup in the natural gas market led us to sell Golar LNG and to invest, as we will discuss below, in its spin-off Cool Company.

As for Sprott Physical Uranium Trust (OTCPK:SRUUF) and TGS, we trimmed our exposure exclusively due to their lower relative upside compared to other alternatives in our portfolio and new investments that we added to Horos Value Internacional in the quarter.

OTHER

Holdings discussed: Sonae (2.1%)

We also significantly trimmed our stake in the Portuguese holding company Sonae, following its very strong performance. The good results of its food distribution business (Sonae MC) and the excellent capital allocation decisions, aimed at creating greater value for shareholders, have certainly played a very important role. We continue to believe that Sonae has attractive upside potential. However, in relative terms, the portfolio has other even more interesting opportunities, hence the lower weighting.

Stake increases & new stakes:

TECHNOLOGY PLATFORMS (9.3%)

Holdings discussed: Naspers (7.3%) and Alphabet (2.0%)

As we pointed out in the previous quarterly letter, high inflation and, more specifically, the consequent interest rate hikes by the vast majority of central banks, led to companies with high growth and future cash flow generation expectations being the most severely hit in this year’s market downturn. This category also includes technology companies with high quality businesses, but which traded at demanding valuations. This is the case of Alphabet, a company in which we are investing again two and a half years after our exit.

As a reminder, the U.S. technology platform owns arguably the ecosystem of products with the greatest network effect that exists in the world. Specifically, Alphabet has products as well known and used in our daily lives, such as the Google search engine, the operating system for Android mobile devices, the YouTube video platform, the Gmail email, the Google Maps navigation service, the Google Play mobile app store, the Google Drive file storage platform and the Google Photos app.

All of them with more than one billion active users (in fact, Android has more than three billion monthly active devices). This rich ecosystem allows the network effects of each product to feed off each other, further strengthening the advertising business, the company’s main source of revenue.

On the other hand, Alphabet made a strong bet a few years ago on the cloud infrastructure and data services business (Google Cloud), and today ranks third in market share, behind Amazon (Amazon Web Services) and Microsoft (Microsoft Azure). In addition, the company has what may be the most advanced autonomous vehicle project in the West (Baidu, BIDU, is the undisputed leader in China), as well as a host of emerging projects, not to mention its huge capabilities in the field of artificial intelligence.

All this, combined with the decline in the stock price that reflects a significant slowdown in Alphabet‘s growth over the next few years, as well as the uncertainty associated with the regulatory pressure that the company has been facing for some time, led us to invest again in this excellent company.

Regarding Naspers, this quarter we decided to increase our stake in the company, after seeing how the bad news related to its investee Tencent Holdings (OTCPK:TCEHY, “Tencent”) and its investments in Russia, as well as the impact of rising interest rates on the market value of the rest of its platforms, caused the share price to fall sharply to a discount to the value of its investments of over 70%, despite the management team’s historic (unsuccessful) efforts to reduce this inefficiency.

However, a few weeks ago, they finally announced a key step that could help to greatly reduce this anomaly. Specifically, Prosus (OTCPK:PROSY, the holding company through which Naspers controls its stakes in Tencent and other businesses) announced on June 27 that it had reached an agreement with Tencent to sell shares in the company on a daily basis, provided that the money is used to repurchase Prosus and Naspers‘ own shares (in a way, Naspers sells Tencent at its market value and buys back its own shares at a steep discount, which helps Naspers to increase its exposure to Tencent on a per-share basis).

Until now, the sale of Tencent shares had been done via block trades subject to a lockup period of several years that prevented further sales. The market responded with gains of more than 20% to the news and, subsequently, with a good relative performance against Tencent, which has allowed the discount to narrow to around the current 45%.

In short, we believe that the move announced by Naspers‘ management team is creating great value for its shareholders, which, together with the long-term prospects of the platforms that make up this holding company, leads us to hold a large position in the South African company.

COMMODITIES (20.8%)

Holdings discussed: Mistras Group (2.0%), Cool Company (1.8%) and Ramaco Resources (1.2%)

Although we trimmed (or even exited) some of our positions in commodity-related companies, new additions to the portfolio offset these sales. Thus, the commodity theme ended the quarter with a similar weight to that of three months ago.

One of the new names we added in this sector during the quarter was Mistras

Group. The U.S. company offers asset protection solutions through non-destructive testing, as well as engineering services or machinery access and maintenance. It is, therefore, a company with products and services similar to those of this business unit of Spain’s Applus Services. Two factors explain why an investment opportunity has arisen in Mistras Group. On the one hand, the company ostensibly increased its debt in 2017 and 2018 to finance major acquisitions in the oil and gas and aerospace sectors.

The crisis that both sectors experienced, later aggravated by the impact of the coronavirus pandemic, put Mistras Group in a fragile financial situation. However, the timely renegotiation with the banks in 2020, as well as the gradual recovery of its business, seems to have taken any financial risk out of the equation (the company should end 2022 with a debt ratio of less than 3x EBITDA). On the other hand, Mistras Group has an exposure of c. 60% of its revenues to the oil and gas sector, so we would be investing at a time when this segment should start to show a significant recovery in its profitability and cash generation.

All in all, we believe that Mistras Group should be able to generate 30 million dollars per year, which would allow it to trade at around 8x its free cash flow in three years. This is certainly a very attractive valuation for a business that should be able to generate returns on capital employed of around 15% in a more normalized position in the cycle.

As we saw earlier, Cool Company is a spin-off of this business carried out by Golar LNG, through the constitution of this listed vehicle, 38% controlled by Eastern Pacific Shipping and 31% by Golar LNG itself.

The company owns and operates a young fleet (about seven years old) of LNG carriers. Therefore, it is a company that gives us a direct exposure to the dynamics of natural gas and, specifically, to the stress that this sector is experiencing in recent months for the reasons we have already highlighted above, which are leading to a substantial increase in demand for LNG from exporting countries such as the United States, Australia and Qatar.

In addition, we believe that the market is pricing in very conservative freight rates for Cool Company‘s fleet at the current stock price, given the current demand and supply dynamics. Therefore, we believe this company represents an interesting investment opportunity in terms of expected return and risks assumed.

Finally, this quarter we reinvested (for the third time in about a year) in the metallurgical coal producer Ramaco Resources. The share price decline, due to fears of a major economic recession, created a new window of opportunity to invest in one of the companies in the sector with the best prospects for the coming years and, moreover, one of the few with a management team fully aligned with the interests of its shareholders (the company’s management and board own close to 50% of the shares).

OTHER

Holdings discussed: Gestamp Automoción (OTCPK:GMPUF, 2.3%) and MBIA Inc. (1.0%)

To conclude our review of the main changes in the fund, we still have to comment on the new stakes of the Spanish company Gestamp Automoción (“Gestamp”) and MBIA Inc.

As you know, our Horos Value Internacional fund gathers the best ideas that Alejandro, Miguel and I are able to find at any given time, so it is logical that we find the most attractive investments of the Iberian portfolio in our global fund. That is why we just added Gestamp to our portfolio. The company manufactures parts for the automotive sector, especially body parts (global leader) and chassis parts (third largest manufacturer).

A significant part of Gestamp‘s sales correspond to the hot stamping manufacturing process, a technology that improves the properties of the parts in terms of weight and strength compared to cold stamping, which allows the company to grow organically above the sector. On the other hand, Gestamp‘s share structure is controlled by the Riberas family, which has also taken advantage of the weak share price to increase its stake to c. 60.5%.

This move demonstrates the management team’s confidence in the company’s future prospects and further increases its alignment of interests with the rest of the shareholders. The sharp market correction in cyclical sectors, such as Gestamp‘s, has made the company very attractively valued, which certainly explains why we added it to our global fund.

MBIA Inc. is a financial entity that we had recently held in our portfolio and that we added back during the second quarter following its stock price drop. We believe that the uncertainties associated with the restructuring of Puerto Rico’s debt are now residual and that the management team’s objective of selling the company may be closer to being achieved, so the margin of safety of the investment has improved.

HOROS VALUE IBERIA

Stake decreases & exits:

OTHER

Holdings discussed: Merlin Properties SOCIMI (5.4%), Sonae (3.8%), Acerinox (OTCPK:ANIOY, 2.2%) and Greenalia (exited)

There was only one exit in the second quarter of 2022. Horos Value Iberia sold its entire stake in the renewable energy company Greenalia. The reason is none other than the takeover bid launched by its main shareholders (CEO Manuel García and Chairman José María Castellano). Although we are pleased with the annualized return of this investment, we cannot help but feel somewhat disappointed by this move, as the valuation offered does not reflect the potential of the company’s future projects.

On the other hand, we trimmed our stakes in the REIT Merlin Properties and the Portuguese holding company Sonae, following the outperformance of both companies compared to the other opportunities in our portfolio. Likewise, we decided not to increase our investment in Acerinox after the stock price decline, given the underperformance of its comparable Aperam (OTC:APEMY), where we increased our exposure in the quarter.

Stake increases & new stakes:

COMMODITIES (8.0%)

Holdings discussed: Aperam (3.5%)

As we have just noted, we purchased new shares of the stainless-steel producer Aperam, following its sharp correction during the period. Although we share the fears of a global economic recession, the reality is that the company is in an enviable business and financial position, which will allow it to generate record free cash flow this year. Even assuming an expected decrease in its cash flows in the coming years, we believe that the current stock price discounts an exaggerated drop in revenues and/or operating profitability of its business.

Furthermore, this is an excellently managed company, with a historical capacity to surprise on the upside in its margins, with successful acquisitions of other entities and, additionally, an attractive shareholder return policy. Finally, the margin of safety of the investment seems very high to us, as we are buying Aperam for c. 4.5x its normalized free cash flow in 2024.

CONSUMER STAPLES (7.7%)

Holdings discussed: Vidrala (2.0%)

In terms of additions to the portfolio, Vidrala joined our Iberian fund this quarter. This is a company in which we were already invested for several years in our previous professional period. After trading at very demanding multiples for a long period, the company trades now at attractive valuation levels again, following the recent share price decline.

Vidrala is one of the leading producers of glass containers in Western Europe, thanks to its excellent capital allocation, which has led it to make two major acquisitions in the last seven years. Specifically, the purchase of the Encirc group (UK) in 2015 and Santos Barosa (Portugal) in 2017. Vidrala is c. 40% controlled by the Delclaux family and other historical shareholders, aligning all board decisions with those of the other shareholders and always characterized by a continuous search for operational excellence (which translates into operating margins and cash conversion higher than those of the sector), limited leverage and attractive shareholder returns (indeed, its brilliant CFO, Raúl Gómez, has had a lot to do with all of this).

Why, then, did the opportunity arise now? Because of the sharp increase in gas and electricity prices at the end of 2021 and this 2022, as these costs account for between 20% and 25% of the total costs of glass container manufacturing. The market is assuming that Vidrala will remain for many years with depressed returns for this reason. However, we believe that, to a large extent, they will be able to pass on (like the rest of the sector) these costs to the end customer, which will allow them to recover profitability levels closer to those of recent years, which would justify an investment in the company at the prices at which it is trading.

Footnotes

|

[1]The data includes the performance of the portfolio management team in its previous professional period working for another asset management firm (from May 31, 2012 for the international strategy and September 30 for the Iberian strategy, until May 22, 2018 in both cases, when they joined Horos AM). [2]We already discussed in previous letters (see here) the concept of complex adaptive systems. [3]For an academic study of the concept of dynamic efficiency, I recommend: Jesús Huerta de Soto: “La Teoría de la Eficiencia Dinámica,” Procesos de Mercado: Revista Europea de Economía Política, vol. I, n.º 1, Spring 2004, pp. 11-71. [4]This topic was also discussed by Alejandro at our III Annual Investor Conference (see here). [5]José Manuel González (December 22, 2014). Día 2 (vídeo 2) – La Función Empresarial es Acción Humana. YouTube. Día 2 (vídeo 2) – La Función Empresarial es Acción Humana [6]Michael J. Mauboussin, Dan Callahan and Darios Majd (October 19, 2016). Capital Allocation: Evidence, Analytical Methods, and Assessment Guidance. Credit Suisse Global Financial Strategies. 7 Thorndike, W. N. (2012). The Outsiders. Harvard Business Review Press. [7]Michael J. Mauboussin, Dan Callahan and Darios Majd (October 19, 2016). Idem. 8 Idem. [8]10 Idem. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment