David Becker/Getty Images News

After a significant drop from last year’s high, Honda (NYSE:HMC) unlocks strong upside potential derived from a discounted cash flow model. Despite temporary headwinds like production halts caused by the pandemic and a high inflationary environment, HMC improved operational efficiency and reassured its inventors that their margins will remain under control and continue to grow. The stock demonstrates a strong catalyst that is just waiting to materialize, making it an excellent buy at today’s weakness.

Company Background

HMC has been around for over 73 years and is among one of the major players in the global automobile industry. It operates through 4 distinct reportable segments: Motorcycle, Automobile, Financial services, and Life creation and Other business operations. This makes the company’s product portfolio diversified and broad enough to cater the potential shift in demand from cars to motorcycles due to the current fuel cost hike which is ignited by the Russia and Ukraine war.

At the moment, HMC is suffering from economic slowdown as a result of the pandemic, which was sparked by the high inflation and semiconductor shortages. As a result, the company has been unable to sustain its pre-pandemic top line growth and in its Q3 2022 report, the company reported a trailing total revenue of $124,250.1 million, which is still less than its fiscal 2020 revenue of $138,871.1 million. In fact, the company posted a declining quarter to date revenue which totaled $32,049.4 million, down 2.19% from the $36,525.7 million recorded in the same quarter last year. This is primarily due to the slowdown in its sales in North America and Europe, which are both experiencing a temporary period of high inflation that is affecting their respective customers’ demand.

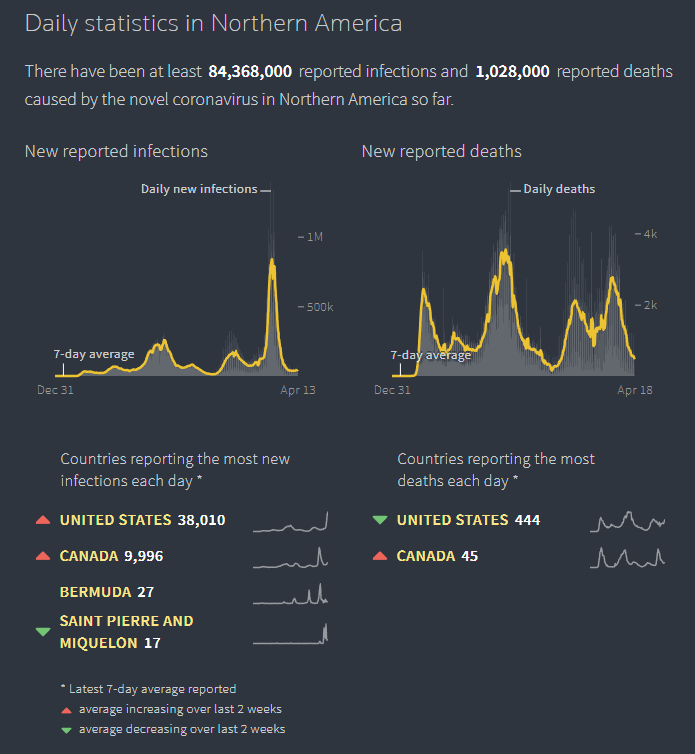

However, despite the uncertainties of economic recovery this fiscal year, the management provided a strong outlook for their top line this fiscal 2022 amounting to ¥14,550 billion ($127,408.06 Million; FX rate USD/JPY= 114.2), which is expected to beat its ¥13,170 billion ($118,943.7 million) recorded in fiscal 2021. This is based on the assumption of continued pandemic recovery, particularly in North America, and from May of last year to today, we have seen a continued decline in new covid cases globally.

Northern America New Covid Cases Declining Trend (Reuters)

Electrified HMC

HMC has two positive catalysts:

- Its solid path towards electrification in the US and a strong R&D spending outlook of ¥8 trillion ($64 billion). One of the challenges Honda is currently facing is its competitive environment and slow transition to battery EVs. It has been a while since the company provided an outlook about its initiative for electrification, the previous being in October last year, talking about their plan to develop 10 EV models over the next 5 years in China which will be called the “e:N Series”. They recently announced an update to their electrification strategy and this time, it includes a plan to dedicate an EV production line in the US, which will bolster their US operation, currently accounting for 50% of its total revenue in Q3 2022. This is one of the few strong catalysts from the management after phasing out their all-electric Honda Clarity, which was the only Honda brand EV available in the US for being outdated in terms of EPA estimated range compared to its peers ranging 300-mile EPA. The company’s recent announcement highlighted several noteworthy figures that will aid in the rejuvenation of its aging product portfolio. One of it is their long-term goal of launching 30 EV models globally and another is their aim to manufacture 2 million units annually by 2030.

- Their plan to introduce two sports EV models on a global scale with ‘distinct’ characteristics. In my opinion, this will help the company reintroduce its electric brand in the US. The management also hinted on their intention to form a joint venture with Sony Group (NYSE:SONY) to aid the company’s long-term goal of developing high-value-added EVs. A successful conversation between the two companies, combined with Sony’s expertise in entertainment technology, will usher in a new era of mobility, possibly challenging Tesla (NASDAQ:TSLA).

Hampered By Temporary Headwinds

Despite temporary headwinds such as production shutdowns due to flooding, the Omicron wave, and the ongoing semiconductor shortage, the management assures investors that their fiscal 2022 automotive unit sales forecast of 4,200 thousand units remains unchanged.

For the next fiscal year, we expect that the impact of semiconductor shortage will linger but we strive to further strengthen the business foundation for profitability which we have built and we ensure that we are well prepared for the future and [relating] for the further growth. Source:Q3 2022 Earnings Call

However, the forecasted total top line for fiscal 2022 is challenged and revised by the management to ¥14,550 billion ($127,408.06 Million) from ¥15,200 ($143,518.08 Million; FX rate USD/JPY= 105.91) billion in Q4 2021, making it still below pre-pandemic levels.

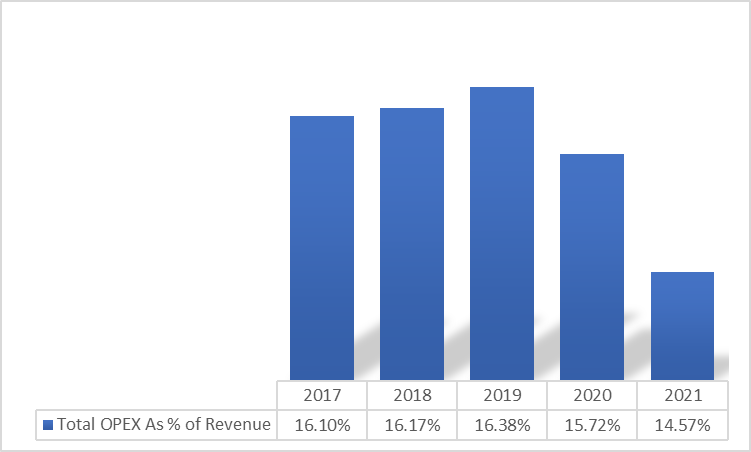

HMC: Improving Operational Efficiency (Source: Data from Seeking Alpha. Prepared by InvestOhTrader)

Despite the downward revision to the top line, the management increased its outlook for operating profit to ¥800 billion ($7,005.25 Million; FX rate USD/JPY= 114.2) from ¥660 billion ($6,231.71 Million; FX rate USD/JPY= 105.91), owing to cost-cutting initiatives aligned with the company’s long-term goal of improving its earnings structure. As illustrated in the chart above, HMC is actually improving its OPEX spending relative to its total revenue, which has resulted in a higher trailing operating margin of 6.19%, up from 5.01% last fiscal year and 4.24% in fiscal 2020.

Potential Wave 2

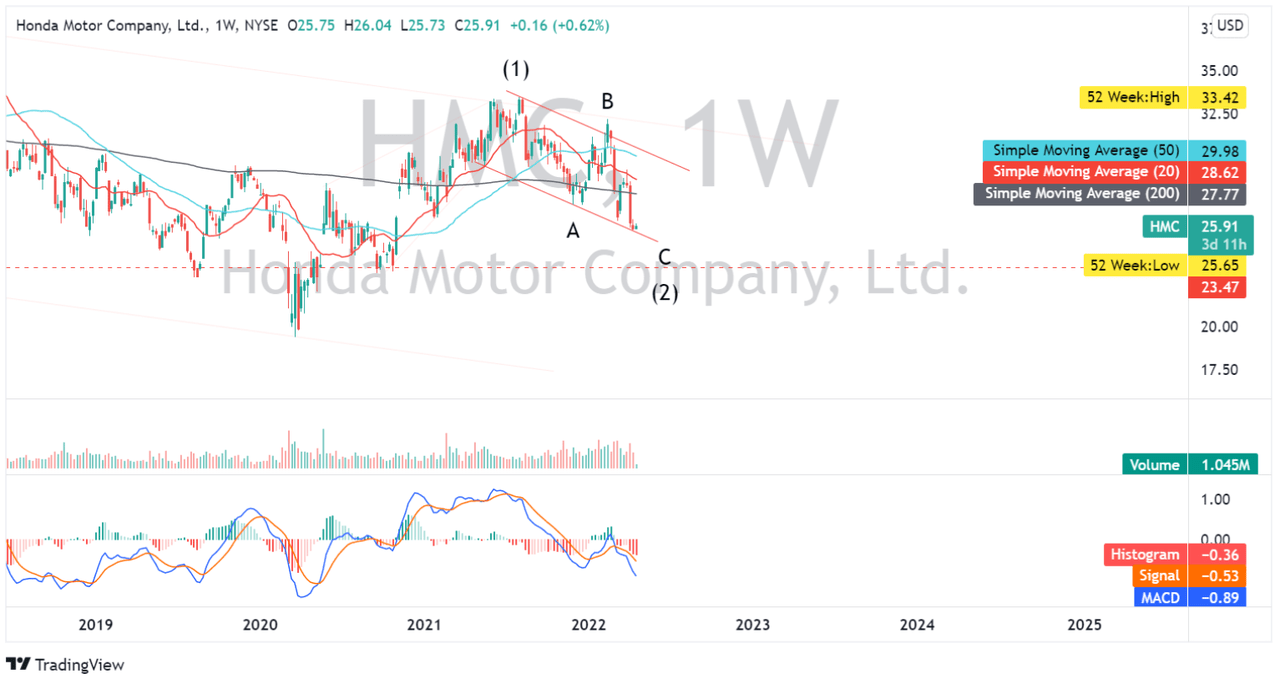

HMC: Weekly Chart (Source: TradingView)

HMC is currently printing a potential bullish flag pattern, as illustrated in the chart above. Consolidation above $23ish, in my opinion, will provide investors and traders with a good entry point. In this scenario, I am expecting HMC to complete its corrective wave C before initiating an impulse wave 3 and likely re-challenging its current 52 week high of $33.42. However, if the price falls below $19ish, this count becomes invalid. This counting method is based on the Elliott wave theory, which predicts that the market will initiate a rally following the completion of its corrective waves. By examining its simple moving averages, it demonstrates a strong bearish sentiment, as the current price is trading below its three SMA’s. This is consistent with the fact that its MACD indicator is currently in the negative territory.

Strong Upside Potential Despite A Conservative Look

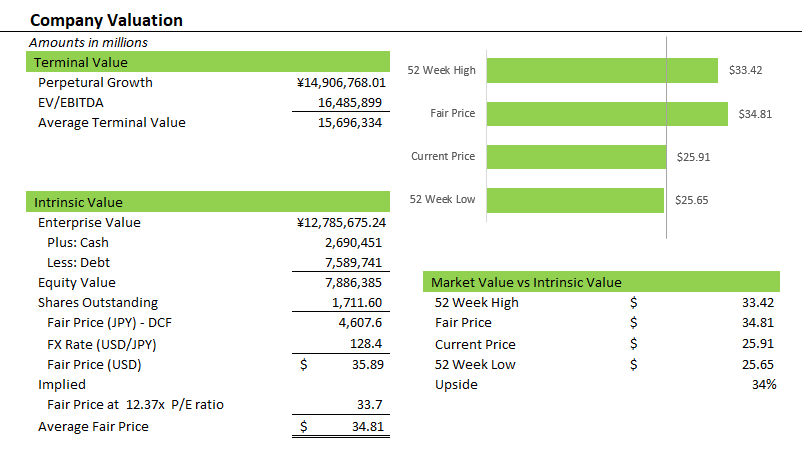

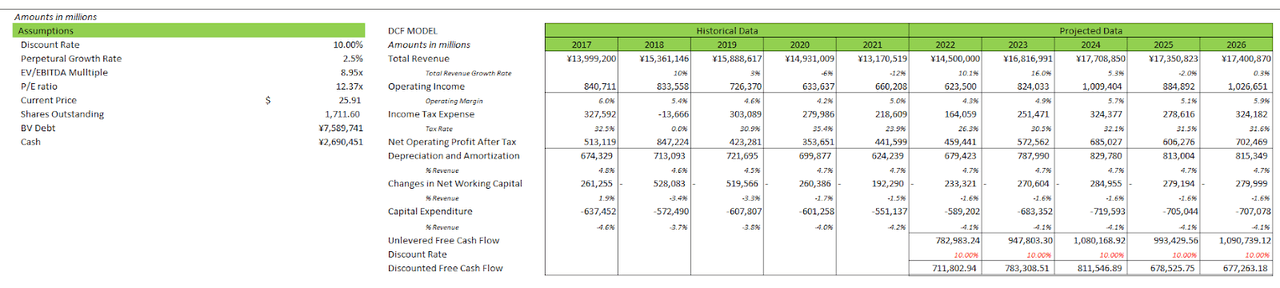

HMC: DCF Model (Source: Prepared by InvestOhTrader.)

By estimating a fair price of $35.89 using a discounted cash flow model and averaging it with the result of an implied fair price of $12.37x P/E of $33.7, I arrived at a $34.81 average fair price with 34% upside potential. In my model, I assumed a conservative FX rate of 1 USD=128.4 JPY compared to its 114.2 JPY 200-day average. I also assumed below its sector’s median multiple of P/E ratio of 13.40x and EV/EBITDA ratio of 9.37x.

HMC: DCF Model (Source: Data from Seeking Alpha and Company Filings. Prepared by InvestOhTrader. )

I completed my DCF model with the help of an experts’ projection. I reflected the management outlook for its fiscal 2022 and projected it to ¥17,400,870 million ($152,371.89 Million; FX rate USD/JPY=114.2) by the end of the model. In my opinion, it is possible as the company continues to expand its production both in China and US and with its high R&D budget, I believe the company is on track to produce 2 million units annually. Despite its current outlook of its operating margin, I modelled it below what the management expects as the tension between Russia and Ukraine intensifies, which may temporarily affect the company’s input cost such as steel, and projected it to grow to conservative 5.9%. I also assumed a conservative 10% discount rate to complete my DCF model, which is aligned at today’s market sentiment.

Final Key Takeaways

After a significant drop from its last year’s high, Honda creates a better upside potential which outweighs current risks. It maintained a liquid balance sheet and actually provided improving metrics with its record current ratio of 1.38x and record debt to equity ratio of 0.78x, despite the temporary headwinds. Additionally on top its improving efficiency, HMC ended its Q3 2022 with an improving trailing FCF margin of 4.88%, up from its 5 year average of 3.60% and enjoys a positive growth in its EPS this fiscal 2022 to be ¥389.54 ($3.41; FX rate USD/JPY=114.2) up from ¥380.75 ($3.44) last fiscal year, up from ¥345.99 ($2.42) in fiscal 2020, and up from ¥260.13 ($3.12) recorded in fiscal 2019. With its margins successfully managed and strong catalysts waiting to be realized, HMC is a strong stock in a current high inflationary environment and is a buy at today’s price.

Thank you for reading and good luck!

Be the first to comment