M. Suhail

Thesis

The Home Depot, Inc. (NYSE:HD) stock has continued to trade close to its June lows as it pulled back sharply from its summer rally. We highlighted in our pre-earnings article urging investors not to be unduly concerned about the looming housing market downturn. We still maintain that conviction, as we deduce that HD’s valuations substantially reflected its near-term challenges.

However, the recent CPI print in August, which showed an 8.3% YoY rise, spooked investors. In addition, the 30Y fixed rate mortgage average has risen above 6%, eclipsing its June highs. Therefore, we postulate that the market has priced in further near-term weakness on Home Depot in H2.

However, we gleaned that HD’s June lows have continued to reject further selling downside decisively, given its well-battered valuation. Coupled with the company’s excellent execution and prudent FY22 guidance, we are confident that the recent pullback represents a fantastic opportunity for investors to add exposure.

As such, we reiterate our Buy rating on HD.

Home Depot’s Underlying Metrics Remained Robust

Investors need to note that Home Depot has also benefited from the inflation tailwinds, which drove up its average ticket price. Therefore, its pricing leadership and robust consumer demand have continued to support its ability to pass on those cost increases.

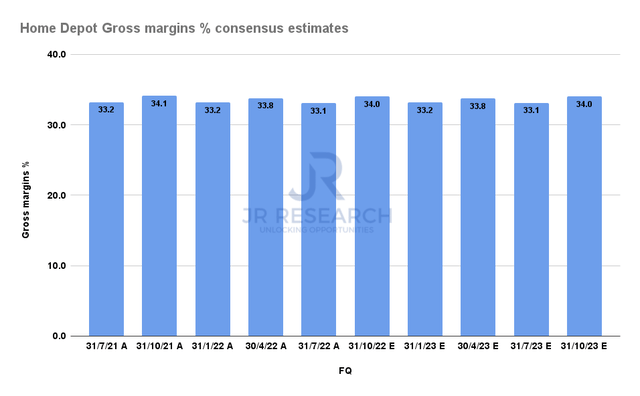

Home Depot Gross margins % consensus estimates (S&P Cap IQ)

As a result, Home Depot has maintained its gross margins over the past year. In addition, the consensus estimates (bullish) suggest that the company should be able to maintain its margins profile, given the strong backlog visibility from consumers and DIY. Moreover, unlike other general big box retailers, Home Depot’s competitive advantage in home improvement products has not led to significant inventory writedowns, even though it continues to invest in capacity.

Furthermore, we believe the easing of the supply chains should alleviate the risks of unforeseen inventory charges moving forward, providing more security over its gross margins profile. It’s critical to note that global supply chain pressure has pulled back in August 2022 to levels last seen at the start of 2021. Also, the S&P GSCI Commodity Index Spot (SPGSCI) has fallen more than 25% from its March 2022 highs. Therefore, we believe these tailwinds will continue to improve the company’s flexibility in its margins as it leverages the changes in mix.

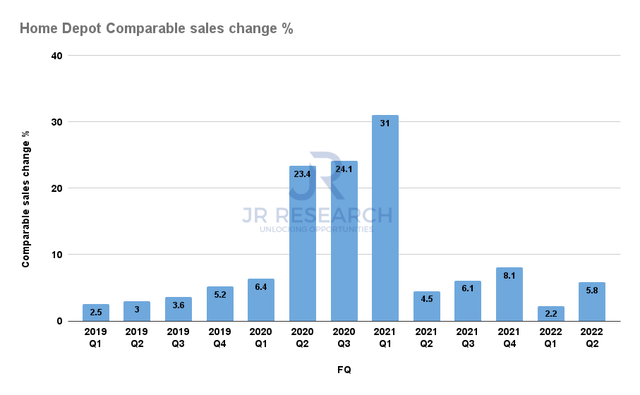

Home Depot Comparable sales change % (Company filings)

Also, Home Depot’s comparable sales growth increased by 5.8% in Q2, benefiting from seasonal uplift after a much weaker Q1 (2.2% increase).

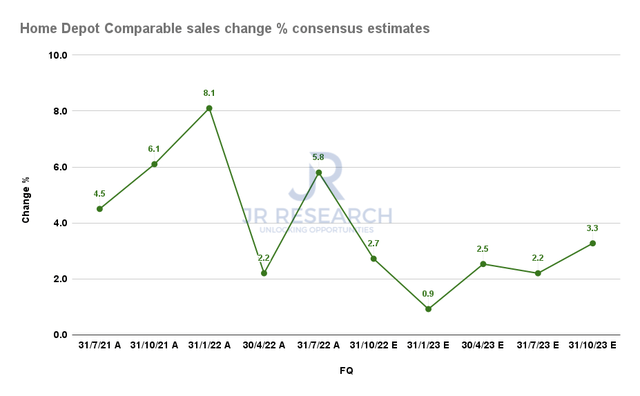

Home Depot Comparable sales change % consensus estimates (S&P Cap IQ)

However, we urge investors to be mindful that management kept its FY22 guidance of 3% YoY growth in comps sales. Therefore, investors should expect tougher comps in H2’22, as seen above, consistent with management’s outlook. We also believe it’s prudent to factor in worsening macro headwinds to account for unexpected changes to the consumer wallet that could affect their inclination to spend on home improvement products.

Notwithstanding, management remains highly confident in the twin Pro and DIY growth drivers, given the high order backlog and resilient home price appreciation over the past three years. Therefore, these growth drivers are expected to remain robust in the medium term.

Is HD Stock A Buy, Sell, Or Hold?

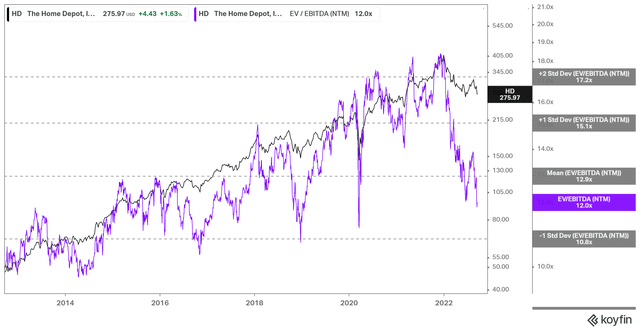

HD NTM EBITDA valuation trend (koyfin)

HD last traded at an NTM EBITDA multiple of 12x. Bears could argue that a significant housing market downturn could send its EBITDA multiples down further to the one standard deviation zone below its 10Y mean, as seen above. That level would be close to where HD bottomed out in March 2020, down nearly 50% in value from the current levels.

Notwithstanding, despite the worsening macro headwinds, we haven’t observed a significant deterioration in Home Depot’s underlying metrics. Hence, we believe the company is in much better shape to withstand any marked impact, providing substantial valuation support at the current levels.

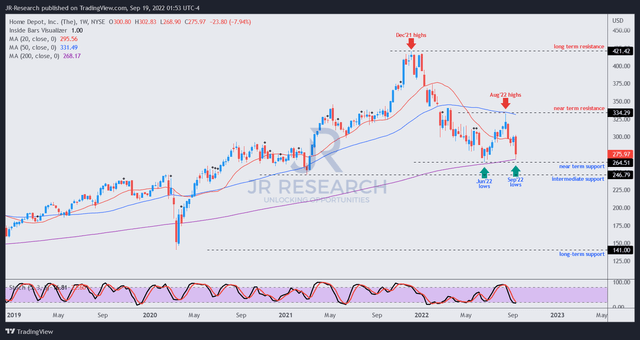

HD price chart (weekly) (TradingView)

We gleaned that HD has fallen back to its June lows and expect the current levels to be supported. While the potential for downside volatility could persist, we posit its intermediate support should provide robust buying support if the market decides to force a capitulation move toward that level.

Hence, we encourage investors to layer in over time, taking advantage of downside volatility to add more positions to a high-quality company with robust medium-term growth drivers.

As such, we reiterate our Buy rating on HD.

Be the first to comment