Michael M. Santiago/Getty Images News

Retail stocks have impressively outperformed since May. One of the VanEck Vectors Retail ETF’s (RTH) biggest holdings is a household name: Home Depot (NYSE:HD).

The Consumer Discretionary behemoth has endured a 35% drawdown off its late 2021 peak. Are shares a good value ahead of its upcoming earnings report? Let’s put on our hard hats and dig in.

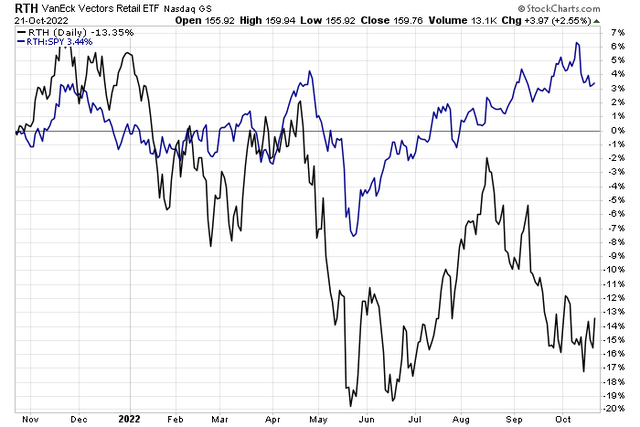

Retail ETF Beating the S&P 500

Stockcharts.com

According to Fidelity Investments, The Home Depot, Inc. (HD) operates as a home improvement retailer. It operates The Home Depot stores that sell various building materials, home improvement products, lawn and garden products, and decor products, as well as facilities maintenance, repair, and operations products.

The $276 billion market cap Specialty Retail industry company within the Consumer Discretionary sector trades at a 16.9 trailing 12-month GAAP price-to-earnings ratio and pays a 2.8% dividend yield, according to The Wall Street Journal.

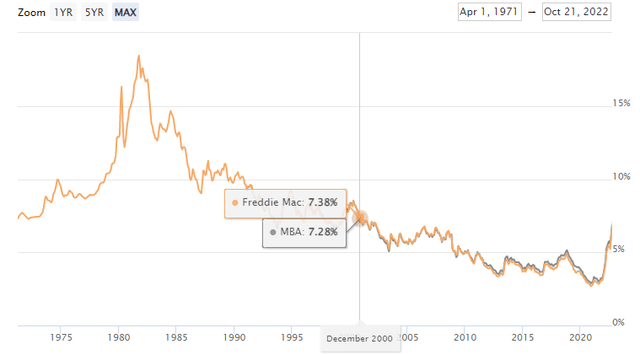

The firm has upside potential as homeowners are locked-in to their mortgages given nearly 22-year highs in the average 30-year fixed rate mortgage level, as reported by Mortgage News Daily. While real estate transactions will almost certainly be weak in the years ahead, the company is less sensitive to people moving to new homes than some suggest.

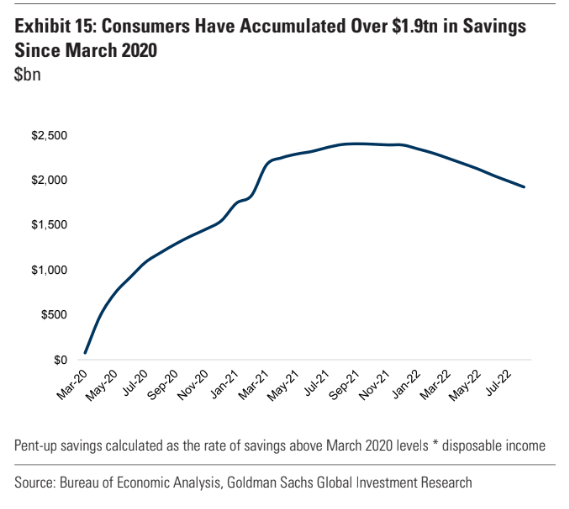

Moreover, consumers still have almost $2 trillion in excess savings accumulated since the start of the pandemic, according to Goldman Sachs. Downside risks include a turn lower in the jobs market next year, pressuring the consumer. Higher interest rates make borrowing against one’s home all the more challenging.

Mortgage Rates Printed Above 7.3% Last Week

Mortgage News Daily

Consumers Continue Sitting On A Cash Hoard

Goldman Sachs Investment Research

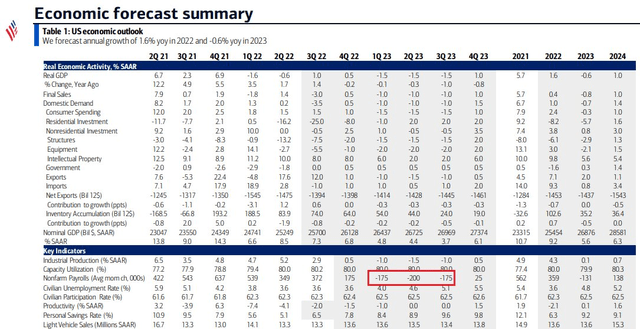

BofA: Job Losses Expected In 2023

BofA Global Research

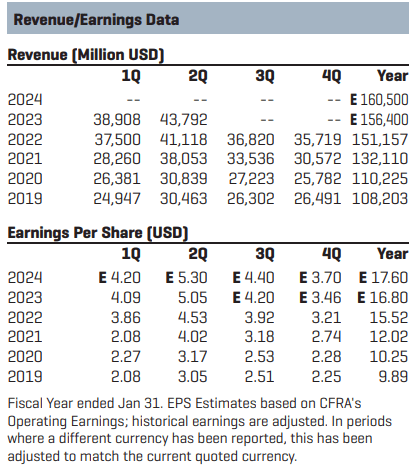

On valuation, CFRA Research forecasts HD earnings to rise from $12.02 in 2021 to $15.52 this year, a nearly 30% jump. Looking further out, EPS growth is seen as rising just 8% in its fiscal 2023 and less than 5% by 2024.

Seeking Alpha shows a forward P/E ratio north of 16, not far from the broad market’s earnings multiple. The stock has a poor “D” valuation rating compared to its industry peers, but both the trailing and estimated P/E ratios are at a 23% to 25% discount to the stock’s 5-year average. HD’s forward PEG ratio of 1.46 is at a 35% discount to its 5-year average, too.

Overall, I think the stock has a decent value case here despite macro headwinds heading into 2023.

Home Depot: Revenue and Earnings Outlooks

CFRA Research

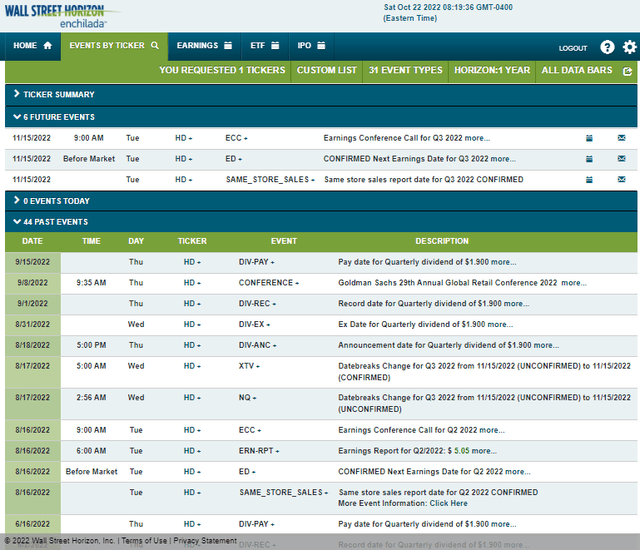

Looking ahead, corporate event data from Wall Street Horizon show a confirmed Q3 earnings date of Tuesday, Nov. 15 BMO with a conference call immediately after results hit the tape. You can listen live here.

Corporate Event Calendar

Wall Street Horizon

The Options Angle

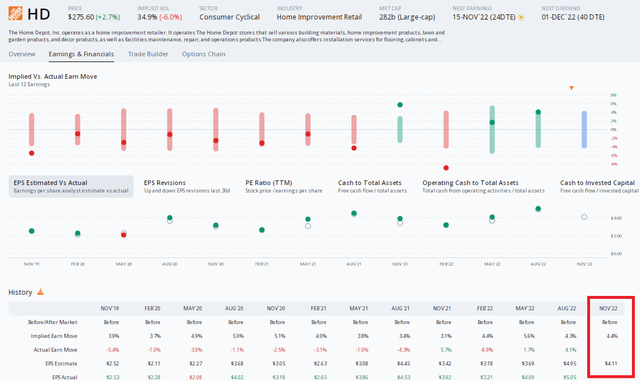

While still early, data from Option Research & Technology Services (ORATS) show a consensus Q3 EPS forecast of $4.11 which would be a 4.8% increase from the same period a year ago. HD has a strong earnings beat rate history, topping analysts’ expectations in each of the previous nine quarters, per ORATS. Since the August report, there has been a single analyst upgrade of the stock and no downgrades.

ORATS also reports that options traders have priced in a 4.4% earnings-related stock price move using the nearest-expiring at-the-money straddle. That’s within the range of anticipated swings from prior quarters as the stock has a current implied volatility of just 35%. Shares have traded higher post-earnings in three of the past four quarters.

Overall, the options look somewhat cheap to me given some big post-earnings consumer stock price changes in recent months. Let’s look to the chart to see where the directional bet should be made.

HD: Options Not Expensive Ahead Of Earnings

ORATS

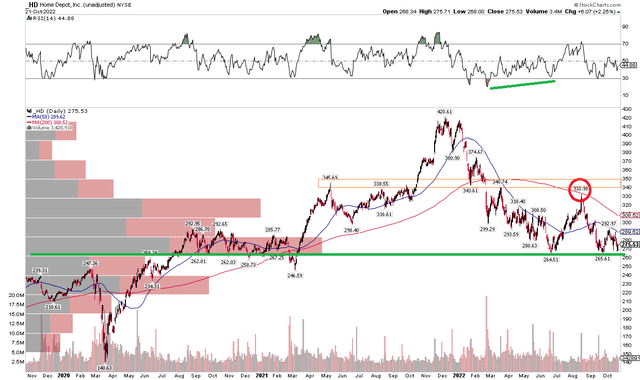

The Technical Take

HD has support in the mid-$260s. Shares bounced off that key spot back in June and September. While the S&P 500 briefly notched new lows earlier this month, HD held its 2022 double bottom. Being long here ahead of earnings with a stop under $260 makes sense.

Also notice that momentum was turning ahead of a low in price in Q2, as seen in the RSI indicator up top. This tells me that there is improving action with the stock. Moreover, there’s a high number of shares traded in the $260 to $280 range as measured by the volume-by-price indicator on the left.

On the upside, though, the stock must reclaim its falling 200-day moving average. That’s where sellers came about in August on a rally attempt. The $340 to $345 range is another area of significance that could be problematic for the bulls.

HD: Shares Constructing A Bottom

Stockcharts.com

The Bottom Line

HD has a decent valuation here despite macro uncertainty that could be harmful to earnings in 2023. Heading into its Q3 report in a few weeks, options look priced fairly while the technical chart shows a tradeable low in place. Long-term investors can take a position here while swing traders can be long above $260.

Be the first to comment