halbergman/iStock via Getty Images

Home Bancshares (NYSE:HOMB) is a regional bank hailing from Arkansas. While its roots are in that state, Home has grown significantly in recent years via acquisitions and now has branches in Texas, Alabama, Florida, and a New York City location in addition to its home state market.

Home took the next big step in its corporate growth with the recent purchase of Happy Bancshares. This gave it its Texas footprint, as Happy operated dozens of branches primarily in the Texas panhandle along with a few locations in Dallas and Austin.

Despite not getting all that much retail investor attention, Home is now becoming quite a significant regional bank. It had $14 billion of deposits last year, and the Happy acquisition brought in more than $5 billion on top of that. Both banks have done a good job of attracting substantial non-interest-bearing deposits, meaning that the combined firm is well-suited to take on the current rising interest rate environment.

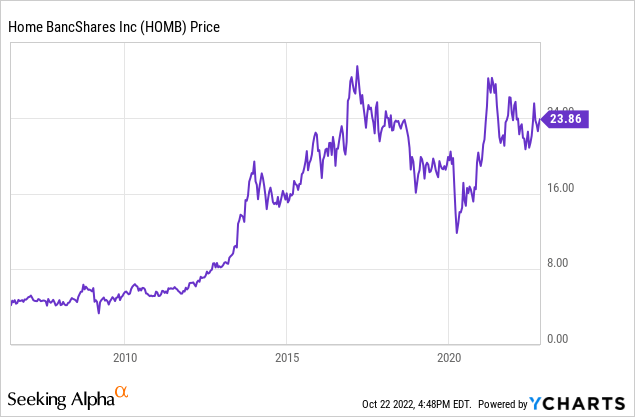

How has Home’s rapid growth strategy worked for shareholders? Pretty well:

Shares came charging out the post-financial crisis period, with HOMB stock more than tripling between 2013 and 2017. Since then, however, it’s been slower going, as shares have largely traded sideways. So, what’s the outlook going forward?

Growing Into The Bank’s Valuation

Home Bancshares has been a tremendous growth operation in recent years. Net Interest Income has soared from $156 million in 2012 to $573 million in 2021 and will be up a lot more going forward with the latest acquisition in addition to higher interest rates.

It’s not just interest income either. Deposits have grown at a 17% annualized compounded rate over the past decade, while the loan book has posted 18% compounded growth over the same period.

The bank has also traditionally posted well-above average net interest margins “NIMs”. With the near zero interest rates we saw through the 2010s, American banks struggled to achieve NIMs much above 3% as an industry. Home Bancshares, by contrast, was above 4% every year of the 2010s, and even ticked 5% at one point. That’s a much better than average performance, made possible due to cheaper deposits and an attractive loan book.

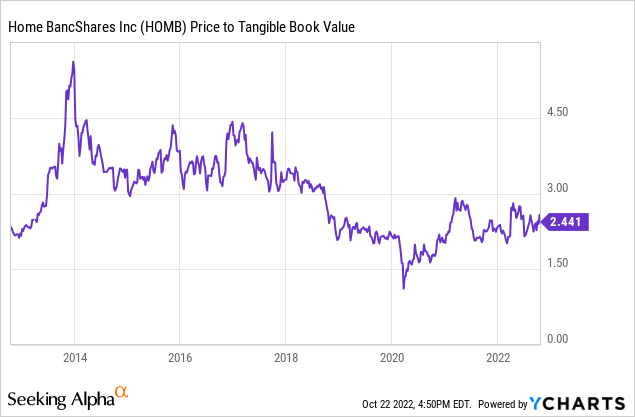

The issue with these strong growth metrics, however, is that the market has paid a huge valuation for this performance. HOMB stock has traded for as much as 4.5x tangible book value over the past decade, and has almost never gone below 2x:

A bank has to deliver pretty tremendous results to make a 4x tangible book value pay off. This is how Home Bancshares could keep putting up such sizzling growth numbers over the past few years but end up with a flat stock price.

As a result of shares not moving higher, however, the valuation has come in to more reasonable levels. 2.4x tangible book value is still expensive to be sure, but it’s not an impossible valuation for something growing as quickly as Home.

I’d also note that Home is cheaper than it looks on an earnings basis. You might notice that the bank is currently going for 17x trailing earnings, which seems really high compared to other peer banks during this current bear market.

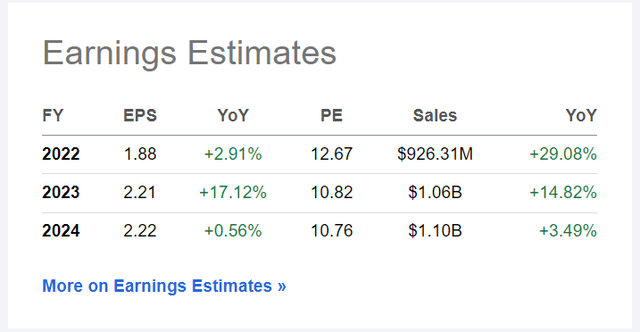

The catch, however, is that Home earned virtually no net income at all during Q2 of this year as it had elevated costs related to its most recent acquisition. If you exclude those costs, the company would be trading closer to 13 instead of 17 times trailing earnings. And earnings are expected to continue to grow:

Home earnings estimates (Seeking Alpha)

Analysts have the company trading at less than 13x full-year earnings and 11x 2023 earnings. Assuming it can hit those figures, this is hardly an unreasonable valuation for a bank that has delivered this solid a track record of rapid growth. I’m still not particularly thrilled about paying this large of a multiple to tangible book value, but so far, management has backed up its premium stock price.

Impressive Dividend Growth Story

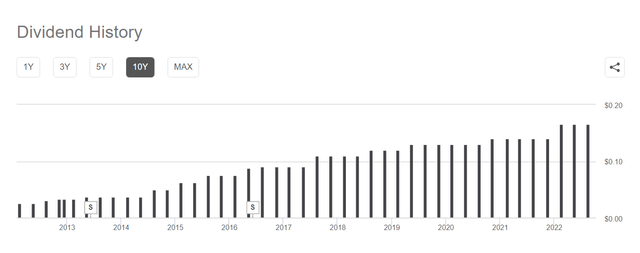

Many growth-oriented banks pay miniscule dividends, reserving the capital to fuel more loan growth and acquisitions. That’s not the case with Home, however. It has offered investors a healthy dividend growth trajectory:

Home Bancshares Dividend History (Seeking Alpha)

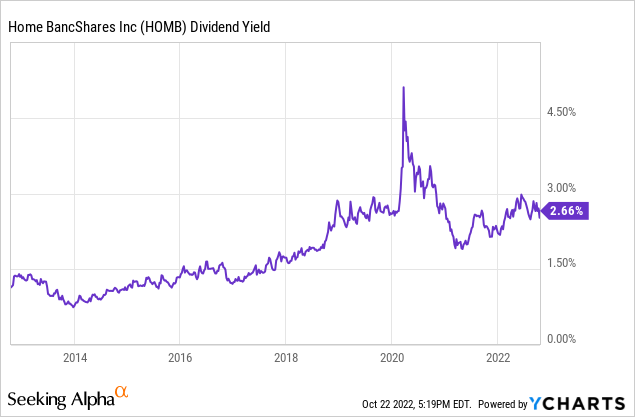

Over the past decade, Home has grown its dividend from 3 cents per quarter in 2012 to 17 cents per quarter today. Over the past five years, the dividend growth rate has been 11% annualized. As the share price has been flat recently, this has resulted in the bank’s starting dividend yield moving up considerably:

Shares used to yield less than 1.5%. They’re now closing in on 3%, which is the highest they’ve ever been aside from a brief spike in March 2020.

I understand that in a much higher interest rate world, a starting 2.7% dividend yield might not sound like a huge reward. However, a 2.7% yield that has grown with more than 10% annualized increases is fairly impressive. It’s also rare to get this sort of healthy income out of such a blistering growth story. Like I said, growth banks aren’t known for paying big dividends. Home Bancshares is pretty unique in that regard.

HOMB Stock Verdict

I currently rate shares a buy thanks to the company’s strong growth track record and favorable dividend history. That said, I don’t have any of my own capital in Home today.

In a bear market, my criteria for deploying capital are harder to meet; simply put, there are so many shares — both banking and otherwise — that are on deep discount now. Home Bancshares is not a deep value here by any means.

That said, if you want a proven rapid growth bank that also pays a surprisingly strong dividend, there’s a lot to say for Home Bancshares. The company’s favorable exposure to rising interest rates should also pay off over at least the next year. The company’s earnings could be surprisingly robust in 2023 between that and the synergies it achieves from the recent Happy merger.

After traditionally selling at a premium valuation, Home Bancshares are discounted enough to offer agreeable forward returns from this price point. I personally would prefer to pay less than 2x tangible book value for the company. But, given how well management has executed up until now, that may be too ambitious an ask on my part. In any case, long-term investors will likely do well with an entry point around current prices.

Be the first to comment