JimmyLung/iStock Editorial via Getty Images

Introduction

Sometimes an opportunity passes by and you’re too late to act on it. That’s exactly what happened when I looked at Hoegh Autoliners (OTCPK:HOEGF) over the summer. I didn’t think there was any rush to get into the story but I clearly was wrong, and in the past few months, the company’s share price jumped by more than 50% and has almost tripled since the start of this year. Despite this, the stock still appears to be rather cheap due to the interesting dynamics of the PCTC (Pure Care and Truck Carriers) segment of the market. Often overlooked, but quite profitable these days.

Yahoo Finance

Hoegh Autoliners has its primary listing on the Oslo Stock Exchange where it’s trading with HAUTO as its ticker symbol. The current market cap is approximately 11.7B NOK which translates into US$1.18B using the current USD/NOK exchange rate. As Hoegh reports its financial results in USD, I will use the USD as base currency throughout this article. The average daily volume in Oslo is just under 400,000 shares per day, for a monetary value of approximately $2.5M, making it by far the most liquid listing to trade in Hoegh’s securities.

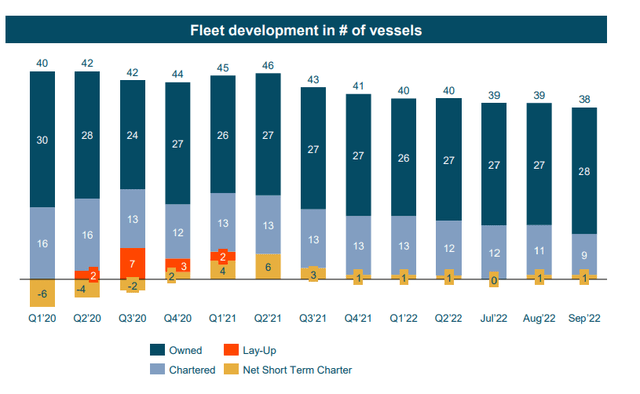

Hoegh Autoliners set the tone in Q3 and will end 2023 on a strong note

While investors and analysts have been recommending all types of shipping companies left, right and center, there’s one specific sub-category which hasn’t been mentioned at all: Shipping companies focusing on car and truck transport. Hoegh Autoliners operates a fleet of 38 carriers with 28 vessels in ownership. Another vessel will be added to the fleet in Q3 2023 as Hoegh exercised an option to purchase a vessel for a pre-agreed price of $53M while the market value of that vessels is now almost $100M.

Hoegh Autoliner Investor Relations

And this once gain confirms Hoegh Autoliner’s ability to strike strong deals. Several of its charter agreements include an option for Hoegh to buy the vessel outright, and as the market value of the vessels continues to increase (this is a direct impact from higher charter rates), it becomes a no-brainer for Hoegh to exercise these options. In October, for instance, Hoegh announced it exercised an option to acquire a 2009 built vessel for US$29.3M while the fair value of that vessel was $70M as of the end of Q3.

This also works in the other direction and Hoegh was recently able to sell three vessels at a value above their book value with for instance the sale of the Hoegh Masan, a 23-year-old vessel, sold at about 3 times its book value. I will discuss the book value of the company later in this article, but keep in mind there’s plenty of evidence of Hoegh selling vessels above book value and buying vessels below market value. Also keep in mind Hoegh isn’t just a “trader” in second hand vessels: Earlier this year, it has ordered four additional newbuilds in China (on top of the previously ordered four Aurora-class vessels) with the capacity to carry up to 9,100 cars. The initial two vessels will be delivered in H2 2024 with the remaining two vessels scheduled for delivery in H1 2025.

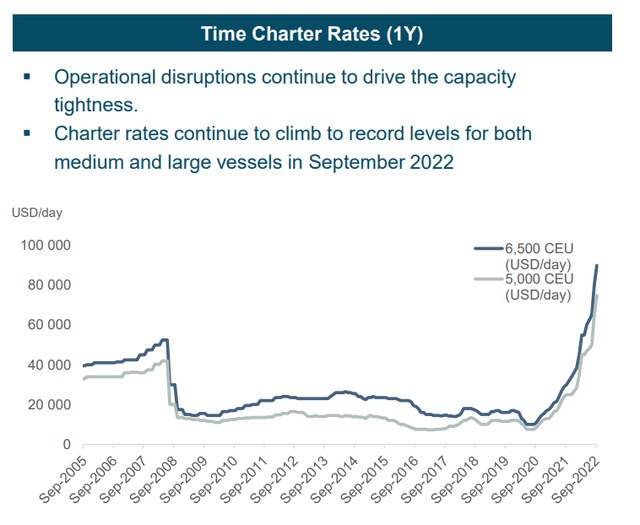

Since the end of the COVID crisis, the charter rates for these PCTC vessels have tripled or quadrupled. As you can see below, the PCTC market has been on a tear and some of the charter rates (by third parties) were fixed north of $80,000/day for a 6,500 car-equivalent unit carrier.

Hoegh Autoliner Investor Relations

And the beauty of this is that the price is pretty inelastic: There’s only a limited amount of car carrying vessels and despite the parabolic chart above, the transportation cost per vehicle remains reasonable. Assuming a 6,500 CEU vessel is 80% filled (5,200 cars on board) for a 25-day voyage, even a charter rate of $80,000/day would represent a transportation cost of just under $385/car. So even if the transportation cost per car has quadrupled from $100 to $400, car manufacturers won’t suddenly stop producing or shipping cars.

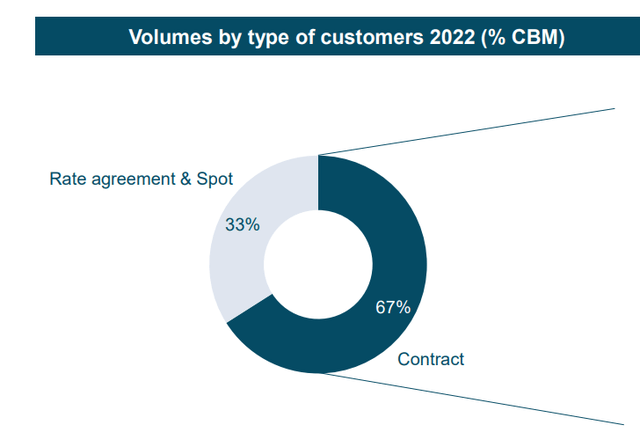

And Hoegh is benefiting. About two thirds of its volume is being shipped on fixed contract prices but about a third is exposed to the spot price, and this has been a big help during the third quarter.

Hoegh Autoliner Investor Relations

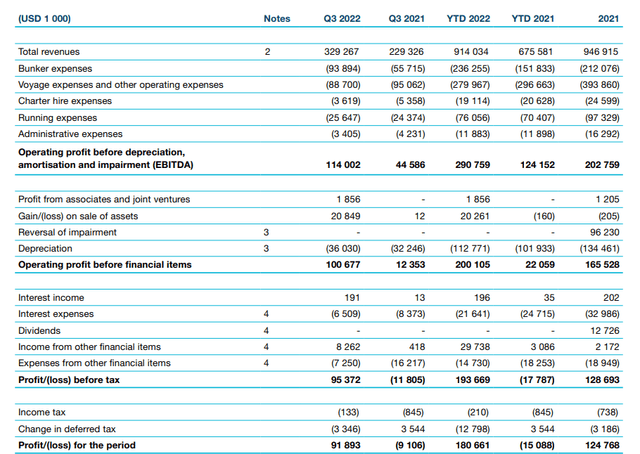

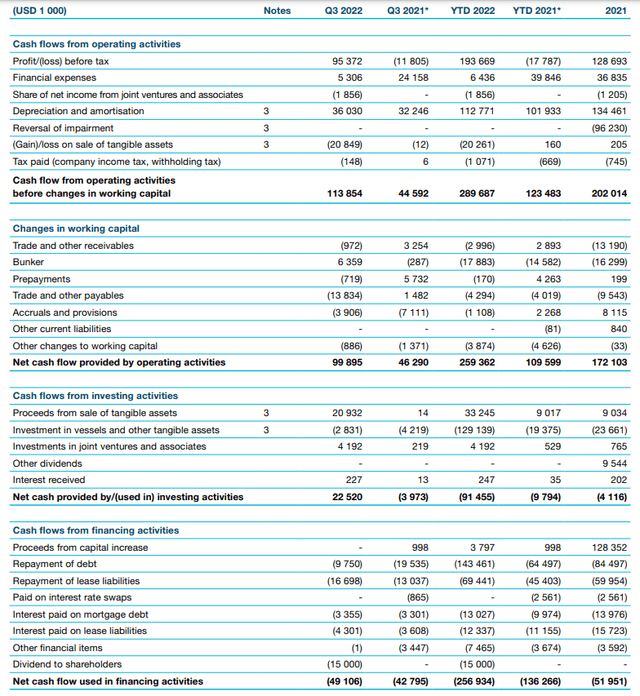

The total revenue in the third quarter was approximately $330M which resulted in an EBITDA of $114M. The EBITDA was a little bit under pressure due to the high bunker prices as the cost of oil and oil-based fuels was very high in the third quarter. But with an EBITDA of $114M there obviously is no reason to complain, and this string third quarter pushed the 9M 2022 EBITDA to just under $291M.

Hoegh Autoliner Investor Relations

As the EBIT was very strong at $101M but as you can see above this included a $21M gain from the sale of two older vessels which means we should take the $101M EBIT and $95M pre-tax profit with a grain of salt. The net income was $92M for an EPS of $0.48. That’s approximately 4.7 NOK per share and this brought the 9M 2022 EPS to approximately 9.3 NOK per share. Not bad for a company trading at just over 60 NOK per share.

The cash flow result is more important to decide on whether or not I should buy the stock at the current share price anyway. The non-cash and non-recurring items are filtered out, and the cash flow statement offers a more “honest” look under the hood.

As you can see below, the company reported an operating cash flow of $114M and after deducting the $17M in lease liabilities and the $8M in interest payments, the adjusted operating cash flow was $89M.

Hoegh Autoliner Investor Relations

With a total capex of just $2.8M (no new vessels were purchased during the quarter), the normalized cash flow was approximately $86M which translates into about $340M per year. The 9M 2022 adjusted operating cash flow (excluding the purchase of vessels) was approximately $200M. At the current rate, Hoegh Autoliners can easily fund its replacement capex which I estimate at $150M per year based on the recent newbuild prices of $100M for 7,000 CEU vessels.

Hoegh paid a Q3 dividend of $0.105 per share (roughly 1 NOK) using a 30% payout ratio. I’m not sure how the dividend is treated from a withholding tax point of view. The standard dividend tax rate in Norway is 25%.

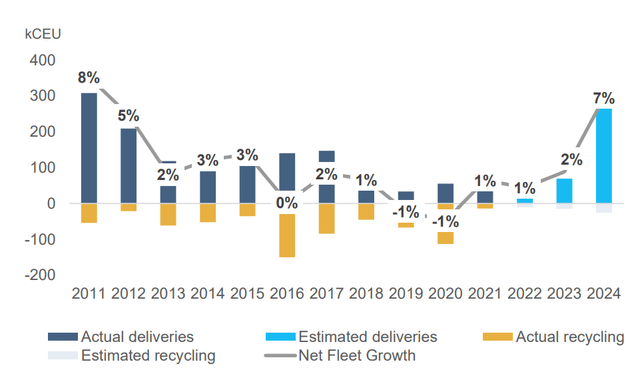

The world fleet will increase by about 10% in the next few years

There are two reasons why I think the PCTC charter rates will remain elevated. The image below has “scared” some investors as there will be a 2% capacity growth in 2023 and a 7% capacity growth in 2024. However, this does not include the potential scrapping of older vessels: As you can see below, only very minimal amounts of scrapping are included in the overview.

Hoegh Autoliner Investor Relations

The current world fleet consists of approximately 500 carriers, so a 10% net fleet growth represents 52 carriers. Keep in mind two of those carriers will be delivered to Hoegh.

Scrapping remains a very real possibility and even Hoegh may (have to) scrap some older vessels: The company owns four vessels that were built before 2000 with its oldest vessel, the Hoegh Trooper, reaching the respectable age of 29 years by the end of 2024. While the useful life of this type of vessels is 30 years, fuel efficiency will also start to play a role.

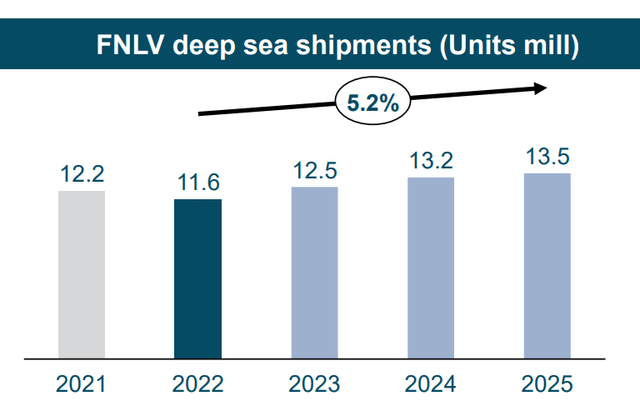

Additionally, the gross capacity growth should be discussed together with the anticipated growth in the FNLV (Factory New Light Vehicles) deep sea shipments, which are estimated to increase by in excess of 15% by 2025.

Hoegh Autoliner Investor Relations

If anything, this could indicate the strong charter rates will persist as we know there will be zero new additions to the world fleet beyond the already included 7% capacity growth in 2024 as shipyards are fully booked. So it is actually looking like the world fleet is growing in line with the anticipated total shipment of vehicles (and any additional scrapping of old vessels will be a bonus).

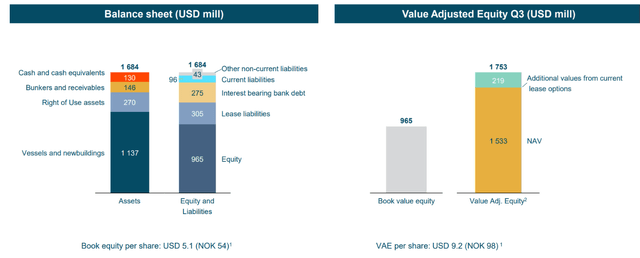

As there currently is a massive discrepancy between the book value of the vessels and their market value, I appreciate Hoegh’s update on the value-adjusted equity (using market values rather than the book value of the vessels).

Hoegh Autoliner Investor Relations

According to the company’s own valuation exercise, the adjusted NAV/share is approximately 98 NOK. That’s roughly 60% above the current share price and this offers an additional layer of safety.

An additional reason why I expect Hoegh Autoliners to do well in 2023

There are two additional reasons why I expect Hoegh to perform well in Q4 2022 as well as FY 2023: As oil prices are coming down, bunkering expenses should decrease substantially which means that even if charter rates don’t increase any further (or are even slightly decreasing), the EBITDA margin should increase. We should see an initial trend reversal in the fourth quarter of 2022 and I anticipate this to accelerate into 2023 as the oil price futures seem to indicate less volatility than what we experienced this year.

The main risk to the thesis would be a collapse in the production and shipping numbers of new cars which would put the charter rates under pressure. That is by far the most important risk.

While I realize the name Hoegh has left a bitter-sweet aftertaste after the delisting of Hoegh LNG Partners and the recent announcement the preferred share (HMLP.PA) will be delisted as well, there are some checks and balances in place here. While the Hoegh family owns just under half of the shares, shipping giant Maersk (OTCPK:AMKBY) (OTCPK:AMKBF) owns just over 26% of the share count which represents a blocking minority (i.e. Maersk has the majority of the total amount of the total float and could theoretically block anything it doesn’t agree with).

Investment thesis

Although the share price of Hoegh Autoliners has shot up this year, it doesn’t look like the stock is overvalued yet. Just like in certain segments of the oil and product tanker sector, there is a perfect storm brewing with very little capacity additions. Even if you would assume no scrapping will take place, the capacity growth between now and 2025 will barely cover the anticipated demand increase for car carrying vessels.

I expect Hoegh to report an EPS of $1.5-1.6 in both 2023-2024 which, again using the current USD/NOK exchange rate, would result in an NOK-equivalent EPS of 15-16 for a P/E ratio of approximately 4. Those are valuations you would usually see for a debt-heavy company but Hoegh only had a net financial debt of $145M (excluding lease liabilities) representing a debt ratio of just 0.4 times the lease-adjusted EBITDA based on the Q3 performance.

I currently have no position in Hoegh Autoliners, but this Norwegian company offers a compelling story which I will continue to follow up on.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment