Charles Wollertz/iStock via Getty Images

2021 was a year to forget for investors in the precious metals space, with the Gold Juniors Index (GDXJ) sinking ~20% and many names down as much as 50%. One name that was hit especially hard was Hochschild Mining (OTCQX:HCHDF), which massively underperformed its peer group, down 41% for the year. 2022 hasn’t been any kinder to the stock, and the 20% year-to-date decline has left the stock trading at a high double-digit free cash flow yield. At US$1.40, there’s no disputing that there’s value here. However, I continue to see Hochschild as an inferior way to play the sector and would only get interested closer to US$1.20.

Hochschild Mining Operations (Company Presentation)

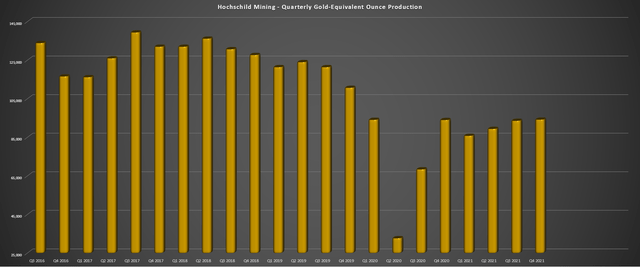

Hochschild Mining (“Hochschild”) released its Q4 and FY2021 results last month, reporting quarterly production of ~94,200 gold-equivalent ounces [GEOs], a slight increase from the year-ago period. The results were helped by a decent quarter out of Inmaculada and a sharp increase in production at San Jose, with production back near 2019 levels. However, production fell for the third consecutive year and remains well below pre-COVID-19 levels on a full-year basis. Let’s take a closer look below:

Hochschild Mining – Quarterly Attributable GEO Production (Company Filings, Author’s Chart)

As shown in the chart above, Hochschild has seen a recovery in production from Q2 2020. The mid-tier miner finished the year on a high note. However, while output increased on a year-over-year basis, Hochschild was up against very easy year-over-year comps, lapping a Q4 2020 report where production was down ~15% year-over-year. If we look at the results on a two-year basis, gold production was down nearly 13% (~68,200 ounces vs. ~78,000 ounces), while silver production declined 11%. The results are even uglier on a 3-year basis (Q4 2018), though this is partially impacted by the Arcata Mine heading into care & maintenance.

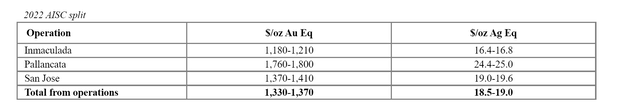

Hochschild Mining 2022 Cost Guidance (Company News Release)

Given the lower production rates impacted by lower-than-budgeted grades at Pallancata, it’s no surprise that costs were up sharply vs. FY2019 levels, with costs expected to come in at ~$1,230/oz at the mid-point vs. sub $1,100/oz in FY2019. This trend is not expected to improve short term. This is because FY2022 guidance is calling for a slight decline in consolidated production year-over-year (~340,000 GEOs vs. ~360,000 GEOs) and while costs are expected to increase to $1,350/oz at the mid-point.

If we compare these figures to the industry average (~$1,100/oz), these costs are very high, with Hochschild’s all-in costs likely closer to $1,480/oz. I would consider these razor-thin margins, especially for a company without pricing power. The lack of pricing power is because miners cannot control their selling price and precious metals are quite volatile. Few companies are immune from cost increases, and even the best producers like Agnico Eagle (AEM) are seeing rising costs. However, these costs are rising from a very low base of ~$920/oz, so Agnico will still have very healthy margins, even if inflationary pressures lead to a ~$50/oz increase in costs year-over-year.

So, is there any good news?

While the rising costs and lower production in 2022 (based on guidance) are not ideal, the company has a decent development pipeline, with a high-grade albeit early-stage project in Snip and an advanced project in Posse (Amarillo acquisition). Posse is expected to produce gold at sub $900/oz costs and could boost annual production by more than 85,000 ounces per annum. This would move the needle nicely, especially in its first four years (100,000+ ounces per annum), and it would also provide a boost to margins.

However, even with Posse that could begin production in 2024, Hochschild’s production would still be below FY2018 levels. So, Posse would simply be offsetting lower grades at its operations and Arcata, which is no longer in production. Therefore, it’s hard to call Hochschild a growth story, given that it’s more of a recovery store, clawing back lost production from three years ago (2018 production: ~514,000 GEOs).

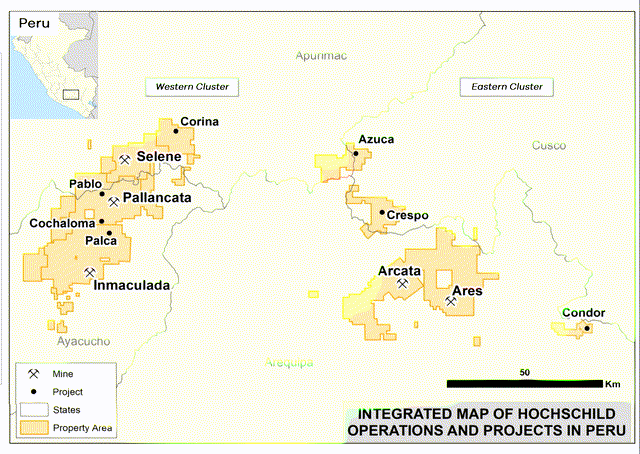

Hochschild Operations – Peru (Company Presentation)

The other piece of good news worth noting is that while there is still uncertainty in Peru, the situation seems to be less volatile than initially expected, with no major rulings or increased taxes on miners since President Pedro Castillo took over last year. Initially, it looked like things could get very ugly for miners, and that would have impacted Hochschild heavily, with nearly 70% of its production coming from Peru.

While Newmont (NEM) is just one example, and they could end up being too aggressive, the company has increased its exposure to Peru, taking over Buenaventura’s (BVN) interest in Yanacocha and going ahead with its Sulfides Project. So, at least from Newmont’s standpoint, who is the world’s largest gold producer, it does not seem to be worried about the policy risks for miners in Peru under newly appointed President Pedro Castillo. Let’s take a look at Hochschild’s valuation after this recent decline to see if it’s worth going bottom fishing.

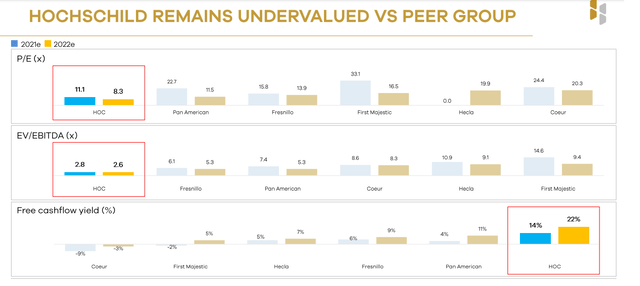

Valuation & Technical Picture

Hochschild Mining has ~514 million shares outstanding and a share price of US$1.40, giving it a market cap of ~$720 million. This is a very reasonable valuation for a producer with an annual production profile of ~350,000 GEOs, with the possibility to increase this figure to ~450,000 GEOs by FY2025. As several key ratios show below, Hochschild trades at a large discount to its peer group, at a forward PE ratio below 7, barely 2x EV/EBITDA and an FY2022 estimated free cash flow yield north of 20%.

Valuation Relative to Peers (Company Presentation, FactSet)

While these are attractive valuation metrics, it’s important to point out that Hochschild operates out of less favorable jurisdictions (Argentina, Peru); is heavily concentrated to one jurisdiction (Peru); has seen a steady decline in production since 2017 and is seeing costs steadily increase. This places it in a much less attractive position than peers like Hecla (HL), which enjoys industry-leading margins and operates out of Tier-1 jurisdictions. This suggests that while the stock is cheap relative to peers, it is cheap for a reason.

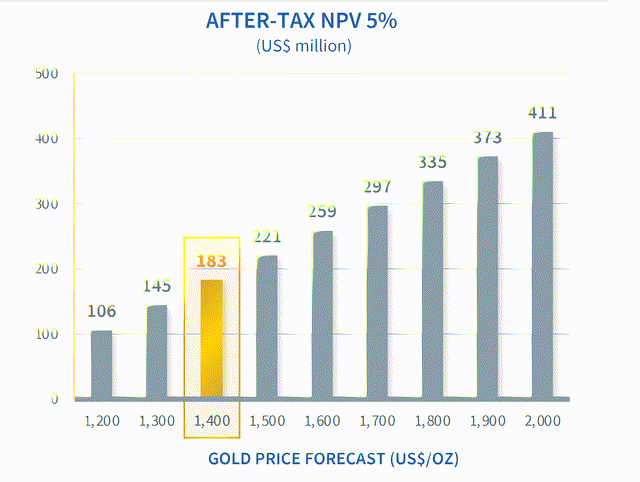

Posse Gold Project – After-Tax NPV (5%) Sensitivity (Amarillo Gold Presentation)

However, Posse has improved the valuation and could mend the lack of diversification and margin issues. This is because the project is expected to produce gold at costs below $900/oz, and it reduces the reliance on Peru, with Hochschild having a new mine in Brazil by 2024. Even at a conservative gold price of $1,700/oz, an NPV multiple of 0.60, and adjusting for inflationary pressures (15% discount to NPV (5%) at $1,700/oz), this project looks to be worth at least ~$150 million.

Suppose we subtract this from Hochschild’s market cap. In that case, investors are getting the operating mines (San Jose, Inmaculada, Pallancata) and the company’s interest in the Snip Project for roughly $570 million, which is very reasonable, even if the costs at these projects are well above the industry average. If gold and silver prices do not stay above $1,700/oz / $21.00/oz, it’s hard to make much of a case for Hochschild. However, for those bullish on metals prices, Hochschild now looks to be a high-risk, high-reward bet, which is much better than when it was an extremely high-risk bet ahead of the Peruvian elections when I warned to avoid the stock.

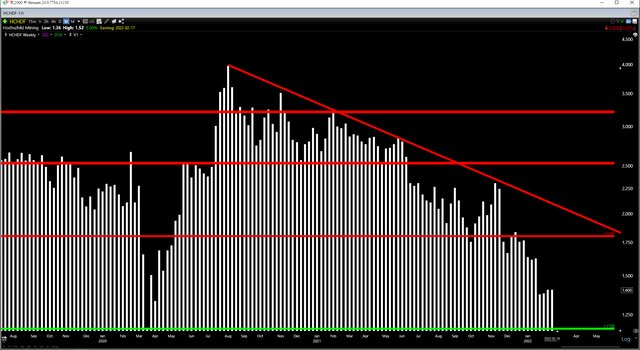

HCHDF Daily Chart (TC2000.com)

Looking at the technical picture below, we see that Hochschild Mining remains in a steep downtrend, with multiple overhead resistance levels. The only good news is that the stock is finally approaching a support level at US$1.17, which lines up with the stock’s March 2020 weekly close. So, if this weakness were to persist, this looks like it would be a low-risk area to enter new positions in the stock. However, as it stands, the current reward/risk ratio of 1.74 to 1.0 does not quite meet my buying criteria. This is based on Hochschild having $0.23 in potential downside to support (US$1.17) and $0.40 in potential upside to resistance (US$1.80).

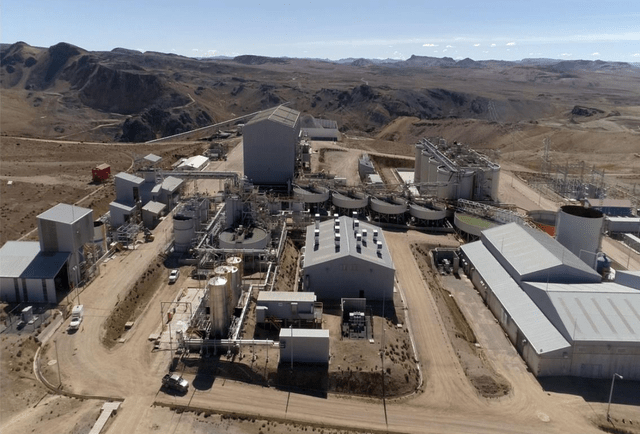

Inmaculada Operations (Company Presentation)

While there’s no disputing that Hochschild Mining is cheap relative to its peer group, it’s hard to argue that the business is stronger than it was pre-COVID-19. This is because production is lower, costs are up, and the Peru situation hasn’t improved with the election of a Socialist President. Although the addition of Posse does help with diversification, the company is still ~2 years away from seeing the fruits of this project. For these reasons, I see more attractive bets elsewhere in the sector. For those looking for beaten-up names that haven’t participated in the recent rally, Kinross (KGC) looks more attractive on weakness.

Be the first to comment