luza studios

HIVE Blockchain Technologies Ltd. (NASDAQ:HIVE) stock rose almost 8% on the back of its recently released Q4/2022 earnings. I find the reaction puzzling as I found the earnings report to be negative, while the stock reacted very positively. Of course this could simply be because I’m an old dinosaur and I just don’t “get” the crypto story. But below, I’ll highlight some of the red flags I saw from HIVE’s earnings report and business in general.

Mining At Negative Gross Margin?

HIVE reported record $211 million in revenues and $79 million in earnings for fiscal 2022, and a 545% growth in BTC mining hashrate. All fine and good, what’s the issue?

The issue I have is the quarterly progression, especially in the mining margins. HIVE has a March year-end, so it’s Q4 is the calendar quarter ended March 31, 2022.

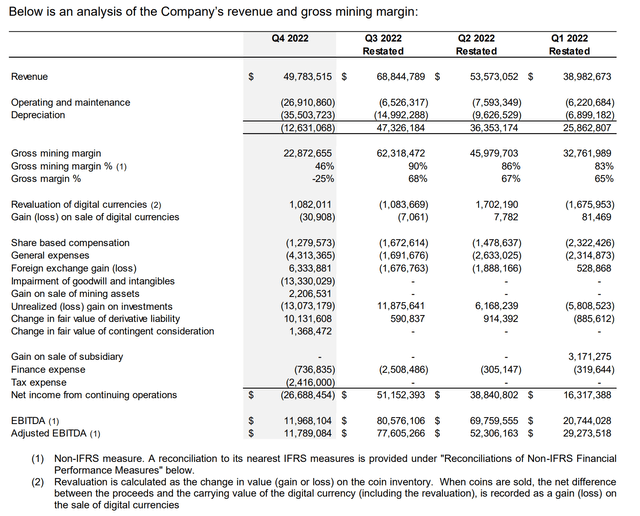

Figure 1 is reproduced from the company’s Q4 MD&A report.

Figure 1 – HIVE quarterly earnings (HIVE Q4/2022 MD&A)

Notice HIVE’s Q4 Gross Mining Margin was 46%. HIVE defines Gross Mining Margin as:

The Gross mining margin is defined as revenue less direct cash costs, being operating and maintenance costs.

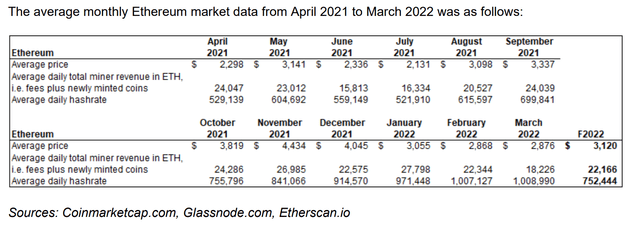

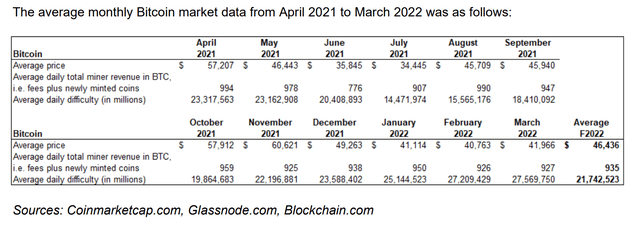

In other words, it’s revenues from selling ‘mined’ coins less the power it costs to operate the mining equipment. What’s wrong with a 46% margin? Figure 2 and 3 shows the monthly average Ethereum and Bitcoin prices. Notice for HIVE’s Q4, Ethereum prices averaged $2,933 while Bitcoin prices averaged $41,281.

Figure 2 – Monthly Ethereum Statistics (HIVE Q4/2022 MD&A)

Figure 3 – Monthly Bitcoin statistics (HIVE Q4/2022 MD&A)

If Gross Mining Margin was only 46% when Bitcoin and Ethereum prices were $41k and $2.9k respectively, what would margins be at current prices?

As of today’s close, Bitcoin and Ethereum were approximately $23.5k and $1.5k, or 57% and 52% of the average Q4 realized price. Even if hashrates and difficulty were kept the same, HIVE would be mining coins at zero gross mining margin!

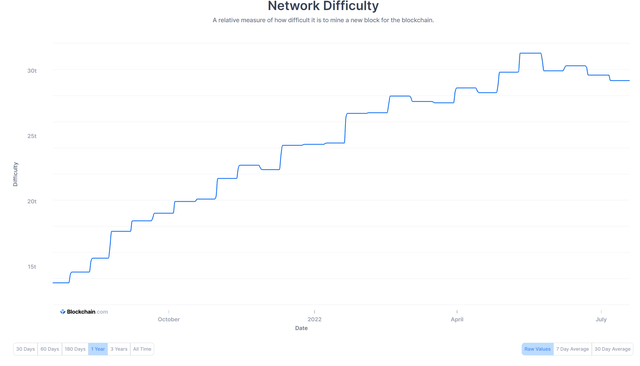

Unfortunately, that’s not all. According to data from blockchain.com, Bitcoin difficult has gone up since March (Figure 4), so HIVE could be mining Bitcoins at negative gross margins.

Figure 4 – Bitcoin difficult has continued to rise (Blockchain.com)

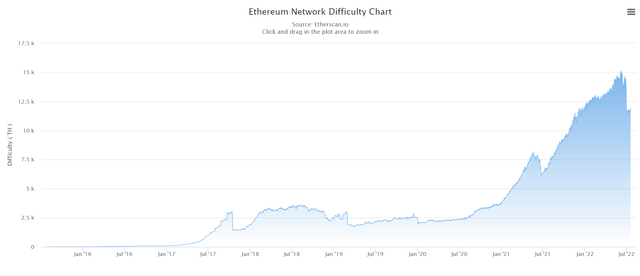

Fortunately for HIVE, Ethereum difficulty has gone down to roughly December 2021 levels, so perhaps HIVE can mine Ethereum at a small positive gross mining margin (Figure 5).

Figure 5 – Ethereum difficulty has gone down (Ethereum.io)

Mining Equipment Obsolescence An Issue

Furthermore, in Figure 1, HIVE already tells the reader it is mining at a negative gross margin of -25% in Q4, after factoring in depreciation.

Unlike traditional mining where mining equipment has relatively long useful lives, crypto mining relies on specialized ASICS and GPUs that become obsolete very quickly. HIVE depreciates its data center mining equipment on a straight line schedule over 2 to 4 years and includes it when calculating Gross Margin.

What is especially interesting with this earnings report is the QoQ jump in depreciation expense from $15 million in Q3 to $35.5 million in Q4.

The MD&A was not very helpful, as it only said:

Depreciation for the quarter of $35.5 million related to the Company’s data centre equipment and right of use assets.

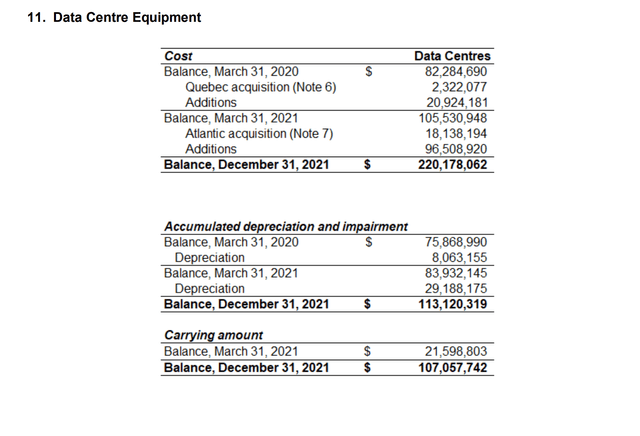

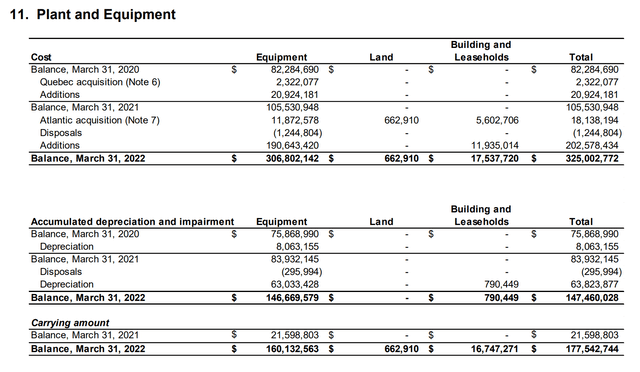

But if we go through the notes to the financial statements in Figure 6 and 7, we can see that HIVE added $106 million in equipment and buildings ($94 million in data centre equipment and $12 million in buildings), and depreciated $35.5 million in the Q4 quarter. As the depreciation amount is much higher than what a straight line depreciation over 2 to 4 years would suggest (Even if the $94 million in data centre additions were depreciated over 2 years, it should only add $11.8 million to depreciation expense, QoQ, not $20.5 million), one has to assume some older mining equipment was ‘written off’ as it could not mine profitably. With the subsequent plunge in crypto prices since March, will more of the mining equipment have to be ‘written off’ in coming quarters?

Figure 6 – HIVE Q3/2022 Data Centre Equipment Balance (HIVE Q3/2022 Financial Report)

Figure 7 – HIVE Q4/2022 Data Centre Equipment Balance (HIVE Q4/2022 Financial Report)

Ethereum Mining Days Are Numbered

Perhaps the biggest red flag against investing in HIVE is that Ethereum is moving away from Proof-of-Work to Proof-of-Stake, with some analysts expecting the event to occur between August to November. Already, crypto miners have been flooding the secondhand markets with GPUs as they try to recoup some of their investments.

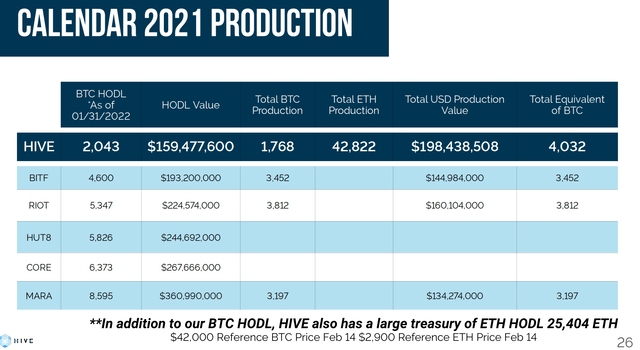

How much of HIVE’s cryptomining equipment will become obsolete overnight with Ethereum’s transition to Proof-of-Stake? If we look at HIVE versus its cryptomining competitors, HIVE appears to have the most exposure to Ethereum, as approximately 56% of its coins ‘production’ in calendar 2021 were ETH, while peers predominantly only mine BTC (Figure 8, HUT8 does mine ETH, but the split is less than 20% and is received as BTC).

Figure 8 – HIVE has high exposure to ETH (HIVE investor presentation)

Will HIVE investors be left holding the figurative bag when Ethereum transitions to Proof-of-Stake later this year?

Risks To Bearish View

The biggest risk to my bearish view is a rally in crypto currency prices, as a rebound in crypto prices can buoy HIVE’s gross margins. Also, if a lot of crypto miners exit the space, mining difficulty would come down, making coins easier to mine and improving gross margins.

Summary

In summary, although HIVE delivered an eye-catching earnings report with $211 million in revenues and $79 million in earnings, those figures were backwards looking. At current crypto prices, HIVE would be mining at a negative gross margin. In addition, mining equipment appears to be becoming obsolete faster than expected by management. Finally, HIVE appears ill-prepared for the Ethereum transition to Proof-of-Stake. For these reasons, I would recommend investors stay away from HIVE.

Be the first to comment