Elmar Gubisch/iStock via Getty Images

With most companies having now reported full year 2021 results, it was time to head back to finviz.com to screen for companies that meet my initial criteria for further investigation. I am always on the look-out for US based companies who have low debt, satisfactory solvency ratios, high insider ownership, and recent insider purchases. From there, I eliminate any biotechs because those are way outside my circle of competence. This typically produces a short list of candidates. One such this week was HireQuest Inc. (NASDAQ:HQI), a staffing solutions holding company. My intent with this article is to get into the details of what my analysis uncovered. Bottom line up front: HQI has a differentiated business model that allows for much higher margins than peers. Recent acquisitions coupled with continued pandemic recovery in the labor market is going to grow the bottom line substantially over 2021. However, capital constraints looking forward may mean the cadence of acquisitions will slow, and organic growth may be muted. Waiting for a share price closer to $18 is my plan before buying.

The Biz

HQI has a pretty straightforward business model that is shared by hundreds of other companies across the country and world, many of them publicly traded. They provide temporary employees to businesses that may need them for a variety of reasons, many of them often being seasonal demand. The thing that sets HQI apart is that they use a franchise model vs. owned and operated. This allows for much higher margins, compared here against near peers:

| HQI | Robert Half (RHI) | BGSF (BGSF) | Hudson (HSON) | GEE Group (JOB) | Manpower (MAN) | 51job (JOBS) | |

| EBITDA margin | 49% | 12% | 7% | 3% | 7% | 3% | 14% |

*Data from Seeking Alpha

Under the franchise model, HQI provides their franchisees with back-office support, dedicated software, use of tradenames, access to working capital, and affordable workers compensation coverage. In return they get a percent of billings, which averaged 6% in the most recently completed year, and they own the accounts receivable of all their offices.

This arrangement is extremely profitable for HQI and simultaneously advantageous for franchisees. HQI has tiny overhead expenses and little capital requirements. Franchisees maintain independence and discretion over the day-to-day operations of their locations, with access to HQI capital and programs. The 10-K explains their differentiated approach this way:

Most of our competitors utilize a company-owned office model in which management of day-to-day interactions with customers is handled by individuals who do not have the same incentive to succeed as franchisees have as owners of their businesses. The company-owned model typically requires significant investment in middle management to overcome this lack of incentive. We largely avoid this expense because our franchisees are independent business owners responsible for their own financial well-being, and in doing so increase our store level economics.

Compared to company-owned offices, our franchise model allows us to employ relatively fewer full-time staff at our corporate headquarters decreasing the working capital needed for operations.

The majority, 94%, of HQI revenue is from franchise royalties. The rest is made up mostly of ancillary activities:

-

HQI charges franchisees interest on accounts receivable that are aged over 42 days. The amount is 0.5% of uncollected dollars every 14 days up to a maximum of 84 days, after which the receivables are charged back to the franchisee.

-

HQI offers financing to franchisees for the initial purchase of office assets and related start-up costs. These notes receivable carry interest rates of 6%-10%. Notes totaled just over $4 million at year-end 2021, and interest income related thereto was $412,000 in 2021 and $712,000 in 2020.

These “service revenues” accounted for 5% of 2021 revenue. Management has no desire to grow the “services revenue” segment. These things exist for functional reasons. The interest charges on overdue receivables encourages franchisees to stay on top of their receivables. The say outright in the 10-K:

The Company does not strive to increase interest on aged accounts receivable.

As it relates to lending, this exists to encourage growth by helping with start-up costs for their franchisees. It isn’t a business line in its own right. Evidence of that is the fact that HQI sold $5.3 million worth of these notes to another party at par value last year. They got those assets off the balance sheet and used the proceeds to acquire other companies so that they could grow royalty income, their bread and butter.

The final 1% of revenue was from locations that HQI owned for a brief time in 2021.

Growth Initiatives

With a franchise model, the only way HQI can grow is to get more franchises. They are trying to get more via acquisitions and by incentivizing existing franchise owners to expand.

Acquisitions

2021 was a big year on the acquisition front for HQI, and 2022 is off to a good start. The combinations from last year:

– Snelling Staffing was bought on March 1 2021. $17.9 million was paid for this 47 office company with a 67 year history. Snelling had $87 million in 2020 sales. Not all the offices were kept by HQI, per the 10-K:

…. we sold the 10 locations that had been company-owned by Snelling. Two of these locations were sold to franchisees. Four locations were sold to a third-party purchaser. Four offices were sold to a California purchaser and operate under the Snelling name pursuant to a license agreement with us. The aggregate sale price for these 10 locations consisted of (i) $1.0 million in the form of a promissory note that bears interest at 6.0% per annum, (ii) the right to receive 1.5% of revenue generated at the Ontario location for the next 12 months, subject to certain conditions being satisfied, (iii) the right to receive 2.5% of revenue generated at the Tracy and Lathrop locations for the next 12 months (iv) the right to receive 2.0% of revenue generated at the Princeton location for the next 36 months, and (v) approximately $1 million in cash. There were no remaining company-owned locations at March 31, 2021.

– LINK Staffing was acquired on March 22 2021 for $11.1 million. It came with 35 locations, all under franchise agreements, that had $57 million in 2020 sales.

– Recruit Media was bought on October 1 2021 for $4.4 million. This was a unique buy in that Recruit isn’t a staffing company, they are an IT company. The rationale for the purchase was to get in front of a risk outlined in the “Risk Factors” section of the 10-K:

We also face increasing competition from gig-economy companies who are attempting to monetize the temporary staffing industry through smartphone applications.

So, HQI went and bought an app that does that. Recruit allows candidates to create a multi-media resume for potential employers. Of the acquisition, HQI CEO said:

The acquisition of Recruit Media brings us to the forefront of staffing and recruiting technology and enables us to differentiate our value in the eyes of our workforce and clients. Recruiting qualified workers is a pain point for businesses across America. This platform focuses on reducing this friction point, increasing throughput to our franchisees. Many of the features and solutions of the Recruit Media platform have been on our internal technology road map for a number of years. This acquisition accelerates that road map, saving us years of development, and provides a more robust base to build upon. Technology increasingly influences all aspects of our business and with the acquisition of Recruit Media we enable our franchisees, employees, and clients to interact with one another more efficiently. We’re very excited about the opportunities this creates for our franchisees today and the opportunities it opens up for us in the future.

Notably, the press release also mentioned that…

… the public facing web domain, www.Recruit.com, along with its respective iOS and Android apps, gives HireQuest a fully functional online job-ad and recruitment platform that could become an additional business line, or stand-alone company, in the future.

– Dental Power Staffing came on December 6th 2021. This company has a 46 year history, operates throughout the United States, and cost HQI $1.9 million. It gives HQI access to a new vertical for them within healthcare.

2022 is off to a strong start with three acquisitions announced in January alone:

– On January they closed on the acquisition of dmDickason, which operates in the southwest US and had $18 million in 2021 sales. Price paid was $5.25 million.

– On February 22nd they completed the acquisition of Dubin Group for $2.4 million. Dubin brings a new vertical to HQI, that of executive placement, which typically fetches more dollars per head. Of particular note is that HQI retained Kenny Dubin, the founder of Dubin Group, to continue in his leadership role.

– They closed on the acquisition of Northbound Executive Search on February 28th. This expands their executive placement vertical mentioned above. Northbound’s clientele consists mostly of blue-chip financial companies, and they also have a consulting arm. Here too, founders were retained. From the press release:

Rachel Feder, co-founder and Managing Partner of Northbound: “As Managing Partners of Northbound, we will continue to operate the business on a day-to-day basis and our teams will continue to focus on providing a premium level of service to our clients.”

Greg Feder, co-founder and Managing Partner of Northbound, commented, “With this partnership, Northbound will have the ability to draw from an organization that will help to fuel our next stage of growth.”

Typically this many acquisitions in close succession is a red flag for me, especially as it required a draw on debt to complete. But for three reasons it doesn’t bother me.

First, the highly saturated and fragmented temporary staffing industry means that organic growth is difficult. Between low barriers to entry and difficulty differentiating one’s services, buying growth is the most efficient path.

Second, with the franchise model, HQI will be able to make back what they spend on these acquisitions in relatively short order. Using the broad data we have, we can get a sufficient picture for how many years it will take for HQI to recoup their investment:

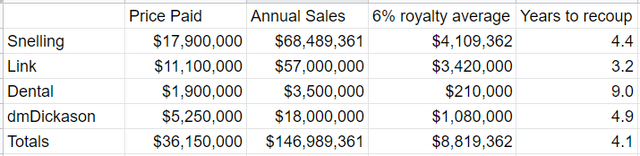

*Excludes Dubin, Recruit, and Northbound as insufficient details were shared.

On average, it will take about four years for HQI to earn back what they spent on these acquisitions. That time frame could actually be much shorter, as the annual sales numbers from Snelling, Link, and Dental Power were for 2020, a year where sales were particularly weak due to COVID. HQI’s organic revenue surged 30% in 2021 over 2020. If the same held true for those acquired entities, HQI is making much bigger royalties off them and the years to recoup will be much shorter.

Third, HQI is following Warren Buffett in the strategy of buying up businesses but leaving founders in place. This assures no interruptions in operations, and synergies are much more likely to be realized.

Organic

While it is certainly true that acquisitions will be the main source of growth, HQI does incentivize franchisees to expand their own operations. They explain it in the 10-K:

We incentivize our franchisees to expand their own businesses through our Franchise Expansion Incentive Program. Under this program, we offer assistance overcoming the startup costs of an office in a new metropolitan area by providing our existing franchisees with credits on the royalty fees they pay in their existing offices. In addition, under certain circumstances, we will provide assistance in acquisition funding or financing.

Pandemic Overhangs

Naturally, COVID-19 presented significant and pointed challenges to the staffing industry. The “American Staffing Association” says that revenue contracted 13% overall for those in this line of business. For HQI, 13 branches were shuttered due in some measure due to the harsh economic environment of 2020. Furthermore, some franchisees have struggled to meet the financial obligations they have to HQI. In 2021, they held $1.9 million in bad reserves for these obligations, $300,000 of which was expensed on the income statement for the year.

Personal Holding Company

In conjunction with the Tax Cuts and Jobs Act, which significantly lowered the corporate tax rate and thus made the formation of corporations more attractive, certain measures were passed to prevent people from forming corporations just to create a tax shelter. One such measure was the Personal Holding Company Tax (PHC). Basically, this law stipulates that if a corporation gets 60% of their income from certain activities (royalties being one, like HQI) AND more than 50% of their stock is owned by 5 or fewer individuals in the last half of their fiscal year, that corporation is subject to an extra 20% tax. The aim was to make it so that high net worth persons in high tax brackets wouldn’t form a corporation for their investments activities with a few of their buds just to be taxed at lower rates. Since almost all of HQI revenue is from royalties, that aspect of them would be considered a PHC. However, they have 140 holders of record on their common stock. Way more than five. So they can’t be considered a PHC. Nonetheless, as PHC status is tested annually, HQI could theoretically fall risk to this tax in the future if holders of record decreases substantially. That likelihood seems slim, but it is significant of a chance that HQI chose to include this matter in the “Risk Factors” section of the 10K.

Work Opportunity Tax Credits

A first glance at HQI’s effective tax rate would understandably cause some head scratching for being so low. It was 5.1% in 2021 and 12.1% in 2020. This is in part because HQI qualifies for a tax credit called the “Work Opportunity Tax Credit” or WOTC. This is a program administered by the IRS and Department of Labor that incentivizes employers to hire people from certain “disadvantaged” categories. Among others, those categories include veterans, ex-felons, Supplemental Nutrition Assistance Program (SNAP) recipients, people with physical/mental limitations who are in rehabilitative programs, and people who live in distressed urban or rural communities. To qualify, said persons also need to be in their first year of employment with HQI and do 400 hours’ worth of work in the year. The demographics of people who frequent temporary staffing agencies often overlap with all the criterion mentioned above. This tax credit allows HQI to take as much as $2,400 off their tax bill for each qualifying person, and up to $24,000 for veterans. With HQI having 73,000 employees, the savings are likely substantial, though we of course do not know how many of their employees qualify for the WOTC or in which amounts.

The reason I bring up this issue is because there are substantial risks associated with it. First is the potential regulatory scrutiny. The margins for error are narrow. What happens if tax authorities get a whiff of any falsification or inaccuracies by HQI in the processing of the people who help the company qualify for the credits?

The second is the fact that the WOTC is due to expire at year end 2025. If it doesn’t get renewed or if it gets significantly tighter, HQI will see a much larger tax bill. In 2021, were it not for the WOTC, EPS would have been ~10% lower. The closer we get to 2025 and without any chatter about the WOTC being renewed, the more the market is going to price this into the shares to the downside.

Valuation

HQI has been publicly traded for a while but only took their current form in 2019. Therefore, we don’t have much of an operating history off of which to base assumptions for future operating results. Coupled with lack of managerial forward guidance, this all makes valuation exercises particularly challenging.

One thing from the last conference call was helpful. An analyst was asking about what HQI nets out of the system-wide sales that their franchisees generate. The answer from the CEO was about 3.5%. After all the acquisitions that have been rolled up recently, system wide sales is about $435 million on a trailing basis. That means that HQI will get about $15,225,000 of net income. Divided by shares outstanding comes out to $1.10 in EPS. In 2021 HQI had $0.87 of EPS, so growth will be 26%! That is with assuming no growth out of quoted system wide sales, and many of those quotes were from 2020, the most challenging pandemic year.

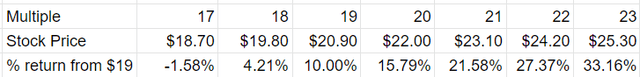

Trailing P/E for HQI is over 21. If that multiple stays the same and with the $1.10 in EPS, year-end 2022 price target for HQI is ~$23.1. From $19.00 that HQI is trading for currently that is a 21.5% return. My minimum required rate of return is 12%, so even if shares don’t get all the way up to $23 I will be fine if I were to buy. Here is a matrix showing stock price and percent return from current trading levels for HQI using $1.10 in 2022 reported EPS as a base-line under several earnings multiple scenarios:

Even if the multiple contracts down to 19, a return in line with long term stock market averages is likely. Anything above that more than exceeds my required rate.

Conclusion

I like the HQI business model. It is extremely simple, and management seems focused. The biggest limitation is capital constraints, where debt will need to be incurred or equity issued to continue rolling up acquisitions. This of course comes at a cost. After all their recent acquisition activity, they only have $17 million left on their revolver, and several of their recent acquisitions cost more than that. They have considerable liabilities in the form of a term loan, the revolver, workers’ compensation obligations, and so forth, so their capacity for added debt isn’t huge. I don’t love that they are paying a dividend, which creates another obligation to the tune of more than $3 million annually. I would prefer they retain earnings so they can pay down debt faster and have resources to expand more.

While 2022 net income will likely be much higher than 2021, that path ahead for high growth seems uncertain. It is for these reasons that I need a higher margin of safety before buying HQI. $18 would be the target at or below which I will start establishing a position.

Be the first to comment