BalkansCat

Investment Thesis: With net debt to EBITDA back down to 2019 levels and RevPAR and earnings growth continuing, I take the view that Hilton Worldwide Holdings could see longer-term upside from here.

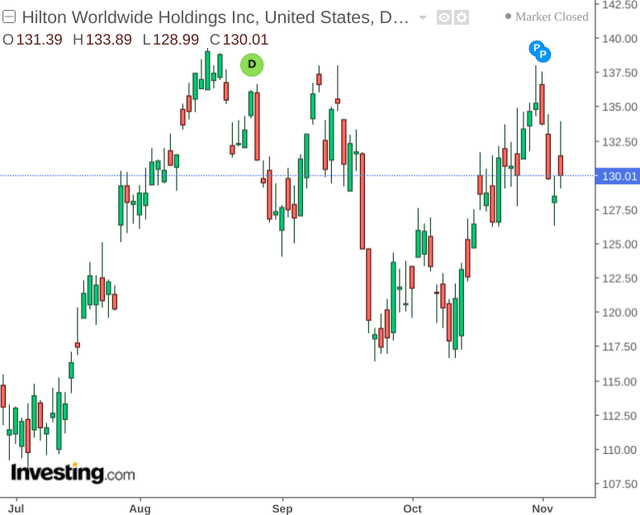

In a previous article back in September, I made the argument that Hilton Worldwide Holdings (NYSE:HLT) could see further upside on the basis of a strong rebound in overall RevPAR and a fall in net debt relative to adjusted EBITDA.

Since my last article, the stock is up by over 5%:

The purpose of this article is to assess the potential trajectory of the stock going forward, taking Q3 2022 financial results into account.

Performance

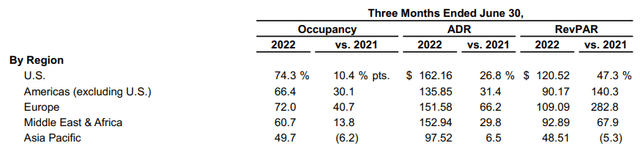

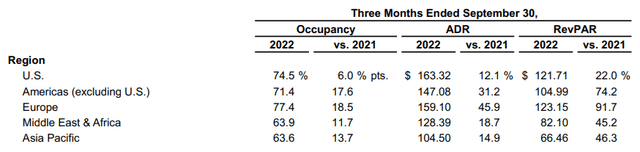

When comparing performance by region with the previous quarter, we can see that RevPAR (revenue per available room) saw growth across all regions except the Middle East & Africa – with the Europe and Asia Pacific regions seeing a particularly strong recovery.

Q2 2022 – Performance By Region

Hilton Q2 2022 Financial Results

Q3 2022 – Performance By Region

Hilton Q3 2022 Financial Results

Moreover, it is interesting to note that while the Waldorf Astoria Hotels & Resorts brand had seen a decline in RevPAR from $266.46 to $233.50 in the most recent quarter – this was still up by 28.6% on that of the same quarter last year. The brand had the highest ADR (average daily rate) across all brands for Q3 2022 at $422.47. Additionally, the Conrad Hotels & Resorts brand (which had the second-highest ADR for the most recent quarter at $268.59) saw growth in RevPAR from $156.16 in Q2 to $169.98 in Q3 – with a 92.6% increase on that of the same quarter last year.

When comparing Q3 2022 performance against that of Q3 2019 performance – we can see that the company’s P/E ratio is currently trading at a similar (albeit slightly higher) level compared to 2019 – while net debt to EBITDA has reverted back to Q3 2019 levels and the company’s cash to long-term debt ratio has increased.

| Q3 2019 | Q3 2022 | |

| Net Debt to EBITDA | 3.1 | 3.1 |

| Cash to long-term debt | 9.21% | 14.68% |

| Net Debt | 7084 | 7446 |

| Price | 94 | 123 |

| EPS (nine months) | 2.9 | 3.31 |

| P/E Ratio | 32.41 | 37.16 |

Source: Net Debt to EBITDA, Net Debt and EPS figures sourced from Q3 2019 and Q3 2022 financial results for Hilton Worldwide Holdings. Net debt figure provided in millions of US dollars. Price figures sourced from investing.com. Cash to long-term debt ratio and P/E ratio calculated by author.

From this standpoint, I take the view that Hilton’s strong recovery in revenues and earnings – along with the fact that price itself is trading at a similar level to this time last year means that the stock may be more attractively valued at this point – which is one of the reasons I decided to go long the stock earlier this month.

Looking Forward

Going forward, Hilton Worldwide Holdings is in a good position to grow revenues and earnings further. From a macroeconomic standpoint, the main risk for the company is that inflation and recessionary fears cause hotel booking demand to decline in the short to medium-term.

While we could see a temporary decline in demand owing to seasonal factors – the fact that revenue and earnings growth has continued to remain strong into the autumn months is highly encouraging. Additionally, the fact that we have seen the company’s luxury flagship brands (Waldorf Astoria and Conrad Hotels & Resorts) continue to show strong growth overall indicates that these brands could show less price-sensitivity among higher-end customers and RevPAR could continue to grow from here.

Conclusion

To conclude, Hilton Worldwide Holdings has seen a strong recovery in revenue and earnings, and given that price itself has seen little growth as compared to last year means that the stock could be trading at a more attractive valuation at this point. For these reasons, I continue to take a bullish view on the stock.

Be the first to comment