urbazon/E+ via Getty Images

Hillenbrand (NYSE:HI) had moderate results in its latest quarter, with adjusted EBITDA, adjusted EBITDA margin, and adjusted earnings per share all down, lower Batesville volume and a boost in investments in the reporting period.

With the recent announcement of the divestiture of Batesville, which is expected to close in the first calendar quarter of 2023, it could help improve earnings in the second calendar quarter, although there will be some downward pressure on margin from its recent acquisitions.

The first half of calendar 2023 will be a challenging one for HI, based upon economic uncertainty, supply chain issues, inflation, delayed orders, and margin dilution from acquisitions.

With a company policy of prioritizing paying down debt after selling off its assets, there could be positive impact on earnings depending on how much capital the company allocates to that purpose.

In this article we’ll look at some of its recent numbers, the implications of selling off Batesville, and where to look for strength going forward.

Some of the numbers

Revenue in the fourth fiscal quarter was $750 million, up 1 percent from the $742 million generated in the same reporting period of 2021. Excluding FX, revenue was up 7 percent in the quarter.

Adjusted EBITDA in the reporting period was $135 million, down 3 percent from the $139 million in adjusted EBITDA from the fourth fiscal quarter of 2021.

Adjusted earnings per share in the quarter were $1.05, up 5 percent from the $1.00 in adjusted earnings per share year-over-year.

Operating cash flow was $97 million, up 13 percent from the $86 million in operating cash flow from the fourth fiscal quarter of 2021.

Investor Presentation

At the end of the reporting period the company had a total backlog of $1.76 billion, but I think a significant portion of that will be delayed in the first half of calendar 2023, and depending on the economic environment, could extend past that.

For the full-year fiscal 2022, the company generated revenue of $2.9 billion, up 5 percent from the $2.8 billion in revenue generated in all of 2021.

Full-year adjusted EBITDA was $527 million, down 1 percent from the $534 million in adjusted EBITDA produced in full-year 2021.

Adjusted EPS for full-year 2022 was $3.93 per share, up 4 percent from the $3.79 per share in adjusted EPS in full-year 2021.

Operating cash flow in full-year 2022 plunged to $191 million, down 64 percent from the $528 million in operating cash flow in full-year 2021. The decline was attributed having to increase inventory in response to supply chain constraints and rising demand, and timing of working capital associated with big plastics projects.

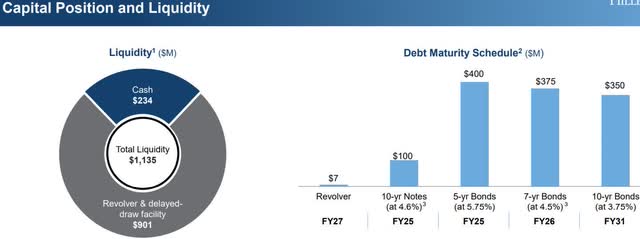

The company held cash and cash equivalents of $234 million at the end of the quarter, and $901 million with its revolver and delayed-draw facility. It had net debt of $988 million at the end of the reporting period.

Investor Presentation

Divestiture of Batesville

In early December Hillenbrand announced it had entered into an agreement with private equity firm LongRange Capital to sell the unit for $761.5 million, which included a sub-note valued at $11.5 million.

The bulk of the revenue generated from the sale will be used to pay down debt.

There are several positives to consider with the divestiture. First, the company will now be a pure-play industrial firm focusing on its core competence.

Second, Batesville had been a drag on the company in regard to declining revenue and adjusted EBITDA, both of which accounted for 21 percent of the overall company totals in those financial categories.

Revenue in the segment was $146 million in the fourth fiscal quarter, down 6 percent from the $155 million in revenue generated in the fourth fiscal quarter of 2021. That was primarily as a result of the lower numbers from the declining deaths associated with COVID-19, along with cremation decisions.

The lower volumes resulted in downward pressure on margin and adjusted EBITDA, as well as high inputs from rising material costs. Adjusted EBITDA for Batesville in the quarter was $24 million, down 28 percent year-over-year, while adjusted EBITDA margin fell 500 bps to 16.6 percent, compared to the 21.6 percent in the fourth fiscal quarter of 2021.

Investor Presentation

While revenue will drop from the selling of the unit, all things being equal, it should improve the bottom line of the company in the second half of 2023, assuming a deepening recession doesn’t occur hit its other units hard.

Whatever plays out in the near term, this will be better for HI over the long haul.

The most important catalyst for the company in selling off the unit will be reducing its debt load and the accompanying interest rates.

Advanced Process Solutions segment

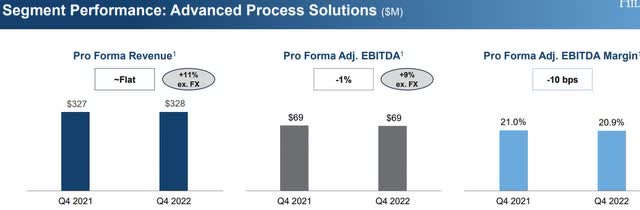

In its Advanced Process Solutions segment the results in the quarter weren’t impressive. It generated revenue of $328 million, flat against the $327 million generated in the same quarter of 2021.

Adjusted EBITDA in the quarter was $69 million, slightly down from the fourth fiscal quarter of 2021. Adjusted EBITDA in the fourth fiscal quarter was 20.9 percent, down 10 bps from 21 percent year-over-year.

Investor Presentation

The segment had record backlog of $1.4 billion in the reporting period, up 6 percent year-over-year. Part of that came from its acquisition of Herbold, as well as an increase in volume from big plastic projects and an increase in aftermarket orders.

There are a couple of things to take into account with its APS unit. The first one is it’s the largest segment in the company, accounting for 43 percent of revenue and 42 percent of adjusted EBITDA. So, however this segment performs will have the most impact on the company’s numbers and share price.

The other thing is, even with its record backlog investors need to understand that not only will the backlog be delayed in the first half of 2023, but there’s a possibility some of it could be cancelled at meaningful levels.

What I’m finding out with many companies is spending decisions are being kicked up higher in the hierarchy and suggests tighter spending in the quarters ahead. With APS being the largest segment of HI, that could weigh significantly on its performance if that’s how it plays out.

One thing for sure is under the best-case scenario the higher percentage of its backlog will be delivered in the second half of calendar 2023. In the worst-case scenario, if the economy tanks worse, this could easily result in orders being pushed ahead into 2024 or cancelled altogether.

Molding Technology Solutions segment

Revenue from its Molding Technology Solutions segment in the fourth fiscal quarter was $276 million, accounting for 36 percent of total company revenue. Adjusted EBITDA in the reporting period was $60 million, up 11 percent year-over-year, and accounting for 42 percent of the total company adjusted EBITDA for the quarter. Adjusted EBITDA margins in the quarter were 21.6 percent, up 100 basis points based upon improvement in productivity and higher pricing.

Investor Presentation

Backlog in the BTS segment was flat at $364 million.

The volume of orders was down in Q4 as a result of its customers delaying decisions on orders. The company expects more customer delays in the first half of 2023, which will have an impact on revenue in that time frame, and with lower volumes, probably earnings as well.

With the anticipated decline in orders in the MTS segment, management said it’s taking measures to manage costs by prioritizing major investments, only hiring employees for key roles, and “optimizing our global supply chain costs.”

Conclusion

HI is a mixed bag of recent results and potential, but I think in the near term the company is going to struggle, and I think that’s reflected in the big hit its share price has taken from early December when it traded near its 52-week high of $54.15 and has since plunged to $44.02 as I write.

TradingView

While the company points to its strong backlog as a catalyst, this isn’t going to have a significant impact on the performance of the company in the first half of 2023. And if the economy worsens, it’s backlog will come under further pressure from more delays and potential cancellations.

If its APS unit falters in any way, it’s really going to have a strong, negative impact on the company, and its share price will suffer in response to that. With its MTS segment projected to perform somewhat flat, and the closing of its Batesville segment, revenue is going to be less than it was last year, although that will be offset some by its latest acquisitions.

Including all the headwinds the company faces and the strong probability its backlog isn’t going to deliver at the level it expects in 2023, I think HI is going to struggle to gain momentum anytime soon, and it has a stronger possibility of dropping further than it already has, and will find it difficult to find a catalyst that will change the narrative over the next year or so.

Be the first to comment