simonkr

Brookfield Renewable (NYSE:BEPC) recently had its annual investor day, and it was an interesting one. Management sounded more upbeat and optimistic about the business than even before. They clearly believe that the company has what it takes to become a global clean energy super-major, with its over 120,000 MW of operating and development renewable energy capacity.

They reminded investors that the company has a global presence being in ~30 power markets across 20 countries, and that it has significant competitive advantages resulting from its operating and development expertise and its value investing approach. The company also has exciting growth opportunities resulting mainly from some key megatrends, including the increased urgency for decarbonization, the desire for lower energy costs, the need to supply the growing electricity demand, and the need for energy security.

Another positive thing shared was that the company is performing well in the current inflationary environment. Rising commodity costs are a pass through as new PPAs are signed at higher prices, and rising inflation increases the margin on over 70% of its existing PPAs. Additionally, hydros are very long-term and scarce assets that naturally rise in value in this environment. It is therefore no surprise that 2022 has been its strongest year across virtually every one of its businesses.

Growth

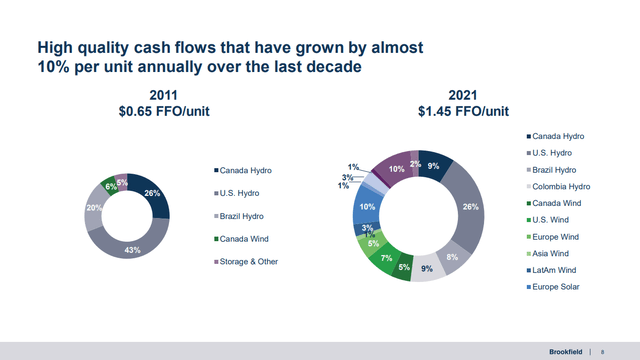

To fund growth the company has a solid balance sheet with a BBB+ investment grade credit rating, and $4 billion in available liquidity. As the company increases investments, its funds from operations per unit have also been growing at a historical ~10% annually. From 2011 to 2021 FFO/Unit more than doubled, and the business has become more diversified.

Brookfield Renewable Investor Presentation

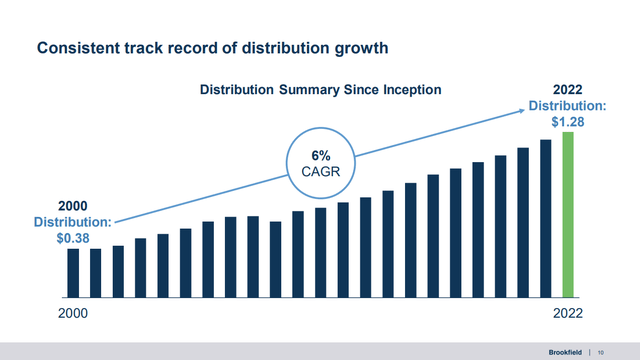

This has enabled the company to increase the distribution by ~6% CAGR, to a record $1.28 in 2022.

Brookfield Renewable Investor Presentation

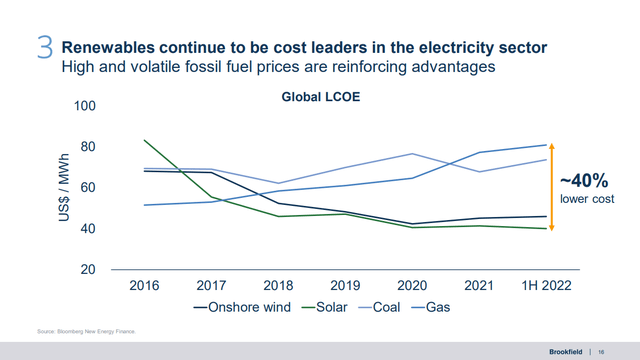

One reason to be optimistic about the future growth of the company is that now the levelized cost of electricity for onshore wind and solar is significantly lower to that of coal and gas. If the company managed to grow at an impressive pace when costs were closer to those of fossil-fuels, imagine what it can accomplish now that it has a ~40% cost advantage.

Brookfield Renewable Investor Presentation

Diversifying

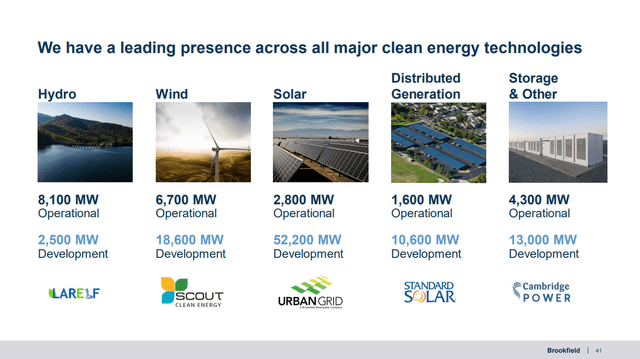

It became very clear from the presentation that Brookfield Renewable is not only looking to grow at a very fast pace, but that it also has the intention to significantly diversify the business. The business once consisted mainly of hydro assets, then expanded meaningfully into wind and solar. Now distributed energy and storage are becoming quite important to the business. As can be seen below, while hydro remains the most important in terms of operational assets, solar has by far the largest development pipeline.

Brookfield Renewable Investor Presentation

Speaking of the pipeline, the U.S. Inflation Reduction Act provides it with meaningful upside. It is making projects more attractive and incentivizing their earlier development.

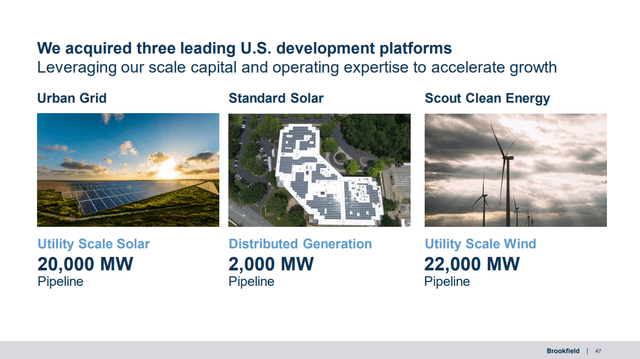

The company also talked about some of the key acquisitions they’ve recently made, including Urban Grid, Standard Solar, and Scout Clean Energy. These three acquisitions add very meaningfully to the company’s already impressive project pipeline.

Brookfield Renewable Investor Presentation

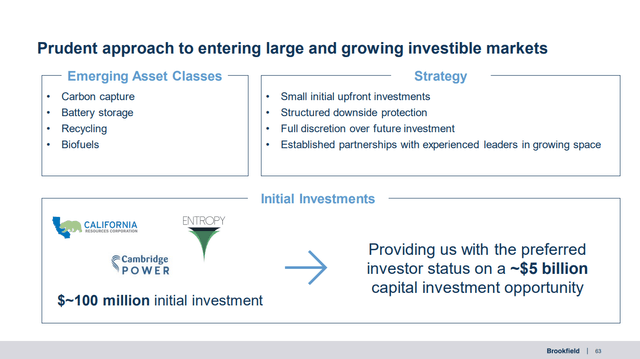

If this wasn’t enough growth and diversification, the company is already starting to explore new opportunities for the next phase of expansion. Some of the areas that are attracting attention from the company include carbon capture, hydrogen, renewable fuels, and recycling. All these technologies are aligned with the company’s objective to help de-carbonize power generation, industrial processes, steel, transportation, buildings, and agriculture.

One of this emerging areas where the company has already taken some first steps is carbon capture. Brookfield Renewable already has the high-growth carbon capture platforms with robust development pipeline. These are operating in some of the most attractive carbon capture markets, Alberta and California.

Brookfield Renewable Investor Presentation

Guidance

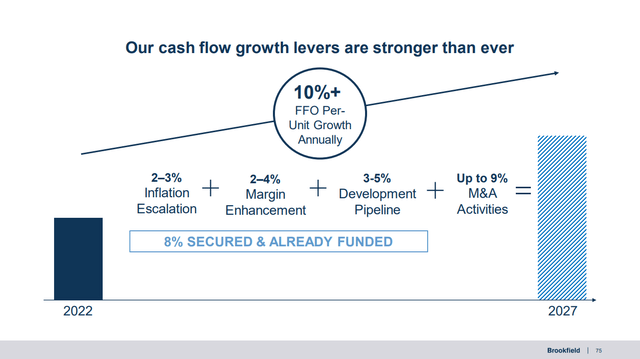

Going forward, the company appears very confident it can at least match the historical ~10% FFO/Unit growth it has historically delivered, and probably even more. Growth would be obtained from inflation escalations, margin enhancement, and delivering on the development pipeline. Further potential growth could come from merger and acquisition activities.

Brookfield Renewable Investor Presentation

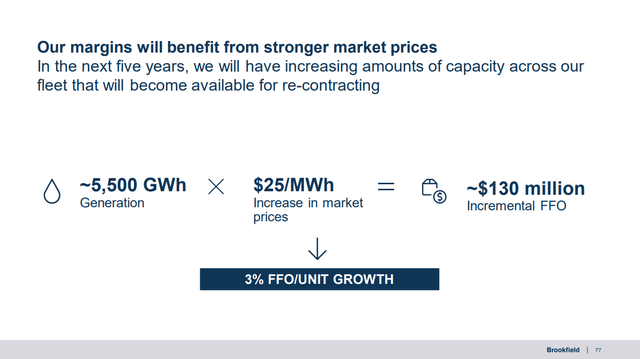

Most of these elements are self descriptive, but it is worth going into more detail with regards to margin enhancement. Beyond operational efficiencies, there is a great opportunity in the next few years to re-contract assets at the currently much higher energy prices. The company estimates these re-contracting opportunity at ~3% FFO/Unit growth.

Brookfield Renewable Investor Presentation

Conclusion

Growth opportunities for Brookfield Renewable are better than ever, with the current environment playing to its operational and financial strengths. The company has a highly visible path to double-digit FFO growth, and it expects its recent elevated level of growth to continue. The company sounded confident that it can continue delivering 5-9% distribution growth and 12-15% total returns.

The company is also doing all that it can to help secure a better energy future, saying that the macro environment today is reminiscent of the ‘oil crisis’ from the 19070’s. Just like it then sparked a significant build-out of domestic energy production, the current crisis should accelerate renewable energy development plans. The big takeaway is that renewables are the way forward if we want to pay less for imported fossil fuels, if we want to be more energy secure, and if we want to put a real fight against climate change.

Be the first to comment