Thomas Barwick

Co-produced with Treading Softly

When it comes to investing for dividends, there are often two camps. One camp buys lower-yielding securities with the hope and promise that the dividend payouts will grow with time. They are often called “dividend growth investors.”

Meanwhile, I have often pitched my tent in the other camp. I’m an income investor. I buy higher-yielding securities, which often have little expectation of growing their dividends in the near term, but I expect to be able to maintain them.

I create my own dividend growth through reinvestment. I encourage everyone to reinvest at minimum 25% of their dividends, even retirees, to keep their income growing. If you’re not living off of your dividends, reinvest as close to 100% of them as possible to rapidly grow your income stream.

So while I don’t invest specifically to enjoy dividend growth, I don’t avoid it either. In the HDO Model Portfolio, we have seen over 40 dividend hikes year to date!

I love when a dividend is hiked. It accelerates the growth of my income. With many “DGR” picks, you’re looking at a 2-3% dividend, and you need a very high growth rate to see meaningful income growth. When something already has a high yield, even a small hike is meaningful. For example, a 3% yielder hiking its dividend 10% has the same gross increase in income as a 10% yield hiking at only 3%.

When you can have both high yield and dividend growth, you’ll always see me happy to be owning and investing in such opportunities.

Today, I want to present you with two such opportunities.

Let’s dive in.

Pick #1: ORCC – Yield 10.3%

It is a huge year for BDCs, and even knowing that, Owl Rock Capital Corp. (ORCC) managed to exceed our expectations with its Q3 results. Just last quarter, we were happy that ORCC was covering its dividend. This quarter, ORCC hiked its common dividend from $0.31 to $0.33. Additionally, it announced a supplemental dividend of $0.03/share. We’ll see 16% more income in Q4 than in Q3.

ORCC knocked the ball out of the park. NII (net investment income) was up 15% from Q2 to $0.37, and book value was up 2.5% to $14.85.

For us income investors, it’s welcome news that ORCC is paying a supplemental dividend, and we appreciate ORCC making clear plans for future supplemental dividends. In the future, ORCC will pay a supplemental dividend of 50% of quarterly NII in excess of the regular quarterly dividend, rounded to the nearest penny. ORCC will cap the supplement dividend so that NAV does not lose more than $0.15 over two quarters. In other words, if bad times hit, the supplement will be paused to protect the company.

So ORCC is paying us more in the regular dividend and creating a framework to provide us with an extra supplement during this high-interest rate period where they have excess earnings. ORCC also announced they will be speeding up dividend payments, making them 15 days from the record date. It was previously 45 days. The supplemental dividend will be paid a month before the regular dividend. So the first supplement will be paid in December, while the regular dividend will be paid in January.

So we get paid more, we get paid sooner, and we get paid more frequently. I think I’m in love!

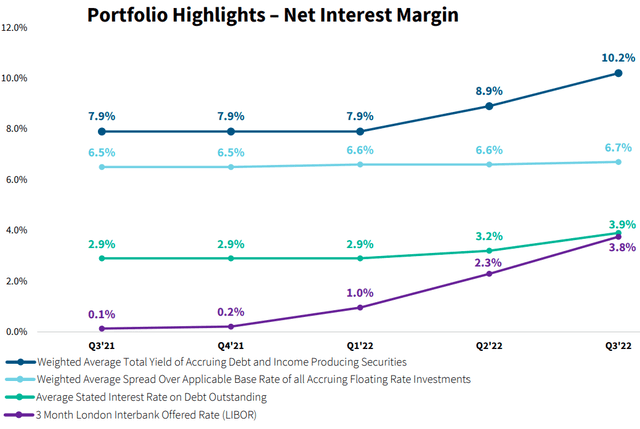

We can expect earnings to keep climbing. Like other BDCs, ORCC’s net interest margin is climbing quickly with rising LIBOR. (Source: ORCC Q3 Investor Presentation)

The Fed just hiked another 75 bps, and while there was a suggestion that they will be “slowing down,” another 50 bps by the end of the year is likely. This is driving ORCC’s earnings higher.

ORCC is a BDC that should be trading at a premium to book value. They have a high-quality portfolio, investment grade rating from the credit rating agencies, significant scale, growing earnings, modest leverage at 1.18x, and now, an extremely shareholder-friendly dividend policy.

There’s no reason for ORCC to be trading below $16, but I’m grateful that the market hasn’t realized that yet.

Pick #2: TPVG – Yield 11.4%

For the past decade, tech has been the place to be, and TriplePoint Venture Growth (TPVG) has been one of the BDCs at the heart of it. TPVG’s list of investments made pre-IPO is an impressive “who’s who” of the past decade in the tech world. (Source: TPVG Q3 2022 Investor Presentation)

TPVG Q3 2022 Investor Presentation

Well, we all know it has been a terrible year for tech, so TPVG must be doing horribly, right?

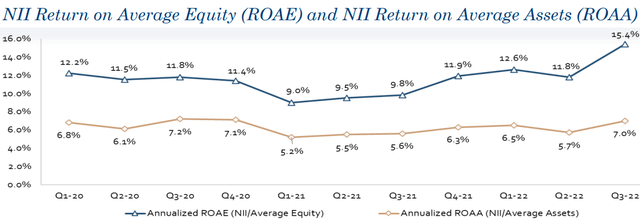

Wrong. TPVG’s earnings are going higher, with $0.51 in NII for the quarter. TPVG’s return on average equity skyrocketed in Q3.

TPVG Q3 2022 Investor Presentation

TPVG is benefiting directly from higher interest rates while also benefiting from a renewed interest in venture companies taking on debt. TPVG is a lender, first and foremost. While they have realized large gains on their equity positions when a company IPOs or is acquired, the bread and butter is interest payments.

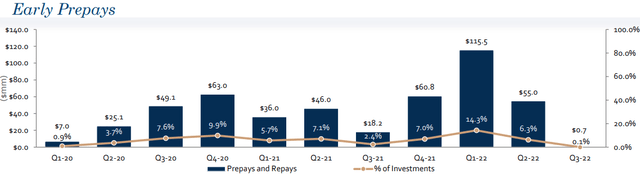

Today’s environment isn’t conducive for companies to IPO. As a result, they look to raise capital while they wait for bullishness to return to the market. Venture capitalists who already own the equity aren’t crazy about being diluted, so taking on debt becomes a solution. As a result, TPVG is seeing high demand for their loans, and companies are repaying slower.

Prepayments declined to virtually nothing in Q3.

TPVG Q3 2022 Investor Presentation

The result? TPVG collects interest for longer. This is why TPVG hiked its regular dividend to $0.37/share. It also has $0.52 in spillover income. In Q3 2020, TPVG had only $0.33 in spillover income and paid a $0.10 special dividend. With TPVG outearning its new dividend by a substantial margin, there’s a strong possibility that we see a special/supplemental dividend announced in December.

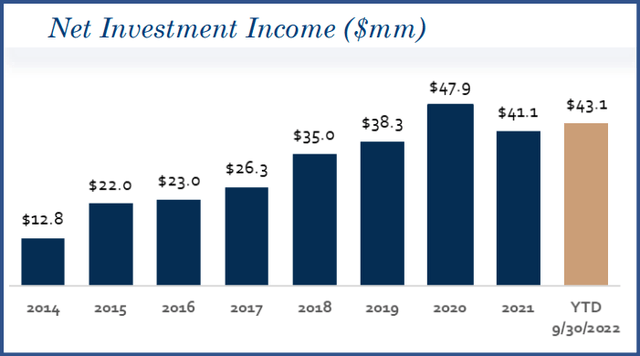

In just nine months, TPVG has exceeded their NII from last year. They will easily break the record year they had in 2020.

TPVG Q3 2022 Investor Presentation

TPVG has sold off because Mr. Caveman Market says “Tech BAAAAAD” and sells. TPVG isn’t a tech company. TPVG is a BDC that benefits from lending to late venture-stage companies preparing for an IPO or other liquidity event. If they take longer to prepare, that means more interest for TPVG to collect.

TPVG has historically traded at a large premium to NAV, and deservedly so. It’s ironic that while TPVG is having a record-breaking year, it’s trading at a discount to NAV. We are very happy to take advantage of the buying opportunity!

Dreamstime

Conclusion

With ORCC and TPVG, we can enjoy high yields now and enjoy dividend growth to boot. ORCC is even adding into the mix share buybacks while the share price is trading at a discount to book value.

These are things that high-yield income investors like myself personally enjoy seeing from our portfolio. I always will be camped out with the income investors, leveraging the market for high levels of current income. When companies are not hiking, I will increase my income myself by reinvesting a portion of my income. Buying more shares and collecting more dividends. When companies are beating expectations and hiking their dividends, that accelerates my income growth.

What does this mean for one’s retirement? That you can get great income to meet your needs now and see more income in the future without reinvestment. This doesn’t mean you should stop reinvesting, it simply means you will see even more benefits sooner!

This way, your retirement budget can continue to grow, or you’ll have more surplus for extra experiences, fun, or gift-giving to those you love. Financial freedom is having the ability to meet your needs and having enough to enjoy your chosen hobbies, all without having to watch every dollar leaving your account.

You can achieve that through income investing, and you can enjoy it faster when you get both high yields and dividend growth.

Be the first to comment