sankai

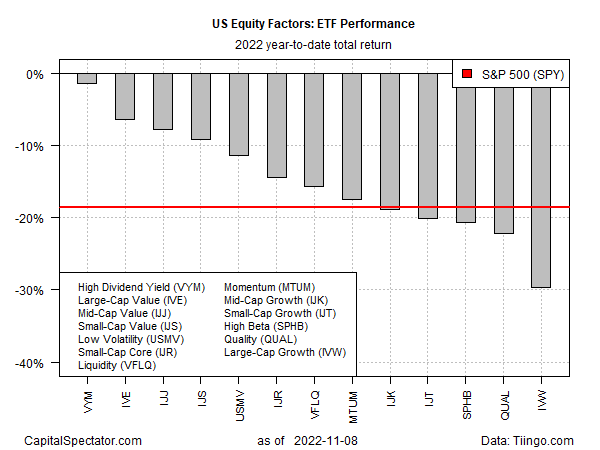

The stock market’s post-election performance starts today. From an equity-risk factor perspective, the horse race begins with high dividend yield in the pole position for year-to-date results, based on a set of ETFs through Tuesday’s close (Nov. 8).

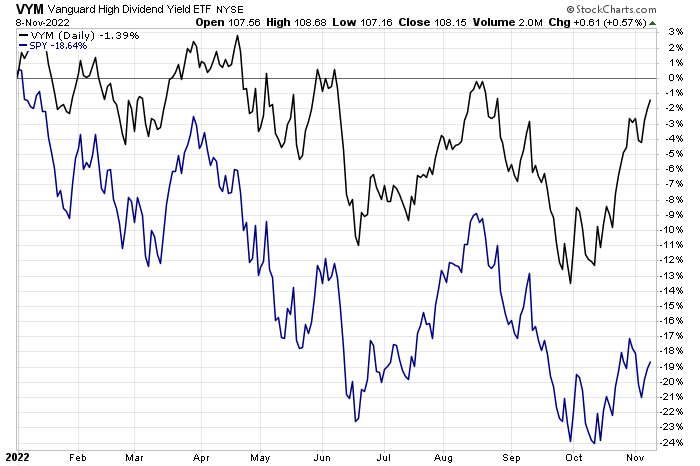

Vanguard High Dividend Yield (VYM) is the top performer for US equity factors, but in 2022 that translates to a relatively modest loss. Compared with the stock market overall, however, that’s no mean feat. SPDR S&P 500 (SPY), the broad index tracker for shares, has lost nearly 19% so far this year vs. a mild 1.4% setback for VYM.

Value stocks are also doing relatively well in 2022, posting the lightest factor losses after VYM. Large-cap value (IVE), for instance, is down a relatively light 6.4% year to date.

The hardest-hit corner of the factor universe: large-cap growth: iShares S&P 500 Growth ETF (IVW) is down nearly 30% this year.

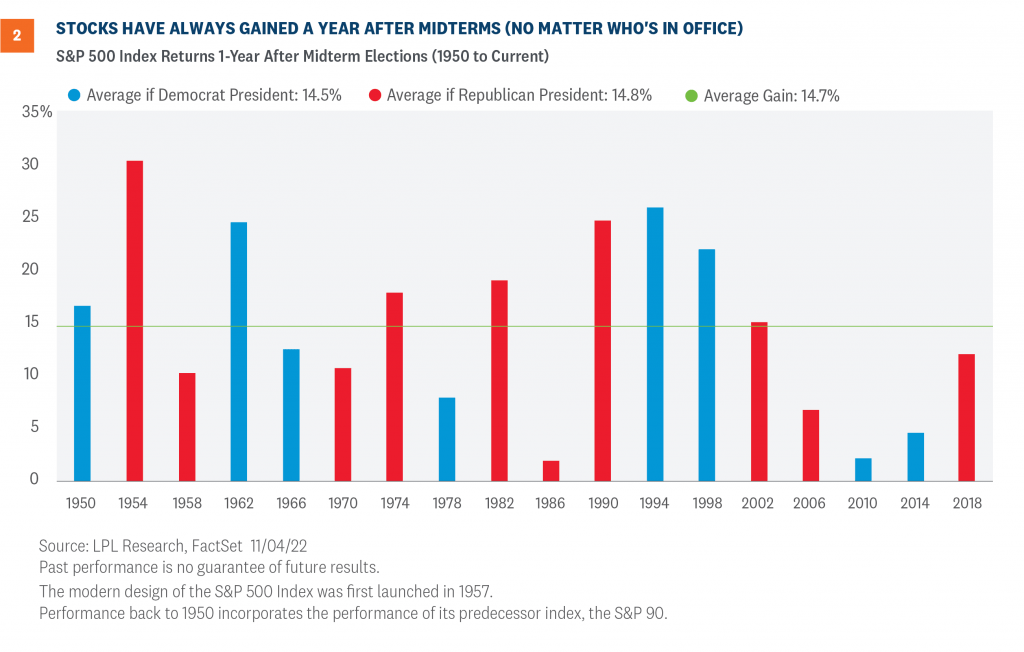

US stocks tend to rally after mid-term elections, according to analysis by LPL Financial. “There are a few possible fundamental reasons for market strength following midterm elections,” the firm’s Barry Gilbert and Jeff Buchbinder wrote earlier this week. “Primarily, the uncertainty associated with the election is behind us, and markets don’t like uncertainty. But on top of that, midterms usually provide something of a course correction from presidential elections… and markets may anticipate prospects of a better policy balance ahead, regardless of who is in the Oval Office.”

Lee Carter, president and partner at Maslansky + Partners, notes that “gridlock… has been pretty good for the markets.”

If so, the outlook looks relatively bright on a morning when control of Congress remains too close to call on Wednesday morning.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment