simoncarter/E+ via Getty Images

Thesis

Highland Global Allocation Fund (NYSE:HGLB) is a multi-asset global allocation fund. Per its literature:

The Fund seeks above-average risk-adjusted total returns by investing in U.S. and foreign equities and fixed income securities, along with select alternative investments in the pursuit of long-term capital growth and future income.

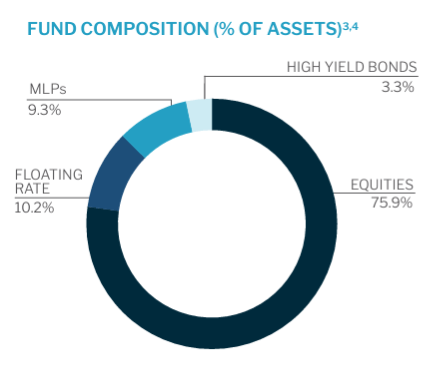

Currently over 75% of the fund is invested in equities, followed by floating rate loans (roughly 10% of the fund) and MLPs (also with around 10% allocation). The fund switched from an open-end structure to a CEF format in 2019:

DALLAS – Feb. 14, 2019 – Highland Capital Management Fund Advisors, L.P. (together with its affiliates, “Highland”) announced today that the Highland Global Allocation Fund, a series of Highland Funds II (the “Fund”) effected a reverse stock split of Class A, Class C and Class Y shares of the Fund and combined such shares into a single class of common shares under the CUSIP 43010T104 in connection with the Fund’s conversion from an open-end fund to a closed-end fund (the “Conversion”).

Since its conversion the CEF has always traded at a sizable discount to NAV due to the illiquidity of its top investment, namely Terrestar Corp. The CEF is now priced at a -19.8% discount to NAV. We expect the discount to always persist as long as Terrestar is in the portfolio.

The fund has a very concentrated portfolio. While the fund has 70 holdings, the top five names represent more than 45% of the CEF. Two of the top 3 names in the portfolio are private companies, with the top name TerreStar accounting for roughly 24% of the fund (via the equity and debt holdings). Terrestar is a privately held, nationwide licensee of wireless spectrum.

HGLB is a global CEF with a very broad mandate that allows the portfolio manager (Mr. Jim Dondero) to pretty much take risk as he sees fit from an allocation perspective. The fund takes very concentrated positions that include illiquid and private companies. By definition these type of investments are harder to value and exit, hence the significant discounts to NAV that the fund exhibits. In our view this is not an appropriate vehicle for a retail investor since the risk factors can change substantially, and in effect an investor is underwriting the Highland platform and Mr. Dondero’s investing acumen. Expect highly concentrated illiquid investments.

Holdings

The fund contains a mix of debt and equities:

Fund Composition (Fact Sheet)

We can see that over 75% of the fund is invested in equities, followed by floating rate loans and MLPs. The fund has a global geographic distribution:

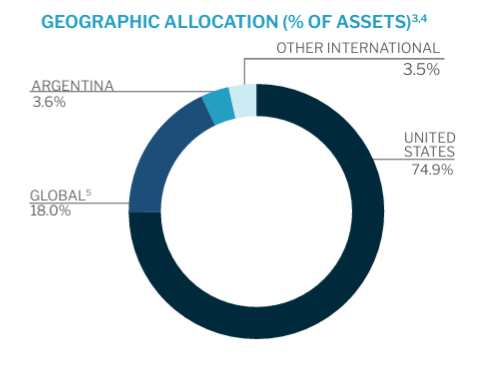

Allocation (fund fact sheet)

While the U.S. represents the largest exposure, the fund has a global mandate across debt and equity and can invest in a plethora of markets. We feel this broad mandate is not beneficial to shareholders because the risk factors can change swiftly and at the fund manager’s discretion. We would much rather see a global fund with a specific risk factor track record.

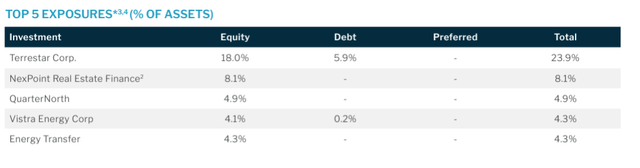

The vehicle is extremely concentrated in its top holdings:

Top 5 Exposures (Fund Fact Sheet)

We can see that the top five holdings represent more than 45% of the fund portfolio. This is fairly significant. It means that the fund performance is largely driven by a handful of names. We can see that historically this has been the theme for this fund:

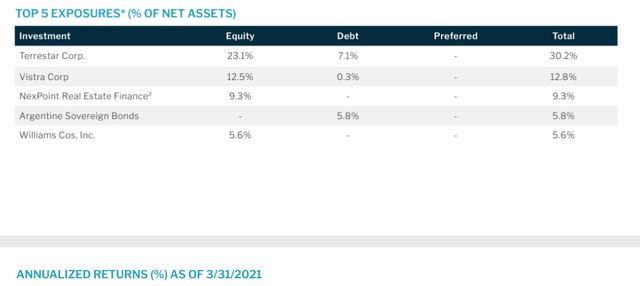

2021 Top Names (Fund Fact Sheet)

We can see from the Q1 2021 Fact Sheet that at the time the fund was running a similar concentration. In fact in Q1 2021 the top-5 names portfolio weighting represented more than 60% of the fund!

Let us have a closer look at the top names in the fund where the majority of the exposure lies. From the Annual Report we can find a little more about TerreStar:

TerreStar, the Fund’s largest position, was a positive contributor to performance during the year. Terrestar is a privately held, nationwide licensee of wireless spectrum, an asset that most people use every day. Spectrum is the radio frequency that carries all wireless communication signals. The Federal Communications Commission (the “FCC”), which has regulatory oversight in the space, administers spectrum for non-federal use. The FCC typically sells or assigns initial wireless spectrum licenses to market participants using an auction process. Access to spectrum may also be attained through the secondary market, which allows licensees like TerreStar to transfer, sell, or lease spectrum, in whole or in part.

[…]

TerreStar’s value is derived from two spectrum assets: a license for 1.7 GHz band spectrum covering 11 of the top 30 U.S. markets and approximately 19% of the population; and a license for 1.4 GHz band for use in wireless medical telemetry (“WMTS”), with the ability to expand into other areas. Dish owns the license covering the remaining 1.7 GHz band spectrum. TerreStar’s ownership of spectrum in key markets and with significant population coverage could make the company an attractive partner for other spectrum holders.

Source: Annual Report

We are not subject matter experts in this field but we can tell an investor that this is an illiquid, hard to value, hard to exit investment.

The 2nd name in the portfolio is NexPoint Real Estate Finance, Inc (NREF) which is a commercial real estate finance company. The company has a small market value of only $320mm, which makes HGLB’s holding to equate almost 7% of the company’s float. That is huge as well. If the fund ever chooses to liquidate its position it will need a substantial amount of time to do so given the volume in the shares and the position held.

The 3rd name in the portfolio is QuarterNorth. QuarterNorth is a private energy company focused on the Gulf of Mexico. Again we are looking at a private illiquid investment here. This is the theme of this fund so far.

Performance

The fund is up year to date based on long energy positions it undertook:

YTD Total Return (Seeking Alpha)

On a 3-year basis the performance is robust but with a massive -50% drawdown during Covid:

3Y Total Returns (Seeking Alpha)

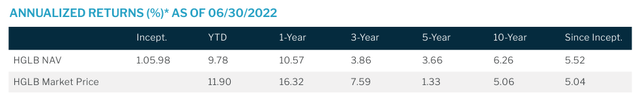

Longer term the fund has posted middle of the road returns:

Discount / Premium to NAV

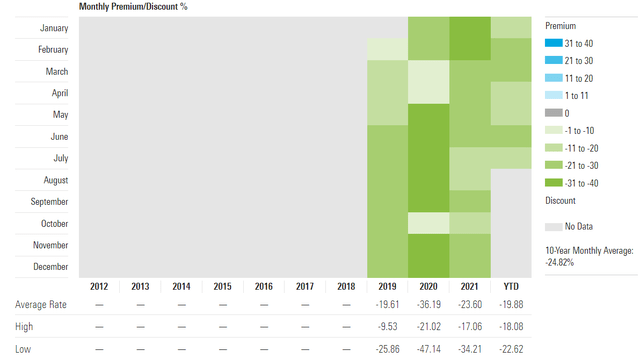

This fund trades at substantial discounts to net asset value:

Premium / Discount to NAV (Morningstar)

We can see that since the conversion to the CEF format the vehicle has traded at substantial discounts to NAV that have been as wide as 47% during 2020! We feel this is warranted due to the large concentration in an illiquid investment such as Terrestar where the value can lag the market substantially. Expect very high discounts for this fund.

Conclusion

HGLB is a global CEF with a very broad mandate. The fund allows the portfolio manager (Mr. Jim Dondero) to switch risk factors swiftly and across investment spectrums. The vehicle tends to take large, concentrated positions, especially in the private / illiquid securities space. These names are harder to value and exit, hence the very substantial discounts to NAV exhibited by the fund. Expect this theme to persist. Currently, the top name in the fund TerreStar accounts for roughly 24% of the portfolio (across debt and equity). In our view HGLB is not an appropriate vehicle for a retail investor unless one wants to underwrite Mr. Dondero’s investing acumen. The vehicle exhibits a long term annualized return of only 5%, obtained with a Sharpe ratio of only 0.29.

Be the first to comment