123dartist/iStock via Getty Images

Hexcel (NYSE:HXL) is one of those frustrating situations where I have a lot of regard for management and see significantly improving financials in the future, but where the share price today seems to already reflect those positives. I thought the same almost seven months ago, though, and that hasn’t kept the shares from rising about 15% since then, handily outperforming most of the company’s customer base and many other aircraft component suppliers.

Hexcel has done better than I expected on margins ahead of reacceleration in widebody production, but that outperformance doesn’t drive a big enough change in my model to fundamentally alter my valuation view. If you’re the type of investor who is less sensitive to valuation and more confident that the shares can see another run as widebody activity accelerates, there’s a case to be made for the shares. For me, though, I need a line of sight on better long-term financials or a lower entry price.

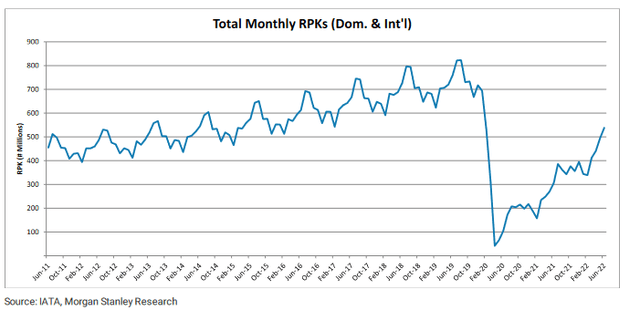

Traffic Is Slowly Improving

The June IATA numbers show ongoing recovery in global air travel, with revenue passenger kilometers down about 29% versus June of 2019, including a 19% decline in domestic travel and a 35% decline in international travel. When I last wrote about Hexcel, the most recent monthly data (December of 2021) had internal travel down 58% relative to pre-pandemic levels, so there has definitely been improvement even with the disruptions from Russia’s war in Ukraine and ongoing COVID-19 lockdowns in China.

Morgan Stanley research

In the meantime, a spike in fuel prices has no doubt reminded airlines of the benefits of running modern fuel-efficient aircraft, and that means newer planes with higher advanced material content (including Hexcel’s carbon fiber products). The “but” here is that that isn’t really new, and I don’t think the spike in fuel prices in the first half of 2022 really altered fleet management plans all that much.

Getting international travel back to pre-pandemic levels remains a key gating event for Hexcel. As international traffic improves, airlines will look to rebuild and renovate their widebody fleets, driving increased production schedules at Airbus (OTCPK:EADSY) and Boeing (BA) and higher revenue and margins for Hexcel.

Managing What They Can, And Exploring New Follow-On Opportunities

Throughout this downturn I have been impressed with management’s efforts to maintain profitability and liquidity, and that has not changed with two more quarters in the bag. The last quarter saw adjusted operating margin nearly double from the year-ago level (from 6% to 11.4%), with Composite Materials segment margin back near 15% and Engineered Products margin just above 12%.

Before the pandemic, Composite Materials were in the high-teens to low-20%’s, while Engineered Products was in the mid-to-high teens. Ramping the business back up to former levels will involve some execution risks, but given the efficiency/cost-cutting maneuvers management has taken (including letting go of some low-margin business and closing/reallocating some facilities), as well as the higher shipset content for new A355s and B787s ($2M to $5M, versus narrowbody content typically below $2M), I expect higher margins once the recovery/expansion phase really takes hold.

Of course, a major lingering question is just how strong that air travel recovery is and how willing airlines are to expand their operating fleets. I’m looking for double-digit revenue growth from Hexcel through 2026, then slowing into the mid-single-digits, but if the more bullish estimates of longer-term air travel demand growth prove accurate, my 4% revenue growth rate from 2019 to 2031 could be too low, perhaps materially so.

The timing, magnitude, and duration of the widebody recovery are still very much in question, but Hexcel isn’t just sitting on their hands and waiting for business to improve. As I hoped to see, and discussed previously in that prior article, management is actively seeking opportunities for new business, though mostly in areas where the company is already established, at least for now.

Since my last update, the company announced agreements with Dassault (OTCPK:DUAVF) (AM.PA) to supply prepreg for the F10X bizjet and with Lockheed Martin (LMT) to supply more content on the CH-53K helicopter program, with potential content of around $3.5M if Hexcel handles more of the rotor manufacturing.

There’s still more work to do here, though. I think management is absolutely making the right decision to focus on higher-value carbon fiber components (which have much better margins), but the downside to that focus is a narrower set of opportunities – customers in end-markets like autos and wind power just don’t need the high-modulus products that carry better margins. Still, markets like urban air could eventually prove to be worthwhile, as could commercial space, but neither are likely to be major contributors over the next 10 years, and certainly not over the next five.

The Outlook

Hexcel has a $7 billion-plus backlog and strong leverage to that eventual recovery in widebody aircraft production. In the meantime, the company is benefiting from recovering narrowbody production, as well as strong growth in bizjets (helped by both underlying unit volume strength and content gains/business wins). With a strong margin base, I expect accelerating revenue over the next five years to drive strong margin leverage.

As I said above, I’m looking for long-term “like for like” growth in the neighborhood of 4% from the 2019 starting point. A stronger, longer aircraft recovery cycle could drive upside, but then there’s also the risk that demand doesn’t materialize to the extent bulls expect. As that revenue ramps, I believe Hexcel will generate stronger margins and record FCF margins, driving healthy mid-single-digit FCF growth from that former peak in FY’19.

How sustainable that margin/FCF margin leverage will be is a valid question – while I’m explicitly modeling new highs for FCF margins, aircraft OEMs usually push hard on suppliers when margins expand, so I don’t want to assume the company can achieve mid-teens (or better) FCF margins on a sustained basis.

The Bottom Line

Neither of my preferred valuation approaches (discounted cash flow) or margin/return-driven EV/EBTIDA suggest substantial undervaluation today. By discounted cash flow, Hexcel seems roughly fairly valued, with a prospective long-term annualized return in the high single-digits. Using my above-consensus FY’24 operating margin and EBITDA estimates, and a 14x multiple, and discounting back at 9%, I get a fair value in the high $50’s.

As I said, investors who are less sensitive to valuation and/or have more bullish recovery expectations likely won’t be deterred, and I’m happy to acknowledge that Hexcel could still have sentiment-driven upside as widebody production recovers and then accelerates. Still, as a more valuation-driven investor, I just don’t see enough upside here today, even though I do like how management has been running this business.

Be the first to comment