shiyali/iStock via Getty Images

Science has it:

Mankind must reduce the burning of fossil fuels in order to avoid unpredictably adverse (and thus expensive) consequences of further man-made climate change.

This means nothing less than a transformation of a very substantial share of how we humans generate, store, transport and use energy – i.e. the fundament of pretty much any personal or commercial activity.

It goes without saying that with such a key change a lot of money will be made by those betting on the right horse today.

Consequently, there is a lot of excitement about the potential winners. Tesla (TSLA), the battery electric car maker, comes to mind. Arguably by now a well-established business and brand, but still carrying an ambitious valuation. But the hype goes further, take Plug Power (PLUG) for example, a green hydrogen company with a strong history of share issuing and not so strong margins, nonetheless currently trading at an EV/sales ratio of about 16. Or the handful of massively hyped European electrolyser manufacturers like Norwegian Nel Asa (OTCPK:NLLSF) or British ITM Power Plc (OTCPK:ITMPF) – the latter being an example that you can easily find an industrial company in the space that grows revenues by 10% YoY, produces a TTM negative EBITDA of more than 7-times TTM revenue, and yet trades at an EV/Sales ratio of 46.

With this article I want to present to readers a potential beneficiary of the ongoing energy transformation that is (unadjusted!) EBITDA positive in its core business and a well-established organisation: Norwegian Hexagon Composites, ASA (OTCPK:HXGCF) – by the way, not to be confused with Swedish Hexagon AB (OTCPK:HXGBF).

The company’s name refers to its core competence: designing, building and integrating high pressure cylinders made of composite materials (e.g., by combining a carbon fiber reinforced plastic structure with an internal liner made of gas-tight, polyethylene plastic) used to store and transport gas and referred to as Type 4 cylinders (where 4 essentially counts the generation of cylinder technologies).

As I will explain below in more detail, Hexagon Composites does not only carry a lot less risk than most of the high attention plays, but it comes with substantial upside, too.

This article is structured as follows:

- Introduction of Hexagon Composites, ASA, and its stock listed 73.3% subsidiary Hexagon Purus ASA (OTCPK:HPURF)

- SWOT Analysis of the business (strengths, weaknesses, opportunities and threats)

- Valuation considerations

I recently entered what into what I refer as a “half position” and consider it a long-time holding. In my opinion, the company is a Buy because it will benefit from long term essentials for the energy transformation whose swift implementation is supported by government financial support globally.

Hexagon Composites at a glance

Some Stock Basics

Hexagon Composites (hereafter just HC) is an Aalesund, Norway, domiciled company that has its main stock listing at the Oslo Stock Exchange. The company prepares its consolidated financial statements in accordance with IFRS, and its reporting currency is the Norwegian Krone (or: NOK). Currently, NOK 10 trade for about USD 0.95 – so readers may just divide all following NOK numbers by ten in order to get a reasonable sense for the scale of operations in USD or EUR or CHF.

The company’s fiscal year is the calendar year. Readers interested to deep dive will find no articles on SA published after 2014, but you have direct access to transcripts and even recordings of recent quarterly earnings calls.

At the October 15, 2022, closing price of NOK 22.26, HC’s equity is valued at NOK 4.49 billion (or some USD 450 million)

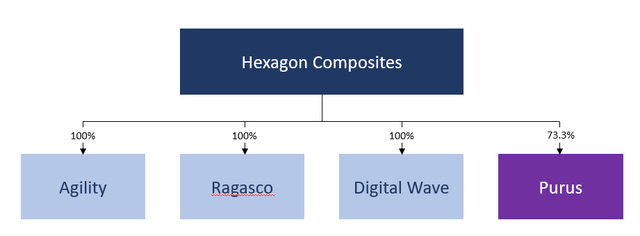

HC has four reporting segments which I will soon discuss in more detail. The company moved around parts of its business between segments quite a bit during the last 24 months, but the current view seems to be stable. All percentages are based on most recent revenue numbers in order to take into account the different growth paths for the various segments:

- Hexagon Agility (contributing about 67.0% of group revenue per HY2022)

- Hexagon Ragasco (15.3%)

- Hexagon Digital Wave (1.8%), and

- Hexagon Purus (16.0%)

Hexagon Purus (hereafter HP or just Purus) stock is listed in Oslo as well, and HC holds a 73.3% stake in that business. At the October 15, 2022 closing price of NOK 18.66, HP’s equity is valued at NOK 4.82 billion, i.e. HC’s 73.3% stake is valued at about NOK 3.53 billion and thereby implying a value of some NOK 1 billion to all the non-HP business. We will come back to these relations in the Section devoted to valuation.

Purus raised additional share capital of about NOK 600 million (a roughly 10% increase at the time) in February 2022. HC made its proportionate contribution, thereby maintaining the stake it had after Purus went public December 14, 2020. However, HC management has stated at various occasions that it expects to reduce its Purus stake to below 50% over time, without giving any specific time schedule. I will come back to this below, especially when it comes to the cash needs of the businesses. At the HY2022 earnings call, HC CEO Jon Engeset stated that Purus is 95% independent already (with the remaining 5% mostly representing shared rents).

And a quick reminder of some basic principle of financial consolidation: HC is the controlling shareholder of HP, thus HC is fully consolidating Purus in its group financial statements. In most financial communication by HC, management reports HC excluding HP (hereafter HCxP) separate from Purus. I remind readers that for e.g. revenue despite full consolidation the simplistic equation of HC = HCxP + HP does not hold, simply because of inter-segment effects. More specifically and as an example, Agility sells some of its products to HP and these internal sales are not reflected in consolidated financials (but the sale of those products by Purus to its third-party customers is, of course).

Author

Some Terminology

Before we can dive deeper into the various businesses, I consider it sensible to introduce some abbreviations / terminology and background:

- HDV / MDV / LDV = Heavy / Medium / Light Duty Vehicle

- LCV = Light Commercial Vehicle

- BEV / FCEV = Battery / Fuel Cell Electric Vehicle

- LPG = Liquefied Petroleum Gas, sometimes also referred to as Autogas. It consists of mainly Propane (C3H8) and Butane (C4H10), i.e. Hydrocarbons. LPG is essentially a by-product of Natural Gas Processing and Oil Refining. It is currently the third most popular automotive fuel in the world, with its use is highly concentrated in certain markets. Propane and Butane are easily liquefied due to their low boiling points of -42° C and -1°C, respectively. Liquefying is a key element of using any kind of gas for running vehicles, because of the substantial volume reduction and thus increase in energy density.

- CNG = Compressed Natural Gas. Natural Gas is essentially Methane (CH4). Methane’s boiling point is at around -161°C. One approach to liquefy is to compress it to around 200 bar, thereby achieving a 1:200 volume reduction.

- LNG = Liquefied Natural Gas. Methane as well, here a 1:600 compression is achieved by cooling Natural Gas to about -162°C – a more complex process, but generating higher density.

- RNG = Renewable Natural Gas. Again, Methane, but here the leading letter does not refer to how the Methane is processed, but to how it is generated. Biogas used to produce RNG comes from a variety of sources, including municipal solid waste landfills, digesters at water resource recovery facilities (wastewater treatment plants), livestock farms, food production facilities and organic waste management operations (source: EPA). Take for example my German town of residence, Hamburg, which just announced a 100 MWh powerplant fuelled by wastewater residuals – maybe the most stable source, because as long as there are humans, there will be, well, wastewater.

- GHG = Greenhouse Gas

- H2 = Hydrogen, the pure gas, which is not readily available in the atmosphere or from some underground storage, so it needs to be generated from e.g. water or Methane, by some physical or chemical process. In an ideal world, green energy is used to generate H2 (and heat) from water, and such H2 is used when and where needed to generate energy with just water (and heat) as byproduct.

Apparently, there was a lot mentioning of Hydrocarbons in the above listing, and some readers may wonder how that fits into an article that covers a stock in the context green energy transformation.

We will come back to this natural question in the SWOT analysis section below. But what I can state right here already is that HC provides for a lot of solutions not only for a perfectly renewable future, but also for the years bridging between today and such future.

To me, this is one of the reasons why HC is an appealing investment today.

Segment Hexagon Agility

Let’s start with Agility, currently the largest segment which became a 100% subsidiary in 2019 (here is a link to the website of the operational entity). Per the company’s self-description (emphasis added):

Hexagon Agility (…) is a leading global provider of clean fuel solutions for commercial vehicles and gas transportation solutions. Its product offerings include natural gas storage and delivery systems, Type 4 composite natural gas cylinders, propane, and natural gas fuel systems.

Thus, in essence, Agility is offering two things: First, Type 4 cylinders for storing Natural Gas or Propane on commercial vehicles as the fuel of those vehicles and the integration of this fuel storage with the engine, see the following example taken from the company’s homepage:

Company Website

This use is quite obvious once one concludes that either gas is a sensible fuel for vehicles – in particular those that Agility is focussing on, like heavy duty trucks, refuse trucks, coaches, school buses and the likes.

Most Natural Gas and Propane used today comes from fossil sources. Nonetheless, there are reasons to consider it a positive contribution to the energy transformation. Specifically:

- Burning Methane reduces CO2 emissions by some 15% (relative to the energy generated) compared to other fossil fuels, and it reduces the emission of nitrite oxides even further (source). In other words, using fossil Natural Gas is not as bad as using Diesel or gasoline, just by the gross emission. But there are further non-negatives with using Methane to fuel vehicles (source): First, “human activities emitting methane include leaks from natural gas systems” (often from oil drilling). So, collecting the Methane while it is leaking anyways and using it makes sense (but this, of course, is a tricky argument – it is just making a certain use of a certain fossil fuel less bad). And second, burning the GHG Methane turns it into the GHG CO2, which is also less bad compared to releasing Methane – at least for the highly relevant next decades.

- Renewable Natural Gas is essentially carbon neutral. There are various examples for companies generating their own RNG, such as distilleries or landfill operators. It is obviously a great incentive for entities to use RNG derived from its production waste residues to power its fleet of delivery trucks. Or to run refuse trucks with the RNG gas gained from the landfill collected.

The latter item above applies at a much wider scale than just e.g. a distillery. The technology to generate renewable fuels, including but not limited to RNG, is advancing, take for example Germany based VERBIO AG (OTC:VBVBF), a large scale producer of RNG from straw and other agricultural by-products, thereby (in theory) avoiding the tank-or-plate dilemma often cited for this type of RNG.

The RNG production sites are located next to the farms, thus all too often in quite a distance to consumers of such RNG or at least a pipeline of a large-scale Natural Gas distribution system (note that RNG is chemically perfectly identical to Methane of fossil origin, thus there is no issue whatsoever about mixing them).

And here, Agility’s second main offering comes into play: Mobile pipeline. This solution connects producers or RNG with users or at least some fixed pipeline based distribution system. And I want to share with readers how big one can go with Type 4 cylinders:

Company Homepage

In a nutshell, Hexagon Agility contributes to the energy transformation and reduced GHG emissions by dealing with those hydrocarbon fuels that reduce emissions compared to other fossil fuels – and that ideally are of non-fossil origin in the first place.

Segment Hexagon Ragasco

Next segment is Ragasco. We start with a quick self-introduction again (source for all Ragasco quotes and screenshots):

Our mission is to transform the use of LPG into an easier and safer experience for everyone. Our lightweight, durable cylinders bring confidence in the use of LPG, leaving users free to focus on the things that matter most in their daily lives.

Here is the range of applications:

Company Website

Apparently, this is just the other end of the range of size for the composite cylinders manufactured by Hexagon Composite Group. Some readers may actually use the company’s products at home or in their RV.

However, the true relevance of Ragasco’s offering is not related to leisure time in rich countries, but addresses basic needs in countries with less developed infrastructure, for example per the following reference on Ragasco’s homepage:

“The Lebanese market was in need of a safer cylinder in the wake of a series of LPG related accidents in our country. The launch of the Hexagon Ragasco cylinder in Lebanon with its unblemished safety record has therefore been welcomed with open arms by the population. Yes, it’s all about safety, it’s all about our complete trust in Hexagon Ragasco to keep our families safe.”

Rock Chlela, Managing Director, ROX GAS, Lebanon.

And providing a safe source of LPG for cooking will help to reduce the use of coal and other sources of energy with higher GHG emissions, thereby also providing a means of energy transformation, albeit not one that is usual getting the spotlight.

Segment Hexagon Digital Wave

We can now turn to Hexagons smallest segment, Digital Wave. Here is Digital Wave’s introduction:

We manufacturer Ultrasonic Examination (UE) cylinder testing equipment, Modal Acoustic Emission (MAE) testing equipment and are a provider of associated inspection services. With applications worldwide, Hexagon Digital Wave serves government entities, academic institutes, and private clients in the compressed gas and pressure vessel industries.

I advise readers to note that Digital Wave is both

- Producer of testing equipment and

- Provider of inspection services

The latter element is of particular interest, because this business is ongoing and – according to management statement – it comes with the most favourable gross margins.

Apparently, cylinder inspection is relevant for all business introduced so far, but it also applies to cylinders used for other purposes, such as to “evaluate [the] end of life performance and requalification methods for TC-3CCM cylinder used in [Canadian] Fire Fighting applications”.

Segment Hexagon Purus

And finally, there is Hexagon Purus. Again, we let the business speak for itself first:

We are global leaders in key technologies needed for zero emission mobility, providing type 4 high-pressure cylinders, fuel storage and distribution systems for hydrogen, complete vehicle systems and battery packs for fuel cell electric and battery electric vehicles (FCEV and BEV).

Here, too, it makes sense to decompose this compact presentation of the segment’s business:

- Producer of Type 4 cylinders for H2 – this is not a surprise, since these cylinders are the root business of Hexagon Group. These cylinders can be used to store H2 in vehicles or marine vessels etc. to provide fuel; they can also be used to store and distribute H2, like the mobile pipeline offering discussed for Agility above.

- Provider of complete vehicle systems for FCEVs

- Provider of complete vehicle systems for BEVs

These latter two points deserve some additional comments. The first thing to note is that even FCEVs all run with a battery. Among other things and in simple terms, the battery aligns the power needed by the drivetrain, thereby acting as a buffer between the fuel cells (as power generators) and the drivetrain (power user). It is also used to recuperate energy that becomes available when braking, increasing any electric car’s energy efficiency.

So, there is a natural link to batteries in the context of fuel cells, to which Purus provides the fuel. This is not just limited to selling cylinders, but involves integrating the cylinders into the entire design: This starts with mass balancing (cylinders and batteries), includes fine-tuning the H2 output from the cylinders to the FC, and integration with the entire vehicle energy system.

Purus does not report any segments, but its 2021 acquisition Wystrach is often reported separately by management. Wystrach offers the full range of H2 distribution systems and is significant to Purus, as it contributed about 2/3 of the entity’s 2q22 revenue at a 10% EBITDA margin.

Summary Of Hexagon’s Business

Hexagon’s cylinder offering ranges from 5 kg household-use Propane cylinders (Ragasco) to stacks of 20+ feet cylinders for Mobile Pipeline solutions – providing for some natural diversification and different growth rates and margins. It is a well-established brand in its relevant markets.

It’s offering in the space of providing fuel to vehicles, trains and vessels is also as diversified as possible at this stage of the energy transformation, ranging from Autogas and Natural Gas all the way to H2. Here, Hexagon essentially is a supplier to and system integrator for OEMs in the respective markets.

Digital Wave may be small at this point, but as it helps to make the testing and (re-)certification of cylinders of all type faster and more efficient, it for sure has a bright future, especially if one assumes that the use of gas will increase.

However, energy storing and transportation is constantly developing and the final call has not yet been made in particular regarding the preferred carrier for green energy (e.g. Methane, H2, Ammoniac) and the best way to store it (gaseous or liquid). Consequently, Hexagon acquired 40% stakes in private Cryoshelter’s development companies for H2 and Methane storing solutions in liquid form, respectively.

Strengths, Weaknesses, Opportunities And Threats

With that background on the company, let’s now look at the good and the possible not so good in more detail.

Strengths

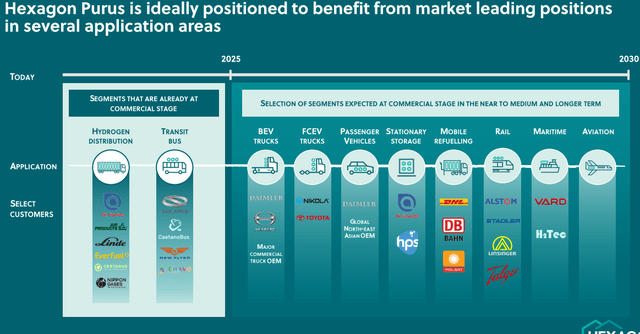

First of all, HC is an industry and technology leader. Take for example the following slide from Purus’ latest capital markets day presentation:

Company Presentation

If you are in the H2 business, this is the customer list you want to have: Gas giants like Linde (LIN), established HDV OEMs like Daimler Trucks (OTCPK:DTRUY), bets-on-the-future like Nikola (NKLA) or solid plays in the electrification area like Alstom (OTCPK:ALSMY). Alstom is of particular interest because it was them that prepared the FC system to run the first regular H2 trains in the German state of Lower Saxony (replacing Diesel train on tracks in rural areas where electrification of railroad tracks would not pay off – and where green wind energy is available at large).

Plus, the company is constantly developing its business, see for example Digital Wave. Management underpinned the relevance it is seeing in this business by making it a segment – and the prospects are great, considering the foreseeable transition to gaseous fuels, specifically with the increasing installed base of cylinders delivered by HC itself.

And except for the non-Wystrach Purus business, all segments were EBITDA positive in 2q22, despite the recent input cost pressure, that HC is facing. So, management knows how to run a business and generate margins once it scales.

Weaknesses

While positive EBITDA margins are fine – especially if they are undadjusted – they are not profits, and they are not even positive cash contributions. During the first six months of 2022, HC (with Purus fully consolidated) had a negative combined net cash outflow from operations and investments of NOK 363 million. This compares to Bank Deposits, Cash and Similar of NOK 800 million and current assets in excess of current liabilities of NOK 1’800 million. The 2q22 Debt-to-Equity ratio was 1.12 and stable.

None of these metrics are raising red flags and with government and corporate spending likely to increase short-term and long-term financing is unlikely to become an issue in my opinion. But in all other aspects the overall economic environment is getting tougher for borrowers.

Opportunities

The opportunities are big, and they are the main reason for this article and my bullish stance.

The world (or rather how humans source and use energy) needs to change, and it needs to do so fast. Governments understand, and so do more and more corporations – see for example Mercedes-Benz (OTCPK:MBGAF) October 2022 decision to commission a Baltic Sea offshore wind park exclusively generating energy for the company. In fact, according to a Handelsblatt report, Mercedes wants to generate more than 50% of its electricity needs itself by 2027.

But most renewable energy production is unstable. Thus, using and storing excess production for use at times with low supply will be key. There are all sorts of solutions to this basic challenge and Power-to-Gas approaches are among the most prominent ones and typically involve H2, Methane (i.e. RNG) and Ammoniac.

HC’s offering is somewhat agnostic with respect to which gas is used and where it is generated from. The more decentralised energy production will become, the more HC’s mobile pipeline solutions will benefit. And the more vehicles/vessels etc. will be fuelled by gas, the more Purus and Agility will benefit. And the more gas is stored and transported in cylinders, the better off Digital Wave will be.

As a result, HC may be a good choice for investors who are convinced that H2 will become a meaningful fuel in the transportation or even passenger car market, but which are not sure on which electrolyser maker to place their bet on – or who may be scared by the massive valuations of PLUG and its peers: H2 cylinders will be needed in any case.

Threats (And Risks)

A large part of HC’s business is with the automobile industry where HC acts as a supplier. Where its business is more or less limited to specialty items like the large cylinders for mobile pipeline solutions there is little risk that the OEMs will attempt to do this by themselves. However, battery/drivetrain integration is way more at the heart of building trucks and even passenger vehicles. Thus, OEM and competitive pressure may increase over time. In fact, I find the prospects of the battery related business of Purus hardest to assess.

Plus, there is the risk that CNG and H2 remain a niche concept (at best) for fuelling cars and trucks and trains and vessels. The rationale for H2 and CNG (derived from RNG) are different, and there are niche applications where H2 does make sense, e.g. whenever weight matters. But as large as the opportunity is, the spectrum of possible solutions for the energy transformation appears to be equally as large. And while I believe that HC is well-positioned to benefit, there is a risk that this transformation will rely on solutions that HC is less of a beneficiary than expected.

And of course, for the time being, there is the risk from rising input expenses – and that management is pushing too hard with customers for price increases. On the other hand, the increase in Diesel prices is beneficial for many of HC’s customers, because RNG investments now pay off much faster.

Finally, it goes without saying that a recession is rarely a positive for businesses, even those likely to benefit from government programs.

Measurement And Conclusion

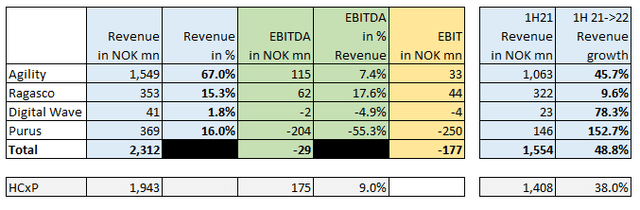

The following table provides for an overview of key metrics of the four segments (before inter-segment elimination with Purus) in 1H22 and some YoY growth figures:

Author

At 2q22, management gave a FY 2022 Revenue guidance for HCxP of NOK 3.7 to 3.9 billion which was confirmed in an October 14, 2022 news release, where management made specific reference to the strong backlog. The midpoint of that range is slightly below of twice the revenue reported for 1H22.

However, per the same news release, EBITDA guidance for HCxP was cut by 17.5% from the previously assumed NOK 400 million:

However, we continue to experience exceptionally high costs of production which we are unable to mitigate in the short term. Hexagon is accordingly adjusting its EBITDA guidance for full year 2022 to approximately NOK 325 million.

Thus, instead of improving EBITDA margins, investors should now expect shrinking margins during the second half of the year.

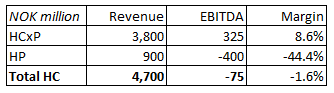

No corresponding release was made for Hexagon Purus. Accordingly, the FY22 guidance given in the half-year presentation stands: Revenue of NOK 900 million and EBITDA of NOK -400 million.

Overall, we get this picture (with Revenue midpoint for HCxP):

Author

To put this into context: As discussed above, HC currently trades at a market cap of roughly NOK 4.5 billion, i.e. just below 1x 2022 current revenue guidance.

At the 2q22 earnings call, management gave a 2025 revenue outlook for HCxP of NOK 6 billion and for HP of NOK 4-5 billion.

If the group would indeed manage to generate this level of sales, HC would be a NOK 10-11 billion revenue company 3.5 years from now. My expectation is that HCxP EBITDA margins make it into low double-digit territory by then, and that Purus should turn EBITDA positive. In that scenario I would expect a valuation of a very minimum of 1x Revenue for the group, implying a more than 100% upside from today.

As a first conclusion, I think HC is an interesting option for investors in the energy transformation. As discussed in the introducing comment there is a wide range of opportunities (even if one limits itself to more or less “pureplay” entities):

- YieldCos like Brookfield Renewable Partners L.P. (BEP) operate renewable energy production sites like wind parks and solar farms etc. and provide for stable dividends and growth over time – these present the least risky option.

- HC is more risky and provides more upside, while being an established business with positive EBITDA margins outside the Purus business.

- There are makers of wind engines, solar panels or converters – which may be closest to HC when it comes to the risk reward profile.

- BEV car makers address a gigantic market, but the place is getting crowded and valuations of the new companies like TSLA anticipate a lot of success already.

- Electrolyser and Fuel Cell makers will be likely large winners if H2 indeed will play the key role in decarbonisation that many anticipate. However, I find valuations of pureplays in this area way too high.

Overall, I think that HC has an excellent risk / reward balance in a market with foreseeable strong growth.

As discussed above, around 75% of HC group’s valuation can be allocated to its Purus stake. For the reasons discussed in the previous section, I see bigger risks with Purus compared to HCxP, and I think the non-Purus business is priced very attractively at around 0.25* expected 2022 revenue.

Thus, I prefer Hexagon Composites as an investment over Hexagon Purus.

However, reasonable people can disagree about where exactly the most interesting opportunities will be, so I invite readers to share their views in the comments section.

Be the first to comment