Sundry Photography/iStock Editorial via Getty Images

Thesis

Hewlett Packard Enterprise (NYSE:HPE) operates a cloud services business, offering a wide range of data storage, processing, and AI solutions. HPE’s stock has seen unimpressive performance for the past few years, with revenue struggling to establish a growth pattern. Looked at by many as a more conservative, value opportunity in the information technology sector, Hewlett Packard’s financial performance, outlook, and valuation are examined in this analysis.

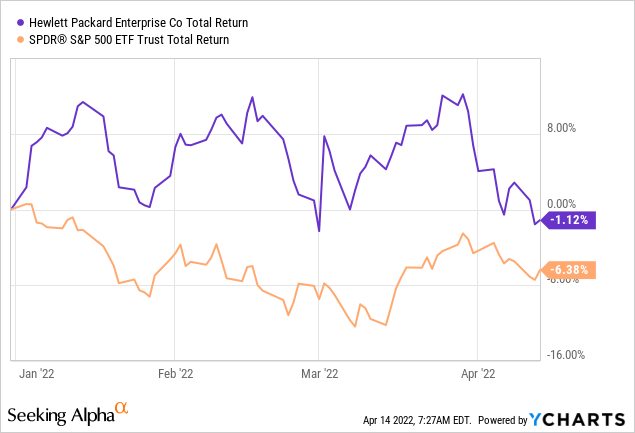

Recent Stock Price Performance

HPE has experienced a moderate decline since the beginning of 2022. Despite broader turmoil in equity markets, the stock has shown resilience, despite displaying elevated volatility. On a YoY basis, Hewlett Packard has seen a -1.2% stock price retreat, after swiftly recovering from a significant, sharp decline in 2020, following the COVID-19 stock market crash. Currently, HPE trades at a -26% discount compared to 52-week high levels, at a $20B market cap, paying a 3.10% dividend yield.

The business

Hewlett Packard Enterprise is a global technology leader offering companies that need a cloud-solutions set to manage data and workloads a wide range of edge-to-cloud solutions. The company was brought into existence following the spun-off from the parent HP Inc (formerly known as Hewlett Packard Company), in 2015, and has since operated as a separate, publicly-traded entity.

HPE’s operations are organized into 4 major business segments: Compute, HPC & AI, Storage, and Intelligent Edge. The Compute segment offers both general-purpose servers for multi-workload computing and workload-optimized servers which offer the optimal performance and value for demanding applications. Compute offerings also include operational and support services. The HPC & AI business offers standard and custom hardware and software solutions designed to support specific use cases, that include supercomputing systems, a data solutions portfolio, AI software and more. The storage segment provides clients with a comprehensive data infrastructure to enable the simplification of IT operations. Customers can store and serve their data with speed and high availability while at the same time securing them against cyber threats. Finally, the Intelligent Edge business segment is comprised of a portfolio of secure edge-to-cloud solutions, that include wired and wireless local area networks, campus and data center switching, as well as software and network security solutions. Source: 10-k report 2021

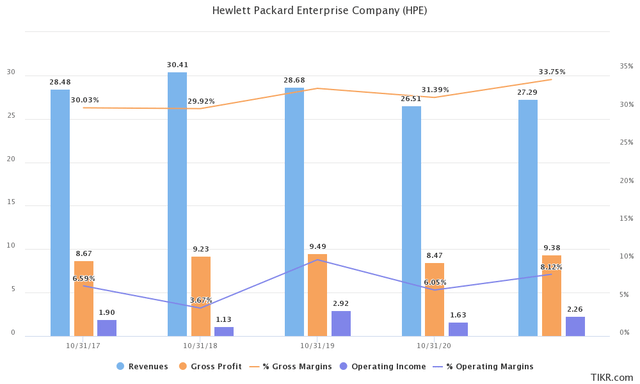

Growth & Profitability

In a sector known for aggressive growth and wide profit margins, HPE appears to be an outlier. Revenue has actually slightly decreased since 2017 (from $28.5B to $27.3B), with gross margins consistently floating around the 30% mark, significantly lower than the sector median of 50%. Operating income growth and margins follow a similar trajectory, appearing unimpressive for growth-oriented investors. In a market that shows increasing demand for cloud services, investors and analysts find it hard to come to grips with HPE’s underwhelming financial performance.

Cash flow generation has seen some variability over the last few years, displaying seasonality and perhaps pointing to some concern regarding HPE’s long-term output prospects. In 2021, however, the company generated a record $5.7B in cash from operating activities. Capital expenditure over time displays consistency, hovering around $3B over the last 5 years. The company is also regularly engaging in M&A activities with Cash acquisitions reported at $505M for the 2021 fiscal year and 866M for 2020.

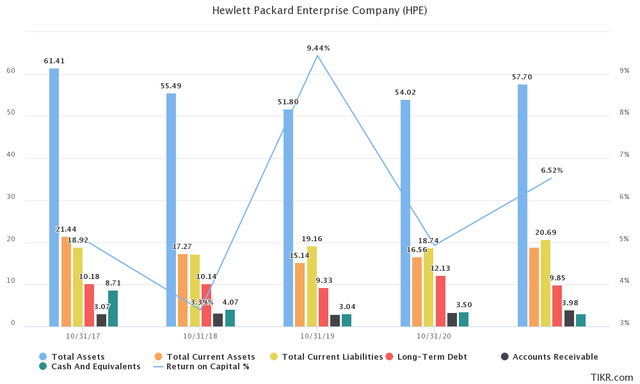

Balance Sheet

A quick examination of HPE’s balance sheet provides mixed signals. Total assets have remained relatively flat since 2017, and while the company maintains a sizable cash stockpile of around $3.5B, it also employs a significant amount of leverage. Returns on capital have been moderately attractive, amounting to 6.5% for the 2021 fiscal year, while fluctuating between 3-10%, since 2017. Current and quick ratios below the desirable 1.0x threshold, also exhume a certain amount of concern for HPE’s short-term liquidity.

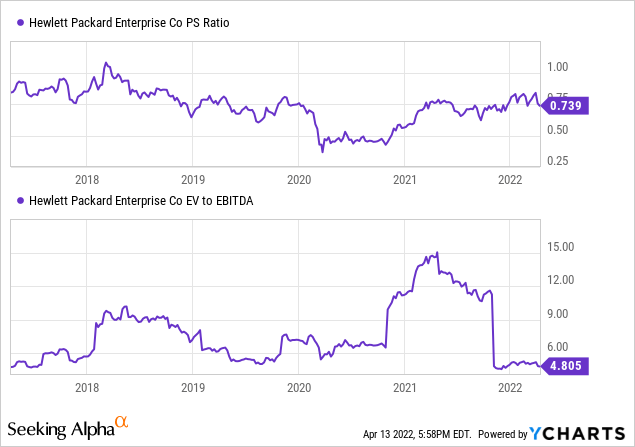

Valuation

Despite a highly recognizable brand name and a significant presence in the information technology sector, HPE should be considered more of a value play rather than a growth one. After all, revenue growth is failing to impress, while profitability is just moderately attractive, especially for a company focusing on could technology solutions. At a 0.74x P/S multiple, HPE might initially appear very inexpensively valued. However, historically, over the past 3 years, the company has traded at an average 0.63x P/S multiple that had even dropped below 0.5x, for the better part of 2020, following the outbreak of the COVID-19 global pandemic. Excluding the 2020 downturn and the consequential valuation multiple decent, HPE currently appears to be reasonably valued. On an EV/EBITDA basis, the company appears to be trading below 3 and 5-year average multiples.

The Dividend Perspective

Hewlett Packard offers an attractive 3.10% dividend yield, double the size of what the S&P 500 is currently offering. After significant increases in payouts from 2017 to 2018, dividend growth has stalled, with 3-year CAGR growth at just 2.17%. Considering high inflationary pressures and an information technology sector that has increased dividends on average at 7.70% over the same time period, it is fair to say that the dividend growth argument for HPE is, in fact, somewhat weak. On a more positive note, share buybacks have been persistent, increasing shareholders’ value by reducing the share count. Common shares outstanding have decreased from 1.6B in 2017 to 1.3B in 2021.

Near-Term Outlook & Recent News

Analysts expect growth to pick up a bit over the next 3 years, with revenue projected to reach $30B for the 2024 fiscal year, implying a 2.56% CAGR. Still, growth is not where investors would want, struggling to displace the inflationary pressures currently challenging equity markets. Earnings growth is expected to be more aggressive at a 6% CAGR, through 2024. Coupled with improved FCF productivity, it could reinforce the HPE value argument significantly.

Hewlett Packard reported better-than-expected results for Q1 2022, in March, with the stock reacting positively to the expanded upside potential. HPE’s increased backlog was viewed as a sign of strong demand. Management also provided raised earnings guidance for the 2022 fiscal year.

In more recent news, however, Morgan Stanley’s move to downgrade the stock to “underweight” caused the price to retreat on Tuesday. Morgan Stanley’s price target was also lowered from $17 to $15. Hewlett Packard declared a $0.12/share quarterly dividend, on March 9, 2022, payable on April 8.

Final Thoughts

While at current valuation multiples HPE appears reasonably valued, the company gives mixed signals in terms of financial performance. Underwhelming growth and moderately attractive profitability fail to generate an appealing outlook for the stock. Some added concerns regarding the company’s balance sheet also steer me away from considering initiating a long position, for now. I would rate the stock as a hold at this time.

Be the first to comment