tupungato

Thesis

Severely affected by the Covid-19 global pandemic, Hertz Global Holdings, Inc.’s (NASDAQ:HTZ) global vehicle rental business struggled to survive. It has been, just in the past year, showing recovery signs. In this analysis, I examine the company’s journey through bankruptcy along with management’s efforts for recovery, as well as the financial changes Hertz has managed to record since. Special attention is also paid to the company’s strategic move toward electric vehicles (“EVs”).

Business Overview

Hertz is a global vehicle rental business, operating more than 14,000 franchise locations across the world. The company uses both on-airport and off-airport franchise locations in almost all major cities, with customers primarily including tourism and business travelers. The company also offers some leasing and fleet management solutions through subsidiaries. Hertz reports results in 2 geographic operating segments; Americas RAC (U.S., Canada, Latin America) and International RAC. Hertz’s rental business is conducted under 4 brands; Hertz, Dollar Car Rental, Thrifty Car Rental and Firefly Car Rental. In terms of revenue composition, 32% of revenue came from off-airport locations in 2021 (versus 46% in 2020).

Resurgence from Bankruptcy

As the Covid-19 pandemic halted travel worldwide, Hertz’s business came under extreme financial distress that led to the company filing for bankruptcy. On May 18, 2020, the company’s CEO resigned and Hertz filed for Chapter 11 bankruptcy four days later. After the news became known, the well-known investor Carl Icahn sold his 39% stake in Hertz in its entirety for just $0.72 per share, taking a $2 billion loss.

In a weird turn of events, Hertz shares soared in the coming weeks with a growing number of retail investors and speculators hoping that more value could be salvaged out of the company. Shares climbed, in a matter of weeks to over $5.00, and management seized the opportunity to issue new equity before the SEC intervened. Assisted by a global car-chip shortage and skyrocketed used cars prices Hertz managed to sell a large portion of its fleet close to cost. As travel was somewhat rejuvenated later in 2020, car rental saw increasing demand while the global shortages persisted. On the improved prospects, Hertz managed to raise more than $5 billion in private equity capital to escape its bankruptcy status.

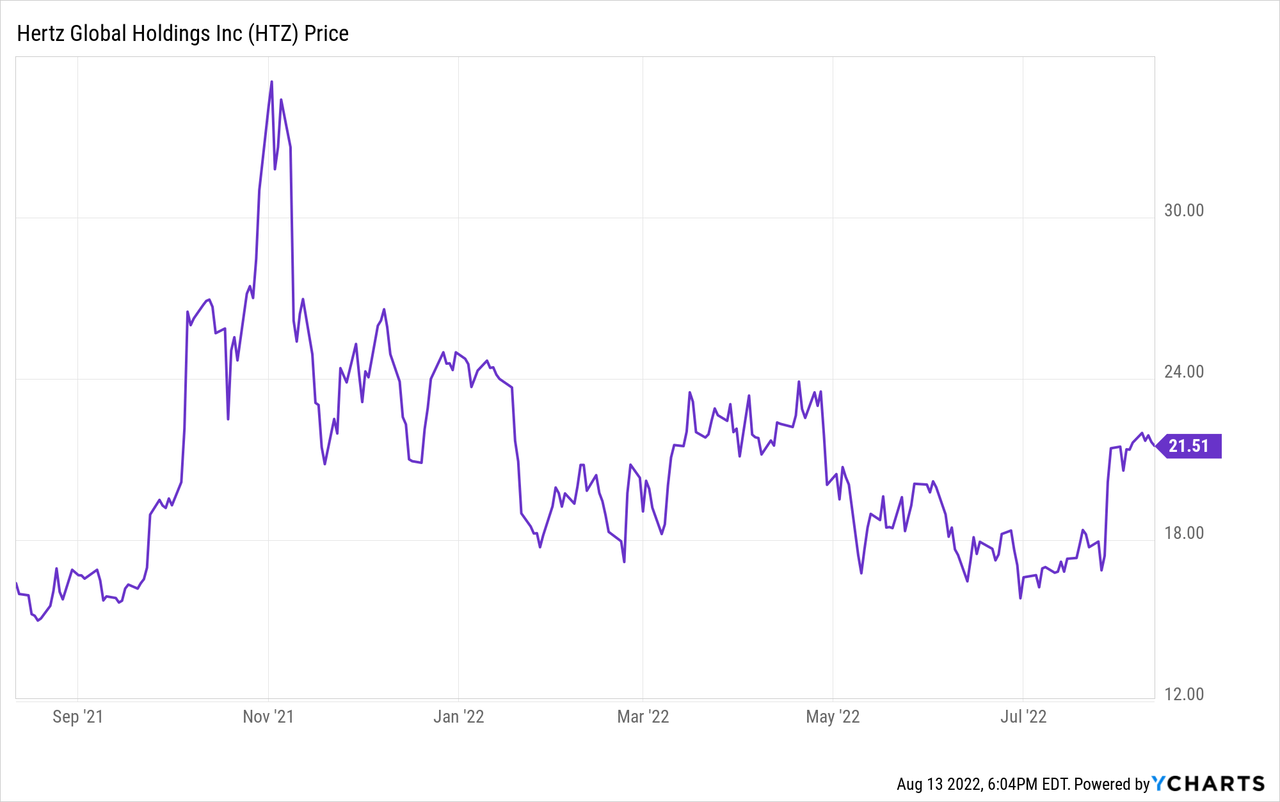

Stock Price Performance

As the company relisted in the NASDAQ through an IPO, its shares have been trading since late 2021. A short-lived stock price spike followed the IPO, lifting shares up, only to later get caught in the broader market retreat of 2022. Currently, the stock has recovered from its 52-week lows, trading at a $7.7B market cap, marking a -13% YTD return. The company pays no dividend and trades at $21.50 per share.

Financial Healing and Risk Factors

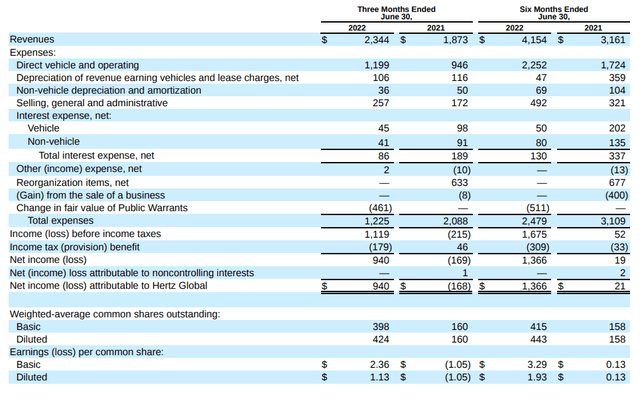

On July 28, 2022, Hertz released results for the second quarter of 2022. Compared to the same trailing 3-month and 6-month periods in 2021, results on the income statement appear improved. Revenue shows solid recovery signs, as Hertz has generated since the beginning of the year $4.15B (vs 3.16 in 2021) and $2.34B (vs $1.87B in 2021) in the past 3 months. Vehicle utilization remains at just under 80%.

Compared to a barely breaking-even Q1 and Q2 in 2021, this year the company has already earned $1.37B in net income. What is more important is the fact that total expenses have actually decreased, showing greater operational efficiency, while also reflecting the interest payment reduction the company has managed to achieve.

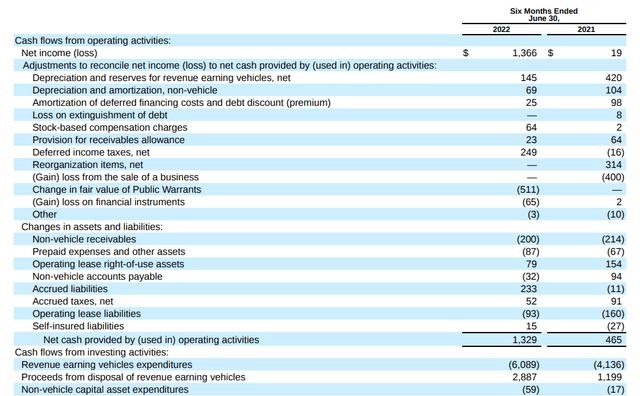

As expected, cash flow from operations has also significantly improved, following the positive changes in net income. Some cash-negative changes in working capital items would require to be addressed in the coming quarters, however. Net capital expenditures have also increased as Hertz reassembles parts of its vehicle fleet.

While some significant offloading of debt has occurred since the company’s bankruptcy, aiming to de-risk the business, still, Hertz maintains very high levels of leverage. As of June 30, 2022, Hertz carries $13.4B in debt, consisting of vehicle and non-vehicle debt. That is compared to $10.9B at the end of 2021. With the outstanding balance almost twice the size of the company’s current market cap, it is clear that Hertz should be viewed as a risky investment.

Hertz’s debt is mostly fixed-rate, and even though the effective interest rate has decreased, debt service payments still consume significant amounts of cash flows, while hurting profitability as well.

Other risk factors the company faces include intense competition and persisting supply chain disruptions. Price is the primary competitive factor in the rental vehicle market and as customers grow more cost-conscious, price wars between competitors could decrease margins. Pricing is also affected by the availability of vehicles and the challenges that the automobile industry is currently tasked with, complicating operational and financial planning.

The EV Catalyst

Expanding the use of electric vehicles in an effort to diversify the overall fleet, has become a major strategic priority for Hertz. Management has entered a massive 100,000 car purchase agreement with Tesla in 2021, leading car rental providers across the world. With electric vehicles seemingly able to increase customer satisfaction, faster adaptation and availability of electric vehicles (mainly Teslas) could be a differentiator in a highly competitive market.

By the end of 2022, management expects to have all 100,000 Teslas (TSLA) available to customers, as the company already offers Model 3 and Ys in multiple markets across the world. As gas prices remain elevated, electric vehicle rentals become more appealing, especially for tourist travelers. In addition, given the zero gas expenditure, Hertz can maintain competitive pricing against rental companies that offer primarily gasoline-operated cars, protecting profitability margins. According to Hertz’s CEO:

“Tesla cars are booked at premium rates that are typically $30 to $35 in excess of comparable average rates. Customers are enjoying the Tesla EV experience, which is being expressed in NPS scores that are 10 points higher than our global average.”

The company is also planning to add electric cars from other manufacturers to its fleet in the in the next couple of years

Valuation

Overall, Hartz trades at reasonable valuation multiples. On a GAAP P/E basis, the stock trades around 13x TTM, while the FWD multiple is looking significantly lower. It is important to note however that 2022 earnings performance is likely to deteriorate going into 2023. While a look at the P/S multiple should provide a better understanding of the company’s valuation, at 1.15x TTM and 0.86x FWD it also seems reasonable, as does a 2.43 FWD multiple.

Final Thoughts

After all things are considered, after almost 2 years of financial and operational challenges Hertz seems able to stand back on its feet, ready to record a profitable fiscal year marked by top and bottom line growth in 2022. Despite a valuation that seems favorable and a likely beneficial turn towards EV, the company still carries a serious load of risk factors, especially over the mid-term.

Be the first to comment