arlutz73

Shares of The Hershey Company (NYSE:HSY) have been a strong performer over the past year, and it has certainly rewarded long-term investors like myself, tripling over the past ten years. With its iconic brands, US-focus, and significant pricing power, I have been glad to be a long-term part-owner of this business and have viewed it like a Warren Buffett “hold forever” type investment. But at $220, its multiple has become expensive. As a consequence, while long-term holders with large tax gains like myself should hold the stock, I would wait for a pullback to buy more.

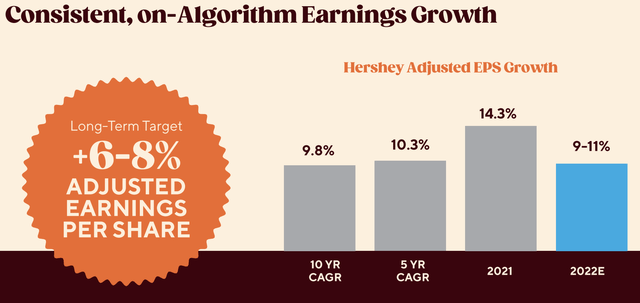

Hershey operates its business aiming to generate 2-4% topline growth and 6-8% EPS growth over the long-term, and management has succeeded in doing just that. As you can see, over the past five and ten years, the company has exceeded this growth target, and it will do so once again in 2022 (Note that guidance has been raised subsequent to this presentation with 2022 adjusted EPS growth likely to be 12-14%).

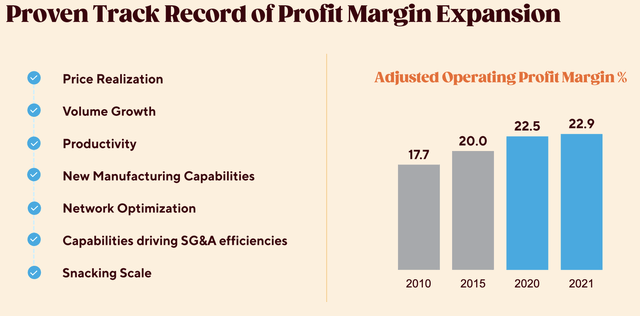

Hershey has been able to generate this strong earnings growth both by growing its sales base and boosting prices. Profit margins have been steadily increasing, and while margins may tick down slightly in 2022, they should stay on par with 2020 results. Hershey has managed through a period of high inflation well. The company has taken steps where possible to reduce its cocoa costs, and the Hershey owns such iconic brands like Hershey, Reese’s, Kit Kat (in the US), and Twizzlers that it has been able to push price to consumers. It has also purchased Skinny Pop and Dot’s Pretzels to expand away from sweets and into salty snacks to success so far.

As seen in the company’s second quarter, its strong performance continues, though there are some signs growth may start to slow from a breakneck pace. Organic, constant currency revenue rose by 14.1%, which enabled adjusted earnings per share to rise 22% to $1.80. Pricing was a 9.5% tailwind; consumers love their sugar, and Hershey has taken advantage of this to significantly push up prices. Volume was up 4.6%, in part due to inventory catch-up, and this growth should moderate somewhat. While adjusted gross margins did fall 250bp from a year ago, it remains a still strong 43.9%.

North American confectionary is the core driver of the business and saw net sales growth of 12.4% to $1.91 billion thanks to a 9.8% price increase. This unit accounts for about 80% of the company’s revenue and 90% of its profits, given higher margins. Volumes rose 2.6% but fell 3.4% holding retailer inventories constant. This inventory rebuild has helped boost H1 results but is largely played out. The ex-inventory decline suggests that price increases may be starting to hit consumer demand and is a reason why I expect growth to moderate over the next twelve months.

The company has been expanding into salty snacks first with Skinny Pop and then last year Dot’s Pretzels. Sales are now $256 million, and the company is reporting double digit price and volume growth. With such strong volume growth, it does not appear that pricing is yet eating into demand here.

One reason, I have liked Hershey is it has little overseas exposure. International revenue is just $207 million, or 8% of the total. Its small penetration creates ample room for growth, and we are seeing that with volume gains of 17.6%. It also means that Hershey is largely immune from the strengthening dollar, which will be a headwind for many more globally-oriented consumer goods companies like Procter & Gamble (PG). The US-orientation of Hershey’s business is a clear positive in the current environment of a strong dollar and slow overseas economic growth.

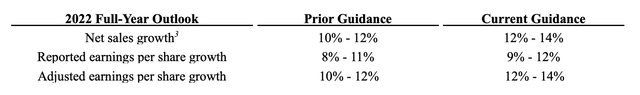

Based on the strength of its results, Hershey raised guidance with both revenue and adjusted EPS slated to grow about 13%. Again, being able to keep bottom-line growth on par with the top-line is really impressive margin resilience. The power of its brands has enabled Hershey to weather the storm of higher input prices better than most any other firm. This should lead the company to earn about $8.15 this year. With inventories also normalizing ahead of the critical Halloween season, Hershey is poised to meet that consumer demand and report strong results in a few weeks.

The challenge is that at the midpoint of guidance Hershey is trading 26x earnings, a higher multiple than companies like Alphabet (GOOG) (GOOGL). Hershey is a premium brand, but with volume growth and/or pricing growth like to slow as consumer demand begins to show some elasticity, the stock is expensive. This multiple is likely a reason why shares have stalled out in the $220 area. Moreover, in a higher interest rate world where you can earn 4% in treasuries rather than the 2% of a year ago, it is more difficult to justify this multiple, let alone multiple expansion required to lift the stock substantially higher.

Now, investors in the stock do enjoy steady income growth. While the strong share performance has pushed the dividend yield down to1.88%, it has an 8.3% growth rate over the past five years. In July, the dividend on the common stock was increased 15% to $1.036. I would anticipate another high-single digit increase next year. Over time, management has committed to a balanced capital allocation policy with 60% reinvested in the business or M&A and 40% returned to shareholders. The ownership structure of the company means this conservative approach is likely to persist.

Hershey has a unique corporate structure as founder Milton Hershey put his stake into a charitable trust that benefits the Milton Hershey School. This meant Hershey stayed a for-profit company, but its primary shareholder is non-profit. The Hershey Trust has Class B stock that receives 90% of the dividends of the common stock but 10x the voting rights. This means the Trust has majority control of the company and three board seats.

This structure allows management to take the long-term view and be immune from any potential activist pressure, but it also means the company is unlikely to ever be acquired with several failed efforts in the past, including from Cadbury and Mondelez (MDLZ). In fact, given its iconic status, Pennsylvania law gives the state Attorney General specific power to intervene if an acquisition would lead to the Trust no longer having voting control of the company. While investors should always scrutinize voting structures carefully, HSY has proven itself able to operate well with this system for many years now.

I believe the trust ownership has contributed to HSY’s very conservative balance sheet positioning. The company carries just $4.3 billion in debt, down from $5 billion at year end, less than 10% of its $45 billion market capitalization. For comparison, Kraft Heinz (KHC) has $21 billion in debt against a $41 billion market cap. Very little debt means the company is positioned well for a period of rising interest rates. While its low debt load adds to its defense nature, if anything, I would like to see the company increase its debt load somewhat to do M&A or repurchase stock in the event of a pullback. Given its ownership structure, I expect there will be reticence to do so.

Hershey is a phenomenal operator with strong brands that give it pricing pressure, the right geographic mix for the current environment, and a stellar balance sheet. If the stock market falls further, I would expect HSY to outperform thanks to its quality, defensive characteristics. Absent a transformational action (which is unlikely with its Trust ownership), I struggle though to see much upside with a 26x multiple and volume growth likely to slow now that inventories are being rebuilt and consumer demand is showing some sensitivity to higher prices in the key confectionary business.

Hershey will need to generate continued 6-8% earnings growth over the next two years in order to grow into its multiple. I do believe “owning” rather than trading shares of Hershey is the right long-term strategy given its steady growth engine and balance sheet flexibility. Owning a defensive, recession-resistant stock is useful in a portfolio context to help provide stability. As such, I would recommend continuing to hold HSY stock (particularly if you have a large unrealized taxable gain), and investors may consider selling upside calls above the $230 strike to supplement their dividend income. For new investors, I would wait for to return to $205 or a 25x multiple to buy in. Hershey is a great company, but at its current valuation, this is being fully reflected.

Be the first to comment