Scott Olson

Introduction

The Hershey Company (NYSE:HSY) is one of the leading chocolate manufacturers in the world. It produces chocolate and non-chocolate confectionery as well as baked sweets.

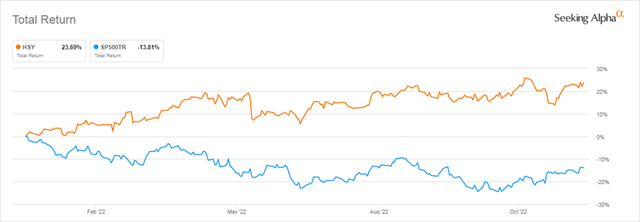

It outperformed the market over the last year, owing to its strong brand portfolio, bolstered by multiple recent acquisitions. Moreover, focusing on innovation and strategic pricing initiatives improved the company’s overall performance.

Despite the increased inflation that weighed on its operating expenses, Hershey raised its guidance for 2022 and is well-positioned in its industry, as we will explain in this article. Finally, it has strong quality, value, and momentum factors, which resulted in a high overall ranking in our factor-based system. All these factors provide considerable evidence that it is an attractive investment opportunity with significant upside potential.

Business Segments

The Hershey Company was founded in 1894 and is the largest chocolate manufacturer in North America and a global leader in chocolate and non-chocolate confectionery. Its brands include Hershey’s, Almond Joy, Reese’s, and snack brands such as Skinny Pop. It used to report its revenues under two geographic operating segments (North America and International) but recently began reporting its operations under three reportable segments:

- North America Confectionery (82% of 3Q22 net revenues): includes traditional chocolate and non-chocolate confectionery products distributed in the U.S. and Canada. This segment reported a 10.4% growth in sales during the third quarter of 2022 versus the same period last year.

- North America Salty Snacks (10% of 3Q22 net revenues): includes salty snacking goods sold in the U.S. Ready-to-eat popcorn, baked and trans-fat-free snacks, pretzels, and other snacks fall under this category. This segment witnessed a massive 86.9% growth during the third quarter of 2022 compared to the same quarter of 2021, which was mainly due to the acquisitions of Dot’s and Pretzels;

- International (8% of 3Q22 net revenues) includes all the company’s revenue generated outside of North America, and its third-quarter 2022 net sales increased by 15.4%.

During its latest quarter, Hershey delivered a bundle of positive news. The company has beaten analysts’ expectations on the top and bottom lines. Total revenue grew by 15.6% year over year, reaching $2.73 billion, while earnings per share reached $2.17, compared to $2.10 during the same period in 2021. Furthermore, management increased their full-year EPS growth guidance to 14-15%, owing to stronger consumer demand. It is impressive growth, especially in a year with significant supply chain disruptions, ongoing inflationary pressures on input costs, and increased threats of a global recession.

Hershey has made substantial investments in expanding its production capacity. According to the company’s CFO, two new Reese’s lines were brought online in the third quarter to support key forms and packs intended to optimize production and support future growth.

Furthermore, Hershey is turning into a powerful dividend stock. It has been increasing its dividend payment for 13 consecutive years, and earlier this month, it announced a quarterly dividend of $1.036 to its stockholders. Its forward dividend yield is 1.77%, which is low compared to other dividend-paying companies. Still, the five-year average growth rate is 8.74% at a 45.65% payout ratio, making it appealing to investors.

Competitive Advantage

Following this overview of the company’s outstanding performance and promising business outlook, we will analyze its current market position using Porter’s Five Forces.

Threat of New Entrants (Low)

It is challenging for any new entrant to maintain competitive prices due to the economies of scale that favor Hershey and the other major players in the sector. Furthermore, new entrants will need to compete for shelf spaces, which is difficult with well-established companies with robust supply chains and distribution channels.

Threat of Substitutes (High)

Hershey’s substitutes range from healthy sweets and confectionary products to candies, chocolate bars, and baked goods. These products threaten the company’s growth because there are no switching costs for customers, as they can move to the next product on the shelf. Nonetheless, Hershey began promoting and stressing its goods’ health benefits and its brands through effective media marketing.

Bargaining Power of Customers (Low)

The global confectionery market is vast, and its customer segments are extensive, with various tastes. The sales value per customer is insignificant relative to the company’s overall sales. Accordingly, the large customer base dilutes the customer’s negotiating power. However, customers are price sensitive, and if Hershey pursues an aggressive pricing approach, it will lose some market share, which we believe will not be the case based on its pricing strategy over the last few years.

Bargaining Power of Suppliers (Low)

Cocoa products are Hershey’s vital raw materials. They are obtained directly from third-party suppliers that grow beans in various regions, such as the Far East, West Africa, and Central and South America. The suppliers do not provide exclusive or largely differentiated products that can affect production or business continuity. As a result, they do not have significant bargaining power, and Hershey can easily switch to alternative suppliers without incurring high switching costs.

Competitive Rivalry (High)

Hershey operates in a highly competitive market dominated by many multinational and regional firms, including Mars Inc., Nestle, and Chocoladefabriken Lindt & Sprüngli. In addition to product innovation, quality, pricing, brand awareness, and loyalty, competition depends on the capacity to identify and meet consumer preferences. Local bakeries and confectioneries, which operate on a much smaller scale, are also possible competitors. And, because there are no switching costs, price competition is fierce.

Rankings

After extensive back-testing for the results of our ranking system, we identified that firms scoring above 90 (the top decile) performed better than other companies. In this case, Hershey ranks among the first decile stocks, with a rank of 96.62, which includes a mix of quality, value, and momentum factors. Hence, it is considered an appealing investment opportunity. Below you can find the breakdown of the ranking by factor:

|

Ranking (%) |

Quality (45%) |

Value (20%) |

Momentum (35%) |

|

96.6 |

97.4 |

63.4 |

78.1 |

Source: Factor-Based

To get the final rank, we first give each of the nine factors a weight before normalizing it to a percentile. The process is explained in our Factor-Based US Equity Strategy presentation.

Now, we’ll look more closely at some factors to see how they led to Hershey’s excellent rating compared to other companies.

Quality

One of the quality factors is the gross profitability ratio which indicates the profitability efficiency relative to the company’s assets. Although this ratio dipped in 2021 following many acquisitions, such as Lily’s Sweets (May 2021) and Pretzels (November 2021), it recovered during this year.

Factset & Factor-Based

Return on Equity (ROE) is another metric that shows how much profit each dollar generates for its shareholders’ investments. Hershey’s ROE of 56.46% is relatively higher than that of its main competitors, such as Chocoladefabriken Lindt & Sprüngli AG (OTCPK:LDSVF), General Mills, Inc. (GIS), Nestlé S.A. (OTCPK:NSRGY), and Mondelez International, Inc. (MDLZ).

|

Company |

ROE TTM (%) |

|

The Hershey Company |

56.46 |

|

Nestlé S.A. |

36.46 |

|

General Mills, Inc. |

28.62 |

|

Chocoladefabriken Lindt & Sprüngli AG |

11.79 |

|

Mondelez International, Inc. |

11.55 |

Value

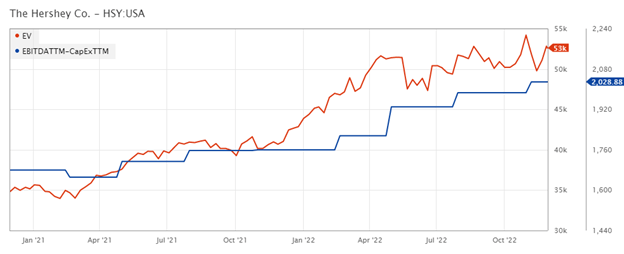

As for value factors, we use the EBITDA (adjusted for CapEx and R&D) to Enterprise Value ratio to assess how much the company generates for every unit of Enterprise Value. Hershey’s value factor is 63.4, and both components of this ratio have been increasing over the last two years.

Factset & Factor-Based

Momentum

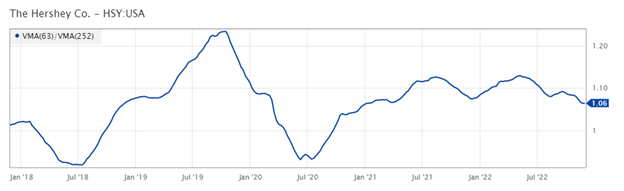

The price slope is one of our momentum factors, computed by dividing the 63-Day VMA (Volume Weighted Moving Average) by the 252-Day VMA. Despite the market’s bearish sentiment due to inflation and interest rate worries, this ratio stayed over 1.0.

Factset & Factor-Based

Investment Risks

Although the Hershey Company is well-established and has a strong business model with sound financials, it faces several threats that could adversely impact its growth opportunities.

Raw material prices

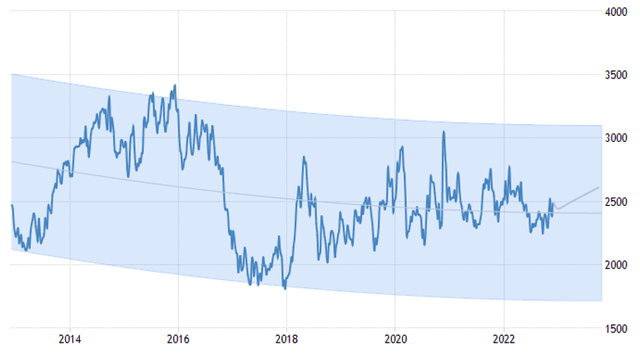

Cocoa is a primary raw material utilized in Hershey’s products. Furthermore, Ivory Coast and Ghana are the world’s largest cocoa producers, accounting for more than 60% of global output. As a result, the inability to secure an adequate quantity of cocoa is a significant threat and a production bottleneck for the company. Additionally, current prices are relatively low compared to the average of the previous two years, and analysts anticipate an increase in prices in the future year, reaching 2610.46 USD/MT.

Geographic concentration

Hershey has a strong presence in North America, generating the vast bulk of its sales (92.0%). As a result, its profitability is highly affected by the state of North American economies. Furthermore, the company’s offerings are concentrated in the food industry. Although it is one of the market leaders, this industry has low-profit margins and weak growth predictions compared to other sectors.

Conclusion

In conclusion, Hershey achieved outstanding results with solid top and bottom-line growth despite increasing supply chain costs, soaring inflation, and declining consumer spending. It has a stable position in the confectionery market and is poised to have a strong start to next year. In addition, Hershey has a high rating in our Factor-based ranking system, showing a higher mix of quality, value, and momentum factors.

Be the first to comment