metamorworks

Investors may consider double down on business development businesses like Hercules Capital Inc. (NYSE:HTGC), which benefit from good credit quality and interest upside now that the Fed is raising interest rates.

Hercules Capital recently increased their base dividend by 6% to $0.35 per share, giving me a 10.9% dividend return on my most recent investment. Given that Hercules Capital non-accruals moved just little in 2Q-22, the stock is quite appealing to dividend investors.

Strong Portfolio Producing A Covered 10.9% Yield

Top business development firms must achieve high investor expectations. They should have strong credit quality, which means they should have a low non-accrual ratio, create consistent portfolio yields, and cover dividend payments with net investment income. Hercules Capital performs all of these functions.

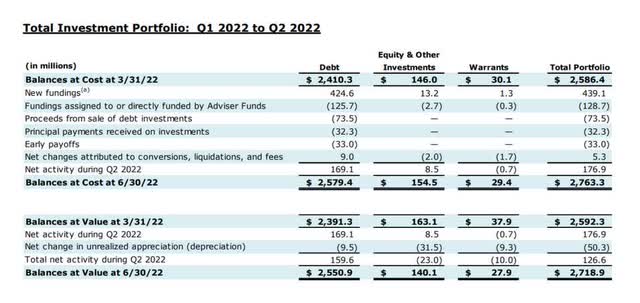

Hercules Capital’s portfolio is heavily weighted in debt, with a total investment value of $2.6 billion as of June 30, 2022, and the business development firm made debt investments in 110 portfolio firms.

Furthermore, Hercules Capital invests in equity and warrants with a total value of $168 million as of June 30, 2022, allowing the BDC to supplement its interest income with investment potential. Hercules Capital invested $169.1 million in new income-producing debt investments in 2Q-22.

Total Investment Portfolio (Hercules Capital)

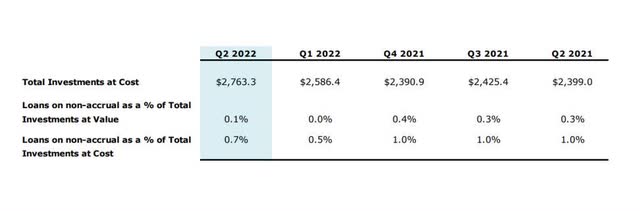

Non-accruals in Hercules Capital’s portfolio were 0.1% of total investments in 2Q-22, compared to 0.0% in the previous quarter. In the second quarter, Hercules added one debt investment to its non-accruals and had only two loans with strained payers on its books at the conclusion of the period.

Based on fair value, the total value of non-accrual investments was $1.9 million. With a portfolio worth more than $2.7 billion, the non-accruals aren’t cause for concern just yet.

Total Investments At Cost (Hercules Capital)

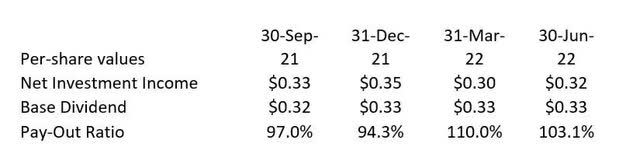

Management has proven to be shareholder-friendly, with Hercules Capital increasing its dividend while increasing net investment income. In 2021, the business development company increased its base dividend from $0.32 to $0.33 per share due to strong loan portfolio performance, and it recently increased its dividend to $0.35 per share. The most recent dividend increase is a 6% increase.

Hercules Capital meets its dividend payments through net investment income, which increased 9% YoY to $40.1 million, or $0.32 per share, in 2Q-22. Hercules’ dividend was slightly under-covered in the second quarter, but the pay-out ratio over the last twelve months was 101%. Hercules Capital’s dividend calculation includes only the main dividend and excludes special dividends, which are intended to share excess profits.

Dividend And Pay-Out Ratio (Author Created Table Using BDC Information)

The BDC announced earlier this year the distribution of special dividends of $0.60 per share, which would be paid in four equal installments beginning in 1Q-22. Two of those special dividends are still outstanding, so if you want to receive the next payment cycle’s $0.15 per share payout, you must purchase HTGC before August 8, 2022.

HTGC’s current stock yield is 9.0% based simply on base dividends, but the payment of special dividends raises the dividend yield to around 10.9%.

Added Benefit: HTGC Is Set To Profit From Higher Interest Rates

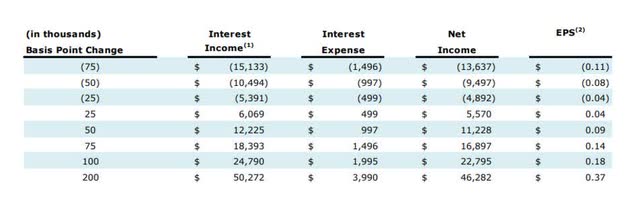

Hercules Capital’s strategic focus on variable rate loans that reset their interest rates under certain conditions is a major characteristic. This situation requires the central bank to boost interest rates, which it is now doing.

With two 75-basis-point hikes in June and July, this added benefit became quite appealing in July, pointing to stronger portfolio income for HTGC in the future.

While rate increases increase the cost of loans, organizations like HTGC can benefit from higher portfolio revenue as well as an improvement in the pay-out ratio.

With 95% of loans being rate-sensitive, Hercules Capital has discovered an effective strategy to hedge against greater inflation while also providing investors with an opportunity to profit from rising interest rates.

The following is Hercules Capital’s updated rate table, which indicates the BDC’s interest rate sensitivities based on a range of predicted rate outcomes:

Updated Rate Table (Hercules Capital)

Proof That Hercules Capital Is A World-Class BDC

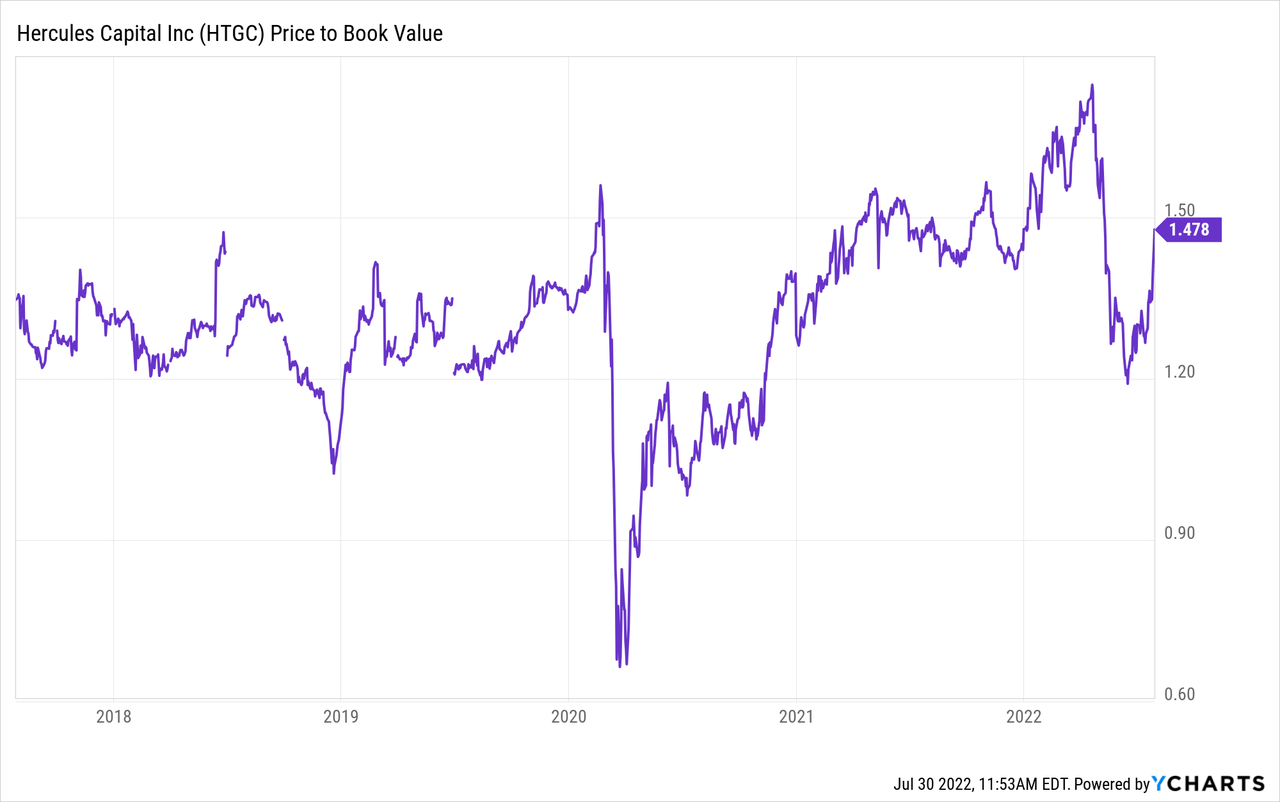

Hercules Capital’s stock has constantly traded at a premium to net asset value, a feat accomplished only by the finest performing and highest rated business development organizations. Hercules Capital is currently trading at a 53% premium to net asset value. The premium is substantial, but it is justified by Hercules Capital’s excellent credit quality.

Why Hercules Capital Could See A Lower Stock Price And Valuation

If more borrowers fail to make interest payments, a recession could lead to an increase in non-accruals and deterioration in asset quality. Obviously, during a recession, the risk of this occurring increases. As a result, Hercules Capital’s net asset value may be under pressure, resulting in a lower premium to net asset value.

My Conclusion

Hercules Capital’s portfolio continued to perform well in 2Q-22, with the accrual ratio increasing by only 0.1% percentage point. While this is not ideal, it is not cause for concern given that the entire investment value at risk is only $1.9 million.

With interest rates on the rise, Hercules Capital is one of the best BDCs to buy in my opinion, because the company is well-hedged against rate hikes, which is more important than ever.

Hercules Capital has recently increased their dividend by 6% to $0.35 per share, giving me a 10.9% stock yield on my last buy.

The interest rate hedges and outstanding asset quality of Hercules Capital make it a BDC worth doubling down on.

Be the first to comment