JHVEPhoto

Not that much has changed over the years, but the market remains wrong about Citigroup (NYSE:C). While the banks face a tough economic scenario here in mid-2022, Citigroup already survived a rather weak Q2 and the stock is insanely mis-priced by the market trading so far below tangible book value. My investment thesis remains Bullish on the large bank.

Spending For the Future

Citigroup fell early this year due to the plans of the large bank to spend on technology to improve the risk mitigation and modernize systems. The market over extrapolated this higher spending as a sign of weakness while other firms in the sector are able to cut costs.

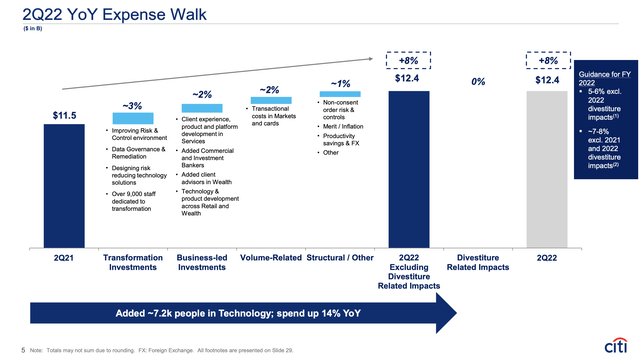

For Q2’22, the large bank added 7,200 people in technology increasing spend by 14%. In total, Citigroup spent 8% more on non-interest expenses to reach $12.4 billion.

Source: Citigroup Q1’22 presentation

The best part of the Q2 report is that the U.S. economy might already be in a recession and the large bank actually thrived in the quarter. Revenues were up 11% to $19.6 billion helping Citigroup offset the higher costs while still generating a 63% efficiency ratio.

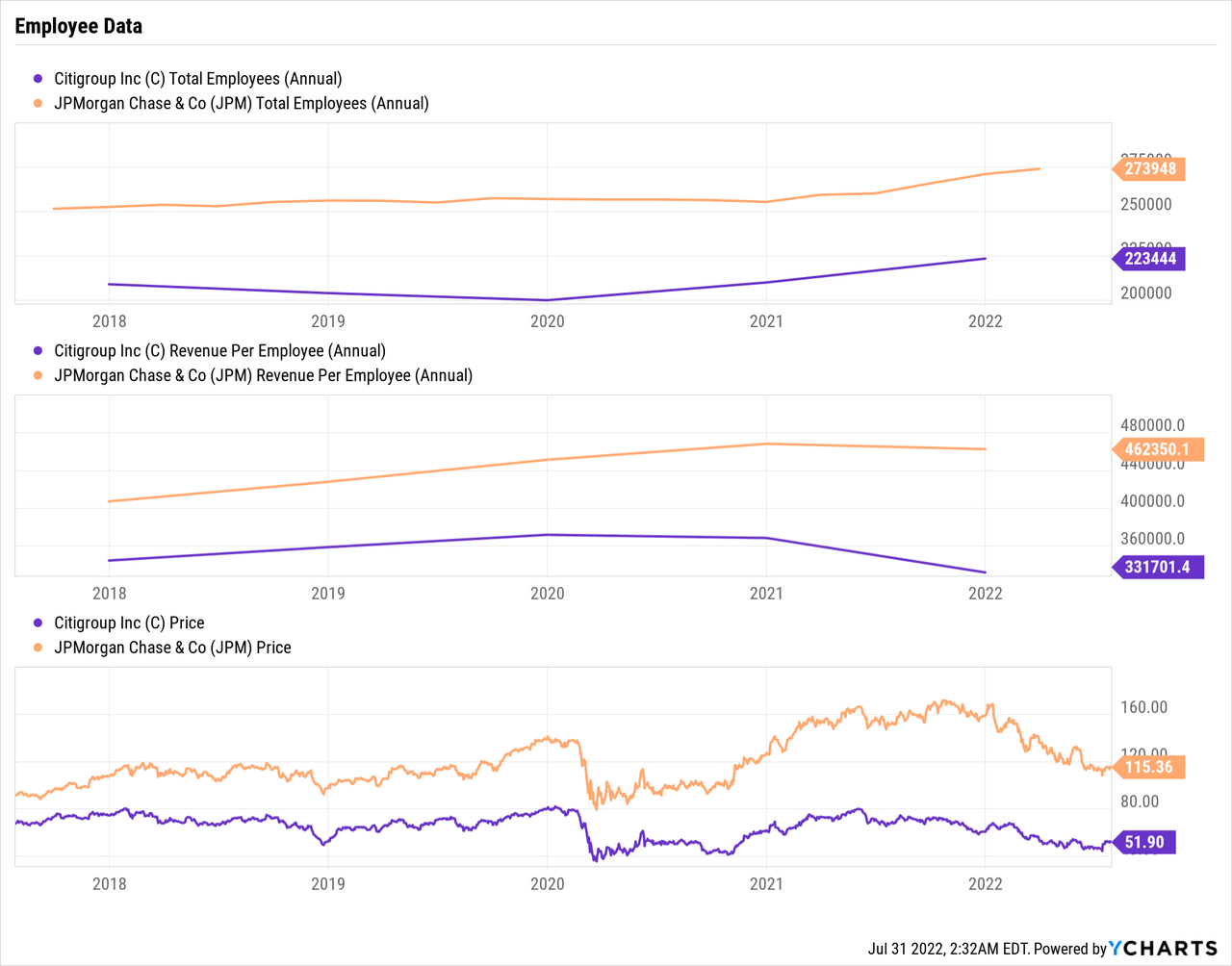

If anything, the extra expenses just came across as matching the strong business from higher net interest income which was up 10% QoQ alone to reach $12.0 billion. The bank had 223K employees to end 2021 and struggles to match the efficiency of JPMorgan Chase (JPM) that obtains over $130K in more revenue per employee.

The bank just forecast another $1.8 billion hike in net interest income in the 2H after the $2.0 billion increase in the 1H. The Fed just hiked interest rates 75 bps and these higher interest fees will help offset the increased technology costs and credit costs.

The market forecasts some more weakness in earnings due in part to higher credit costs, but Citigroup is still forecast to top an EPS of $7. Even taking all of the known and now expected economic weakness, the unloved bank is expected to produce what would amount to $13.5 billion in annual profits.

Buybacks Will Return

The biggest problem actually facing Citigroup and the large bank stocks are regulators that increasingly place restrictions on the business at the worse times. Due to lingering impacts of the financial crisis, the capital ratios are always increased right when the large banks should be purchasing extremely cheap shares.

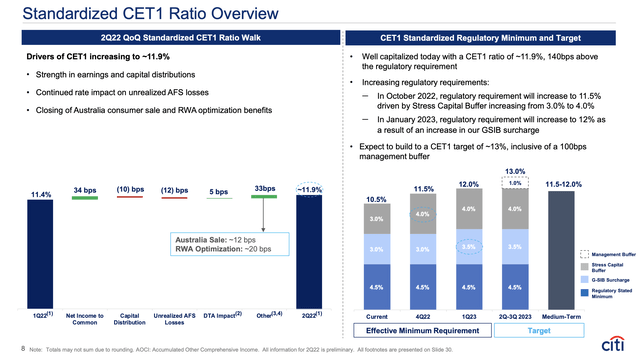

Citigroup has a tangible book value, or TBV, of $80.50 per share while the stock only trades at $51.90 right now. The large bank should be purchasing shares far below TBV here, but regulators have made it to where Citigroup boosted the CET1 ratio to 11.9%, yet the bank still doesn’t have enough capital.

Regulators have boosted the Stress Capital Buffer to 4.0% from 3.0% boosting the October 2022 regulatory CET1 requirement to 11.5%. Citigroup is already up at 11.9%, but the bank doesn’t have much of a buffer at this level.

Source: Citigroup Q2’22 presentation

In addition, the GSIB surcharge will increase to 3.5% from 3.0% in January. Citigroup will suddenly be required to keep a CET1 ratio of 12.0% when the effective minimum requirement is only 4.5%.

On top of this, management wants the internal buffer to include an additional 100 bps pushing the CET1 targets to 13.0%. Citigroup now needs to boost the capital ratio 110 bps before returning to stock buybacks.

These numbers are ridiculous for Citigroup or any bank to now have 7.5% in capital in excess of the effective minimum capital. In the recent CCAR, Citigroup ended up with the minimum CET1 ratio of 9.0% in the worst possible financial scenario unlikely to occur in the next 100 years.

The company made this statement about buybacks and capital returns on the Q2’22 earnings call:

We will generate significant capital given our earnings power and the completion of pending divestitures. We know how important buybacks are to shareholder value creation, in particular when we are trading at these levels, and are committed to restarting them as soon as it is prudent to do so.

Citigroup will continue paying what amounts to a 4% dividend yield. Ultimately, the large bank will have a substantial amount of capital and stock buybacks will return soon enough. In the future, the bank will likely see capital requirements lowered providing another extra boost. Not being able to use the extra capital doesn’t eliminate the capital.

Takeaway

The key investor takeaway is that Citigroup shouldn’t trade far below tangible book value. The bank generates a substantial amount of profits and any reduction in stock buybacks over the next year only builds up the capital position of the large financial to easy survive and thrive during any economic downturn over the next year. Investors should use any weakness to buy the stock far below tangible book value.

Be the first to comment