Tom Werner/DigitalVision via Getty Images

In the Quest for Steady Growth that Outperforms the Market, Henry Schein, Inc. Fills the Need

If you want a higher probability that the overall value of your portfolio will grow over time and outperform the market, then US-listed equity in Henry Schein, Inc. (NASDAQ:HSIC) can do that.

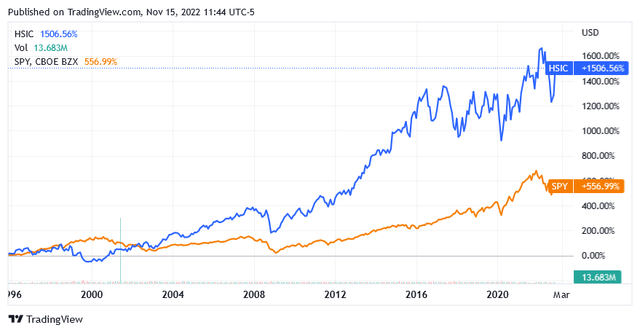

The company does not pay dividends, but the reward for shareholders has materialized in a continued appreciation of the share price over the years thanks to the achievement of higher sales and profits over time.

Over the past 25 years, Henry Schein, Inc. is up more than 1,500%, while the SPY SPDR S&P 500 Trust ETF (SPY), which is a benchmark for the U.S. stock market, is up 560% as of this writing.

With the company showing robust performance in all markets worldwide and with good growth prospects, Henry Schein stock is poised to continue the trend shown in the chart above.

About Henry Schein, Inc.

Headquartered in Melville, New York, Henry Schein, Inc. is a provider of healthcare products and services to dentists and laboratories, physician offices, government and institutional health clinics worldwide.

It operates through two segments. These are the Healthcare Distribution segment and the Technology and Value-Added Services segment.

The Health Care Distribution segment offers various dental products, including infection control products, impression materials, anesthetics, dental implants, abrasives, dental chairs, X-ray accessories and various equipment. This segment also offers branded and generic drugs, vaccines, surgical products, infection control and X-ray products, diagnostic tests, vitamin supplements, and various medical devices.

The Technology and Value-Added Services segment offers practice management software systems for dentists and physicians, as well as specific financial services, practice technology, and continuing education and consulting services for physicians.

Third Quarter 2022 Financial Results

In the third quarter of 2022 [Q3 2022], the Henry Schein company reported revenue of $3.1 billion, down 2.2% year-over-year and missing analysts’ average expectations by $90 million.

Although the company reported slightly lower sales compared to the same period last year, the profit of the company was not affected at all. Pro forma earnings per share [EPS] increased 4.5% year-over-year to $1.15 for the third quarter of 2022, beating analysts’ average estimate by $0.01.

What About Sales

Sales were impacted by unfavorable exchange rates, both locally and in foreign markets, as well as a decline in sales of COVID-19 test kits and other products to prevent the spread of the virus, such as personal protective equipment and clothing. Sales of these two product categories were boosted during the global health crisis due to the spread of the COVID-19 virus.

Henry Schein points out that if you exclude sales of COVID-19 infection control products, organic sales have instead grown year-over-year at a nearly 7% growth rate.

The equipment to protect against the COVID-19 virus and the kits to carry out the tests to detect the coronavirus have sold like hotcakes during the pandemic.

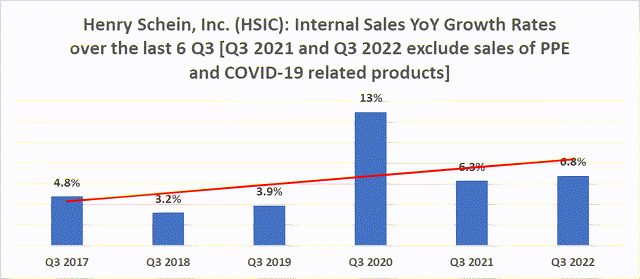

Aside from the occasional component of the COVID-19 virus, Henry Schein’s sales have generally continued to perform well, as illustrated in the chart below. Organically, the business continues to grow in terms of sales, which defines a high probability that the company will continue along this line in the future.

investor.henryschein/financials-filings?hsi_domain=www.henryschein&hsi_locale=us-en

The year-on-year growth rate for Q3 2020 should be lower as it includes sales of COVID-19 virus protection equipment and virus testing kits. For the third quarter of 2022, Henry Schein did not provide a measure of organic sales growth that excludes COVID-19-related products.

By business segment, excluding COVID-19-related personal protective equipment and test kits, organic sales developed as follows:

- Global Dental consumables grew 5.1% year-on-year while Global Dental equipment grew 8% year-on-year, both in local currencies. Sales were driven by the good performance of the dental consumables sub-segment regardless of region, as well as the strong performance of the dental equipment sub-segment across North America.

- Global Medical sales grew 9.3% year-on-year in terms of local currency, driven by the company’s continued efforts to improve relationships with its existing customer portfolio of large healthcare organizations.

- Global Technology and Value-Added Services revenue increased 4.2% year over year thanks to a strong contribution from Henry Schein One. This is a technology that aims to improve the management of the dental business by simplifying and automating tasks.

Global dental consumables and equipment accounted for 58.2% of total revenue, Global Medical accounted for 36.1% of total revenue, and Technology and Value-Added Services accounted for 5.7% of total revenue.

The Outlook Looks Bright

The future of the market in which Henry Schein, Inc. operates looks very bright.

According to forecasts by analysts, the dental equipment and supplies market, valued at $19.75 billion last year, is expected to grow very rapidly in the next few years, reaching nearly $33 billion by 2026, which will represent a growth of more than 10% per annum.

According to the analyst, the growth of the world population is the main driver of the global dental equipment and consumables market.

Advances in public health, nutrition, hygiene and medicine have helped the world population surpass 8 billion, an official United Nations estimate recently revealed.

As these are positive factors that industrialized and developing countries try to promote with huge spending year after year, they will keep driving global population growth in the future. Based on the cause-and-effect relationship proposed by the analysts at the link above, the growth of the Dental Equipment and Consumables market will follow.

The global market, therefore, offers excellent growth prospects from which Henry Schein, as a leader in this field, should benefit by making good use of the global scale of his business.

Henry Schein is a member of the FORTUNE 500, which is a list of the top 500 US companies by revenue, and of the S&P 500 Index (SP500). This index serves as a benchmark for evaluating the performance of companies whose share capital is listed on U.S. stock exchanges.

Revenue and Earnings Growth Estimates

Looking ahead, the company is forecasting 2022 revenue year-over-year growth in the 1.5% – 2.5% range, versus analysts’ median forecast of 1.98% to $12.65 billion.

The company hasn’t provided any revenue guidance for 2023, while analysts have issued a median estimate of $12.94 billion for year-over-year growth of 2.32%.

In terms of diluted pro forma EPS, Henry Schein forecasts 6-8% year-over-year growth to a range of $4.79-4.87 for 2022, while analysts forecast average growth of 6.86% to $4.83.

For 2023, analysts are forecasting diluted pro forma EPS of $5.05, up 4.52% year over year.

If these estimates are centered or even exceeded, higher sales and earnings could potentially be very favorable for the stock price.

The Stock Is Cheap, But the Valuation Could Get Even More Attractive

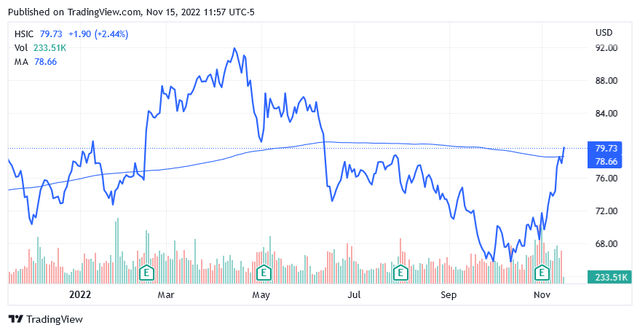

As of this writing, Henry Schein shares traded at $79.73 for a market cap of $10.55 billion and a 52-week range of $64.75 to $92.78.

Shares are recovering after a 3-month decline but still not trading high compared to the long-term trend of the 200-day moving average at $78.66.

Currently, the stock price is slightly above the median of $78.77 in the 52-week range.

Given the growth catalysts outlined above, shares should also be cheap aside from trading low from a technical perspective.

Another indication of a cheap stock is by comparing the stock’s P/E Non-GAAP [TTM] of 16.63 to the sector median of 18.12 and the stock’s price-to-sales [TTM] ratio of 0.85 with the sector median of 4.30.

Therefore, at these market valuations and considering the growth prospects, it would make sense to add shares to the position in Henry Schein, Inc.

However, there is also the possibility of being able to purchase the shares in the future at a lower price than current levels. It shouldn’t be long before this happens.

As the global economy slides or falters into recession as central banks tighten runaway inflation, dentistry is one of the things families can save for. This could affect the market value of Henry Schein, Inc. stock. A purchase decision could then be postponed to 2023 if, according to analysts, the global economy develops significantly less dynamically than today.

However, Henry Schein stock should continue to offer the shareholder a return above the market average, even given the current share price.

One way or another, Henry Schein, Inc. is definitely an investment for the long term.

Conclusion – Henry Schein Stock Has a Solid Business Poised for Continued Long-Term Appreciation

Henry Schein, Inc. is growing organic sales across all regions and segments and this is a great sign for shareholders who have ambitions to steadily increase the value of their investment over time.

The company will benefit from higher demand for dental and medical products as the world population increases due to improved life expectancy.

As governments in a consumption-based society strive to help people live longer to compensate for the reduced birth rate, their decisions about public health, nutrition, hygiene and medicine should positively impact the demand of several markets, including Henry Schein.

Be the first to comment