97/E+ via Getty Images

Investment thesis

Henkel (OTCPK:HENKY) is in a delicate situation after a long period of headwinds. First, the company wasn’t able to grow organically in 2019 and margins slightly declined, then the coronavirus pandemic caused a slight decline in sales as the Adhesive Technologies segment reported a sales decline of 8.21%, and profit margins declined significantly due to declining volumes and higher growth investments, especially in marketing. Sales recovered in 2021 but supply chain issues, as well as inflationary pressures and labor shortages, kept margins low. Now, in 2022, the conflict between Russia and Ukraine poses new risks to the company’s operations as inflationary pressures intensify and the company ceased operations in Russia.

Despite this, the company has continued to make acquisitions and reduce its debt pile over the past few years while the dividend yield has increased as share prices declined due to temporary headwinds. Furthermore, we must not forget that the company has been in business since 1876 and that its products are part of the lives of its consumers who have internalized its brands over the years (and generations). Therefore, I am going to explain why the current headwinds, which are temporary as they are directly linked to the current macroeconomic landscape, represent a good opportunity for dividend growth investors with a long time horizon.

A brief overview of the company

Henkel is a global leading manufacturer of adhesives, beauty care, and laundry and home care products with operations all around the world. The company was founded in 1876, its market cap currently stands at ~€28 billion, employing over 50,000 workers worldwide, and its operations are divided into three main segments: Adhesive Technologies, Beauty Care, and Laundry & Home Care.

Henkel logo (Henkel.com)

Under the Adhesive Technologies segment, which provided 48% of the company’s sales in 2021, the company manufactures adhesives, sealants, and functional coatings for a wide range of industries, including packaging and consumer goods, industrials, automotive, metals, electronics, construction, craftsmen, and other professional industries. These products are mainly sold under the Loctite, Technomelt, Bonderite, Teroson, and Aquence brands. Under the Beauty Care segment, which provided 18% of the company’s sales in 2021, the company manufactures hair cosmetics and body, skin, and oral care products through brick-and-mortar stores, hair salons, third-party online platforms, and direct-to-consumer channels mainly under the Schwarzkopf, Dial, and Syoss brands. Under the Laundry & Home Care segment, which provided 33% of the company’s sales in 2021, the company manufactures a wide range of consumer products, including heavy-duty and specialty detergents, fabric softeners, laundry performance enhancers, fabric care products, automatic dishwashing products, cleaners for bathroom and WC applications, household, glass, and specialty cleaners, and air fresheners and insect control products for household applications. In this business segment, the company owns very known brands such as Persil, Bref, and Purex, among others.

The company is constantly launching new products to keep its portfolio updated based on the changes taking place over the years in the industries it serves. For example, it recently launched a silicone-free, liquid thermal gap filler that extends the life of automotive batteries in an economically efficient way to break into the market for electric vehicle batteries. Also, the company has been relentlessly investing in technology start-ups in recent years.

Henkel ordinary share prices (Henkel.com/investors-and-analysts/shares/share-prices)

Currently, ordinary shares are trading at €63.00, which represents a 45.03% decline from all-time highs of €114.60 in June 2017. This decline has caused a significant increase in the dividend yield, which is currently at 2.94% and has a lot of room for growth because the company spends a small amount of its generated cash on dividend payments. In this article, I’m going to explain why Henkel is a dividend stock you can buy and hold forever. But first, let’s look at the expansion efforts that have taken place in recent years.

Recent acquisitions and divestitures

After a period of expansion via acquisitions that included the acquisition of The Sun Products Corporation for around €3.2 billion in 2016 and the acquisition of Zotos International, the North American Hair Professional business of Shiseido, for $485 million in 2017, among others, the company has successfully reduced its debt load significantly in the 2018-2021 period while making other smaller acquisitions.

Looking towards the most recent acquisitions, in July 2020, the company agreed with Invincible Brands Holding to acquire a 75 percent stake in a business comprised of three fast-growing premium direct-to-consumer brands: HelloBody, Banana Beauty, and Mermaid+Me, which are mostly sold in Europe. Later, in November 2020, the company acquired the skin model technology from SkinInVitro GmbH, expanding thus Henkel’s existing product portfolio in the field of reconstructed human tissue models.

In June 2021, the company sold its Right Guard and Dry Idea brands from the Beauty Care business as the management considered them to be non-core brands for Henkel, and a month later, it acquired Swania SAS, a fast-growing French-based manufacturer of sustainable laundry, home care, and dishwashing products that generated around €40 million in sales in 2020.

In February 2022, the company announced the acquisition of Shiseido’s Hair Professional business in Asia-Pacific. The business generated around €100 million in sales in 2020, with a strong presence in Japan, China, and South Korea, and employed more than 500 people. Later, in September 2022, the company acquired NBD Nanotechnologies Inc., a US-based advanced materials start-up that develops surface properties such as repellency for plastics or optical coatings for displays. NBD’s products can be used in a wide range of markets, including electronic, consumer goods, automotive, and packaging, among others. During the same month, the company also acquired the Thermal Management Materials business of Nanoramic Laboratories, an R&D company focused on developing high-end energy storage and thermal management technologies based on carbon composites.

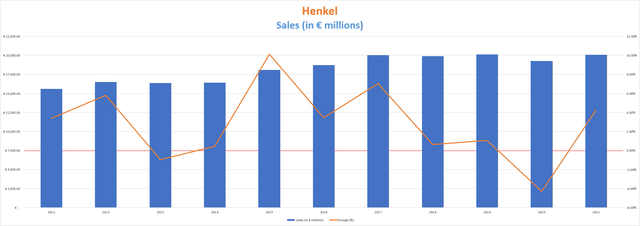

Sales have increased in the past decade

The company’s sales have slowly but steadily increased over the past decade thanks to the acquisitions that have taken place in recent years, but they have stuck in the 2017-2021 period, coinciding with a stage marked by debt reduction. Still, and as I will explain later, said debt reduction is opening the door to a new stage marked by more acquisitions that will allow sales growth to continue in the years to come.

Despite the recent stagnation in sales, 2022 is proving to be a very positive year for the company as sales increased by 9.9% year over year during the first half of 2022, and by 17.36% year over year during the third quarter to €5,976 million, the highest figure in Henkel’s history for a quarter boosted by a 16.8% organic sales growth in the Adhesive Technologies segment. The company increased the price of its products in all business segments and the increase in sales took place despite the fact that the company exited its business in Russia, where ~5% of Henkel’s sales took place before the conflict between Russia and Ukraine, in April 2022. Still, volumes remained lower during the third quarter at -3.4% year over year.

The company’s expansion efforts go beyond acquisitions as it has been lately building new manufacturing plants to increase manufacturing capacities in the different geographies where it operates and R&D centers around the world. Furthermore, we must bear in mind that Henkel’s sales have enjoyed great stability over the years due to the fact that its brands are highly internalized by its customers as the company’s products are considered of high quality and affordability.

Using 2021 as a reference, 41% of the company’s sales take place in emerging markets, whereas 30% take place in Western Europe, 25% in North America, and 3% in Japan, Australia, and New Zealand. In this sense, operations enjoy a very high geographical diversification, and the great penetration in emerging markets makes Henkel much less exposed to competition from private labels since in emerging markets private label consumption is not as widespread as in Europe or North America.

Margins, although temporarily depressed, are very healthy

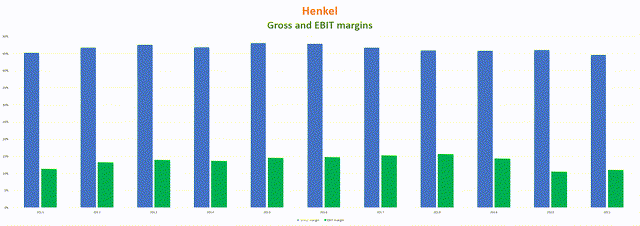

The company has enjoyed an EBIT margin significantly above 10% during the past decade and even managed to surpass the 15% barrier in 2017 and 2018, but restrictions due to the coronavirus pandemic along with subsequent supply chain issues, inflationary pressures, and labor shortages, have caused a significant decline in gross and EBIT margins in 2020 and 2021, although gross margins still remain close to 45%. In this sense, the company is highly profitable.

Henkel gross and EBIT margins (Annual reports)

Gross margins declined to 44.7% during 2021 and the EBIT margin to 11.0%. For 2022, the management expects an EBIT margin oscillating between 10% and 11%, which would represent a slight decrease compared to 2021 despite strong pricing actions.

It is important to take into account that since around 30% of sales come from operations within Europe, the inflationary headwinds from the war between Russia and Ukraine are having a significant impact on the company’s operations. In this sense, increasing energy prices in Europe represent a major headwind for which no solution is foreseen in the short and medium term. The management is currently considering how to take further pricing actions in order to pass some of the recently increased costs on to consumers and thus reflect inflation in its products, and this should help the company continue paying down its current debt pile.

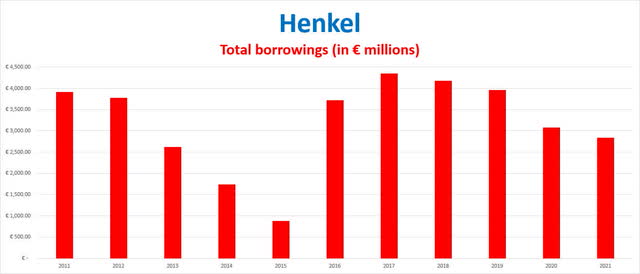

Constant debt reduction demonstrates the company’s profitability

The company’s high profitability becomes clear when one observes its ability to reduce its debt loads after each major acquisition.

Henkel total borrowings (Annual reports)

In this sense, total borrowings declined by 35% to €2.84 billion from 2017 to 2021, and this is opening the door to a new stage of growth via acquisitions like the recent acquisition of Shiseido’s Hair Professional business in Asia-Pacific. The debt decline to €2.84 billion in 2021 should mean the company is ready to reach further sales increases via new acquisitions, although the company’s debt reduction capacity is significantly slowing down as a result of the increase in the dividend cash payout ratio due to lower cash from operations from lower profit margins.

The management has taken strong pricing actions in recent quarters to reflect inflation in the price of the company’s products, but these have apparently not been enough to prevent the decline in profit margins as inflationary pressures persist today. Further price increases should help contain further margin declines, but these increases will likely be absorbed by increased production costs for as long as inflationary pressures continue.

The dividend is safe and the cash payout ratio is temporarily higher than usual

The company’s dividend policy states that the annual dividend payout ratio should dance between 30 to 40 percent of net income after non-controlling interests.

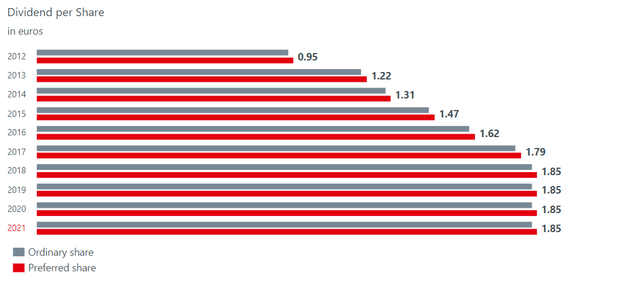

Henkel dividends per share (Henkel.com/investors-and-analysts/shares/dividends)

The company has steadily raised its dividend payout from €0.95 in 2012 to €1.85 in 2019, which represented a 95% increase in a period of 7 years. Still, the company froze the dividend for 2020, 2021, and 2022 as a consequence of mixed results in 2019, the coronavirus pandemic crisis in 2020, the subsequent supply chain and inflationary pressures in 2021, and the current conflict between Ukraine and Russia, which is worsening the 2021 headwinds.

These intensifying headwinds have put the current annual dividend of €1.85 at risk as the company reported cash from operations of €177 million during the first half of 2022 compared to €685 in the same period of 2021, which explains why shares have failed to recover after the shock of the coronavirus pandemic and the inflationary and supply chain headwinds in 2021. Still, inventories increased by €426 million year to date and account receivable by €492 million while accounts payable increased by only €389 million.

In the following table, I have calculated the dividend cash payout ratio over the years by calculating what percentage of the cash from operations is allocated to the payment of dividends each year in order to assess its sustainability over the years. In this way, we can see the company’s ability to cover the dividend through actual operations.

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Cash from operations (in millions) | €2,116 | €1,914 | €2,384 | €2,850 | €2,468 | €2,698 | €3,241 | €3,080 | €2,141 |

| Dividends paid (in millions) | €407 | €525 | €564 | €633 | €698 | €772 | €798 | €798 | €798 |

| Cash payout ratio | 19.23% | 27.43% | 23.66% | 22.21% | 28.28% | 28.61% | 24.62% | 25.91% | 37.27% |

As we can see, the company has maintained a very low cash payout ratio over the years. This explains its ability to continuously make acquisitions and reduce its debt levels, and despite the sharp decline in the company’s EBIT margin in 2021, it has maintained a very healthy cash payout ratio of 37%. In this sense, the dividend is highly safe from a cash from operations perspective, but shareholders should not expect the same rate of dividend growth as in previous years until the conflict between Russia and Ukraine is over and margins stabilize again as adjusted net income declined by 19.3% year over year to €840 million during the first half of 2022. For this reason, I consider Henkel to be a suitable investment for dividend investors with a very long time horizon as the current share price decline left a dividend yield on cost of 2.94% in a company with a historical cash payout ratio between 20% and 30%.

Risks worth mentioning

The company’s risks have significantly increased throughout 2020, 2021, and 2022, and this is the price that shareholders will have to pay in exchange for the current discount in the share prices.

- Although the company’s debt has been reduced in 2018, 2019, 2020, and 2021, and its current amount does not pose a significant risk to the company’s operations as cash from operations overly covers the dividend, the company still has a high enough debt load to limit the pace of acquisitions in the short and medium term.

- The company’s turnaround strongly depends on the end of the conflict between Russia and Ukraine. Once said conflict ends, the headwinds derived from it still need to be relaxed significantly. In this sense, the inflationary pressures, increased energy costs, and the loss of sales as a consequence of activity cessation in Russia could continue for quite some time after the end of the conflict.

- The dividend could remain frozen for more years as the management is very conservative on the payout ratio. Personally, I would not expect a further raise until the company pays off a good part of its debt and the margins return to normal, which could take a long time, as I mentioned in the previous point. Adjusted net income declined by 19.3% year over year during the first half of 2022, and this is the metric used by the management to calculate the company’s dividend growth potential.

Conclusion

Personally, I think it’s a good opportunity for dividend growth investors to buy Henkel shares at current prices. A dividend yield on cost of ~3% for a company whose cash payout ratio has historically been below 30% is a very generous yield despite the current headwinds of 2021 and 2022, where the cash payout ratio is approaching 40%.

Such headwinds are temporary as they are directly linked to the coronavirus pandemic crisis in 2020, the post-coronavirus supply chain and inflationary pressures in 2021, and the current war between Russia and Ukraine, and Henkel is a company that has been in business for almost 150 years operating under legendary brands. Furthermore, the company’s debt load has been shrinking since 2018 thanks to high profitability, which is opening the door for new acquisitions that will boost the company’s sales in the years to come. For these reasons, I believe that a 45.03% drop in share price represents a good opportunity to add Henkel shares to any dividend growth portfolio with a long time horizon.

Be the first to comment