monticelllo

Before commenting on Heineken Q3 results (OTCQX:HEINY), we would like to deep dive into the latest sector development. First of all, sparkling water and soft drinks (including beers) have become rare commodities on EU supermarkets and hypermarket shelves. We should blame the lack of CO2 for food use that has forced the major European producers of soft drinks to suspend production lines (Nestlè (OTCPK:NSRGY) with the famous San Pellegrino sparkling water is the last in line). This is an enormous difficulty for Food & Beverage companies that find themselves having to face a further crisis. This is in addition to the high energy cost, as brewers use natural gas to heat water for the production process and are temporarily switching to oil.

While on the one hand, the beer recovery trend is certified by the latest positive data; on the other hand, uncertainty and rising costs are complicating the sales rebound from the pre-COVID-19 levels. This is particularly true for small breweries such as artisan producers that still complain about a 28% lower turnover compared to 2019 numbers. Less structured and less financially solid, there is a risk to see their competitiveness further compressed.

This fully supports our investment thesis back on the following assumption:

“In a period of inflation, consumers are looking for cheaper alternatives within the same categories. Over the last decade, craft beers have surged – and we believe this trend will now be reverted to favoring Heineken and also AB InBev. We can also include the fact that clientele might switch from wines to beer products“

With Heineken’s latest strategy, the company might be a clear beneficiary to increase market share penetration thanks to beer premiumization as well as the special beers (that are commercial premium beers sold in supermarkets with a reference price of more than 30/40%, versus the traditional beer). This is confirmed by Wietse Mutters, managing director of Heineken Italia, who said that “the long-term vision is to expand the choice available to the consumer by making the beer category increasingly interesting, having developed a portfolio over the years by introducing so-called special beers. This category includes Birra Messina Cristalli di Sale and Birra Moretti Cold Filtered: unique beers, produced with new ingredients and processes that have met with great success and opened new spaces on the market“.

Q3 results

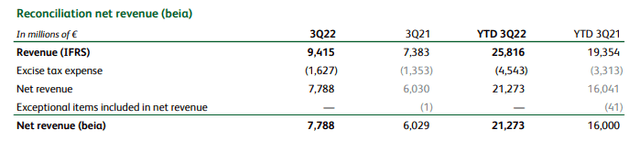

Heineken achieved a clean net profit of €2.2 billion in nine months, down year-on-year after the 2021 account which was driven by the remeasurement to the fair value of its stake in United Breweries Limited. Turnover was up by 27.5%, but the group warns of a drop in demand. Looking at the nine months’ aggregate results, top-line sales reached €25 billion compared to the €19 recorded in 2021 during the same period. Positive FX development was mainly driven by emerging market currency evolution (especially by the Brazilian Real and the Vietnamese Dong). In addition, Heineken consolidation of United Breweries Limited (the latest Indian acquisition) positively influenced its sales by 3.5%.

Source: Heineken Q3 press release

According to our key takeaways, Heineken has:

- The most interesting geographical footprint within the sector thanks also to the United Breweries’ consolidation in India and pending the Distell acquisition in Africa;

- The most important exposure to the secular premiumization trends trajectory, which was also reinforced by the latest data (i.e., the category volume was up by more than 15% in Q3). There is no sign of slowdown and it is nearly recession-proof;

- A talented management team that is both focused on value and growth, with a clear focus on optimizing Heineken’s operating leverage. eB2B platform was one of our micro company catalysts and looking at the latest press release, we can note that Heineken is capturing 2.5x sales growth;

- Despite EU weakness, it is critical to note that the company left its target unchanged.

Conclusion and Valuation

Even if Heineken delivered a solid set of results, we decide to lower our EPS estimates for 2023. In total, we are forecasting a lower EPS by almost 5% for the following reason: 1) lower operating profit in Europe, 2) less favorable currency development, 3) higher costs for the Distell acquisition with a consequent higher non-controlling interest and 4) higher cost of equity. Q3 was a good quarter and the company’s next catalyst is planned for 1-2 December. The company is also trading at a 15% P/E discount versus the European staples, so we derive a new price target of €110 per share, maintaining a buy rating.

Be the first to comment