PM Images

The Direxion Daily S&P 500 Bull 2X Shares ETF (NYSEARCA:SPUU) is an instrument magnifying the broad market performance for trading purposes. However, its daily 2X leverage factor is a source of drift. It must be closely monitored to detect changes in the drift regime. This article explains what “drift” means, quantifies it in more than 20 leveraged ETFs, shows historical data, and finally concludes about the current market conditions.

Why do leveraged ETFs drift?

Leveraged ETFs often underperform their underlying index leveraged by the same factor. The decay has essentially four reasons: beta-slippage, roll yield, tracking errors, management costs. Beta-slippage is the main reason in equity leveraged ETFs. However, when an asset is in a steady trend, leveraged ETFs can bring an excess return instead of a decay. You can follow this link to learn more about this.

Monthly and yearly drift watchlist

There is no standard or universally recognized definition for the drift of a leveraged ETF. Some are quite complicated. Mine is simple and based on the difference between the leveraged ETF performance and Ñ times the performance of the underlying index on a given time interval, if Ñ is the leveraging factor. Most of the time, this factor defines a daily objective relative to an underlying index. However, some dividend-oriented leveraged products have been defined with a monthly objective (mostly defunct ETNs sponsored by Credit Suisse and UBS: CEFL, BDCL, SDYL, MLPQ, MORL…).

First, let’s start by defining “Return”: it is the return of a leveraged ETF in a given time interval, including dividends. “IndexReturn” is the return of a non-leveraged ETF on the same underlying asset in the same time interval, including dividends. “Abs” is the absolute value operator. My “Drift” is the drift of a leveraged ETF normalized to the underlying index exposure in a time interval. It is calculated as follows:

Drift = (Return – (IndexReturn x Ñ))/ Abs(Ñ)

“Decay” means negative drift. “Month” stands for 21 trading days, “year” for 252 trading days. A drift is a difference between 2 returns, so it may go below -100%.

|

Index |

Ñ |

Ticker |

1-month Return |

1-month Drift |

1-year Return |

1-year Drift |

|

S&P 500 |

1 |

(SPY) |

-9.24% |

0.00% |

-15.51% |

0.00% |

|

2 |

(SSO) |

-18.37% |

0.05% |

-33.61% |

-1.30% |

|

|

-2 |

(SDS) |

20.33% |

0.93% |

23.18% |

-3.92% |

|

|

3 |

(UPRO) |

-26.91% |

0.27% |

-49.98% |

-1.15% |

|

|

-3 |

(SPXU) |

31.03% |

1.10% |

27.82% |

-6.24% |

|

|

ICE US20+ T-bond |

1 |

(TLT) |

-8.24% |

0.00% |

-27.69% |

0.00% |

|

3 |

(TMF) |

-24.36% |

0.12% |

-67.17% |

5.30% |

|

|

-3 |

(TMV) |

26.39% |

0.56% |

114.53% |

10.49% |

|

|

NASDAQ 100 |

1 |

(QQQ) |

-10.54% |

0.00% |

-24.87% |

0.00% |

|

3 |

(TQQQ) |

-30.53% |

0.36% |

-68.98% |

1.88% |

|

|

-3 |

(SQQQ) |

35.10% |

1.16% |

42.11% |

-10.83% |

|

|

DJ 30 |

1 |

(DIA) |

-8.74% |

0.00% |

-13.54% |

0.00% |

|

3 |

(UDOW) |

-25.49% |

0.24% |

-43.46% |

-0.95% |

|

|

-3 |

(SDOW) |

29.60% |

1.13% |

29.49% |

-3.71% |

|

|

Russell 2000 |

1 |

(IWM) |

-9.66% |

0.00% |

-23.64% |

0.00% |

|

3 |

(TNA) |

-28.06% |

0.31% |

-65.22% |

1.90% |

|

|

-3 |

(TZA) |

31.04% |

0.69% |

49.17% |

-7.25% |

|

|

MSCI Emerging |

1 |

(EEM) |

-11.54% |

0.00% |

-29.14% |

0.00% |

|

3 |

(EDC) |

-32.24% |

0.79% |

-70.41% |

5.67% |

|

|

-3 |

(EDZ) |

42.57% |

2.65% |

114.45% |

9.01% |

|

|

Gold spot |

1 |

(GLD) |

-2.89% |

0.00% |

-5.82% |

0.00% |

|

2 |

(UGL) |

-6.12% |

-0.17% |

-15.58% |

-1.97% |

|

|

-2 |

(GLL) |

5.68% |

-0.05% |

7.12% |

-2.26% |

|

|

Silver spot |

1 |

(SLV) |

5.55% |

0.00% |

-14.72% |

0.00% |

|

2 |

(AGQ) |

12.22% |

0.56% |

-35.10% |

-2.83% |

|

|

-2 |

(ZSL) |

-14.07% |

-1.49% |

10.27% |

-9.59% |

|

|

S&P Biotech Select |

1 |

(XBI) |

-5.23% |

0.00% |

-36.90% |

0.00% |

|

3 |

(LABU) |

-19.24% |

-1.18% |

-87.32% |

7.79% |

|

|

-3 |

(LABD) |

7.11% |

-2.86% |

12.39% |

-32.77% |

|

|

PHLX Semicond. |

1 |

(SOXX) |

-13.32% |

0.00% |

-27.75% |

0.00% |

|

3 |

(SOXL) |

-36.69% |

1.09% |

-77.76% |

1.83% |

|

|

-3 |

(SOXS) |

47.02% |

2.35% |

-0.10% |

-27.78% |

The inverse leveraged biotechnology ETF (LABD) has the worst monthly decay of this list with a drift of -2.86%, due to large daily swings. It also shows the worst 12-month decay: -32.77%.

The highest positive drifts in one month are for inverse leveraged ETFs in emerging markets (EDZ) and semiconductors (SOXS), with 2.65% and 2.35%, respectively. The inverse Treasury bond ETF (TMV) has the highest positive 12-month drift (10.49%). These three drifts are enhancing large gains due to downtrends in underlying assets.

Positive drift follows a steady trend in the underlying asset, whatever the trend direction and the ETF direction. It means positive drift may come with a gain or a loss for the ETF. Negative drift comes with daily return volatility (“whipsaw”). For example, you can see in the table above that leveraged ETFs in the S&P 500, the Dow Jones, gold and silver have a negative drift in one year (bull and bear ones).

SPUU drift history

Since inception in May 2014, SPUU has gained +186% (13.5% annualized) vs. 116% for SPY (9.7% annualized) in the same time. Even if it is less than twice the daily leveraging factor, it looks great. However, a simulation with synthetic prices calculated from January 2000 is much less attractive: SPUU is at 187% (4.7% annualized) vs. 269% (5.9% annualized) for SPY. On two decades and through two market cycles, the leveraged ETF (simulated) has lagged the non-leveraged underlying index.

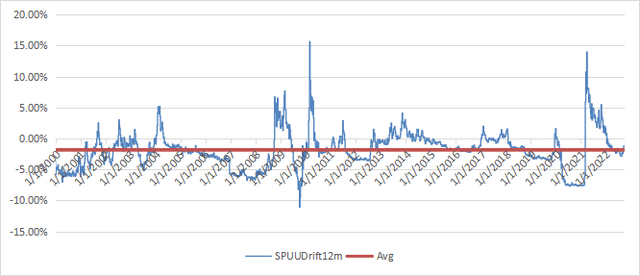

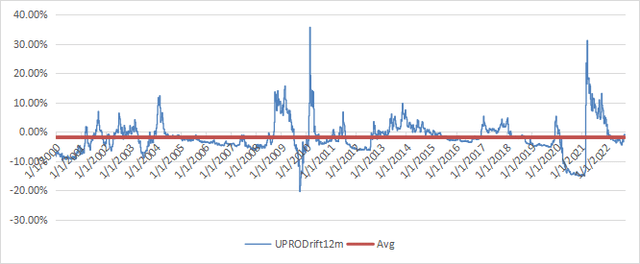

The next chart plots the 12-month drift since January 2000 using synthetic prices based on the underlying index. The historical average is -1.8%, which is just a bit better than -2% for the 3x ETF UPRO.

12-month drift of SPUU (simulated with synthetic prices before inception). (chart: author; data: Portfolio123) 12-month drift of UPRO (simulated with synthetic prices before inception) (chart: author; data: Portfolio123)

The difference of a few bps doesn’t look so large, but on the 22-year period, UPRO (simulated) would have returned only 16%, less than a tenth of the underlying index return!

Takeaway

SPUU is an efficient trading instrument in a bull market. The drift history is less harmful than for 3x ETFs (UPRO, SPXL). However, it suffers a significant decay when the S&P 500 alternatively cumulates positive and negative days. The VIX index (implied volatility) is not directly related to decay, but it may be a warning. Even if SPUU is less tricky than UPRO or SPXL, it has been designed for seasoned investors with a good understanding of their behavior behind the advertised leveraging factor.

Be the first to comment