naveen0301

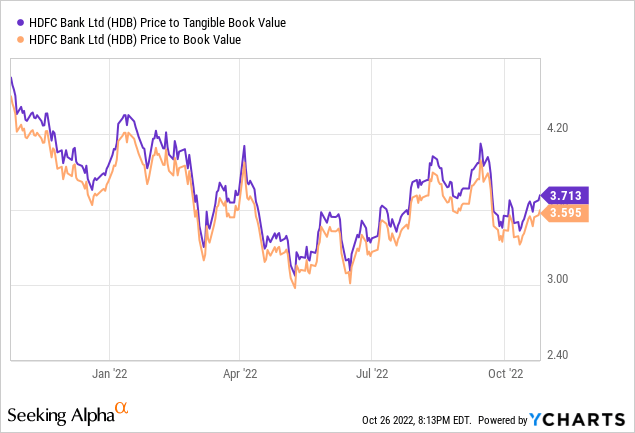

HDFC Bank’s (NYSE:HDB) Q2 2023 earnings performance ticked all the right boxes, with broad-based loan growth and strong net interest margin expansion despite an uncertain macro backdrop. With the bank poised to regain further market share within the Indian banking space (particularly in retail/SME loans) and benefit from a faster asset re-pricing trend in the coming quarters as well, expect upside to fee income ahead. In addition to loan growth, the key over the next few quarters will be execution, as the bank will need to manage its cost-to-income as it expands its distribution network and integrates the HDFC Ltd deposit base post-merger. At a 3-4x tangible book valuation (a discount to historical trading levels), the market seems cautious on the stock ahead of the HDFC integration, offering patient, long-term-oriented investors a favorable risk/reward here.

Another Quarter of Double-Digit Loan Growth

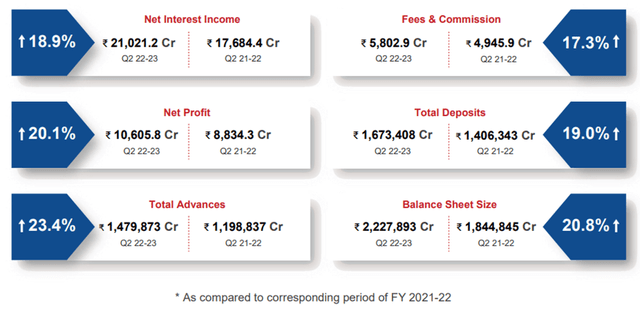

HDFC Bank reported an industry-leading ~23% YoY loan growth in Q2 2023 on the back of sequential outperformance in commercial loans (+8.7% QoQ) and retail (+4.1% QoQ), as well as back-ended wholesale gains (+9% QoQ). By mix, retail loans declined 70bps QoQ to 38.9%, with contributions rising from loans against property, gold loans, mortgages, and personal loans. While payment products grew at a relatively slower pace this time around, the respective 14.1% QoQ growth and 8.7% QoQ growth in agriculture and small/medium enterprise loans more than offset any headwinds.

Alongside the loan growth, the pace of retail deposit mobilization was a key highlight as well, rising to Rs730bn (well above the ~Rs500bn in the prior quarter). As the Current Account/Saving Account (CA/SA) mix further winds down amid the rising rate backdrop (down ~140bps QoQ this quarter), the bank’s pace of quarterly deposit mobilization will be a key metric to watch, as it looks to deliver on its ~Rs1tn target.

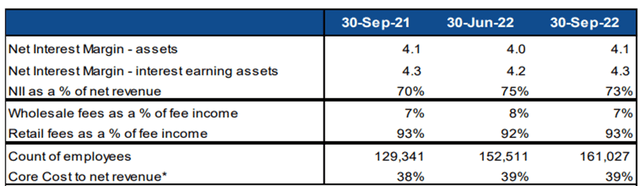

Positive NIM Trend Supports Core PPoP Growth

Building off the strong loan growth this quarter, fee income also outperformed at +17% YoY, driving the overall net interest margin (NIM) ~15bps QoQ higher. With the bank’s ramped-up deposit mobilization also in play, HDFC Bank saw overall deposit growth in the double digits % on-year – well above that of the broader system, as retail deposit growth led the way at +15% YoY and +4% QoQ. Overall, the strong credit growth drove a significant expansion in the incremental loan-deposit ratio (LDR) to >120% during the quarter, resulting in a loan mix improvement as well.

Broadly speaking, another quarter of NIM improvement bodes well for HDFC Bank’s future growth path, while the favorable loan mix shift should also provide a tailwind to its margins. In the meantime, managing opex will be key – expense growth remained high this quarter at +20% YoY and will likely remain elevated in the near term as the bank further builds out its employee base and distribution (+1,500 branch additions targeted). Still, core pre-provision operating profit (PPOP) growth has accelerated to +16% YoY, and with net interest income also going from strength to strength (+19% YoY this quarter), the earnings recovery has legs, in my view.

Strong Near to Mid-Term Outlook Intact

Going forward, loan re-pricing benefits look set to benefit the P&L through the rest of the fiscal year, although potential deposit rate pressures and an eventual liability mix shift to term deposits (from (CA/SA) will cap overall gains over the mid-term. Still, with the bank already running at its ~2% ROA target, the reinvestment runway is compelling. Most of the investment dollars will likely be focused on accelerating branch expansion for now – per management, the bank is focused on building out its branch network and staffing through FY24. This does, in turn, put upward pressure on the cost-to-income ratio (still one of the lowest among the larger Indian banks) in the coming quarters, although as the investment cycle winds down beyond FY24, the ratio should normalize lower.

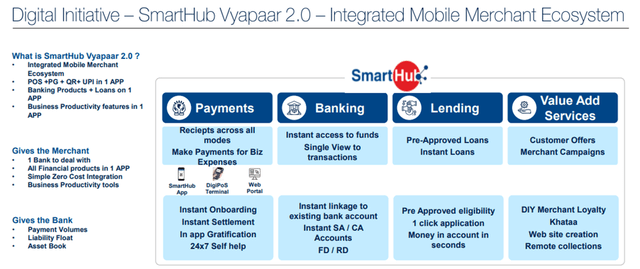

Elsewhere, HDFC Bank’s ability to maintain its deposit market share gains will be worth keeping an eye on, particularly following the recent loan-deposit ratio expansion. Over the mid to long term, digital transformation efforts will also be key. Thus far, the bank has been executing well here. Of note, its SmartHub Vyapar app (i.e., payment and digital banking solutions) has achieved ~1.6m merchants on the app and sustained the onboarding of >60k merchants per month. With merchant touchpoints also increasing 41% YoY to 3.5m, the bank is moving closer to its target of onboarding 20m merchants in the next few years. Accelerated progress here (note management believes it is halfway through the digital transformation journey) could also mean lower tech investment costs in the near future, presenting incremental upside to the current cost-income ratio guidance.

Steady as She Goes

On balance, HDFC Bank’s latest quarterly print delivered across virtually all operating metrics, from NIM (+10bps QoQ) and loan growth (+23% YoY) to asset quality (net slippage at ~90bps). As the bank further regains share and shifts its loan portfolio to a more favorable mix, expect further improvements to the NIM and NII growth ahead. While opex will likely move higher alongside the distribution network expansion, the income growth should more than offset this, driving core profitability growth over the next few quarters.

Net, the bank’s path to achieving a target core PPOP growth of ~20% CAGR and ~2% ROA remains intact over the mid-term, in my view. The key risk remains the HDFC/HDFC Bank merger timeline, though management’s updated guidance that the process is on track for an earlier close (sometime in Q1/Q2 2024) should reassure investors. At an undemanding valuation of 3-4x fwd book as well, the stock has ample room to outperform in the coming months.

Be the first to comment