CatLane/iStock via Getty Images

The availability of money, is the most important driver of both the economy and the stock market. In this piece, we report on the money-flows into the economy and the effects on the stock market.

Money is what releases real resources like labour and commodities, and government spending is how money is added to the economy (private sector bank accounts). Treasury budget-deficits represent the money that was left in the economy (i.e., not taxed back and cancelled).

FEDERAL GOVERNMENT DEFICITS = PRIVATE SECTOR SURPLUSES

Treasury budget-deficits are good for the economy, yet nearly everyone on this planet has it backwards!

Biden is bragging that he has reduced the deficit. Imagine bragging that you have managed to reduce the amount of money that is transferred to private bank accounts. Luckily, the deficit is growing again. It is the only thing that will prevent a recession if the Fed insists on further raising the UBI (risk-free yield) for the bankers.

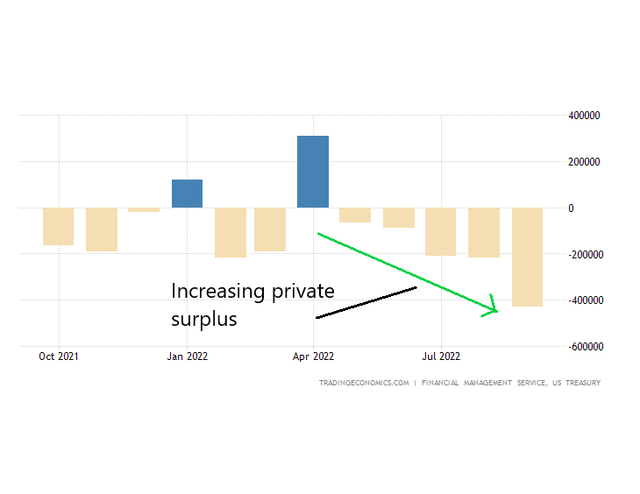

The two blue-columns (January and April) below, represent budget surpluses (private-deficits) and are the reason for the stock market weakness since the start of the year. The increasing deficits (private surplus) will support the stock market over the next month or two.

Government Budget (ANG Traders, tradingeconomics.com)

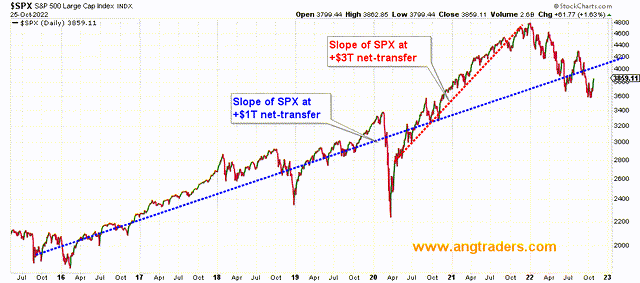

The blue dotted-line below is the slope (rate of change) of the SPX that results when net-transfers (budget-deficits) are between $0.6T – $1.0T/year. The red dotted-line shows the slope of the SPX during the pandemic when net-transfers were $3.0T/year. We are now back to the pre-pandemic net-transfer level and the SPX should trend higher in the same general direction as the blue line.

Net-transfer and the SPX (ANG Traders, stockcharts.com)

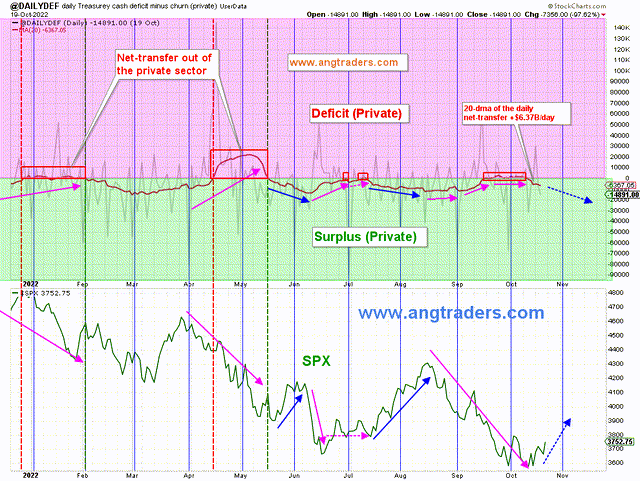

The 20-day average of the daily net-transfers (from the Treasury into (+), or out of (-) the economy) increased to an average of +$6.37B/day; this corresponds with more than +$1.5T/year. This will support the stock market.

Daily Net-Transfer (ANG Traders, stockcharts.com)

Aggregate bank credit is the other way that money enters the private sector. Note, however, that bank loans must be paid back and cancelled, while Treasury spending does not have to be taxed back and cancelled–it can be left in the economy (private bank accounts)–making it more powerful than bank credit.

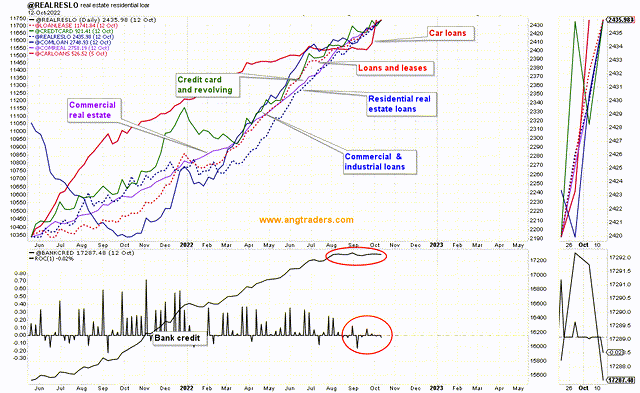

Although aggregate bank credit has been stalled for the past two months, the major loan types, which are the most impactful on the economy, have all been increasing (chart below).

Major Loan Types (ANG Traders, stockcharts.com)

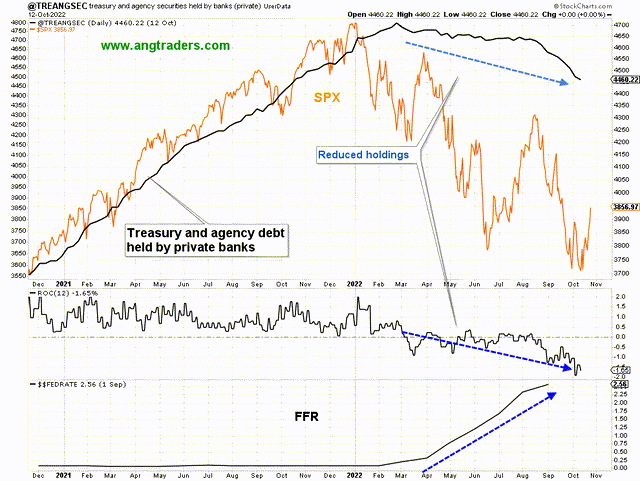

The reason why aggregate credit has stalled, is that banks are not investing in Treasuries as much now that interest rates are rising–Treasuries are treated as bank credit although they are sequestered money that does not impact the economy in the same way as the other loan types (chart below).

Treasury holdings by banks (ANG Traders, stockcharts.com)

At this point, we need to clarify what Treasury-securities are. They are a form of dollar-accounts, often called “yellow dollars” (after the color of the paper certificates), which pay a yield like bank savings-accounts do–but ‘risk-free’, since the US Government can never be forced to default like a private-back could.

These ‘yellow dollars’ are, in fact, a vestigial leftover from the gold standard when the government tried to avoid dollar dilution (when it needed to deficit-spend) by pretending that it was not really printing more dollars, but rather “borrowing” dollars from the economy (like a snake eating its own tail). Since 1971, when Nixon removed the dollar/gold linkage completely (to fund the Vietnam war), the value of the dollar has been determined at the FOREX auction, and Treasury sales have been unnecessary. However, the practice of matching budget-deficits with Treasury sales continues to this day because it benefits the financial industry (risk-free yield) and provides the Federal Reserve Bank with a tool for managing interest rates.

The Treasury does not need treasuries in order to spend since it is the sovereign currency-creator and does not need to “borrow” what it creates at will. Actually, the depositing of dollars into a Treasury-bond account requires that the dollars be created first, just like the payment of taxes requires that the dollars be created first before they can be taxed back and cancelled.

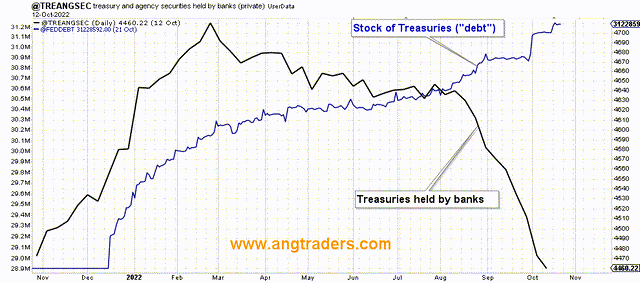

Although the banks are holding fewer Treasuries (chart above), the stock of Treasuries (“debt”) has increased. Leading to the question, ‘where have all the Treasuries gone’? (Chart below.)

Treasuries and Banks (ANG Traders, stockcharts.com)

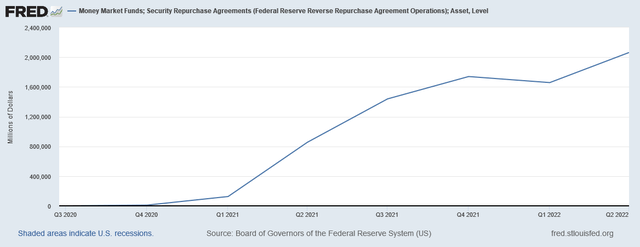

Alan Longbon and I looked at this and the following chart may be part of the answer…money market funds may have picked them up.

Moneymarket Funds T-securities (ANG Traders, FRED, Alan Longbon)

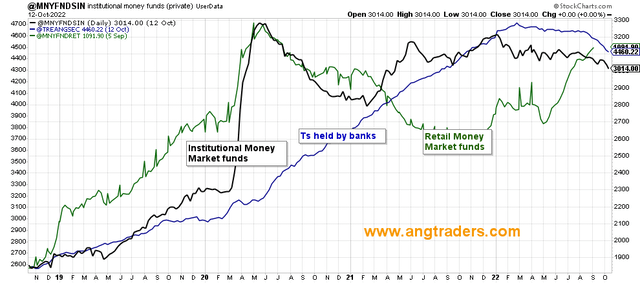

The money market funds must have bought the Treasuries, but sold other debt because the institutional funds have not grown, and the retail funds have only grown by a few hundred billion dollars. It was only an asset swap, not a net increase (chart below).

Institutional and retail Money Funds (ANG Traders, stockcharts.com)

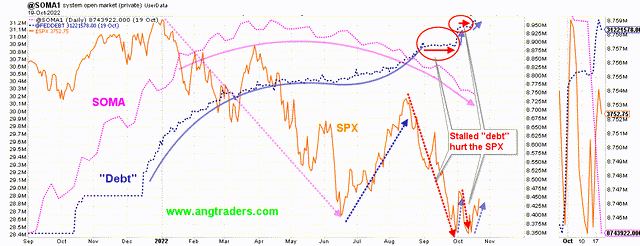

Regardless of where the missing Treasuries are, the fact remains that the stock market tends to rise as the “debt” (blue-line below) rises…even when the SOMA (pink line below) is tightening.

SOMA, “debt”, and SPX (ANG Traders, stockcharts.com)

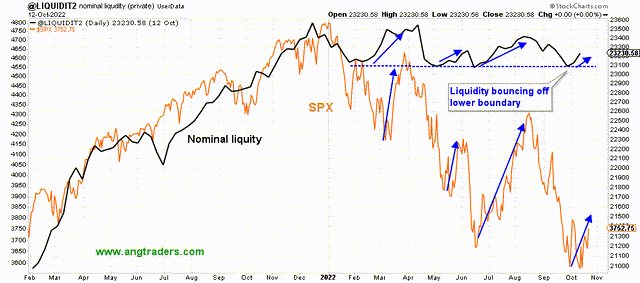

The net fund-flows into the economy suffered a huge drop in liquidity (+$3T/year, to +$1T/year) in 2022, but the liquidity levels have stabilized and our liquidity model is showing that the market will rise for the next month or two (blue-lines on the chart below).

Liquidity (ANG Traders, stockcharts.com)

We suggest that investors should enter long positions in broad-spectrum ETFs such as SPY, QQQ, DIA, and IWM.

Be the first to comment