Phynart Studio/E+ via Getty Images

Intro

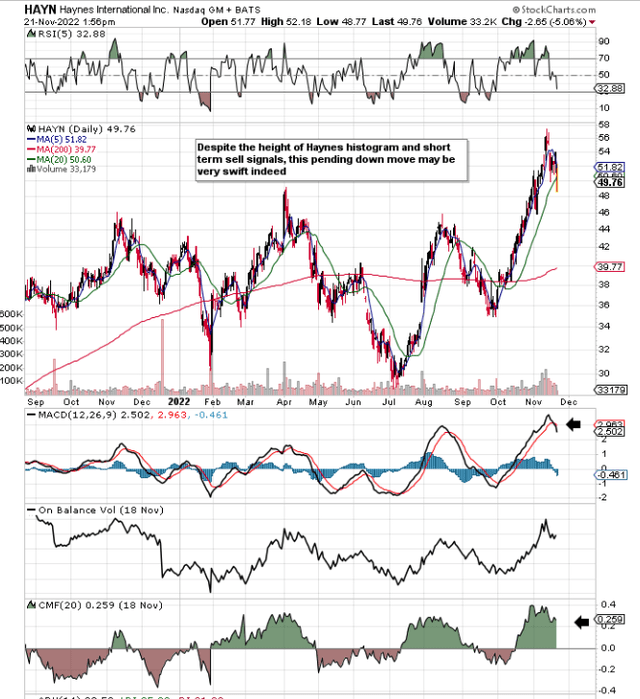

Haynes International, Inc. (NASDAQ:HAYN) (metal fabrication space) looks very close to delivering a convincing short-term sell signal using a cross-over of the stock’s respective 5-day & 20-day moving averages. We already see Haynes’ stochastics as well as its respective MACD indicator (which is in a pretty lofty position in itself) give sell signals to the downside. However, given the company’s strong trending move over the past eight weeks, which aligns with the significant multi-year bullish move in this play, particularly since October 2020, investors need to be careful shorting this play at this moment in time.

Haynes Technical Chart (Stockcharts.com)

Successful investing and particularly trading is all about having as little as possible downside risk but yet very significant upside potential. Given the momentum Haynes stock has enjoyed in recent times as well as the low short-interest ratio of 1.86%, the short delta risk in this play may be greater than what appears at present.

Growth

In fact, one has to only look at the growth metrics in the company’s fiscal fourth quarter to see that momentum continues to accelerate. Top-line sales of $143.8 million increased by $48.5 million (50%+ growth rate) over the same period of 12 months prior. Furthermore, the encouraging trend was that Haynes’ top-line growth took place across all three of its segments with IGT, CPI & Aerospace all registering solid double-digit growth rates in the quarter. The fundamentals of the company’s largest segment (Aerospace which registered almost half of Haynes’ top-line take in Q4 ) remain very strong with the commercial space in particular expected to see strong gains, particularly from new builds as the company´s products get rolled out in specific updated modern engines.

Higher sales on higher volumes as well as productive efforts with respect to cost control led Haynes to report a net income of $16.3 million for the fourth quarter which, is a number that dwarfs the $2.6 million bottom-line number in the same period of 12 months prior. Management on the recent earnings call went into how Haynes has transformed itself in such a short period of time, and if these trends continue, we have no doubt that Haynes will continue in its bull market.

One reason for the quick change in the company’s fortunes has obviously been the continued success of the company’s alloys in that they continue to make up the lion’s share of Haynes’ top-line revenues. This speaks of quality in-house operations not just from a value-adding standpoint but also with respect to being able to keep competitors at bay. Furthermore, management is bullish on the alloys under development, with the aerospace segment as mentioned earlier being the prime candidate for these updated products.

Custom Made Operator

Then you have the company’s ability to not only supply its products at scale but also in smaller quantities, which is something that many of Haynes’ competitors simply cannot do. This ability stems from Haynes’ “custom-made” approach, where the customer comes first irrespective of the respective orders being wire, tubing, or flat in nature. Traditionally, this attention to detail may be frowned upon by investors because of the lack of potential to really take costs out of the system at scale. However, Haynes’ recent figures state otherwise. Haynes’ gross margin topped 22% in the recent fourth quarter which was well ahead of the 17.5% number in the same period of 12 months prior. Furthermore, despite the sizable increase in both sales and gross profit in the fourth quarter, SG&A costs of $10.7 million actually came in lower over Q4 last year ($11.4 million).

Suffice it to say, these are bullish trends that undoubtedly will keep Haynes’ share-price heading north if indeed they do continue. Furthermore, this is why the market is not taking note of Hayne´s maybe overextended valuation to any great degree. Haynes now trades with a trailing sales multiple of 1.23 and a trailing book multiple of 1.61. Furthermore, the absence of positive operating cash flow is another trend that the market may be overlooking due to the company’s vastly improved profitability. This profitability is expected to result in positive cash-flow generation by the middle of next year. Any deviation from this expectation will undoubtedly result in the market looking at Haynes’ valuation with far more scrutiny.

Conclusion

To sum up, although shares of Haynes International, Inc. are due for a short-term pullback, current trends regarding sales, margins, and bottom-line revisions demonstrate that the company’s bull run should resume in earnest. Longs should continue with trailing stops to ride this trend. New participants should wait for a convincing swing before putting money to work. We look forward to continued coverage.

Be the first to comment