Noah Berger

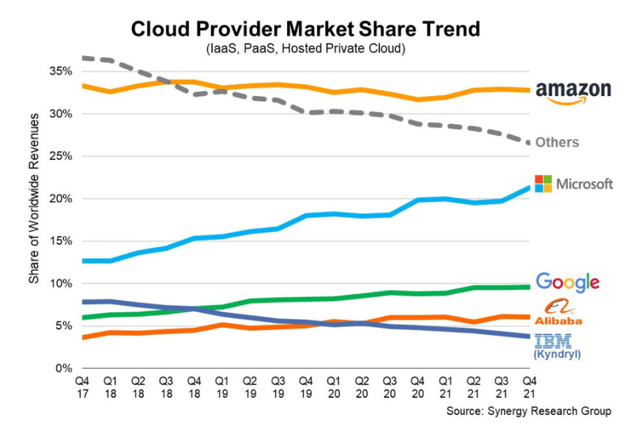

Cloud computing is one of the most profitable and fast-growing industries in the world. In 2021 alone, the global cloud computing market was estimated to be ~$405.65 billion and is expected to grow at a ~20% CAGR for the foreseeable future. Given the sheer size of this market, it is not surprising to see the major technology giants rush into the space. While Amazon (AMZN) is still leading the industry with its AWS division, companies like Microsoft (MSFT) and Alphabet (GOOG) (GOOGL) are starting to make some serious gains.

While Amazon continues to maintain an admirable presence in the space with approximately 33% market share, Microsoft is rapidly gaining ground with approximately 22% market share. Businesses are increasingly utilizing both AWS and Azure, with some business even focusing purely on Azure. This increasingly competitive cloud landscape is where HashiCorp (NASDAQ:NASDAQ:HCP) has an opportunity to shine.

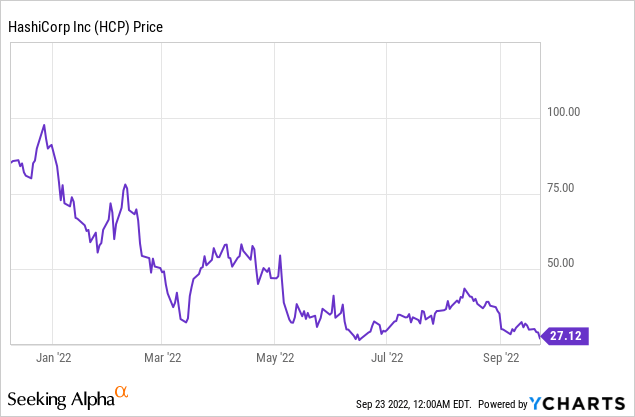

HashiCorp’s precipitous decline could present a golden opportunity for investors.

Cloud-Agnostic Platforms

HashiCorp boasts some of the most popular cloud infrastructure, networking, and security products. What stands out about HashiCorp is the fact that its most popular products are cloud-agnostic, which is becoming more important in the increasingly diverse cloud landscape. With cloud platforms like AWS, Azure, and GCP all furiously fighting over business, companies are increasingly reliant upon multiple cloud providers.

It is no longer uncommon for cloud professionals like DevOps Engineers to be familiar with services across multiple cloud platforms. As such, products like Terraform have exploded in popularity. As a frequent user of Terraform myself, there is no better tool for infrastructure provisioning given how adaptable Terraform is across different cloud providers. While some companies may still require skills in cloud-specific provisioning tools like AWS with CloudFormation, Terraform is rapidly making such platform-specific tools less important.

It is incredibly hard for one company to maintain a dominant grip on such a large and fast-growing industry. This is even more true given the fact that the barriers to entry in the cloud industry may not be as high as one may think. As long as a company has enough money to buy components cheaper at bulk and has the technical know-how to manage cloud services, they will have a good chance of finding success in the industry. This is one of the reasons why Microsoft has been able to take so much market share in so little time. This also gives cloud-agnostic companies like HashiCorp a great opportunity to continue growing.

The cloud computing space is becoming far more competitive as more companies enter the fray.

Synergy Research Group

Risks

While the cloud industry appears to be trending towards greater fragmentation, there still is a chance that one company may consolidate market share in the coming years. If, for instance, AWS or Azure starts to eat away at the competition for whatever reason, cloud-agnostic platforms may no longer make much sense. It would make sense for AWS or Azure to push their own proprietary technology (which they already do) rather than rely on third-party tools. However, there appears to be little evidence that such a market consolidation will happen anytime soon, if ever.

Even companies that are focused on a single cloud provider still widely use cloud-agnostic tools like Terraform given that such tools are becoming the industry standard. After all, it does not make sense for cloud engineers of DevOps engineers to specialize in cloud-specific tools given how frequently some professionals switch jobs. So, even if a company wanted to focus on cloud-specific tools like CloudFormation, the company will find it far harder to hire talent given how popular Terraform and other cloud-agnostic tools have become for cloud infrastructure engineers.

Conclusion

HashiCorp’s market capitalization of ~$5.56 billion is attractive in a multi-cloud market. The company recently reported a Q1 revenue of $113.9 million and should witness strong growth moving forward. Market share for cloud leaders will likely erode as more and more companies join the cloud fray in an attempt to carve out a piece of the pie. HashiCorp is perfectly positioned to capitalize on a business landscape in which enterprises are rapidly transitioning to an increasingly multi-polar cloud landscape.

Be the first to comment