unomat

Has Bitcoin Bottomed Out?

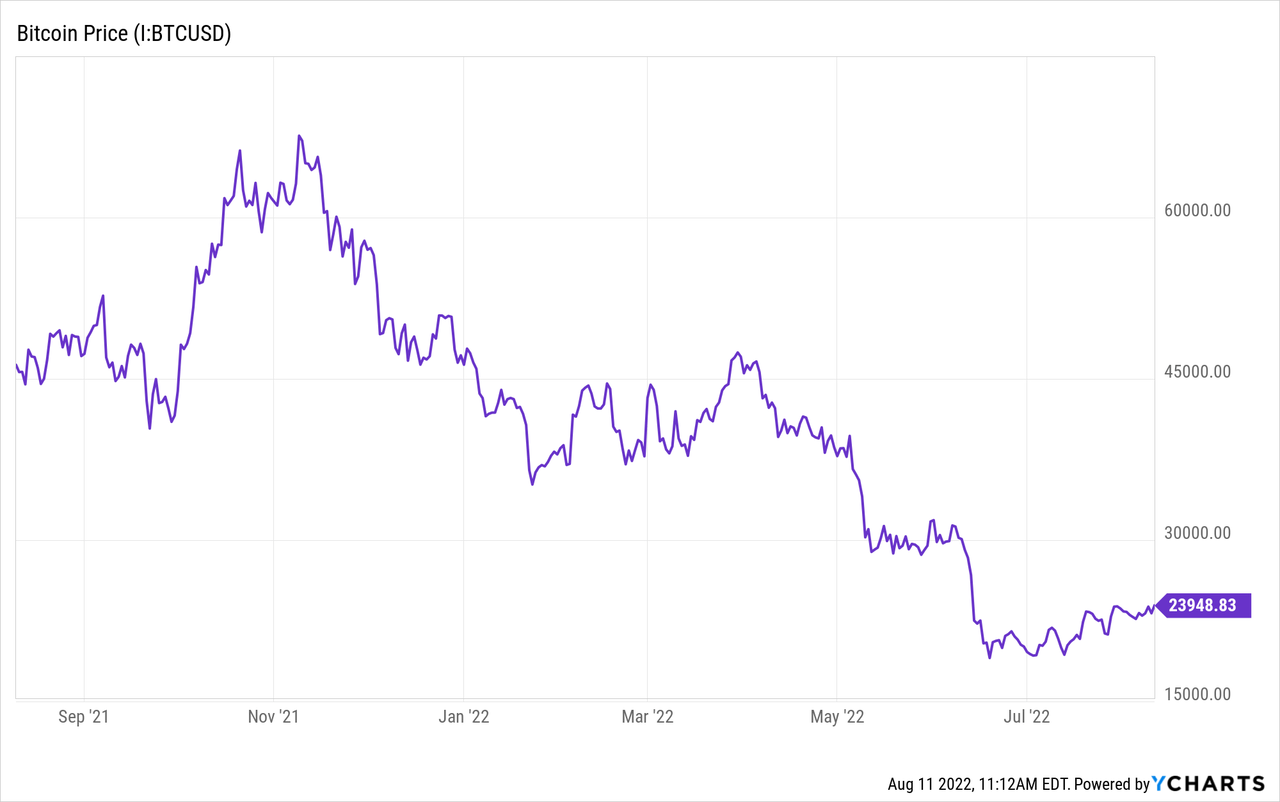

Bitcoin (BTC-USD) is back on the move again, surging after the July CPI numbers for the US came in better than feared and investors renewed their optimism for risk assets. The past few months have been tumultuous for crypto, with the high-profile failures of Terra, Three Arrows Capital, Voyager Digital, and Celsius Network. Billions of investor dollars went missing, and fingers were pointed in various directions. When Bloomberg went to get Three Arrows’ side of the story, they found mail piled up at their Singapore office-the founders had already fled the country. There were hotly contested rumors that the team at Celsius tried to flee the United States as well.

Many people (myself included) underestimated the scale of shadiness that was happening in the crypto world from 2020 to now. The failure of these firms is a much-needed flush-out to get back to basics. The main question I have and that readers would likely have is whether the first round of failures/bankruptcies was a clean break or the tip of the iceberg. History could offer some guidance. The 2008 Global Financial Crisis saw several waves, first in 2007, second in March 2008 when Bear Stearns failed, and then finally in September/October 2008 when all hell broke loose. Crypto is more self-contained- it’s not threatening to take down the global banking system. But if there is another round of undiscovered fraud, undisclosed leverage, and more money is missing, then Bitcoin will very likely go below its June lows. Bitcoin is down about 50% for the year, but looking out past the next 6-9 months or so, the long-term picture for BTC remains good, for reasons I’ll detail below.

I believe Bitcoin has tremendous long-term value and that the current market cap of less than $500 billion leaves plenty of room to grow. Along these lines, billionaire Bitcoin bull Mike Novogratz is skeptical about the odds of a soft landing and the recent surge in crypto but is a solid long-term believer. Cathie Wood also thinks Bitcoin could double shortly-take from that what you may. However, much of Wood’s enthusiasm is joined by more practical bulls like billionaires Stanley Druckenmiller and Paul Tudor Jones.

Will Bitcoin Boom Again?

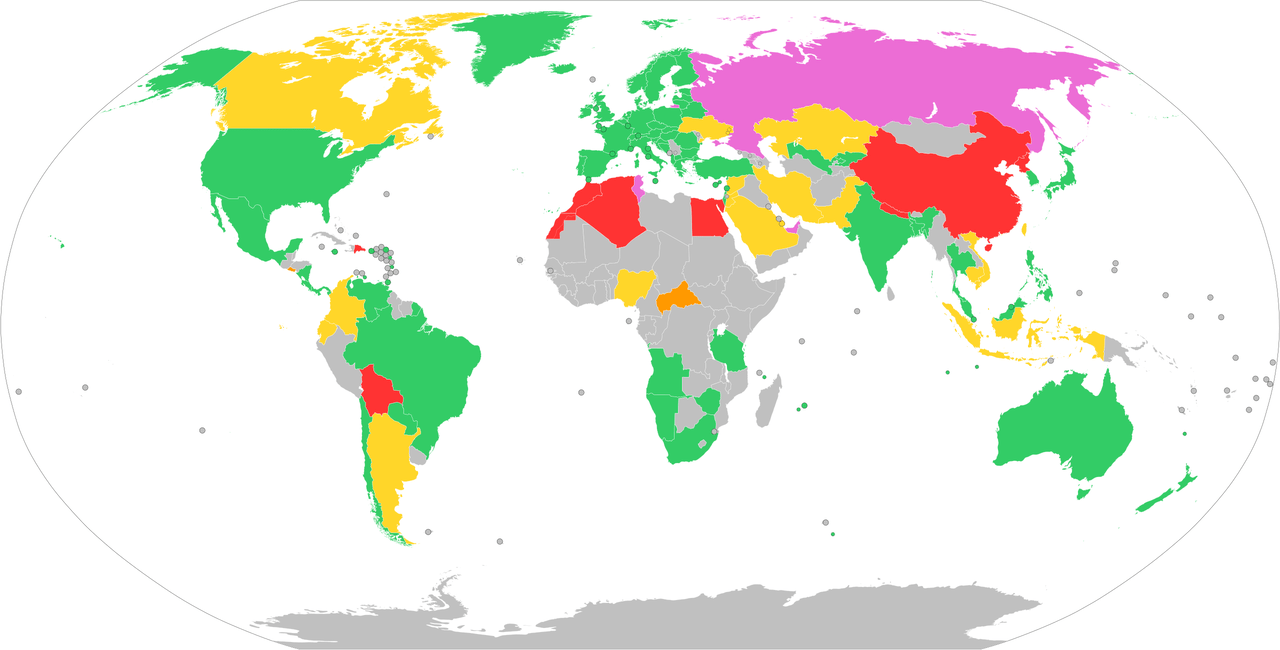

As I’ve written again and again, the long-term picture for Bitcoin is good. Demand for Bitcoin comes from all over the world. American and European investors like it as a hedge against monetary policy. Coinbase (COIN) stock nearly doubled off of panic lows after announcing a deal with BlackRock (BLK) to offer Bitcoin to institutional investors. Wealthy Chinese like BTC because they use it to move money out of the country (the CCP banned Bitcoin but pushed it underground). BTC is life or death for entrepreneurs in failed states like Venezuela and Burma, where hard currency is not easy to come by. Developing countries (Pakistan, Nigeria, Vietnam, Argentina) with poor monetary track records are a huge source of demand for Bitcoin as well. El Salvador has taken it a step further, making Bitcoin an official currency. With the supply of Bitcoin famously fixed at 21 million coins, all of these sources of demand add up to give Bitcoin fundamental value. Gold (GLD) has held its value for thousands of years as an alternative to government money, and now Bitcoin has stepped in to serve in this role as well, with the added benefit that you can send your Bitcoin to someone halfway across the world in a few minutes time. Every bit of wealth that goes into Bitcoin takes a little power away from autocratic third-world governments that rely on massive money printing to finance their agendas.

Bitcoin is a challenge to governments, not only in a philosophical way but because of the exponential increase in electricity use that the Bitcoin boom has spawned. This was a big factor in China and others deciding to ban Bitcoin mining. My guess is that as Bitcoin continues to grow, there are going to have to be rules around this, whether it’s a mandate that Bitcoin mining is carbon-neutral or a requirement that they’re not taking electricity away from consumers and businesses and tanking the grid. A solution could also come from Bitcoin’s protocol itself to make the mining process less energy intensive. I don’t view these as dealbreakers, but rather as a need for reform.

Legal Status of Bitcoin

Bitcoin Legality (Wikipedia)

Green (legal to use bitcoin)

Yellow (some legal restrictions on usage of bitcoin)

Purple (contentious interpretation of old laws, but bitcoin is not prohibited directly)

Red (full or partial prohibition)

Gray (No data)

At least in the US, the legal status of Bitcoin is remarkably favorable. I’ve covered here before how the government could have taxed Bitcoin gains as a collectible (31.3% max rate) but chose to tax it as property (23.8% max rate). Of course, the SEC denied the Grayscale Bitcoin Trust (OTC:GBTC) conversion and Grayscale is appealing, but the overall environment is pretty benign. To this point, I think Grayscale will eventually prevail at getting a spot ETF accepted.

More reforms are inevitable, as is some regulatory squabbling. But as long as Bitcoin adoption continues to increase, the fundamental value of the coin increases along with it. My guess is that in the long run, Bitcoin’s value should be in the same ballpark as gold, implying upside of at least 5-1 and possibly 10-1 over the next decade. People coat-tailing BTC’s success with 10,000 crappy altcoins, NFTs, and metaverse real estate, doesn’t change the fundamental long-term value proposition as a universal digital store of wealth. Yes, Bitcoin will boom again. There likely are some more shoes to drop with shady people using crypto as a means to an end, and Bitcoin could hit $10,000 if the technical recession develops into a deeper one. But long-term, it’s hard to dislike the potential here.

Is Now A Good Time To Invest In Cryptocurrency?

Sort of.

In Matt Damon’s famously maligned crypto ad, he declares that “fortune favors the brave.” The ad became a meme for its bad timing, but it’s true! In business and life, fortune does favor the brave. The trick seems to be to know when to be bold, and when to sit and wait for better opportunities. In baseball, a walk is as good as a hit. In crypto, swinging for the fences seems to have hit more often than not (and if you strike out with your investors’ money, the move seems to be fleeing to countries without extradition treaties!). Anyway, Treasury bills are likely to be paying 4% or so by year-end as the Fed continues to wrestle with core inflation and normalize its balance sheet, so you can get on base without swinging.

If I had to guess, there are more problems lurking in stablecoins that are equal or greater in size to the earlier crypto crisis, and liquidity is slowly draining from shady areas of the crypto world. There are known ties between major stablecoins and crappy Chinese debt, and at some point, more people are going to ask for their money back and the companies aren’t going to have it. At the same time, there are still structural issues with the US and global economies that are likely to be a slow but sure drain on liquidity.

It’s very likely that the lows for crypto are tested again. I also feel that Bitcoin is a decent long-term value at its current price. There are still shoes to drop and issues to be resolved. If you feel that fortune favors the bold, bet big. And if you bet big, I’d do it in GBTC, which has the added benefit of unlocking a large NAV discount if they’re able to get a favorable ruling for the spot Bitcoin ETF. This said, I really don’t feel like this is the time to bet big. In that case, keeping a nice stash of Treasury bills and I Bonds handy can safely get you to first base, and you can use the relative stability to slowly dollar-cost average into BTC and other investments as we see how this crazy year continues to unfold.

Bottom Line: Is Bitcoin A Buy, Sell Or Hold?

I say hold, but it makes sense to buy cautiously and by dollar-cost-averaging. I’m speculating here, but I’d guess there’s a 50% chance the lows are in at $18,000 or so and a 50% chance they aren’t. In the long run, BTC should have a runway to $100,000 or more based on increasing adoption by households and institutions all over the world.

Be the first to comment