Spencer Platt/Getty Images News

Investment Thesis

HRBR stock is trading around a conservatively estimated liquidation value, and investors essentially own a free call option that expires in February 2023 that could help substantially re-rate the stock price. Insiders own ~51% of the shares, and the company has been repurchasing shares at prices above the current stock price.

Business Background

Harbor Diversified (OTCPK:HRBR) is a holding company that is the parent company of Air Wisconsin Airlines, which is a regional aircraft (with a fleet of 64 CRJ-200 50-seater regional jets) that provides scheduled passenger service to ~81 cities in 31 states. The sole major airline partner is United Airlines, which accounts for all of Air Wisconsin’s revenue.

Regional airlines provide short/medium-haul scheduled flights that connect more isolated cities with larger cities that serve as domestic or international hubs. Large airlines often enter into contracts with smaller regional airlines (called capacity purchase agreements), where the large player provides the regional player with fixed daily revenue for each aircraft covered under the agreement, a fixed payment for each departure and block hour flown, and reimbursement of certain direct operating expenses in exchange for providing flying service.

As a result, the capacity agreements protect the regional aircraft from elements that typically cause volatility in airline financial performance (e.g., fuel prices, variations in ticket prices, and fluctuations in passengers). In exchange, regional airlines use the larger player’s logos, service marks, and aircraft paint scheme, while also adhering to the larger player’s route selection, pricing, seat inventories, marketing and scheduling.

Normally, I would caution investors to stay away from investing in airlines due to terrible economics. Regional airlines represent a rather unique way to obtain superior economics in the airlines space, albeit a limited scale opportunity, as there can only be a certain amount of regional airlines, and they can’t really scale.

Why Does This Opportunity Exist?

Mr. Market often gets confused between risk and uncertainty. In HRBR’s case, the uncertainty is clear: the United capacity purchase agreement expires in February 2023 and United has yet to renew the contract on the same terms and most likely won’t.

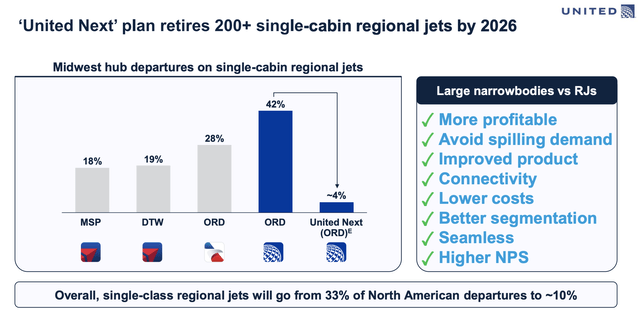

In June 2021, United launched a campaign titled “United Next,” which describes the airline’s post-pandemic development plans. As part of the strategy, United will transition regional markets from older, single-cabin regional jets to newer, larger, but more efficient mainline aircraft. In addition, United will be stepping away from servicing the 50-seat markets and more isolated cities, citing operational and economic constraints.

United Investor Event (June 29, 2021)

In addition, in April 2022, Air Wisconsin and United entered into a third amendment to the capacity purchase agreement which addressed the date by which United must provide a wind-down schedule for the period following the expiration of the agreement (page 13 of the 2022 Q1 10Q).

In short, HRBR’s future beyond February 2023 is completely unknown.

Air Wisconsin is currently in discussions with United and other airlines (good to note here that Air Wisconsin flew for American Airlines for over 10 years prior to March 2018), but there is a nontrivial chance that a contract will not be secured, and the fleet will be grounded in February 2023.

However, the risk of investors losing money is fairly low, as HRBR is trading around (and possibly below) my estimate of liquidation value.

Valuation

With ~65M diluted shares outstanding and currently trading ~$2.01 per share, the market cap is ~$131M.

Assets (as of March 2022)

-

Current Assets + Long-Term Investments: $240M

-

Fleet of Bombardier 64 CRJ-200 Jets: ~$13M (assumes $200K / jet; according to FlyRadius, the price of a CRJ200 was between $7M-$20M in 2012, and $1.5M-$4M in 2016, so basic linear extrapolation assumes ~80% decline in price every 4 years or so; note that $13M is ~6% of stated book value and probably a pretty conservative number)

-

Earnings Until February 2023: ~$36M (HRBR earned $9M in Q1 2022 and should operate for ~4 more quarters until the contract expires in February 2023; so $9M x 4 = $36M; also note that HRBR is trading at a 3.6x PE, most likely given the uncertainty)

Liabilities

Liquidation Value: Assets – Liabilities = $240M + $13M + $36M – $165M = $124M (or ~$1.90 / share)

Price / Liquidation Value: $131M/$124M = 1.06x

To sum up, HRBR is trading ~3.6x PE and roughly around liquidation value. In other words:

-

If HRBR does announce a new contract, the stock should re-rate higher (probably to ~8-10x earnings).

-

If HRBR doesn’t announce a contract and winds down operations / liquidates, shareholders are likely to get their money back.

Another way to think about it is that shareholders of HRBR own a free call option that expires in February 2023.

Insider Ownership + Buying

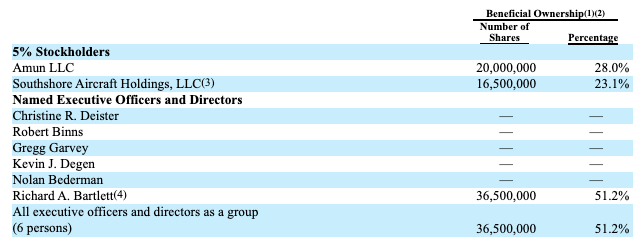

HRBR 10K (2019)

Insiders own a 51.2% majority stake, so it’s safe to assume that they have a vested interest in creating shareholder value.

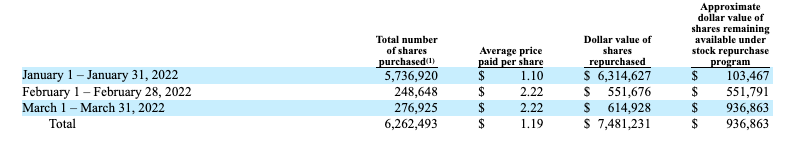

The company has also been repurchasing shares in the $2.22 range in Q1 2022 (note the 5,736,920 shares transaction was the result of a settlement of a legal claim with a group of stockholders) and have bought stock at higher prices in prior quarters:

HRBR 10Q (2022 Q1)

Catalysts

-

New Purchase Agreement: pretty straightforward, if a new agreement is signed, we will have visibility of earnings for the next few years, which should help re-rate the stock

-

Repurchases: stock repurchases below intrinsic value should help close the gap between price and value and serve as a soft catalyst

Risks

-

Failure to Find a New Agreement: failure to continue as an operating business would eventually force the company into liquidation, but luckily the stock is trading around a conservatively estimated liquidation value, so investors most likely won’t lose too much money

-

Controlling Management: I prefer to invest alongside management teams who own a good chunk of the company, but that also represents a double-edged sword as management can easily not act in the best interests of minority shareholders (e.g., pay themselves exorbitant salaries and stock options); in short, I would keep a close eye on management

Takeaway

HRBR represents an interesting opportunity to essentially buy a free call option that expires in February 2023 and at current prices, it doesn’t seem like investors will lose much money if things go south.

The best-case scenario is that Air Wisconsin is able to negotiate a new purchase agreement, which should help re-rate the company higher and earnings visibility becomes clear. The worst case is where Air Wisconsin goes into liquidation, but since the market cap is approximately the liquidation value, investors will get their money back. The absolute worst case is if management milks the company for their own gain and screws over the minority shareholders, so keep a keen eye out for evidence of misconduct.

Based on the analysis above, I recommend taking a long position in HRBR.

Be the first to comment