ljubaphoto/E+ via Getty Images

Investment Thesis

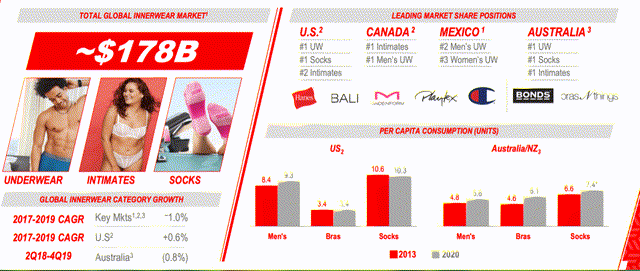

Hanesbrands (NYSE:HBI) is the #1 brand in North America for innerwear. Through a large and diverse distribution system, it produces over two billion units annually and has added quickly growing sectors like activewear.

HBI has embarked on an ambitious “full potential” campaign to reduce costs and streamline the company to maintain high levels of revenue growth in a slow-growth segment. This also focuses on balance sheet improvement to a sub-2.0x Debt-to-EBITDA ratio (currently at 3.7x). The amount of unique products offered by HBI count has decreased, focusing instead on lower cost and high sales items. Fewer SKUs result in greater efficiency and, hopefully better margins. By 2024 HBI’s cost-saving initiative is hoped to increase revenue CAGR to 6% and raise the operating margin to 15% (currently at 8.5%).

From a valuation perspective, even after poorer 3Q22 results, HBI remains cheap even with revisions to lower year end EPS. Forward P/E for the current year sits at 6.4x, and a price to sales is still below the sector median at 0.38x.

Because of its leadership position, cost reduction measures, and dividend stability, we believe HBI can grow its already generous dividend, and the stock is undervalued at current levels. In addition, HBI’s products are necessary items and should prove to be recession resistant especially with the inventory repositioning.

Estimated Fair Value = Estimated 2023 EPS of $1.10 times P/E 10.0 = $11.00

|

Hanesbrands |

E2022 |

E2023 |

E2024 |

|

Price-to-Sales |

0.4 |

0.4 |

0.4 |

|

Price-to-Earnings |

6.4 |

5.6 |

4.7 |

|

Estimated Yield |

8.5% |

8.6% |

8.8% |

Business Model and Latest Results

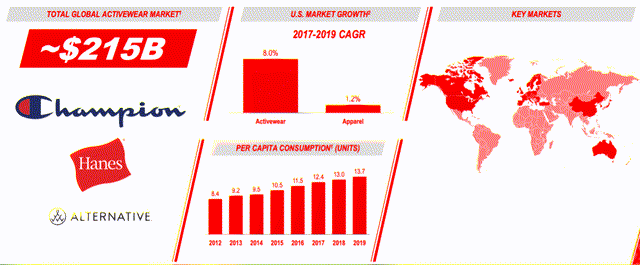

The global innerwear market is $178 billion a year, and the global activewear category has grown to $215 billion per year. Though economic conditions provide significant headwinds, a new marketing initiative toward Gen Z and younger consumers in the form of “Hanes Originals” and “Maidenform” is expected to expand distribution in FY23.

Innerwear sales have decreased 11% year over year in 3Q22, which is attributed partly to consumer spending impacts from macroeconomic conditions and partly due to shortages. These macroeconomic conditions also contributed to margin contraction in the innerwear area, dropping a hard 500 basis points to 16%.

Activewear sales remained steady but were disappointing for Champion in 3Q22, a previous winner for HBI. Champion’s activewear brand saw a decrease in total sales by around 9% while other activewear brands saw sales increase by 15%. The goal remains to grow online sales as a percentage of Champion products to 25% by 2024.

Despite the decrease in results, HBI declared a $0.15 per share dividend, marking a 39th consecutive quarterly dividend. While HBI did not buy back any stock in 3Q22, it still has $575 million remaining in its current authorization.

The “Full potential” initiative is now reaching the stage of consolidating distribution centers and divestitures. One of these divestitures is the Sheer Hosiery business which has effectively zero operating profit and will be offloaded sometime in 4Q22 or in FY23.

HBI Investor Day HBI Investor Day

Risk and Outlook

The stock has been pounded by just over 60% given the disappointing operating performance this year. Amid stagnating revenues, the full potential initiative was announced and was proceeding well until macroeconomic conditions significantly slowed down consumer spending.

While net sales grew by 11% during the pandemic, inflation and supply chain kinks have adversely affected HBI, as much of their manufacturing operation is outside the US in Asia or South America. Earlier in FY22 these bottlenecks were expected to alleviate by 2023. However, it has continued to cause margin contraction across the company this year.

Pressure from inflation, sales of high margin luxury clothing items decreasing, and rises in interest rates will prove to be a challenge to management. At the same time, we do believe that management is more than capable of facing these headwinds. It could take a few years, but we do believe earnings will trough this year around $0.95 per share. With a $0.60 dividend being adequately covered by earnings, we do expect the company to maintain its dividend although divided growth will be subdued. For this reason we rate it a buy, the dividend itself makes the stock a worthy pick.

Be the first to comment